What is CJC Markets?

Based in Auckland, New Zealand, CJC Markets (Carrick Just Capital Markets Limited) is a regulated online NDD (No Dealing Desk) trading broker that allows clients to trade multiple financial assets with flexible leverage up to 1:400 and floating spreads on the MT4 trading platform via 3 different live account types, as well as 24/5 customer support service.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Pros & Cons

CJC Markets has several advantages including a wide range of tradable instruments, a variety of deposit and withdrawal options, and 24/5 customer support. However, there are also some significant drawbacks, including high minimum deposit requirements, and mixed reviews from clients. Overall, traders should exercise caution and carefully consider these factors before deciding whether to trade with CJC Markets.

CJC Markets Alternative Brokers

There are many alternative brokers to CJC Markets depending on the specific needs and preferences of the trader. Some popular options include:

FP Markets - An ASIC and CySEC-regulated broker with a wide range of trading instruments, competitive spreads, and multiple trading platforms, suitable for both novice and experienced traders.

FXDD - An offshore broker offering ECN trading accounts with a variety of trading instruments and low spreads, but lacks regulatory oversight and has mixed reviews from clients.

Global Prime - An ASIC-regulated broker with a focus on transparency, offering ECN trading accounts with competitive spreads and a range of trading tools, but has limited trading instruments and high minimum deposit requirements.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Market Instruments

CJC Markets provides investors with 500+ instruments including Forex, Metals, Equity Indices, US Shares, Asia Shares, EUR Shares, Cryptocurrency CFDs. The broker provides access to more than 100 currency pairs, such as the EUR/USD, GBP/USD, and USD/JPY. Clients can also trade precious metals such as gold and silver, as well as a variety of equity indices such as the S&P 500 and the Nasdaq 100. CJC Markets also offers a broad selection of shares from the US, Europe, and Asia. Additionally, the broker provides access to popular cryptocurrency CFDs such as Bitcoin, Ethereum, Ripple, Litecoin, and Tether.

Account Types

There are three account options available on the CJC Markets platform: Standard, VIP and ECN. The minimum initial deposit for a Standard account is $1,000, way too high for most regular traders to get started. The high minimum initial deposit can be a disadvantage for many traders, especially beginners who want to start with a smaller amount of money.

However, the higher minimum deposit requirement for the Standard account may be suitable for more experienced traders who want access to higher leverage and other advanced trading features. The VIP and ECN accounts require a minimum initial deposit of $25,000 and $50,000 respectively, which may not be feasible for many traders.

Leverage

In terms of trading leverage, the maximum leverage for the Standard account is up to 1:400, up to 1:300 for the VIP account and up to 1:200 for the ECN account. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Spreads and commissions with CJC Markets are scaled with the accounts offered. Specifically, the spread starts from 1.5 pips on the Standard account, from 1 pip on the VIP account, and raw spreads on the ECN account. As for the commission, there is no commission charged on the Standard and VIP accounts, while unspecified on the ECN account.

While the Standard and VIP accounts do not charge commissions, the spreads are higher, which may not be as cost-effective in the long run. Traders should carefully consider their trading style and needs when choosing an account type with CJC Markets.

Below is a comparison table about spreads and commissions charged by different brokers:

Note that these rates are subject to change and may vary depending on account type and market conditions. Traders should always confirm the most up-to-date rates directly with the broker.

Trading Platform

CJC Markets offers the leading MT4 trading platform for iOS, Android, Windows, and Mac to meet a wide range of user needs. MT4 is currently the most popular forex trading platform on the market, with a user-friendly interface, and powerful charting tools. With a user-friendly interface, powerful charting tools, and a large number of custom indicators, MT4 is available for automated trading and EA trading, helping traders of all levels to develop different trading strategies and help traders to get ahead in the financial markets.

See the trading platform comparison table below:

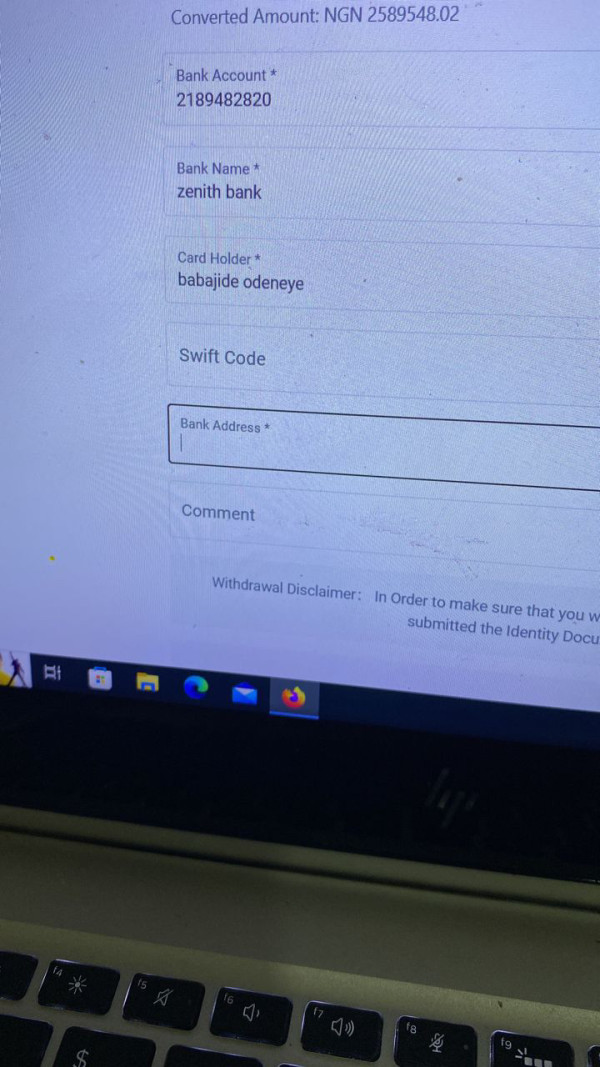

Deposits & Withdrawals

From the logos shown at the foot of the home page on CJC Markets official website, we found that this broker seems to accept numerous means of deposit and withdrawal choices, consisting of Visa, MasterCard, Bitcoin, bit wallet, BTPay, Bank Wire, dragon pay, help2ay, PayTrust, Skrill, Neteller, and Tether.

Having multiple payment options provides more convenience and flexibility for traders to deposit and withdraw their funds. It's worth noting that certain payment methods may have fees or restrictions, so it's essential to check with the broker's website or customer service before making any transactions.

CJC Markets minimum deposit vs other brokers

See the deposit & withdrawal fee comparison table below:

Note: Withdrawal fees for FXDD vary depending on the payment method used. Please refer to the broker's website for more information.

Customer Service

The CJC Markets customer support team can be contacted 24/5 through telephone, email, social media, or live chat. You can also follow this broker on social networks such as Facebook, Instagram and LinkedIn. FAQ section is also available. Alternatively, traders can visit their physical office in Auckland, New Zealand.

It's worth noting that having a physical office can provide additional peace of mind for traders who value face-to-face communication and transparency with their broker. The availability of multiple channels for customer support is also a plus, as traders can choose the most convenient way to reach out for help. However, the lack of 24/7 customer support may be a disadvantage for traders who need immediate assistance outside of regular business hours.

Please note that these pros and cons are based on the information available and may not be exhaustive.

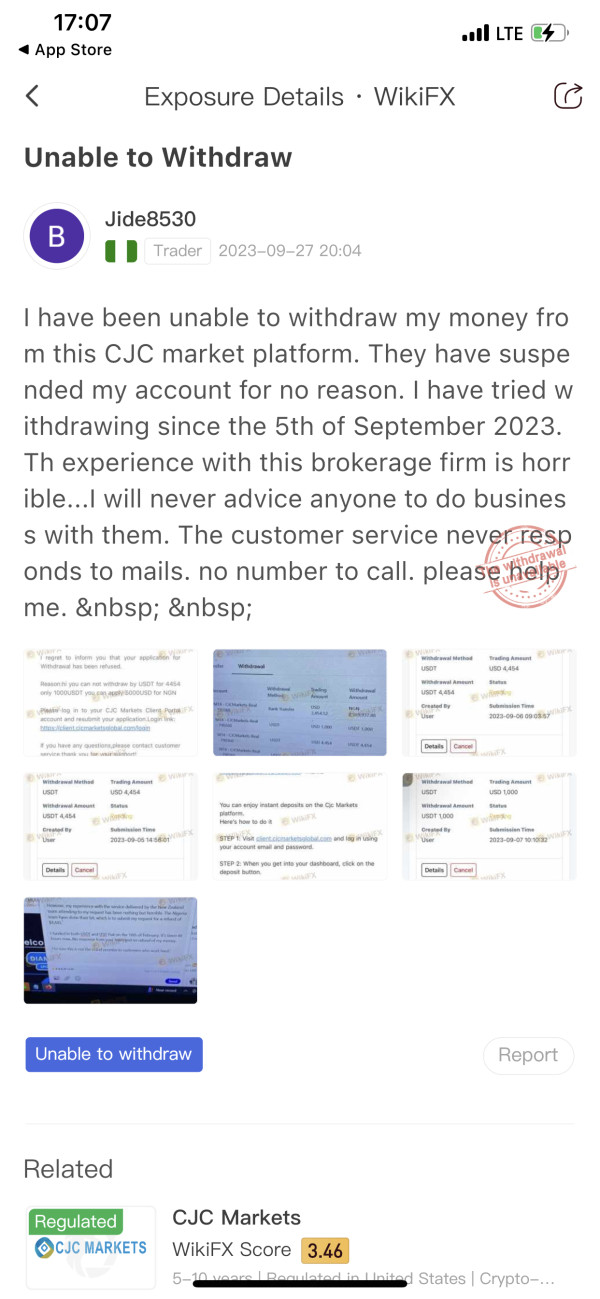

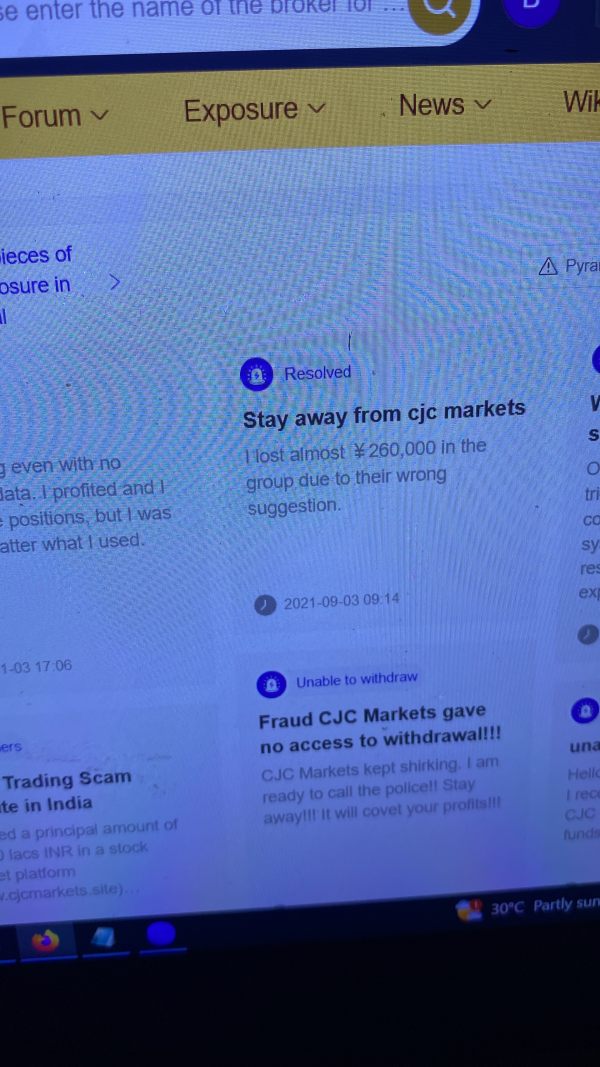

User Exposure on WikiFX

On our website, you can see that some users have reported scams and unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

Generally, CJC Markets is a regulated broker that provides a range of instruments. However, the high minimum deposit requirement and negative reviews from clients raise concerns about the safety of the platform. On the other hand, the broker offers balance protection up to $500, and there is a range of deposit and withdrawal options available. The customer support team can be contacted 24/5. Overall, traders should approach CJC Markets with caution and consider the potential risks before investing.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

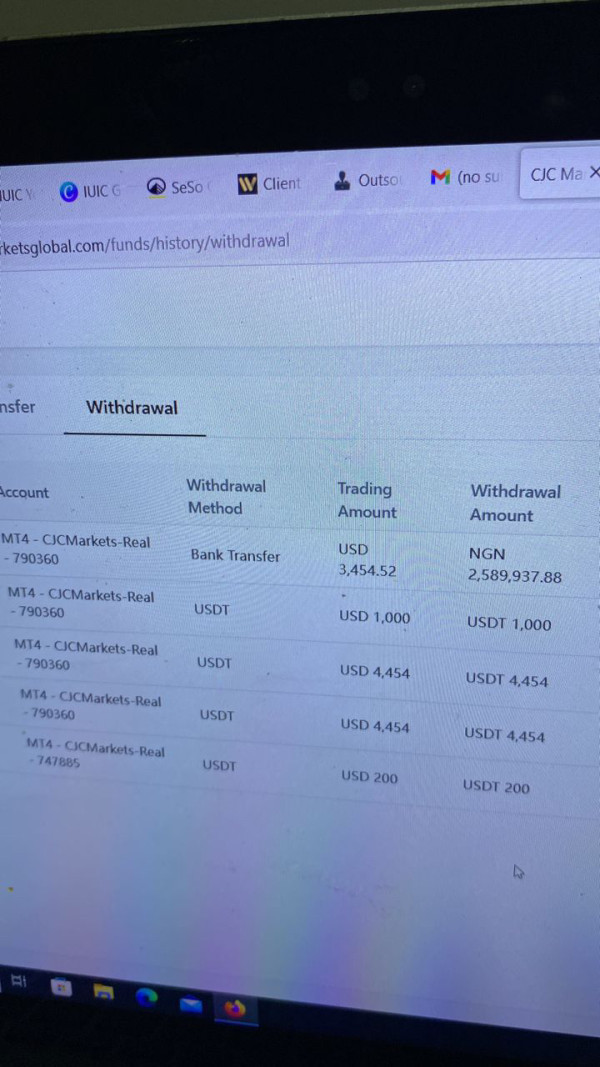

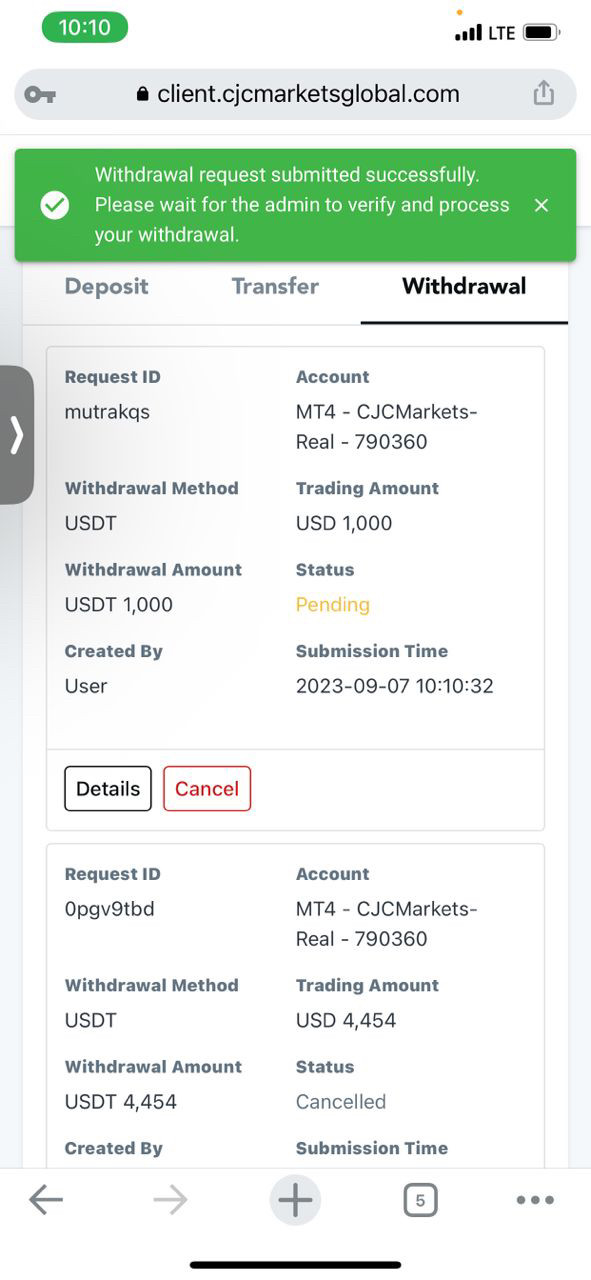

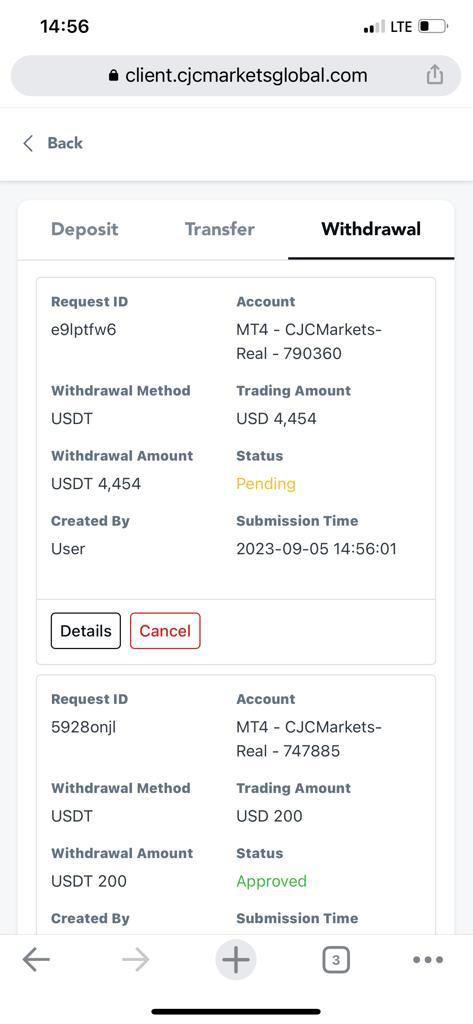

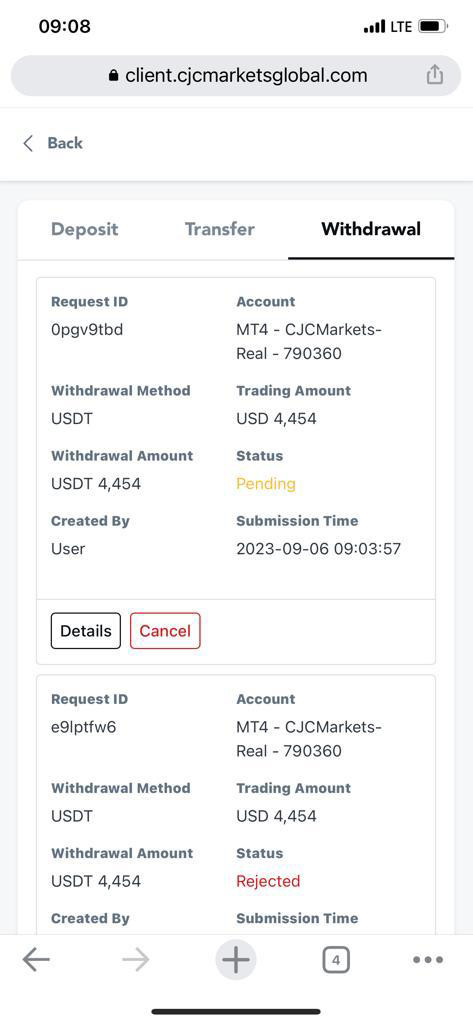

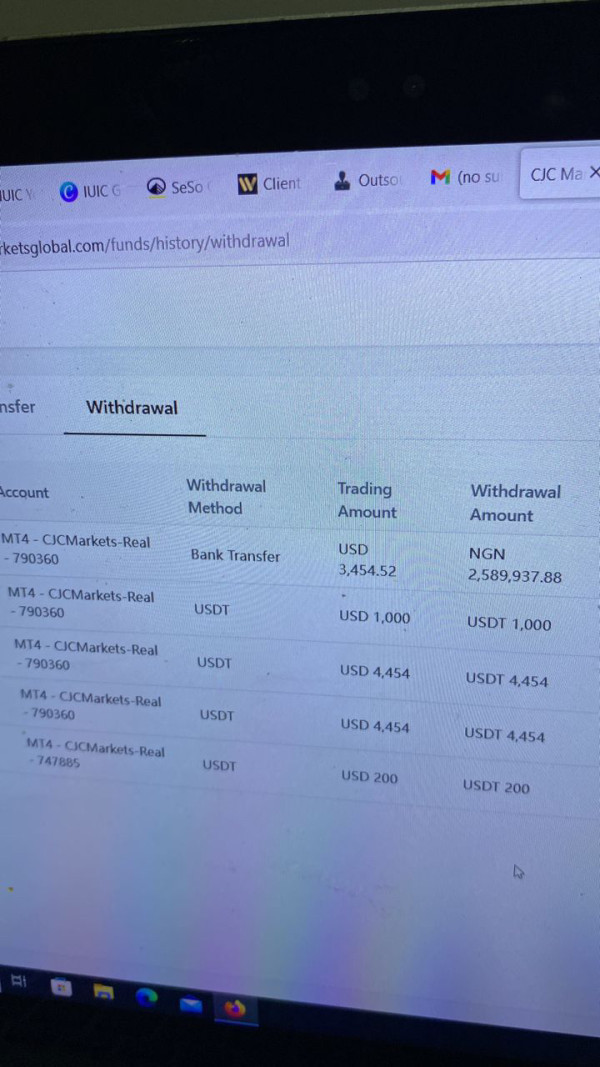

Jide8530

Nigeria

I have been trying to withdraw my money from Cjc Nigeria since 23rd of September 2023. it has been horrible for me since that time till now…they shut down and took peoples monies away without explanation. I have attached evidences and if you guys need more I am ready to provide them

Exposure

2024-03-01

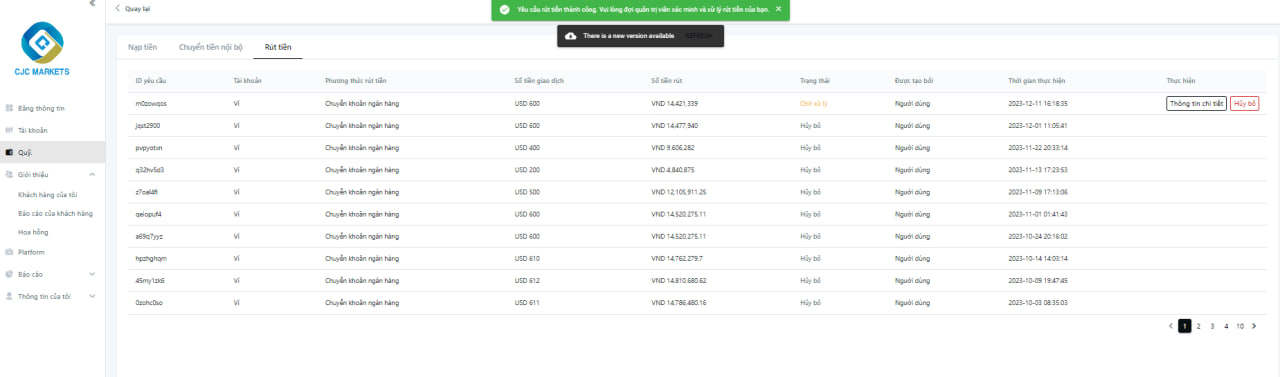

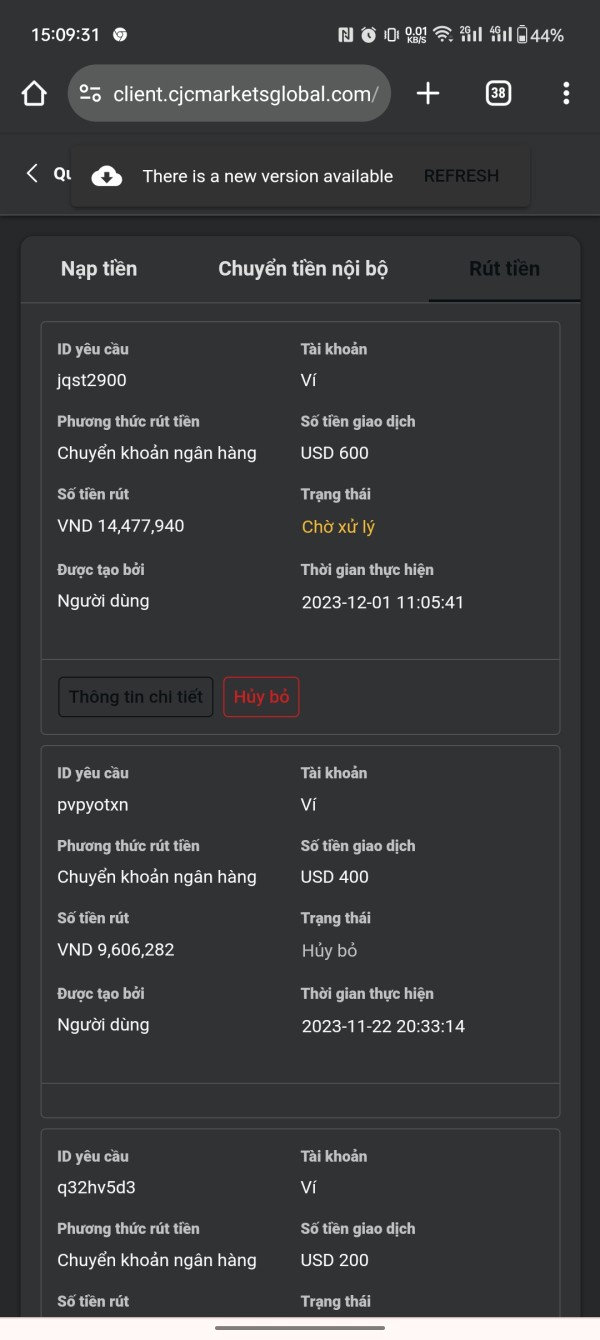

mq0802

Vietnam

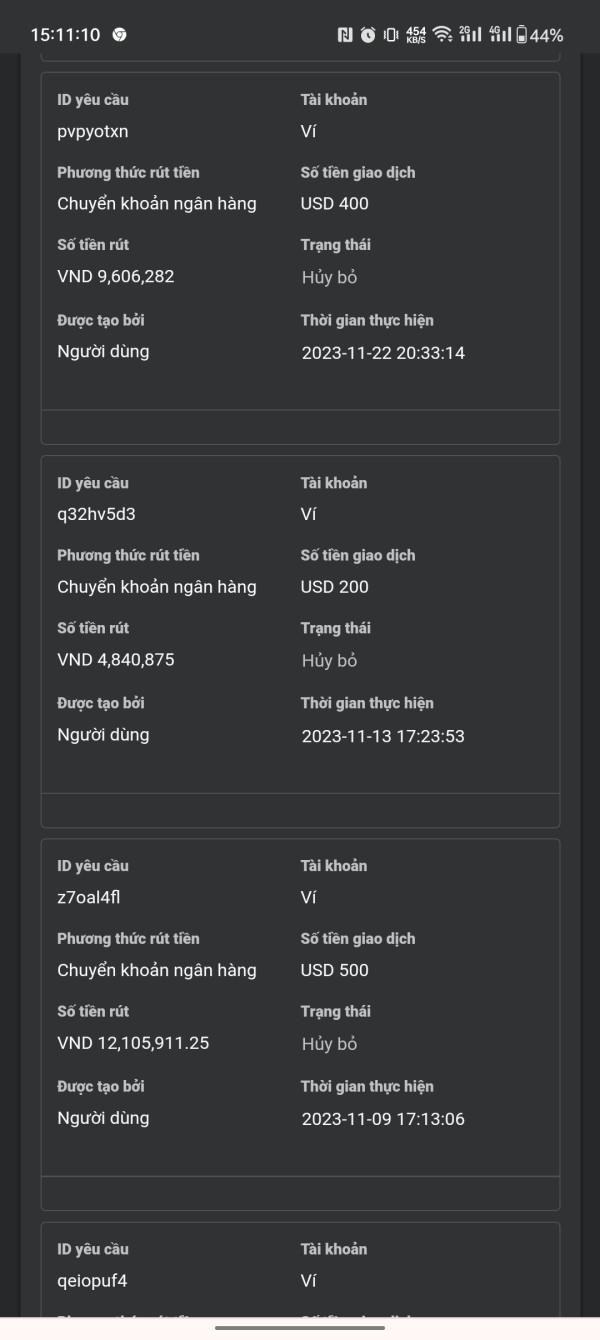

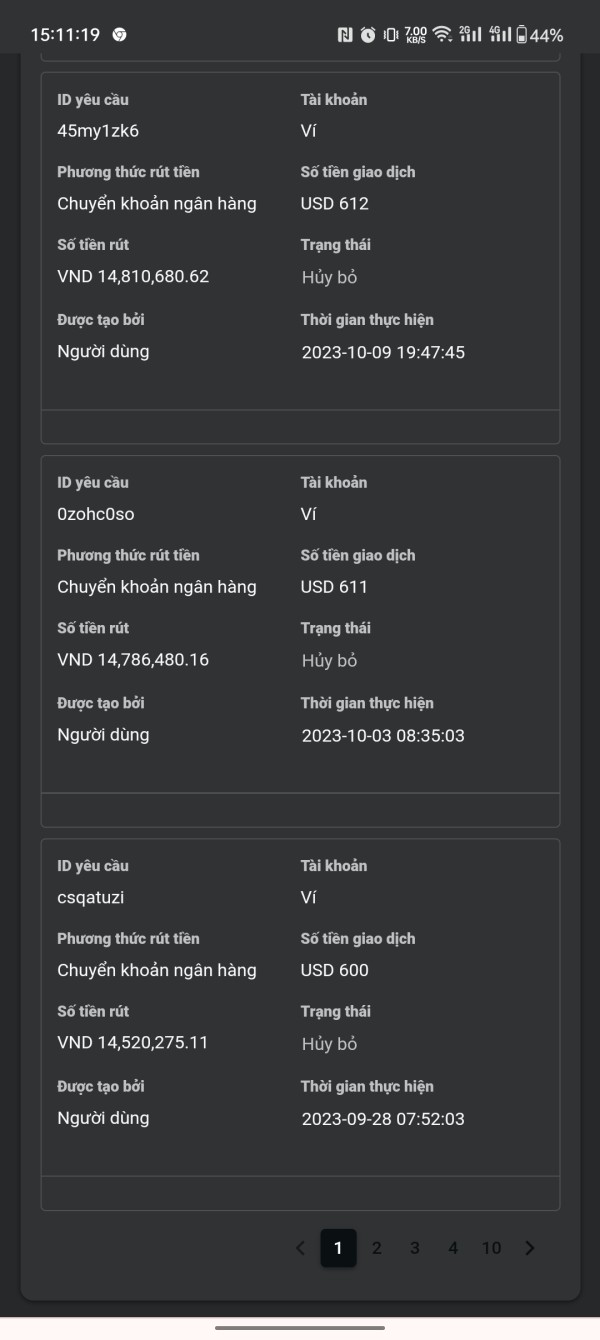

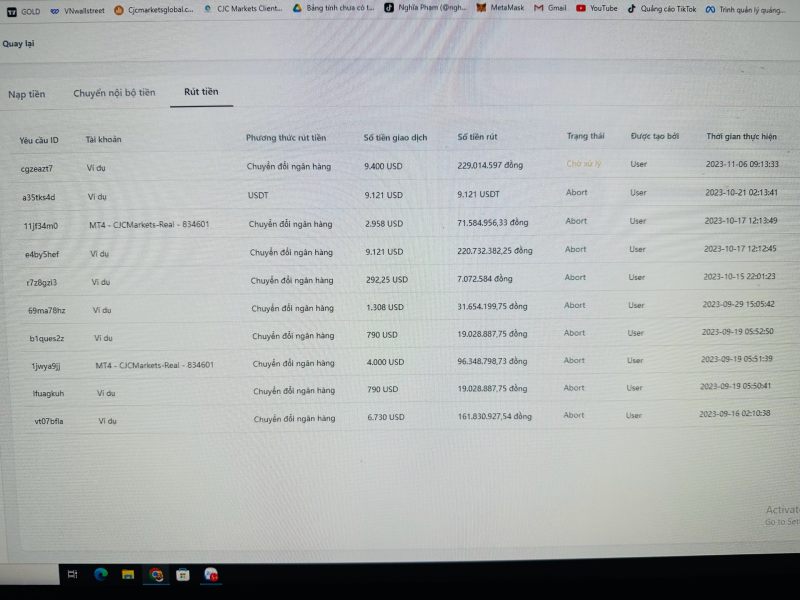

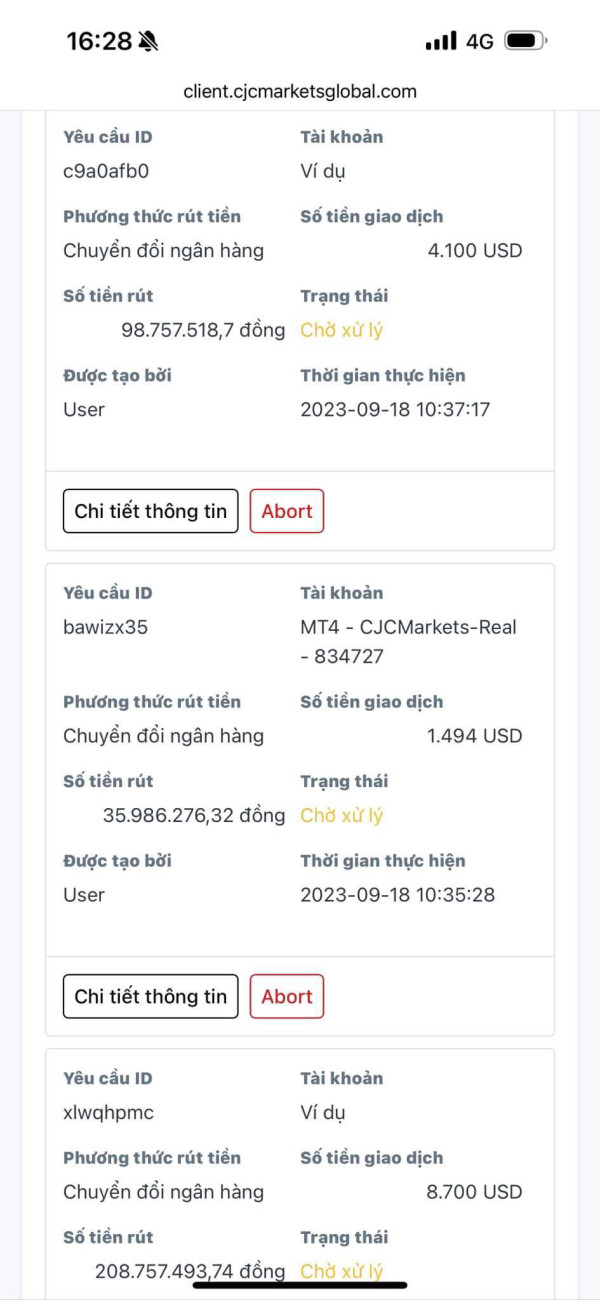

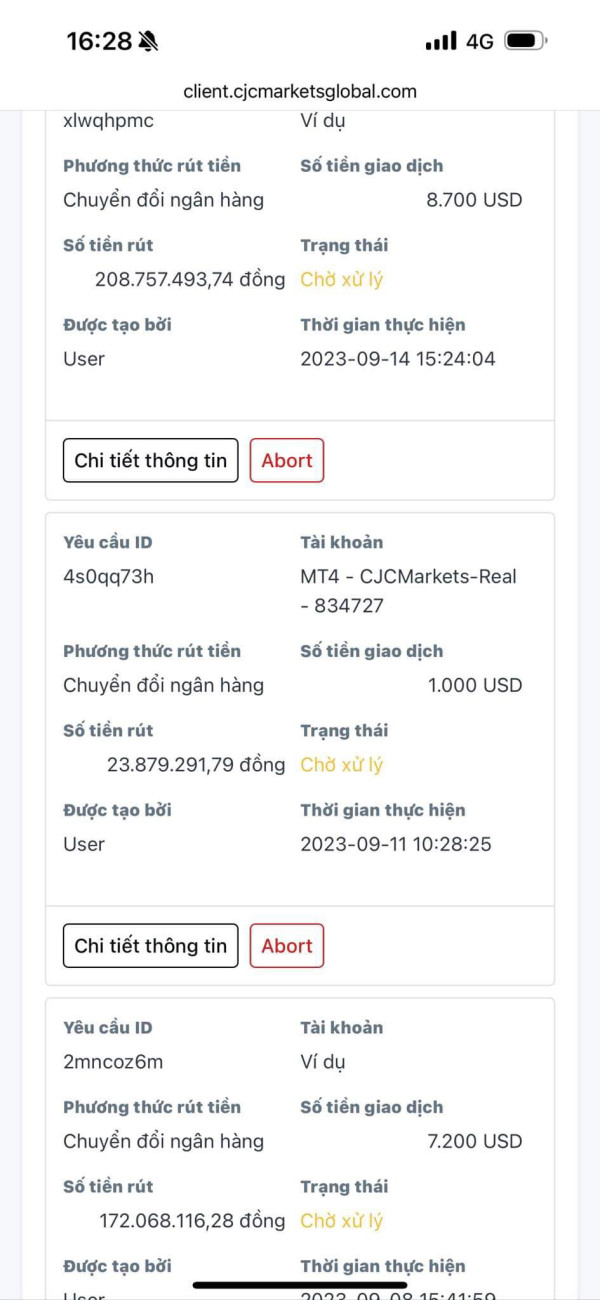

SCAM BROKER. I HAVE WITHDRAWED MONEY FOR MORE THAN 3 MONTHS AND I CAN'T. NO WITHDRAWAL ORDERS HAVE BEEN APPROVED AT ALL. INVEST IN THIS BROKER MUST BE CAREFUL.

Exposure

2023-12-11

mq0802

Vietnam

It's been more than 2 months since I withdrew money from cjc markets and they still haven't processed it. This exchange is a scam so people should be careful when investing.

Exposure

2023-12-05

nghia8651

Vietnam

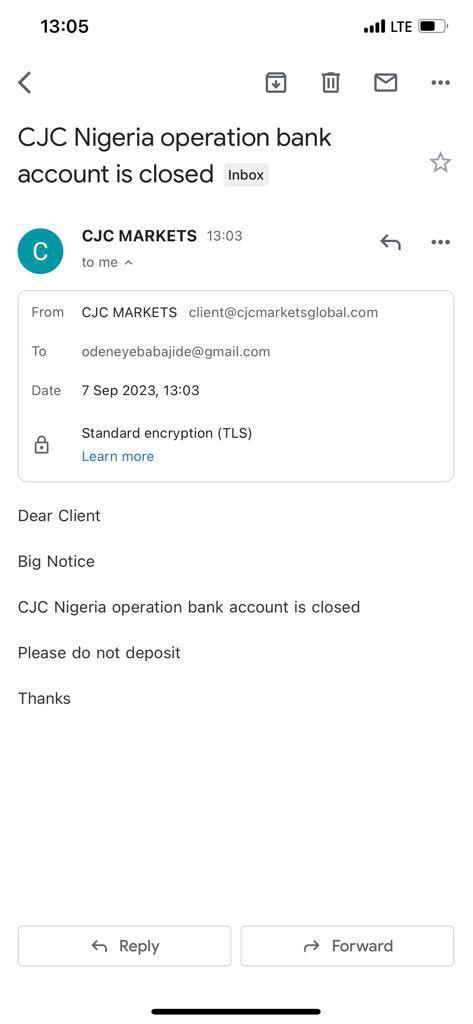

From September 9, 2023, CJC Market has blocked all of their payment gateways. Users are not allowed to withdraw money. And the platform previously sent an email notifying some kind of error, but it has been 3 months and it still hasn't been resolved. I strongly request CJC Market to return benefits to investors.

Exposure

2023-11-28

Hieu Ngo

Vietnam

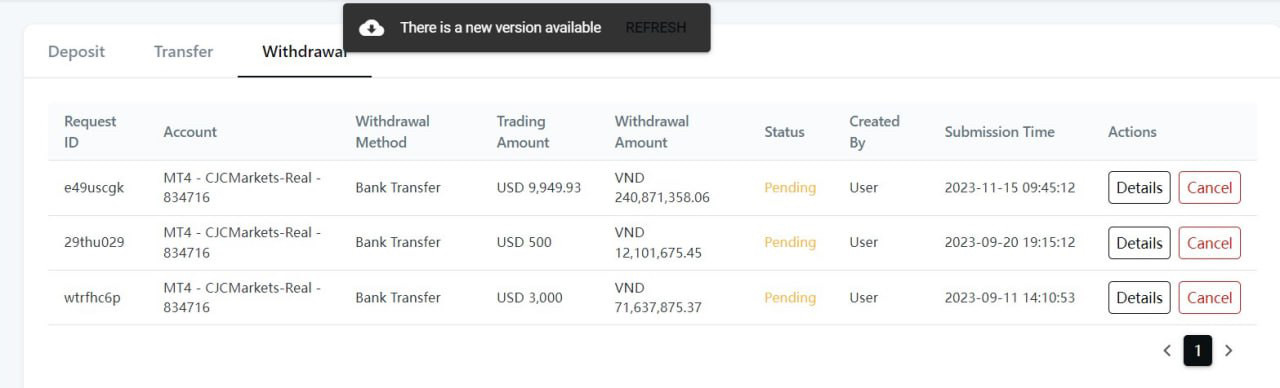

The Vietnamese market is unable to withdraw money at CJC Markets. The Support also doesn't work anymore. More than 100 customers are unable to withdraw their money. We are in need of support.

Exposure

2023-11-15

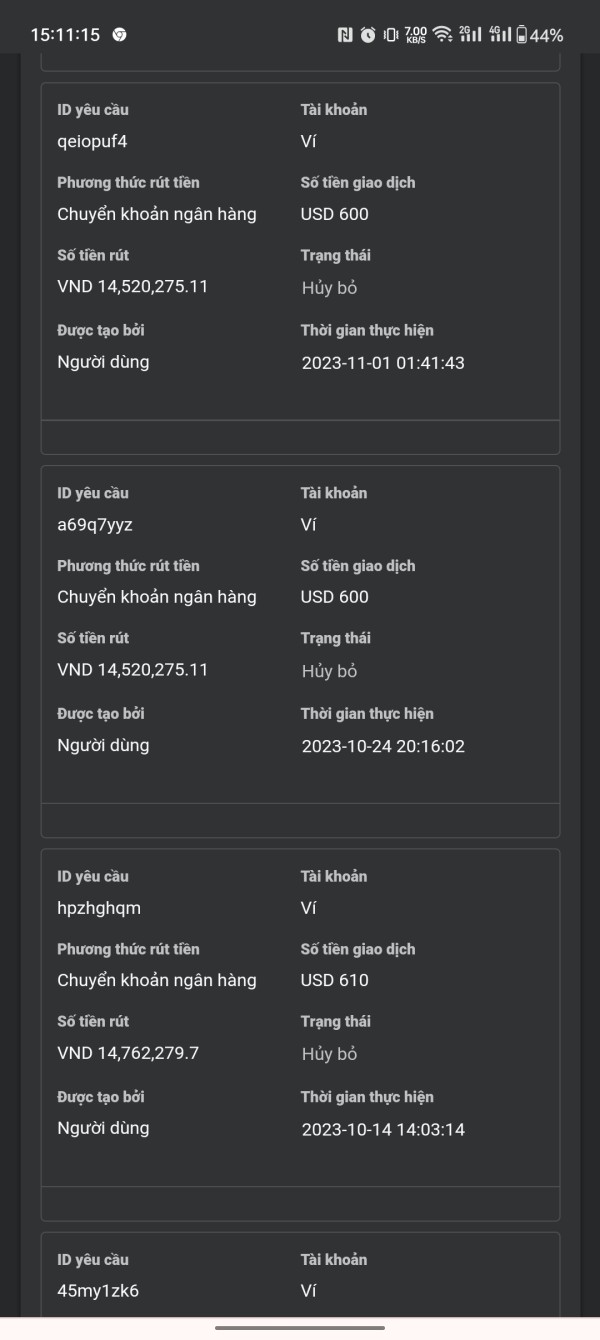

Mrs hằng

Vietnam

The exchange does not allow us to withdraw money. Overnight fees have increased dramatically. I don't understand if the exchange is a scamming broker or what?

Exposure

2023-11-10

Minh3633

Vietnam

I have placed a withdrawal order on September 20, 2023 but have not received approval or response from the broker. Everyone, please be wary of this broker. If anyone helps me get the money, I will give you some of it.

Exposure

2023-11-08

Bùi Đức

Vietnam

I have not been able to withdraw money since September 14. I contacted support but they did not respond.

Exposure

2023-11-01

Bless9123

Nigeria

I have been trading for 2 Years with CJC Markets in Lagos, Nigeria, I have been trying to withdraw, but it keeps showing me pending. CJC Markets, here in Lagos, Nigeria, sent me a mail that they have shut down their Nigerian office. Since then I have not been able to withdraw. My withdrawal kept indicating 'PENDING', without funds moving to my personal account. Please help. I visited their office location here in Lagos, to verify and found out it was true, they have shutdown operations with no plan to refund my cash, I just want to my money back. I suspect a FRAUD in motion. So far I have traded over $5000 Attached are relevant details to help your investigation.

Exposure

2023-10-25

Hoàng Yến

Vietnam

Not allowing customers to withdraw money for nearly 1 month

Exposure

2023-10-25

刘生4639

Hong Kong

A few years ago, I was lured to this company by a guy named Yi Ge on Tencent in Beijing to invest in XAU/USD trade. I lost money, I can’t find this person, and now I can’t even get my balance out.

Exposure

2023-10-19

mq0802

Vietnam

I withdrew money on CJC Market more than a month ago but the withdrawal order was not processed. This exchange is a scam, don't deposit money into it

Exposure

2023-10-18

Hoàng Yến

Vietnam

I have made a withdrawal application. And for nearly 10 days, the money hasn't been withdrawn.

Exposure

2023-10-17

Mrs hằng

Vietnam

PLEASE CONSIDER MY CASE AND HELP ME. Since September 17, the exchange has sent an email stating that the payment gateway is having an error and I hope you understand. Cjc will fix it as soon as possible, but until October 15, I still haven't been able to withdraw it. I don't understand what the error is. But do you keep hiding your trading money like this or is the floor committing fraud?? I signed up for no overnight fee, but from September 17, I found the overnight fee was sky-high

Exposure

2023-10-15

Mrs hằng

Vietnam

Please help handle this account. I want to withdraw money from the exchange but the exchange reports an error at the deposit and withdrawal port since September 17. What is the final result?

Exposure

2023-10-13

Hellen123

Vietnam

Cjc didnt reply support email, they didnot accept withdraw requests, Get my profit back get my money back

Exposure

2023-10-13

Hellen123

Vietnam

Iam not lose, I trade and take profit but they dont accept me withdraw my money even deposit. CJC is cheat give my money back

Exposure

2023-10-13

Bùi Đức

Vietnam

I have not been able to withdraw money since September 14. When I asked the support, they said the error could not be fixed.

Exposure

2023-10-11

kiss6356

Vietnam

Currently, I've been withdrawing money for 2 weeks and it hasn't come back. If I notify support, I just say it to urge the exchange. What business are you doing?

Exposure

2023-09-22

Duy Hoàng

Vietnam

Why my account? I didn't place a withdrawal order but the exchange automatically withdrew my money, what is that??

Exposure

2023-09-04