Score

HTFOX

United States|2-5 years|

United States|2-5 years| https://www.htfox.us/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Pakistan 2.46

Pakistan 2.46Contact

Licenses

Licenses

Licensed Entity:HUATAI FINANCIAL USA INC

License No. 0487359

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United States

United StatesUsers who viewed HTFOX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

htfox.us

Server Location

China

Website Domain Name

htfox.us

Server IP

8.210.218.67

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Registered Country/Area | Hong Kong |

| Company Name | HXPM |

| Regulation | Suspected Clone Firm |

| Minimum Deposit | Starter: $100, Advanced: $1,000, Pro Elite: $10,000 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starter: Starting from 1.0 pip, Advanced: Starting from 0.5 pips, Pro Elite: Starting from 0.1 pip |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Indices, Commodities, Cryptocurrencies |

| Account Types | Starter, Advanced, Pro Elite |

| Customer Support | Phone (Chinese (Simplified): +852 3798 8888), QQ (800025790), Email (cs@hx9999.com) |

| Payment Methods | Bank Wire Transfers, Credit/Debit Card Payments (Visa, MasterCard, Maestro), E-Wallet Services (Skrill, Neteller, PayPal) |

| Educational Tools | None |

General Information & Regulation

HTFOX, full name is HTFOX FINANCIAL USA INC, was allegedly formed on the 30th of April in 2021 as a business corporation registered with the Colorado Department of State (CDOS) in the USA, claiming to provide its clients with a variety of financial instruments on the worlds most widely-used MeatTrader4 and MetaTrader5 platforms. The company offers a range of account types, each with varying minimum deposits, but its website's current unavailability adds to its questionable reputation. While it boasts high leverage and tight spreads, HXPM's lack of transparency on commissions and fees leaves traders in the dark. Moreover, the absence of regulatory oversight compounds the risks associated with trading through this platform. Limited customer support options and a dearth of educational resources further diminish its credibility. Traders should approach HXPM with extreme caution due to its dubious status and the multitude of concerns surrounding its operations.

Note: Since HTFOXs official site (https://www.htfox.us/) is not accessible at the time of writing this introduction, only a cursory understanding can be obtained from the Internet.

Regulation

Clone Firm.

The emergence of HXPM as a suspected clone firm operating as a broker is a significant concern for the financial industry. Clone firms replicate the identity of legitimate entities, endangering market integrity and investor protection. Regulatory scrutiny is crucial, potentially leading to fines, license revocation, and legal consequences. This situation highlights the need for robust regulatory measures to detect and deter fraudulent activities in the digital era, preserving trust in the financial industry.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

HXPM presents a mixed bag of advantages and disadvantages. While it offers a diverse range of market instruments and high leverage, its lack of regulatory oversight raises concerns about its legitimacy. The broker's transparency regarding account tiers and minimum deposits is limited, and it lacks educational resources for traders. Additionally, the deposit and withdrawal methods are inefficient, and the trading platforms are uninspiring. Customer support may be hindered by language barriers and potential call charges. Traders should weigh these pros and cons carefully when considering HXPM for their trading needs.

Market Instruments

HTFOX advertises that it offers more than 250 trading instruments in financial markets, which include but are not limited to futures hedging, global forex, cryptocurrencies of Bitcoin, commodities, stock indices, stock CFD, precious metals like gold, energy, oil and digital currencies.

Forex Trading:

HXPM does cover major, minor, and exotic currency pairs in the Forex market. On the surface, this appears promising. Yet, it also opens the door for traders to speculate on the volatile exchange rate movements between different global currencies. Major pairs include the likes of the US Dollar (USD), Euro (EUR), British Pound (GBP), and Japanese Yen (JPY). Minor pairs involve lesser-known currencies paired with major ones, while exotic pairs carry the risk of currencies from emerging or smaller economies.

Index Trading:

For those lured by index trading, HXPM offers access to some of the most widely tracked indices worldwide. This includes renowned indices like the NASDAQ, S&P500, Dow Jones, DAX30, CAC40, FTSE100, and Nikkei225. While trading indices might seem attractive, it can be fraught with risk, as investors speculate on the overall performance of specific markets or sectors without investing in individual stocks.

Commodity Trading:

HXPM claims to offer commodity trading, including popular choices such as Gold, Silver, Oil, and Natural Gas. However, this opens a Pandora's box of potential issues. Commodities do provide a means for traders to diversify portfolios and hedge against economic uncertainties. Yet, Gold and Silver's safe-haven status and the volatility tied to Oil and Natural Gas add layers of risk to this offering.

Cryptocurrency Trading:

In the era of digital assets, HXPM delves into cryptocurrency trading with major cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Cryptocurrencies may appear alluring due to their decentralized nature and high volatility. Still, this introduces a different realm of risk for traders, with the potential for substantial gains and equally substantial losses.

Overall, HXPM's purported broad range of market instruments may not be as advantageous as it first appears. The diversity it offers comes with elevated risks and potential pitfalls, which traders must carefully consider before engaging.

Account Types

Starter Account:

While HXPM offers a Starter Account aimed at beginners, it requires a minimum deposit of $100. This might seem reasonable, but the devil is in the details. The competitive spreads starting from 1.0 pip might not be as advantageous as they sound, and the leverage of up to 1:200 can lead to significant losses. Additionally, the simplicity of this account may mask limitations for more experienced traders.

Advanced Account:

The Advanced Account at HXPM targets experienced traders, necessitating a minimum deposit of $1,000. Tighter spreads starting from 0.5 pips might attract traders seeking reduced costs, but this account's value proposition lacks clarity. Like the Starter Account, it may not offer the features and benefits required by sophisticated traders.

Pro Elite Account:

The Pro Elite Account supposedly caters to professional traders and high-net-worth individuals, with a minimum deposit requirement of $10,000. It boasts the tightest spreads starting from 0.1 pip and leverage of up to 1:500. However, this elite status comes with an air of exclusivity that may alienate traders looking for transparency and inclusivity.

In summary, HXPM's account offerings, while appearing diverse, raise questions about their true value and suitability for traders. Minimum deposit requirements, spreads, and leverage ratios may not align with the expectations and needs of all traders.

Leverage

HXPM offers a maximum trading leverage of up to 1:500, which may initially seem enticing. However, this high leverage, while potentially amplifying profits, also poses a significant risk. With such leverage, traders can control substantial positions with relatively small capital. This allure of magnified gains may lead to overexposure and substantial losses. The availability of high leverage at HXPM should be regarded with caution, as it can be a double-edged sword that inexperienced traders may not fully comprehend, potentially leading to their financial detriment.

Spreads & Commissions

When considering spreads and commissions at HXPM, the situation becomes murkier. The broker offers three account types, each with its own set of trading conditions:

Starter Account: Traders using the Starter Account can benefit from competitive spreads starting from 1.0 pip. While this might sound appealing, the absence of specific information on commissions leaves traders in the dark regarding the full extent of their potential trading costs.

Advanced Account: The Advanced Account offers tighter spreads starting from 0.5 pips, promising reduced trading costs. However, as with the Starter Account, details on commissions are conspicuously absent, leaving traders uncertain about the true cost of trading.

Pro Elite Account: The Pro Elite Account touts the tightest spreads starting from 0.1 pip, which may attract professional traders. Yet, the lack of information on commissions remains a glaring omission, preventing traders from fully understanding the financial implications of this account.

In conclusion, the ambiguity surrounding spreads and commissions at HXPM raises doubts about the transparency and trustworthiness of its pricing structure. Traders must tread carefully in the absence of comprehensive information.

Deposit & Withdrawal

Examining deposit and withdrawal methods at HXPM reveals a less-than-ideal scenario:

Deposit Methods:

Bank Wire Transfers: While accepted, this method presents inconveniences, including potential delays and additional fees from banks involved in the transaction. The lack of convenience may deter traders seeking smoother deposit options.

Credit/Debit Card Payments: HXPM does accept major credit cards like Visa, MasterCard, or Maestro. However, the possibility of additional fees for international transactions raises concerns about unexpected costs.

E-Wallet Services: HXPM supports e-wallets like Skrill, Neteller, and PayPal. Yet, the limited range of options and potential fees imposed by e-wallet service providers may not satisfy all traders, hampering their flexibility.

Withdrawal Methods:

Bank Wire Transfers: This withdrawal method is prone to delays due to the involvement of multiple banks and international transaction processes. Additional fees from intermediary banks and the recipient's bank can further erode the funds received.

Credit/Debit Card Refunds: While seemingly convenient, the potential for restrictions imposed by card issuers and withdrawal delays casts doubts on the reliability of this withdrawal option.

E-Wallet Withdrawals: E-wallet withdrawals may offer shorter processing times, but traders should exercise caution regarding withdrawal fees imposed by service providers, which could diminish the funds received.

In summary, HXPM's limited and inefficient deposit and withdrawal methods, coupled with potential delays and fees, create a less-than-optimal environment for financial transactions.

Trading Platform Available

When it comes to trading platforms available,HTFOX gives traders the worlds most trusted and popular MeatTrader4 and MetaTrader5 platforms. MT4 and MT5 are known as the most successful, efficient, and competent forex trading software. MT4 offers an intuitive and user-friendly interface, advanced charting and analysis tools, as well as copy and auto-trade options. While MT5 allows traders to execute trades on different financial markets through a single account and there is a hedging option.

MetaTrader 4 (MT4): HXPM offers the widely-used MT4 platform, which, while suitable for beginners, lacks advanced tools and features sought by seasoned traders. The absence of proprietary platforms or exclusive trading tools suggests a lack of investment in research and development to provide cutting-edge solutions.

MetaTrader 5 (MT5): HXPM also provides the MT5 platform, which, like its predecessor, offers a familiar but somewhat outdated trading experience. The absence of groundbreaking features and customization options leaves traders wanting more.

While HXPM does mention mobile trading apps for Android and iOS devices, their reliability and performance remain uncertain. Traders may grow frustrated with subpar mobile trading experiences, potentially missing out on crucial market opportunities.

In conclusion, HXPM's choice of trading platforms appears uninspiring and outdated, lacking the innovation and modernity demanded by traders in today's dynamic financial markets. With limited options and a dearth of unique features, traders may find other brokers more appealing, offering a broader range of cutting-edge trading platforms and tools.

Customer Support

HXPM's customer support options have notable shortcomings. The single contact number provided for Chinese (Simplified) support, +852 3798 8888, lacks language-specific lines and may lead to communication issues for non-Chinese speakers. Additionally, international call charges for clients outside of Hong Kong add to the inconvenience.

The use of QQ support at 800025790 as an alternative contact method may limit accessibility for clients unfamiliar with the platform.

Moreover, the generic email address, cs@hx9999.com, implies a one-size-fits-all approach to customer inquiries, potentially resulting in delays in addressing concerns.

In summary, HXPM's customer support falls short of providing a seamless and customer-centric experience. The lack of language-specific phone lines, potential international call charges, limited alternative contact methods, and generic email addresses suggest suboptimal support services. Traders should exercise caution when relying on HXPM for assistance with their trading issues.

Educational Resources

HXPM's offering in terms of educational resources is notably lacking. The absence of educational materials, such as tutorials, webinars, or written guides, raises concerns about the broker's commitment to helping traders enhance their skills and knowledge.

Without access to educational resources, traders, especially beginners, may find it challenging to navigate the complexities of financial markets and make informed trading decisions. This gap in support for traders looking to improve their understanding of trading concepts and strategies may deter potential clients who prioritize access to educational content.

Summary

In summary, HXPM presents a host of concerns and uncertainties across its services. Its suspected clone firm status raises regulatory red flags, casting doubt on its legitimacy and investor protection. Market instrument offerings, account types, and leverage options come with potential pitfalls and may not align with traders' needs. Ambiguity surrounding spreads and commissions, limited deposit/withdrawal methods, and outdated trading platforms further detract from its appeal. Customer support options and educational resources fall short, leaving traders seeking a seamless and supportive experience wanting. Overall, traders should exercise caution and consider alternatives due to the lack of regulation, potential clone firm status, and multiple shortcomings that pose risks to investments and trading experiences.

FAQs

Q1: Is HXPM a regulated brokerage?

A1: No, HXPM operates without regulation, raising concerns about its legitimacy and investor protection.

Q2: What is the maximum leverage offered by HXPM?

A2: HXPM offers a maximum leverage of up to 1:500, which can amplify both potential gains and losses.

Q3: Are there educational resources available at HXPM?

A3: No, HXPM lacks educational materials, leaving traders without access to tutorials or guides to enhance their trading knowledge.

Q4: What deposit methods does HXPM offer?

A4: HXPM provides limited deposit options, including bank wire transfers, credit/debit card payments, and select e-wallet services.

Q5: Does HXPM offer innovative trading platforms?

A5: No, HXPM offers the widely-used MetaTrader 4 and MetaTrader 5 platforms but lacks distinctive features or cutting-edge solutions.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Suspicious Overrun

- High potential risk

Comment 5

Content you want to comment

Please enter...

Comment 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

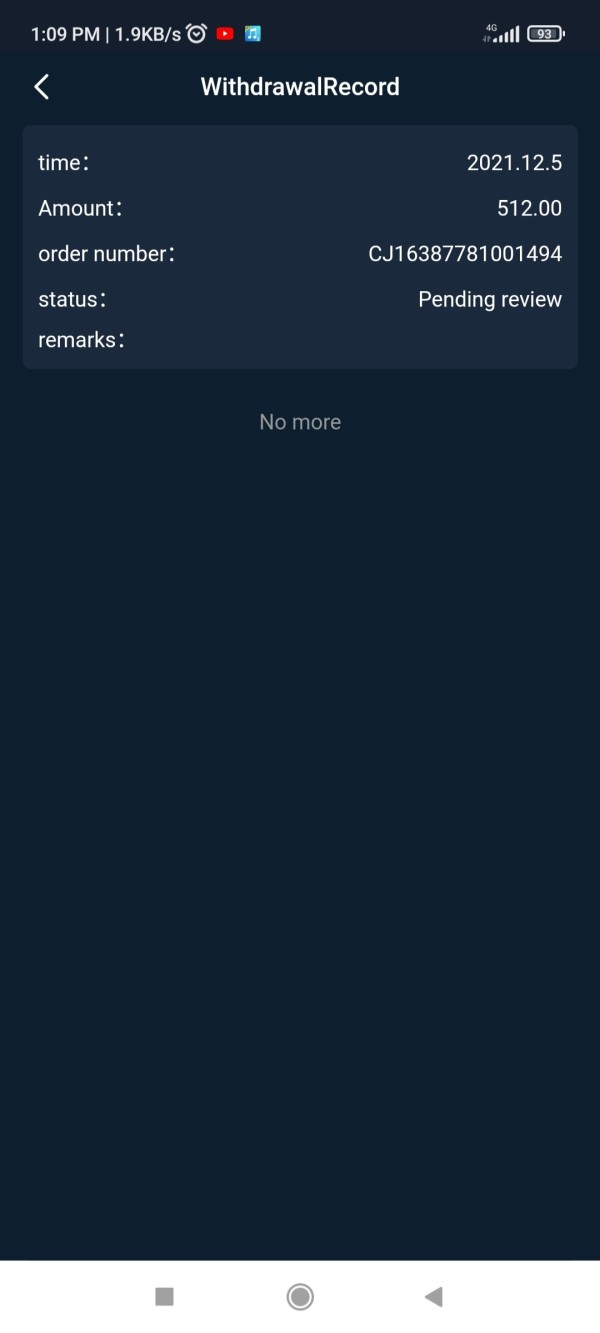

FX3569838311

Pakistan

512 $ they robbed.please do needful

Exposure

2021-12-22

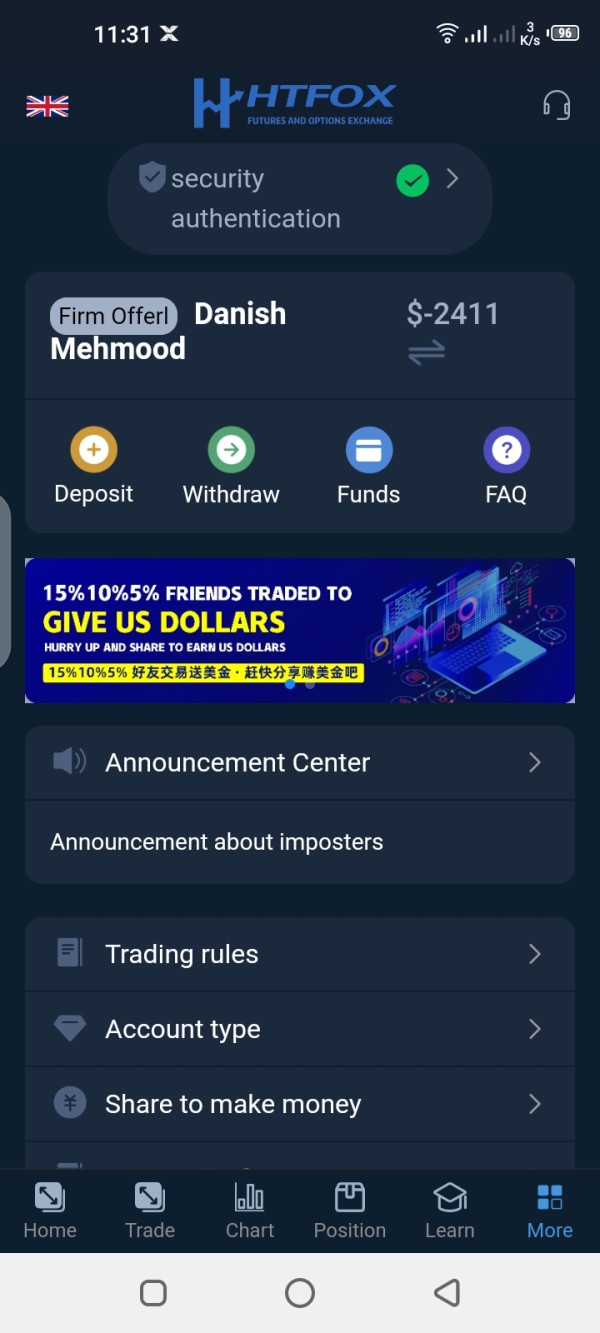

Danish Khan Baloch Dani

United Arab Emirates

My htfox Account 0$ show .last friday Htfox scam .All people Account 0$Show Such a Scam

Exposure

2021-12-21

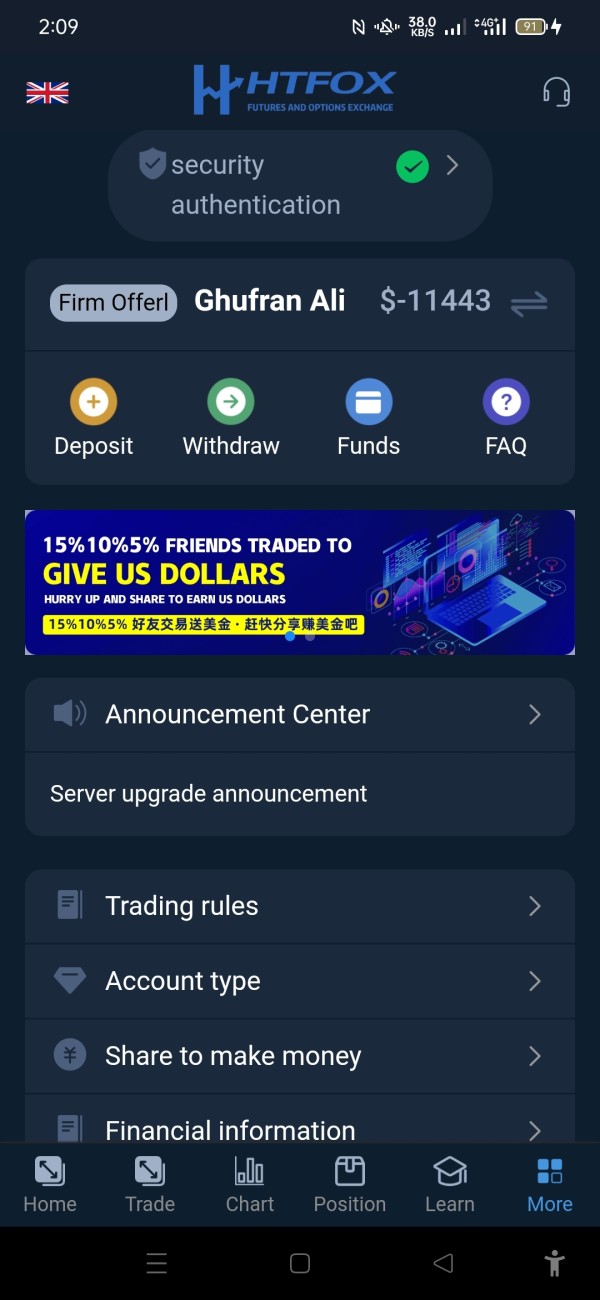

FX1869284604

Pakistan

HT Fox Company took money from the public by lying to the New York Stock Exchange and then cheated us by playing a big plan. We demand from the New York Exchange to file a case of fraud against the owners of this company.

Exposure

2021-12-19

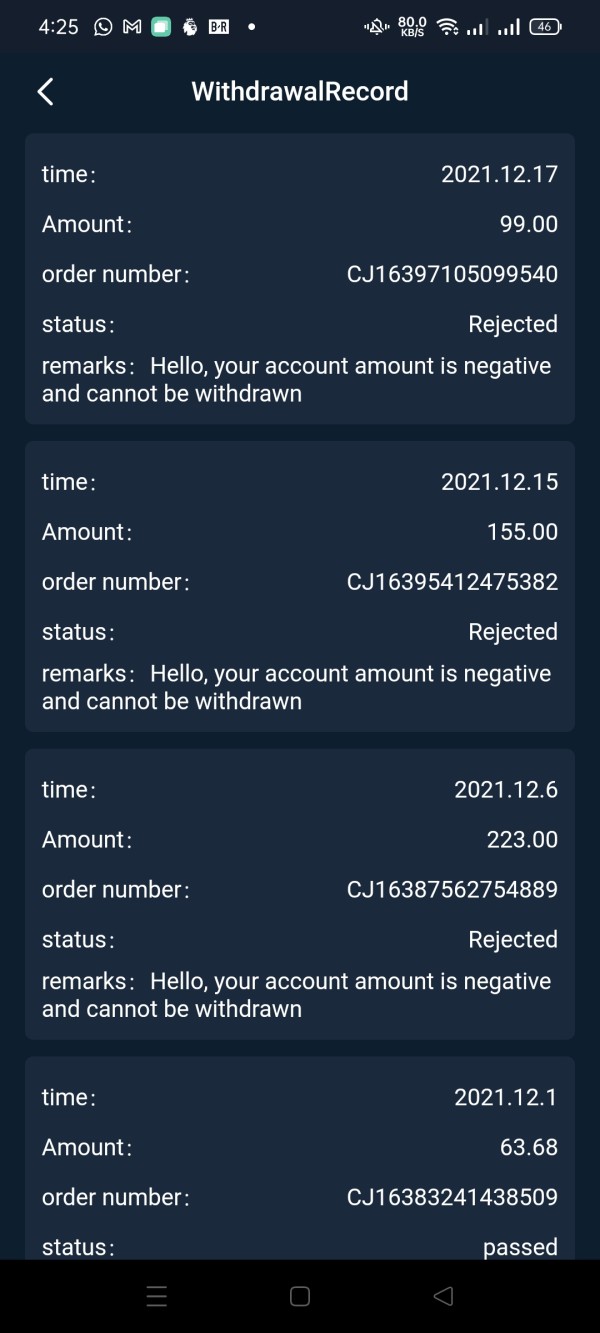

AlPacino

Pakistan

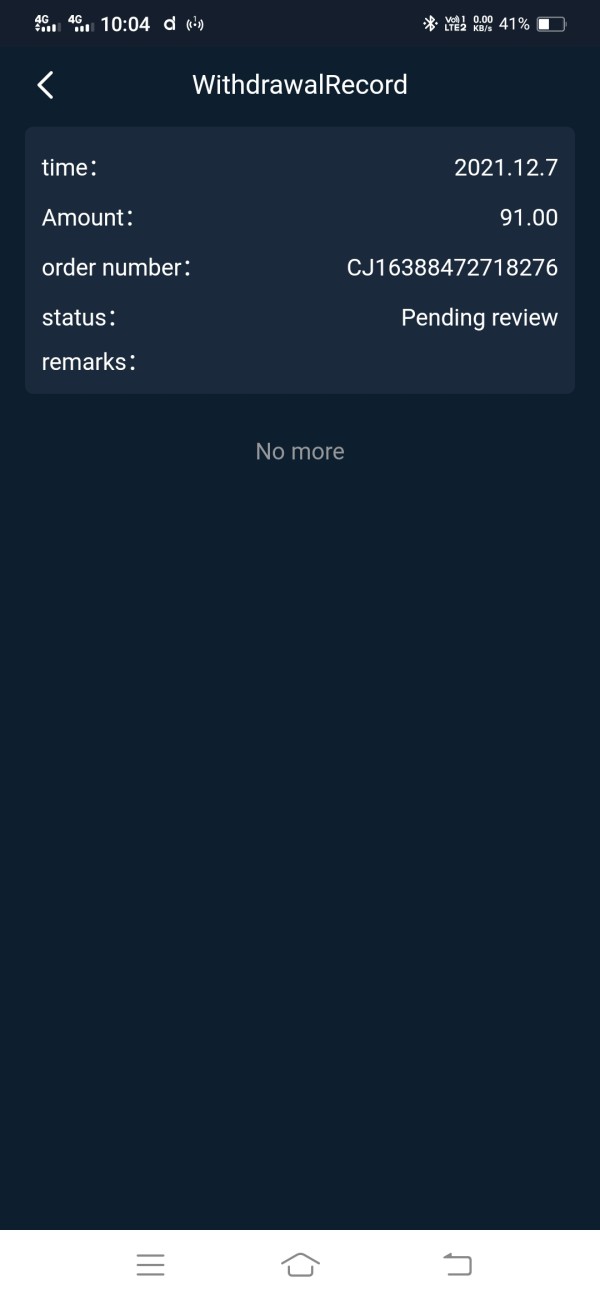

Cannot withdraw my money

Exposure

2021-12-19

FX2745893685

India

Withdrawal Pending, Customer Care Not Responding

Exposure

2021-12-12