What is QFX?

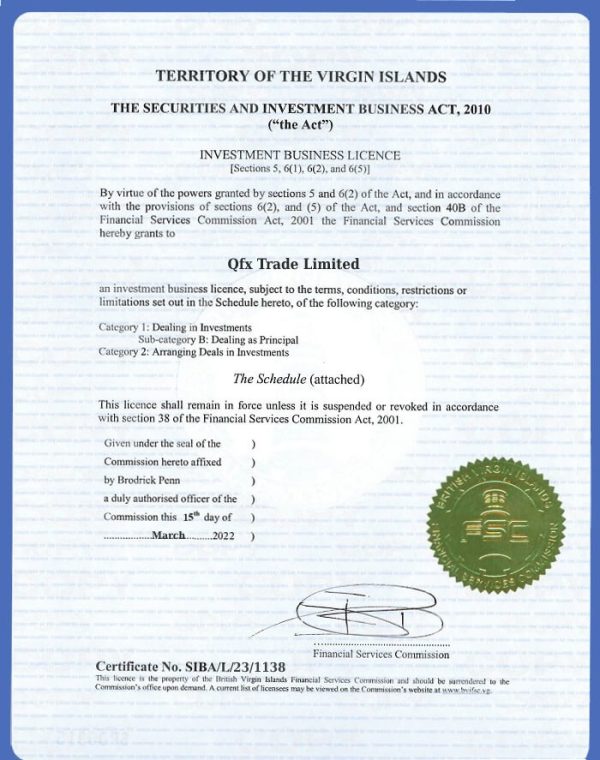

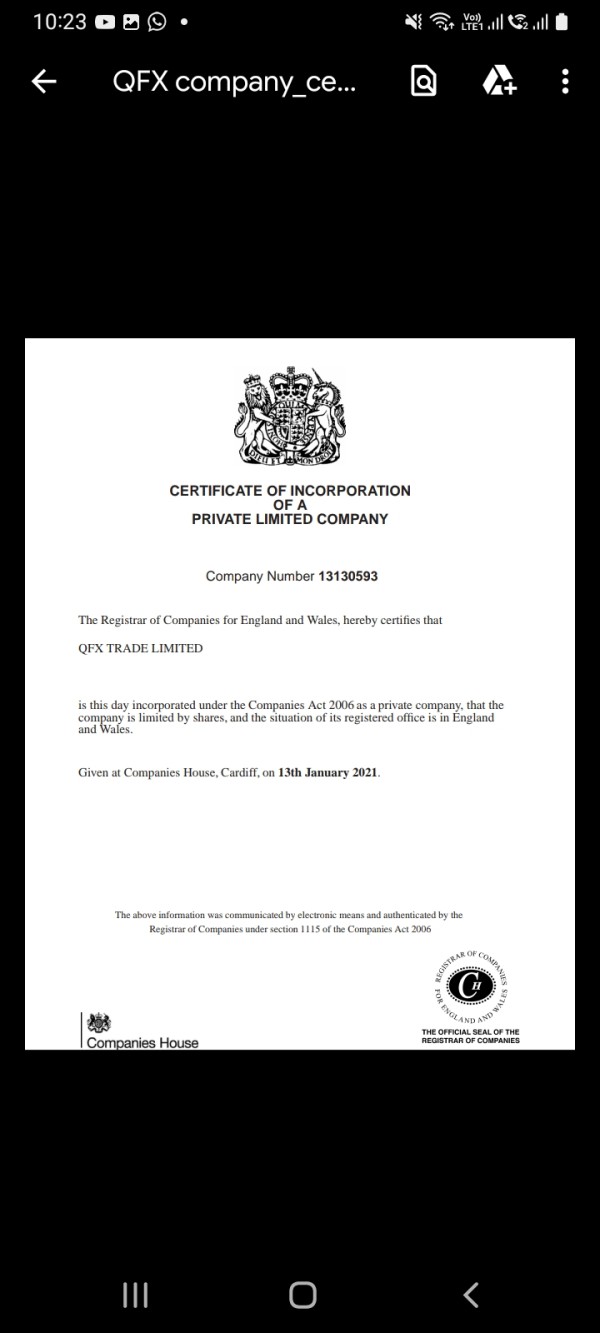

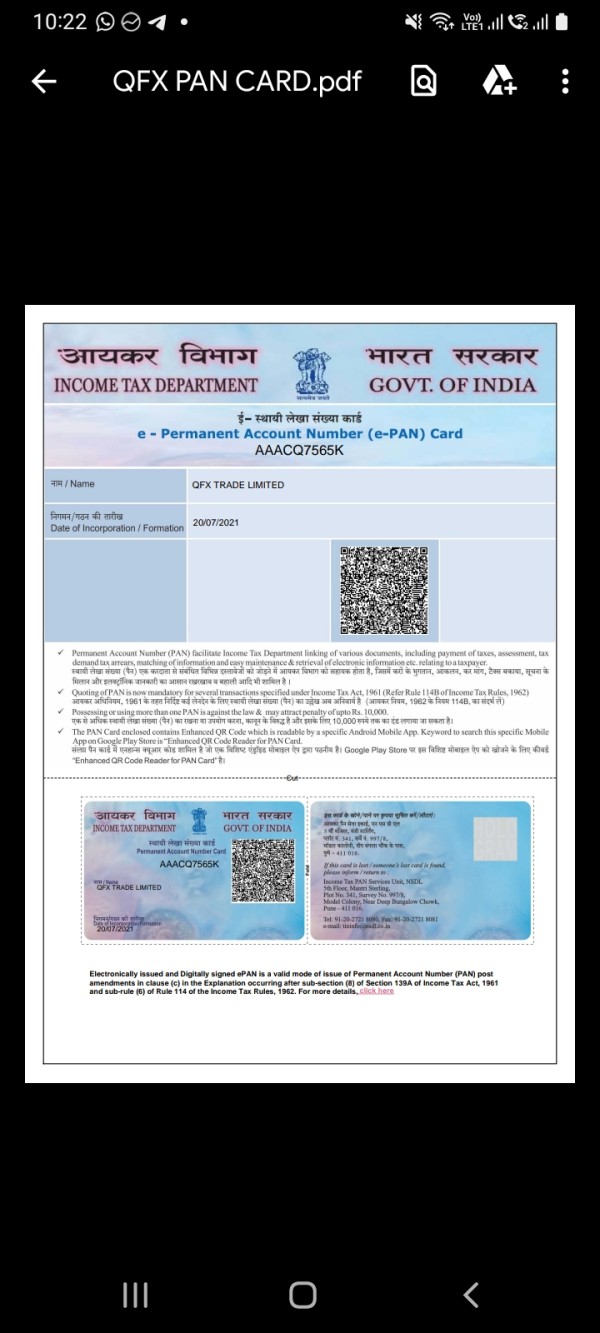

QFX, a trading name of QFX Trade Limited, is a newly-established online forex and CFD broker registered in the United Kingdom that claims to provide its clients with over 160 tradable financial instruments with flexible leverage up to 1:1000 and variable spreads from 0.0 pips on the MT5 for Android, Mac OS, iOS, Windows and Web Trader trading platforms, as well as a choice of five different live account types and 24/5 customer support service. It is not currently regulated by any major financial authority.

What Type of Broker is QFX?

QFX is an online forex and CFD broker that operates as a Straight Through Processing (STP) and Electronic Communications Network (ECN) broker. This means that QFX provides direct market access to its clients, allowing them to trade forex, commodities, indices, and cryptocurrencies with no dealing desk intervention.

Pros & Cons

QFX has some advantages, such as offering multiple account types, low minimum deposit, and a variety of trading instruments. However, there are also some drawbacks, such as limited regulatory oversight, lack of transparency about fees, and negative reviews from some users.

QFX Alternative Brokers

As QFX is a relatively unknown broker, there are not many direct alternatives that can be recommended. However, there are several well-regulated brokers that offer similar trading services and can be considered as alternatives. Some of these brokers include:

IG - A globally recognized broker with over 45 years of experience offering a wide range of trading instruments and competitive fees.

Pepperstone - An Australian-based broker with a strong reputation for low fees and excellent trading conditions across a range of platforms.

XM - A globally recognized broker that offers a wide range of trading instruments and a variety of account types to suit different trading styles.

IC Markets - An Australian-based broker that offers very low spreads and commissions and a range of trading platforms.

FXTM - A well-regulated broker that offers a wide range of trading instruments and a variety of account types with competitive fees.

It's important to note that traders should always conduct thorough research before selecting a broker, taking into consideration factors such as regulation, fees, trading instruments, customer support, and trading platforms.

Is QFX Safe or Scam?

Based on the information available, QFX is an unregulated new-established broker. It is important to note that trading with an unregulated broker can be risky as there is no oversight or protection for traders in case of fraud or financial issues. It is recommended to only trade with regulated brokers that are licensed and authorized by reputable financial authorities.

Market Instruments

QFX provides its clients with a range of financial instruments to trade, including forex, cryptocurrencies, energies, stock, indices and commodities. The specific instruments offered may vary depending on the account type chosen by the client. QFX offers a total of over 160 trading instruments across different asset classes.

Accounts

QFX offers a range of account types including Standard, Classic, Premium, Swap-free, and ECN accounts. Each account type has its own unique features, such as different minimum deposits, spreads, and commissions. The minimum initial deposit amount is only $10 for the Standard account, while the other four account types have much higher minimum initial capital requirements of $500, $2,000, $3,000 and $5,000 respectively. Risk-free demo accounts are also available.

Leverage

QFX offers different leverage levels depending on the account type and the instrument being traded. Clients on the Standard account can enjoy the maximum leverage of 1:1000, the Classic and ECN accounts have the leverage of 1:500, while the Premium and Swap free account members can experience leverage of 1:200. It's worth noting that while high leverage can amplify profits, it can also increase losses, so it's important for traders to use leverage responsibly and manage their risk appropriately.

Spreads & Commissions

QFX claims that different account types can enjoy quite different spreads. Specifically, the spread on the Standard and Swap free accounts starts from 1.5 pips, the Classic account has spread from 1.2 pips, the Premium account has spread from 1.0 pips, while only the ECN account holders can enjoy raw spreads from 0.0 pips. All charging no commissions.

Below is a comparison table about spreads and commissions charged by different brokers:

Note: The spreads and commissions listed here are indicative and may vary based on market conditions and account type.

Trading Platforms

QFX offers its clients the popular MetaTrader5 (MT5) trading platform, which is available for Android, Mac OS, IOS and Windows. The platform is known for its advanced charting capabilities, technical analysis tools, and automated trading options. It also supports multiple order types and offers fast trade execution speeds. WebTrader is also supportable.

See the trading platform comparison table below:

Overall, QFX's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

Deposits & Withdrawals

QFX offers multiple deposit and withdrawal options to its clients, including bank wire transfer, credit/debit card, and e-wallets such as Neteller and Skrill. More details can be found in the table below:

Minimum deposit requirement

QFXs minimum deposit requirement vary depend on the account type. Specifically, $10 for the Standard account, while $500, $2,000, $3,000 and $5,000 for the Classic, Premium, Swap-free, and ECN accounts respectively.

QFX minimum deposit vs other brokers

QFX Money Withdrawal

To initiate a withdrawal, clients need to log in to their QFX account and go to the “Withdrawal” section. From there, they can choose their preferred withdrawal method, enter the amount they wish to withdraw, and follow the instructions to complete the process. It is important to note that QFX may require additional documentation to verify the client's identity before processing a withdrawal.

Note that QFX charges withdrawal fees for some payment methods. The fees vary depending on the payment method.

Fees

QFX charges several types of fees, including spreads, commissions, and swap fees. The spreads and commissions vary depending on the account type and trading instrument. QFX does not charge any deposit fees, but it charges withdrawal fees for certain payment methods. There is also an inactivity fee for accounts that have been inactive for more than 60 days.

Inactivity fee: QFX charges an inactivity fee of $10 per month for accounts that have been inactive for more than 60 days.

See the fee comparison table below:

It is important to note that these fees are subject to change and may vary depending on the specific account type or region. It is recommended to check with the broker for the most up-to-date information on fees.

Customer Service

QFX provides customer service via live chat, email, WhatsApp, or sending messages online to get in touch. You can also follow them on some social networks such as Facebook, Twitter, YouTube, LinkedIn and Instagram.

However, there are some concerns about the quality of their customer support. Some users have reported slow response times and difficulty getting their issues resolved. Additionally, QFX does not provide 24/7 support, which can be a disadvantage for traders who need assistance outside of regular business hours.

Conclusion

Overall, QFX is a relatively new broker with a limited track record and regulatory oversight. They offer a good variety of trading instruments and account types, but their leverage is much higher compared to other brokers. Their trading platforms are also limited to the MT5 platform. While they have no reported major scam allegations, their customer service has mixed reviews. Overall, traders should exercise caution and do their own research before trading with QFX.

Frequently Asked Questions (FAQs)

fxvo2200

Romania

This broker is a scam. It does not approve withdrawals. I was creating a withdrawal request with QFX on 12 April 2023 and they refused my withdrawal 3 times because I was trading from VPS. After I was trading from home and requested again my withdrawal they blocked my access to the portal and didn`t even give my deposit back. Stay away...QFX scam broker

Exposure

2023-05-31

FX1356629517

Nigeria

Withdrawals come in time, while the support team is responsive and quick. The only thing I might wish to see here is the cTrader platform as I like the feature-rich interface and adjustable settings of the Automation section and history of trades.

Positive

2023-03-10

FX5054700952

India

Best broker This is in the world

Positive

2023-01-12

FX1056583068

India

Qfx market is a legal broker worldwide. Qfx is a LP license holder. Withdrawal is also perfect. Every month date of 6th they are paying . No worries.

Positive

2022-11-04