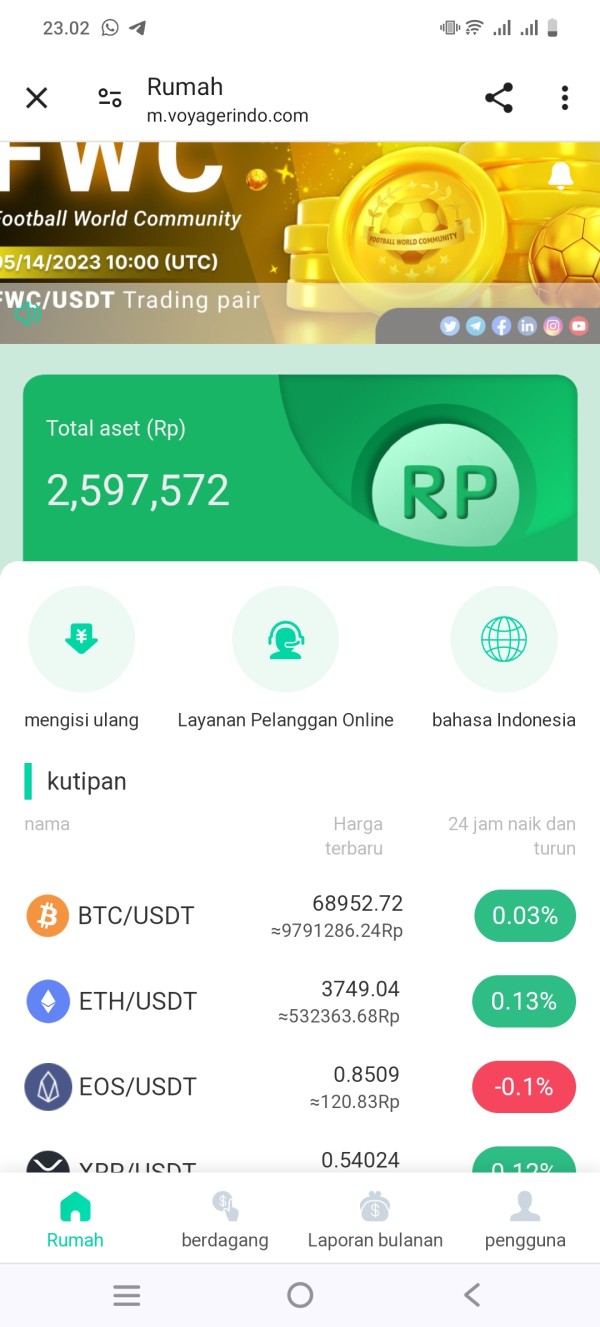

Overview of FX-BTC Trade

Founded in the United Kingdom in 2022, FX-BTC Trade focuses on cryptocurrency trading, featuring major assets like Bitcoin (BTC), Ethereum (ETH), and stablecoins such as Tether (USDT) and Binance USD (BUSD). Offering advantages like a fee-free deposit structure, the platform provides various account types for different trader preferences.

However, potential drawbacks include reported issues with customer support, limited cross-fiat trading options, and the absence of regulatory oversight. Traders should consider these factors, including the platform's relatively recent establishment, when evaluating FX-BTC Trade for their cryptocurrency trading needs.

Is FX-BTC Trade legit or a scam?

FX-BTC trade operates without regulatory oversight. The absence of regulation poses potential risks, as market participants lack protection and oversight mechanisms. Investors face heightened vulnerability to fraud, manipulation, and unfair practices.

Without regulatory checks, the market lacks transparency, hindering the detection and prevention of illicit activities. This unregulated environment attracts bad actors, jeopardizing the integrity of FX-BTC trade.

Pros and Cons

Pros:

Various Market Instruments:

The platform offers a variety of market instruments, with a primary focus on cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and stablecoins such as Tether (USDT) and Binance USD (BUSD). It also includes major fiat currencies like the US Dollar (USD), Euro (EUR), and Japanese Yen (JPY).

Varied Account Types:

FX-BTC Trade provides multiple account types. The Classic Account suits beginners with a minimum deposit of $100, while the Platinum Account, requiring $5,000, targets those seeking tighter spreads. The Professional Account, with a minimum deposit of $10,000, is suitable for experienced traders offering lower spreads.

Utilizes MT4 Trading Platform:

The platform employs the widely recognized MetaTrader 4 (MT4) trading platform. MT4 is known for its user-friendly interface, offering features like real-time price quotes, historical data, and technical analysis tools. It supports the implementation of automated trading strategies through Expert Advisors (EAs).

Fee-Free Deposit Structure:

Cons:

Unregulated:

FX-BTC Trade operates without regulatory oversight. The absence of regulation raises risks about investor protection and market integrity. Traders face heightened vulnerability to fraud, manipulation, and unfair practices.

Customer Support Issues:

Reports indicate customer support shortcomings, including slow response times and inadequate issue resolution. Users have expressed dissatisfaction with unhelpful and generic responses, pointing to a need for improvement in the support services.

Limited Cross-Fiat Trading:

Higher Spread Costs for Classic Account:

The Classic Account has relatively higher spread costs, typically around 1.5 pips. This could be a consideration for traders who prioritize lower spread expenses, prompting them to explore other account types.

Official Website Inaccessibility:

Market Instruments

FX-BTC Trade offers a limited selection of trading assets, focusing primarily on cryptocurrencies and a handful of fiat currencies.

Cryptocurrencies:

Bitcoin (BTC): The leading cryptocurrency by market capitalization.

Ethereum (ETH): The second-largest cryptocurrency, known for its smart contract functionality.

Tether (USDT): A stablecoin pegged to the US dollar.

Binance USD (BUSD): Another stablecoin pegged to the US dollar, issued by Binance.

Litecoin (LTC): A “lite” version of Bitcoin.

Fiat Currencies:

US Dollar (USD): The world's reserve currency.

Euro (EUR): The official currency of the European Union.

Japanese Yen (JPY): The currency of Japan.

Trading pairs:

FX-BTC Trade allows trading cryptocurrencies against each other (e.g., BTC/ETH) and against fiat currencies (e.g., BTC/USD). However, the platform's limited selection of fiat currencies restricts cross-fiat trading options.

Account Types

FX-BTC trade provides various account types, including Classic Account,Platinum Account and Professional Account.

The Classic Account in FX-BTC trade is suitable for users with a minimum deposit of $100. This account type offers a maximum leverage of 1:500 and typically features spreads around 1.5 pips. Notably, there is no commission associated with the Classic Account. It serves traders who are starting in the FX-BTC market and prefer a lower initial investment.

On the other hand, the Platinum Account requires a minimum deposit of $5,000. With the same maximum leverage of 1:500, this account type stands out with tighter spreads, usually around 0.5 pips. Similar to the Classic Account, the Platinum Account does not involve any commission. This account is suitable for more experienced traders or those with a higher risk appetite, given the elevated minimum deposit requirement.

For users seeking even more favorable trading conditions, the Professional Account in FX-BTC trade becomes relevant with a minimum deposit of $10,000. Offering a maximum leverage of 1:1000, this account type boasts spreads as low as 0 pips. Like the other account types, the Professional Account does not impose any commission. This account is tailored for seasoned traders who are well-versed in the FX-BTC market and seek enhanced trading capabilities with the potential for lower spreads.

How to Open an Account?

Registration Process:

Begin by visiting the official FX-BTC trade platform's website.

Locate the “Sign Up” button and click on it.

Fill out the required registration form with accurate personal information, including your full name, email address, contact number, and residence details.

Create a strong password for your account and ensure compliance with any specified security requirements.

Agree to the platform's terms and conditions, and confirm your acceptance.

2. Account Verification:

After completing the registration, access your email to verify your account. Click on the verification link sent by FX-BTC trade.

Provide any additional identification documents as requested for account verification. This includes a copy of your government-issued ID, proof of address, or other specified documents.

Await confirmation from the platform regarding the successful verification of your account. This step is crucial for compliance with regulatory requirements and to ensure the security of your account.

3. Funding Your Account:

Log in to your verified FX-BTC trade account using your credentials.

Navigate to the “Deposit” section.

Choose your preferred deposit method (e.g., bank transfer, credit card, cryptocurrency) and follow the instructions to complete the transaction.

Verify that the deposited funds reflect in your trading account.

Once funded, you are ready to explore the FX-BTC market and engage in trading activities on the platform.

Leverage

In FX-BTC trade, leverage refers to the ratio of borrowed funds to a trader's own capital, allowing them to control larger positions in the market. The maximum leverage is expressed as a numerical ratio, indicating how much larger a trading position a trader can control relative to their initial investment.

The leverage varies on account types:

Classic Account:

2. Platinum Account:

3. Professional Account:

For example, with a leverage of 1:500, a trader can control a position worth $50,000 with an initial capital of $100. The higher the leverage, the greater the potential for profit, but it also involves increased risk, as losses can be magnified. Traders need to carefully assess and manage their risk exposure based on the maximum leverage offered by the chosen account type in FX-BTC trade.

Spreads & Commissions

In FX-BTC trade, spreads and commissions play a significant role in determining the overall cost of trading. The spread represents the difference between the buying (ask) and selling (bid) prices, while commissions are direct charges applied to each trade. Examining the provided account types, we observe distinct fee structures:

The Classic Account features spreads typically around 1.5 pips, with no associated commission. This account is suitable for traders with a lower initial investment of $100, as it offers a cost-effective option without additional transaction charges.

In contrast, the Platinum Account, requiring a minimum deposit of $5,000, offers tighter spreads, typically around 0.5 pips. Similar to the Classic Account, there is no commission, making it an attractive choice for traders seeking reduced spread costs and willing to commit a higher initial deposit.

The Professional Account, suitable for experienced traders with a minimum deposit of $10,000, boasts spreads as low as 0 pips, and like the other account types, does not incur commission charges. This account is tailored for advanced traders who prioritize ultra-low spreads and are willing to meet a higher deposit requirement.

Trading Platform

FX-BTC trade utilizes the MetaTrader 4 (MT4) trading platform.

MT4 is a widely recognized and established trading platform in the financial industry. It provides users with a range of features for analyzing and executing trades in the FX-BTC market. The platform supports a variety of order types, technical analysis tools, and customizable charts, allowing traders to make informed decisions.

One notable aspect of MT4 is its user-friendly interface, making it accessible for both novice and experienced traders. The platform offers real-time price quotes, historical data, and a range of technical indicators to aid in market analysis. Additionally, MT4 allows for the implementation of automated trading strategies through Expert Advisors (EAs), enhancing the efficiency of trading activities.

Deposit & Withdrawal

FX-BTC Trade offers two primary payment methods for deposits – bank transfer and credit card. These methods provide flexibility for users to fund their accounts based on their preferences. Bank transfers are a traditional and widely used option, allowing users to transfer funds directly from their bank accounts to their trading accounts. Credit card payments, on the other hand, offer a convenient and quick method for depositing funds, providing users with an accessible way to start trading in the FX-BTC market.

Minimum Deposit:

The minimum deposit requirements vary based on the chosen account type. The Classic Account requires a minimum deposit of $100, making it an accessible option for traders with limited capital. The Platinum Account has a higher minimum deposit of $5,000, while the Professional Account has a minimum deposit requirement of $10,000.

Payment Fees:

FX-BTC Trade operates with a deposit fee structure that is notably fee-free for all account types. This means that users can deposit funds into their trading accounts without incurring additional charges or fees. The absence of deposit fees contributes to a transparent and cost-effective funding process for traders.

Customer Support

FX-BTC Trade's customer support, reachable at support@fx-btctrade.com, falls short in addressing user inquiry.

Numerous reports indicate slow response times, with users experiencing delays in receiving assistance. The support team's lack of effectiveness is compounded by inadequate resolution of queries, leaving traders dissatisfied. Additionally, there are grievances regarding unhelpful and generic responses, indicating a lack of personalized attention to customer issues.

Conclusion

In conclusion, FX-BTC Trade offers a platform for cryptocurrency trading, specializing in major assets like Bitcoin and Ethereum.

The advantages of the platform include a wide range of market instruments, fee-free deposits, and a user-friendly MetaTrader 4 (MT4) trading platform. The provision of multiple account types serves traders with varying experience levels and risk appetites.

However, the absence of regulatory oversight poses potential risks, raising risks about investor protection. Reports of customer support issues, including slow response times and inadequate problem resolution, highlight a need for improvement in service quality. Additionally, the limited selection of fiat currencies hampers cross-fiat trading options.

FAQs

Q: What is the minimum deposit for a Classic Account on FX-BTC Trade?

A: The minimum deposit for a Classic Account is $100.

Q: Is FX-BTC Trade regulated by any authority?

A: No, FX-BTC Trade operates without regulatory oversight.

Q: What is the maximum leverage offered by the Professional Account?

A: The Professional Account offers a maximum leverage of 1:1000.

Q: What are the market instruments on FX-BTC Trade?

A: FX-BTC Trade focuses primarily on cryptocurrencies, including Bitcoin, Ethereum, and select fiat currencies.

Q: What trading platform does FX-BTC Trade utilize?

A: FX-BTC Trade utilizes the MetaTrader 4 (MT4) trading platform.

Q: Are there any fees associated with deposits on FX-BTC Trade?

A: No, FX-BTC Trade operates with a fee-free deposit structure.