Overview of GIC Trade

GIC Trade, established in 2023 and based in Singapore, is a peer-to-peer (P2P) forex trading platform that utilizes Metatrader 5 and blockchain technology. It allows investors to choose between being a Trader or a Market Maker, offering flexibility and potential income opportunities. GIC Trade provides multiple account types (PRO, CASHBACK, ECN) tailored to different trading styles and offers various educational resources and analysis tools to assist traders.

Being a relatively new company, its track record is limited, potentially leading to the uncertainty for potential users. Additionally, customer support availability is restricted to weekdays, which may be inconvenient for some traders.

Regulatory Status

GIC Trade, incorporated in Singapore, operates without regulation from any recognized financial authority. This lack of regulatory oversight is a major red flag for potential traders, as it means there are no safeguards in place to protect client assets or ensure fair trading practices. Engaging with an unregulated broker like GIC Trade carries substantial risks, and investors should be aware of the potential consequences before depositing funds.

Pros and Cons

GIC Trade distinguishes itself with its unique peer-to-peer (P2P) trading model, offering traders flexibility and potential income opportunities beyond traditional platforms. The platform further caters to diverse trading styles by offering various account types, including PRO, CASHBACK, and ECN. Additionally, GIC Trade provides a convenient crypto-to-fiat exchange, along with a wealth of educational resources and analysis tools, making it an attractive option for traders seeking a comprehensive and innovative platform.

However, GIC Trade operates without regulation, sowing doubts about the safety and reliability of the platform and its handling of client funds. Being a relatively new company, its track record is limited, potentially adding to the uncertainty for potential users. Additionally, customer support is only available during weekdays, which may be inconvenient for some traders.

Market Instruments

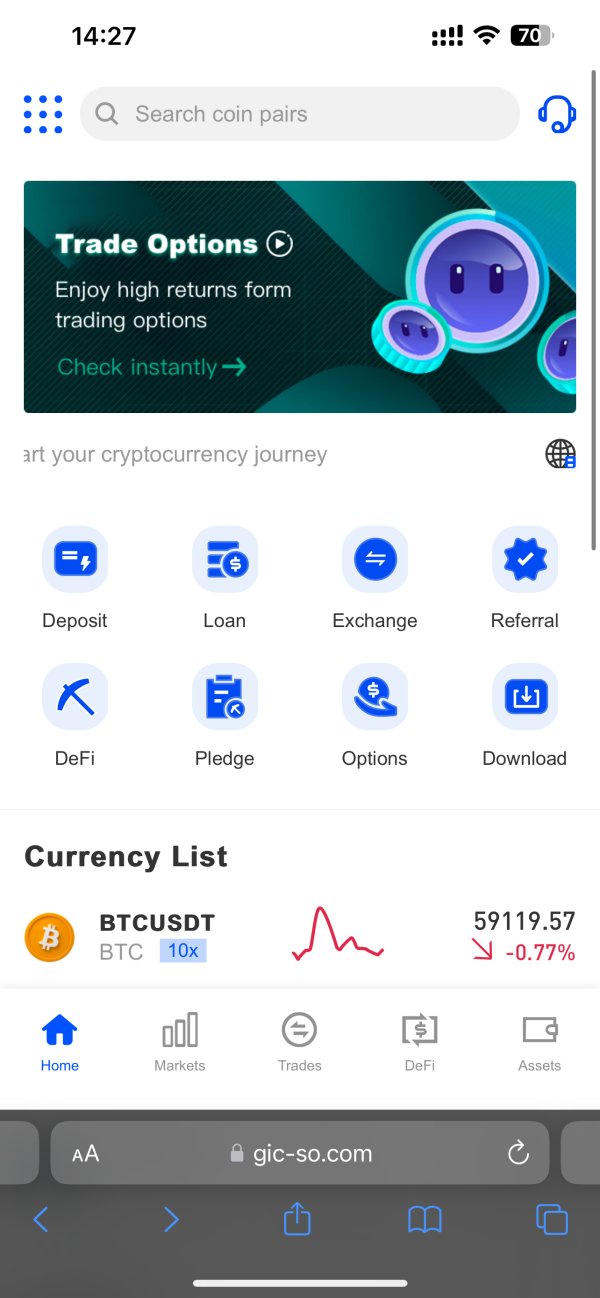

GIC Trade primarily focuses on forex, futures, and cryptocurrency trading:

Forex: Clients can trade a variety of currency pairs in the global forex market.

Futures: Traders could speculate on the price movements of futures contracts on various assets.

Cryptocurrencies: GIC Trade provides opportunities to trade popular cryptocurrencies like Bitcoin and Ethereum and GIC tokens.

Account Types

GIC Trade offers three live trading account types and a demo account:

PRO Account: Designed for traders who prioritize low spreads.

CASHBACK Account: Offers cashback on trades, making it attractive for frequent traders.

ECN Account: Geared towards experienced traders who demand raw spreads and faster execution.

The PRO and CASHBACK accounts share several similarities, including low spreads, a fee of 1 GICT per lot, free swaps, and a minimum deposit of 10 GICT. Both allow leverage of 1:100 on all instruments and up to 1:400 on Forex. However, the CASHBACK account extends the 1:400 leverage to Gold as well, providing additional flexibility for precious metal traders.

The ECN NGW account stands out with its raw spread model, offering potentially tighter spreads but with a higher commission of 3.5 GICT per lot. While leverage and swap conditions remain consistent with the other accounts, this account type requires a significantly higher minimum deposit of 1000 GICT, making it more suitable for experienced traders with larger capital.

Account Opening Process

Opening an account with GIC Trade is a straightforward process that can be completed in a few simple steps:

Visit the GIC website: Go to the official GIC Trade website.

Click “Sign Up”: Start the registration process.

Provide Information: Enter your personal details, email address, and create a password.

Verify Email: Confirm your email address through the confirmation link sent to you.

Complete Profile: Fill in additional details to complete your profile.

Deposit Funds: Deposit funds into your account using GICT or other supported cryptocurrencies.

Leverage

GIC Trade offers leverage up to 1:400 for Forex and Gold and 1:100 for other instruments across all account types. The Mini account features Dynamic Leverage, adjusting leverage based on trade size and offering up to 2000:1 leverage for smaller positions.

Trading Fees

GIC Trade's trading fees vary by account type. The PRO and CASHBACK accounts have low spreads and a fee & commission of 1 GICT per lot. The ECN account offers tighter spreads but has a higher fee & commission of 3.5 GICT per lot. All account types benefit from swap-free trading.

Trading Platforms and Tools

GIC Trade offers multiple trading platforms:

GIC Affiliate: GIC Affiliate is an affiliate program of GIC that facilitates aspiring traders & brokers to generate additional income from affiliate marketing. The program provides marketing support, rewards, and bonuses for affiliates who successfully generate transactions from their referrals.

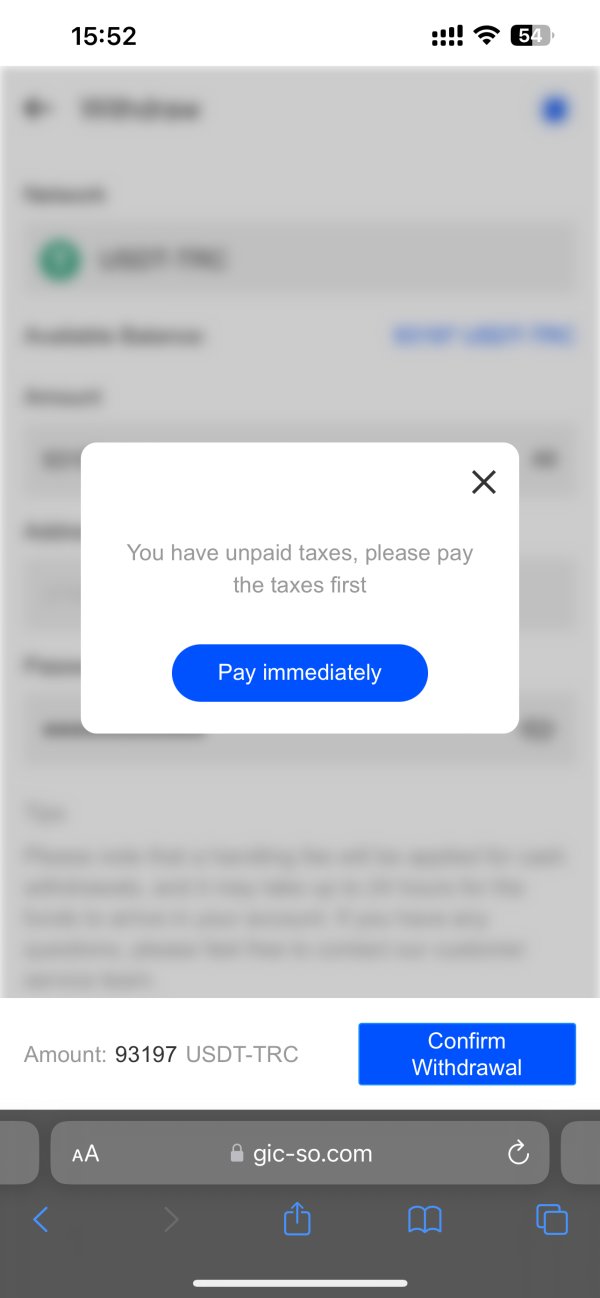

Deposit and Withdrawal

GIC Trade offers deposits through the Duitku Merchant on their GICTrade mobile application. After completing OTP and KYC verification, users select Duitku transfer, choose a merchant, enter the deposit amount, and then finalize payment through the provided Virtual Account.The minimum deposit for basic accounts is 10 GICT, and for ECN accounts, it's 1000 GICT.

GIC processes withdrawals on business days, with timing impacting processing speed. Withdrawals made before 11:00 WIB are processed the same day, while those made after are processed the following day, with variations for non-BCA bank accounts.

Customer Support Options

GIC Trade offers customer support through:

Email: Support@gicindonesia.com

Phone: 0817 - 0095 - 888 (Monday - Friday, 09.00 - 17.00)

Social media channels: Facebook, Twitter, Telegram, Whatsapp, and Discord.

Educational Resources

GIC Trade provides various educational resources:

Conclusion

GIC Trade's unique P2P model and use of blockchain technology offer a fresh approach to trading. With various account options and educational resources, it could be appealing to traders seeking flexibility and transparency.

However, the lack of regulation and limited track record are significant drawbacks that potential clients should consider before investing.

FAQs

Q: Is GIC Trade a regulated broker?

A: No, GIC Trade is not regulated by any known financial authority.

Q: What is the minimum deposit for a GIC Trade account?

A: The minimum deposit varies depending on the account type: 10 GICT for basic accounts and 1000 GICT for ECN accounts.

Q: What trading platforms and Tools does GIC Trade offer?

A: GIC Trade offers GICTrade, GIC Social Trade, MT5, and an affiliate program.

Q: How can I contact GIC Trade customer support?

A: You can contact GIC Trade through email, phone, or various social media channels.