Score

ZHONGZHOU FUTURES

China|5-10 years|

China|5-10 years| https://www.zzfco.com/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

China 2.67

China 2.67Contact

Licenses

Licenses

Licensed Institution:中州期货有限公司

License No.:0271

Basic Information

China

ChinaUsers who viewed ZHONGZHOU FUTURES also viewed..

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

zzfco.com

Server Location

China

Website Domain Name

zzfco.com

ICP registration

鲁ICP备08106169号-1

Website

WHOIS.PAYCENTER.COM.CN

Company

XINNET TECHNOLOGY CORPORATION

Domain Effective Date

2002-02-22

Server IP

218.56.38.37

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| ZHONGZHOU FUTURES | Basic Information |

| Company Name | ZHONGZHOU FUTURES |

| Founded | 1995 |

| Headquarters | China |

| Regulations | Regulated by Chinese authorities |

| Products and Services | Commodity futures, financial futures, investment consulting, asset management |

| Fees | Margin requirements ranging from 10% to 25%, depending on volatility and contract type |

| Trading Platforms | Boyi Cloud Trading Edition, Yingshun Cloud Market and Trading Software, Zhongzhou Futures Kuaiqi V3, etc. |

| Deposit Methods | Bank transfer, check deposit |

| Customer Support | Phone support(400-820-5060), online chat |

| Education Resources | Covers macroeconomics, various commodity sectors, technical analysis, and more |

Overview of ZHONGZHOU FUTURES

Zhongzhou Futures is a prominent brokerage firm in China known for its wide range of services tailored to commodities and financial futures markets. It offers a selection of trading platforms suited to diverse trading strategies and provides educational resources and tools for risk and investment management. With its regulatory compliance, Zhongzhou Futures positions itself as a reliable option for traders looking for stability and support in the volatile futures market.

Is ZHONGZHOU FUTURES Legit?

Zhongzhou Futures is regulated, as it is overseen by Chinese authorities. The displayed information confirms a “Regulated” status, along with a specific futures license number (0271) issued in China, verifying its compliance with regulatory standards.

Pros and Cons

Zhongzhou Futures stands out as a well-regulated brokerage firm in China, providing a comprehensive suite of services and educational resources tailored for a wide array of trading needs. The firm's diverse array of advanced trading platforms caters to both new and experienced traders, promoting an environment of efficacy and growth in trading skills. Additionally, regulation by Chinese authorities lends a layer of trust and compliance to its operations. However, the very nature of the volatile markets it operates in may heighten investment risk. Another limitation is the firm's lack of transparency regarding specific operational details and fee structures, which could hinder informed decision-making by traders. Moreover, its services are primarily focused on the Chinese market, which may limit the firm's appeal to international traders.

| Pros | Cons |

|

|

|

|

|

|

Products and Services

Zhongzhou Futures primarily offers a range of services including commodity futures brokerage, financial futures brokerage, futures investment consulting, fund sales, and asset management. It is an official member of major Chinese exchanges like the Shanghai Futures Exchange, Dalian Commodity Exchange, Zhengzhou Commodity Exchange, China Financial Futures Exchange, and Shanghai International Energy Exchange. Zhongzhou Futures is authorized to trade all listed products on these exchanges, catering to the investment and risk management needs of domestic and international institutions, hedgers, and a broad investor base.

How to Open an Account

To open an account with ZHONGZHOU FUTURES, follow these steps.

Visit the ZHONGZHOU FUTURES website. Look for the “open account online” button on the homepage and click on it.

- Registration: Complete the registration form by providing necessary personal information and any required documentation.

2. Verification: Undergo a verification process to confirm your identity.

3. Activation: Once verified, activate your account to start trading.

Fees

Zhongzhou Futures charges fees primarily in the form of margin requirements for various futures contracts, which vary depending on the commodity and whether the position is speculative or hedging. These fees include both the company's own margin percentage and the exchange margin percentage. Here are some general trends observed from the data:

- Company Margin Rates: Typically range from 10% to 25% for speculative positions and slightly lower for hedging positions.

- Exchange Margin Rates: Generally range from 6% to 20%, varying by the type of contract and specific conditions of the market.

- Volatility Influence: Higher volatility commodities, such as metals and energy products, tend to require higher margins, reflecting the increased risk associated with trading these products.

Trading Platforms

Zhongzhou Futures offers various trading platforms designed for futures, securities, and forex markets:

1. Boyi Cloud Trading Edition: Supports real-time domestic and international market data, charts, and advanced trading features.

2. Yingshun Cloud Market and Trading Software: Integrates trading, market data analysis, and speed into a user-friendly platform.

3. Zhongzhou Futures Kuaiqi V3: Provides robust futures and options trading capabilities with multi-window support, technical indicators, and advanced order options.

4. Tonghuashun Futures通: Combines market data, trading, and news for comprehensive market analysis.

5. MCTrader: Specialized MultiCharts version for the Chinese market focused on automated trading and strategy development, requiring special access.

6. Suixinyi: Offers comprehensive, intelligent trading features for futures and options, including quick order entry and algorithmic trading.

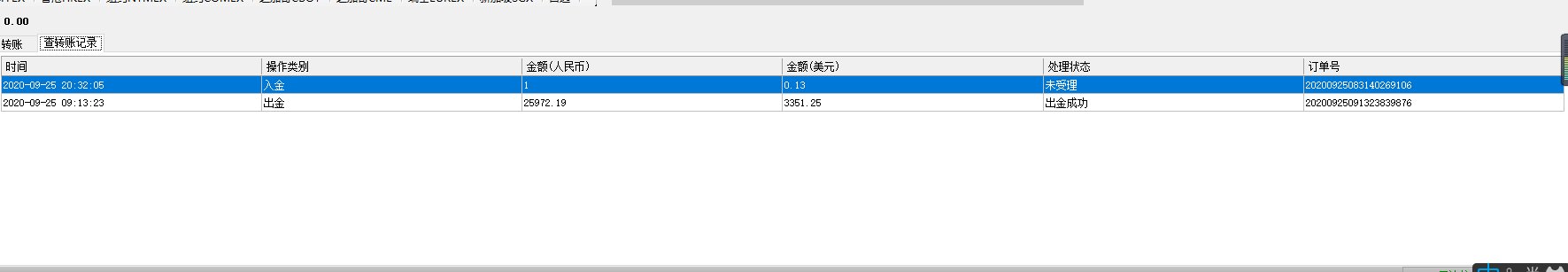

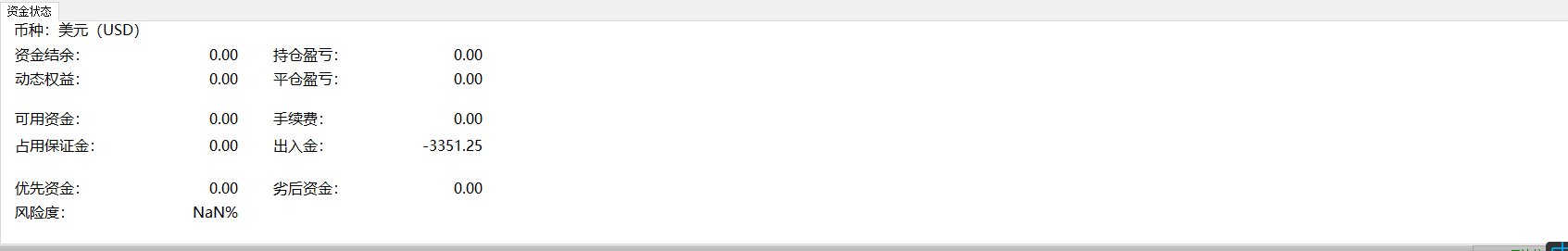

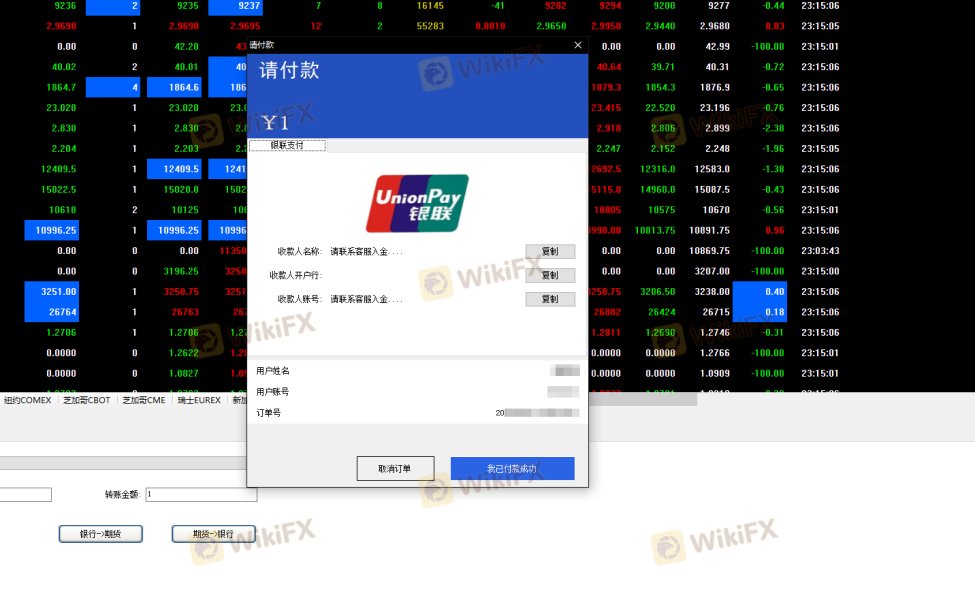

Deposit & Withdraw Methods

Zhongzhou Futures offers the following deposit and withdrawal methods:

- Deposit Methods:

- Bank transfer

- Check deposit

- Withdrawal Methods:

- Bank transfer

- Withdrawal at a branch office (requires identification)

Both methods emphasize the use of traditional banking channels, and withdrawals can be completed on the same day if processed before the cut-off time. For larger transactions, the company ensures a high security standard, with up to 95% of funds held in segregated accounts.

Customer Support

Zhongzhou Futures offers customer support through two primary channels:

- Phone Support: Customers can reach support via a dedicated phone line at 400-820-5060.

- Online Chat: Support is also available through an online chat service, providing real-time assistance.

Educational Resources

Zhongzhou Futures offers educational resources through its research center, which covers a broad range of topics. These include macroeconomics, energy and chemicals, agricultural and sideline products, ferrous industry, non-ferrous metals, and options trading. The center also provides services like position analysis, public information disclosure, and a complaint mechanism. Additionally, an analyst team is available to support and enhance the learning experience for clients.

Conclusion

Zhongzhou Futures provides a wide range of services, including trading platforms and educational materials, along with reliable trading solutions. Its legitimacy is increased by China's regulated status. However, there may be drawbacks, such as the intricacy of charge schedules and the inherent dangers of erratic futures markets. Customers gain from comprehensive assistance and an array of resources for effective investment management.

FAQs

Is Zhongzhou Futures a regulated entity?

Yes, Zhongzhou Futures is regulated by Chinese financial authorities.

What types of products does Zhongzhou Futures offer?

They offer commodity and financial futures, investment consulting, and asset management services.

How can I start trading with Zhongzhou Futures?

To start trading, visit their website, complete the registration form, undergo identity verification, and then activate your account.

What educational resources does Zhongzhou Futures provide?

They offer resources covering macroeconomics, energy, chemicals, metals, and more, along with trading strategies and market analysis.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then.

Keywords

- 5-10 years

- Regulated in China

- Futures License

- Suspicious Scope of Business

Comment 3

Content you want to comment

Please enter...

Comment 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now