Score

Z.com Bullion

Hong Kong|10-15 years|

Hong Kong|10-15 years| https://bullion.z.com/en

Website

Rating Index

Capital Ratio

Capital Ratio

Good

Capital

Influence

B

Influence index NO.1

Thailand 8.03

Thailand 8.03Capital Ratio

Capital Ratio

Good

Capital

Influence

Influence

B

Influence index NO.1

Thailand 8.03

Thailand 8.03Contact

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 6 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

Hong Kong

Hong KongUsers who viewed Z.com Bullion also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM)

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Japan

Vietnam

Myanmar

Thailand

fxprime.com

Server Location

Japan

Most visited countries/areas

Japan

Website Domain Name

fxprime.com

Website

WHOIS.JPRS.JP

Company

JAPAN REGISTRY SERVICES CO., LTD.

Domain Effective Date

2003-09-22

Server IP

122.50.120.86

gmo-click.com.hk

Server Location

Japan

Website Domain Name

gmo-click.com.hk

Website

WHOIS.HKIRC.HK

Company

-

Server IP

27.110.58.14

gmoz.com

Server Location

Canada

Website Domain Name

gmoz.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2004-04-25

Server IP

64.98.145.30

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

Note: Z.com Bullion's official website: https://bullion.z.com/en is currently inaccessible normally.

Z.com Bullion Information

Z.com Bullion is a regulated brokerage company registered in Hong Kong. Due to the closure of the official website of this broker, traders cannot obtain more security information.

Is Z.com Bullion Legit?

Z.com Bullion is authorized and regulated by SFC, license number AZE792, while the supervision of FSA and FCA is revoked and a suspicious clone status by FSA.

Downsides of Z.com Bullion

- Unavailable Website

Because of the inaccessible Z.com Bullion's official website raises concerns about its reliability and accessibility.

- Lack of Transparency

Since Z.com Bullion does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

Securities and Futures Commission of Hong Kong(FSC) regulates Z.com Bullion, which is safer than unregulated one. But risks are inevitable.

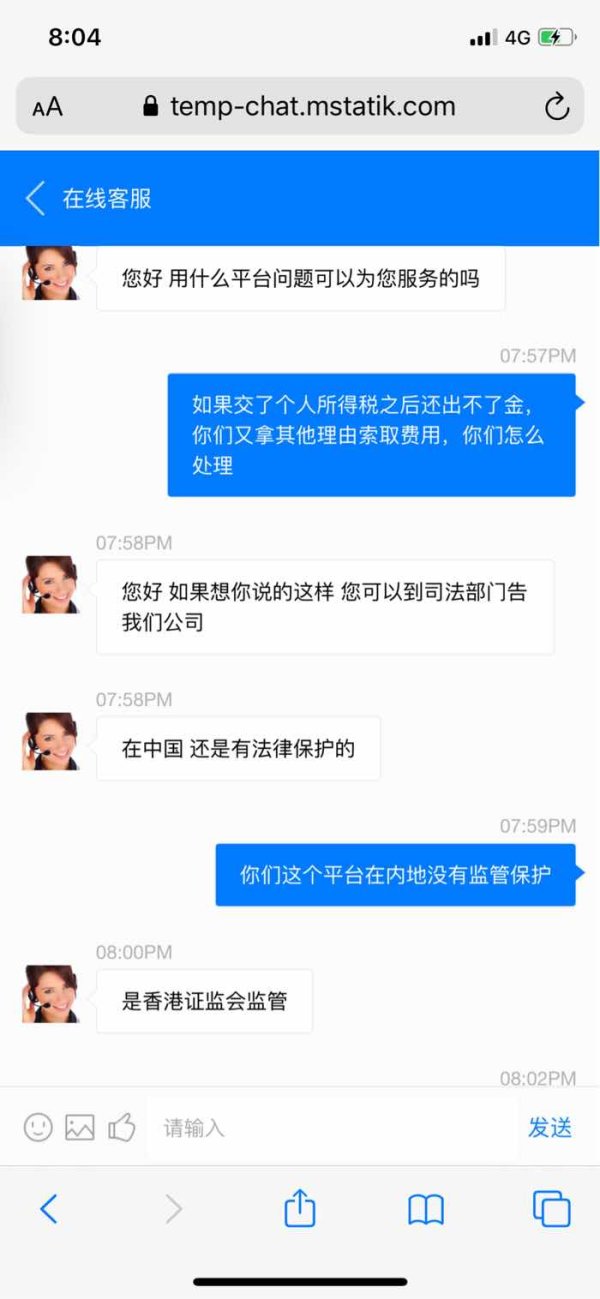

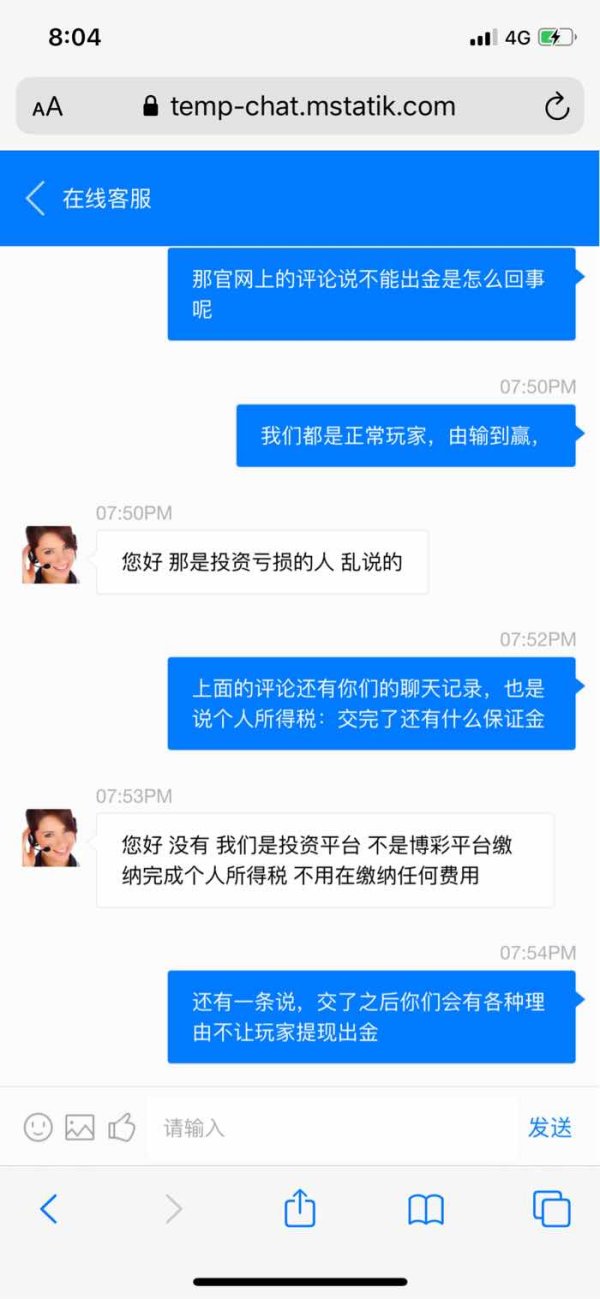

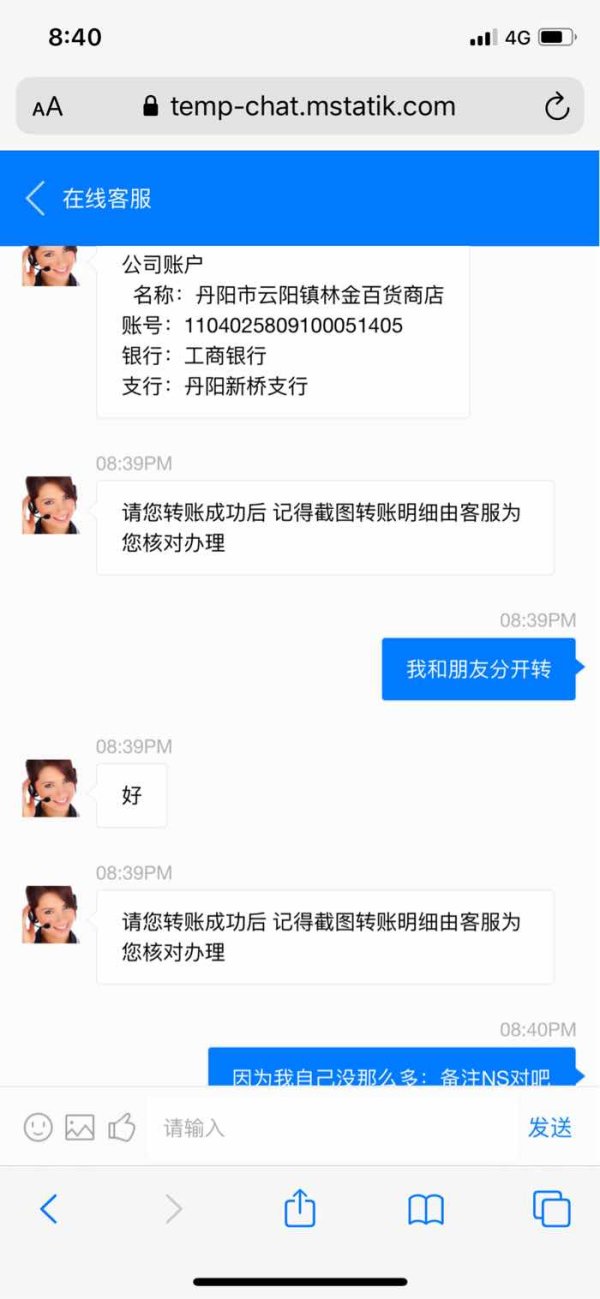

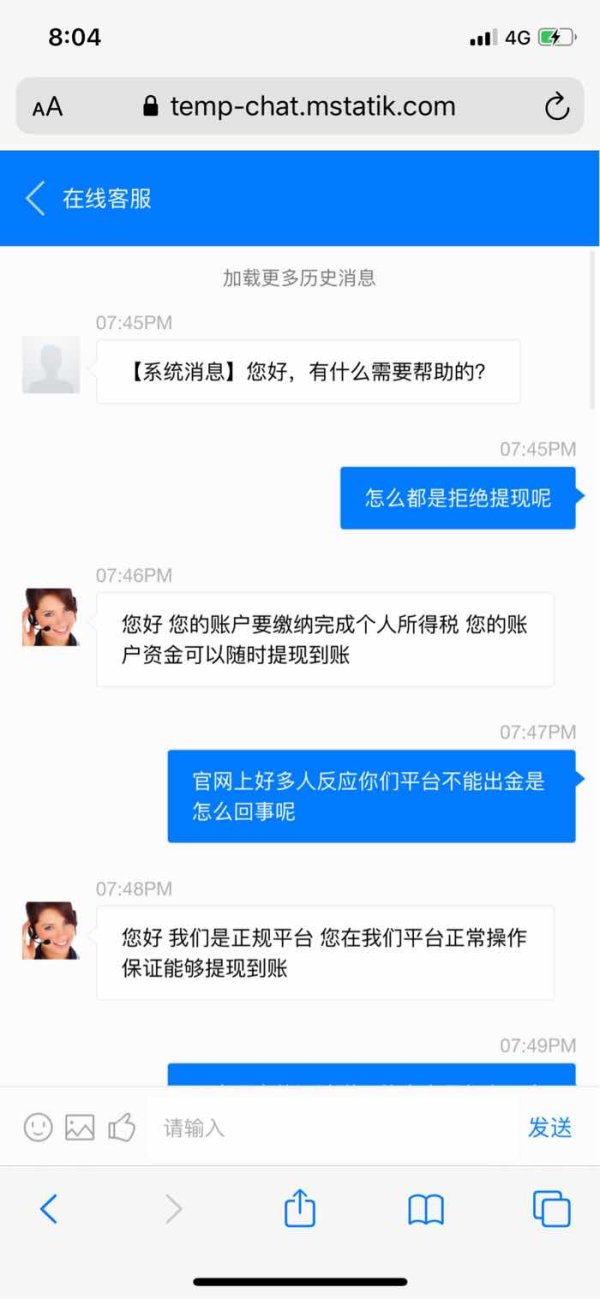

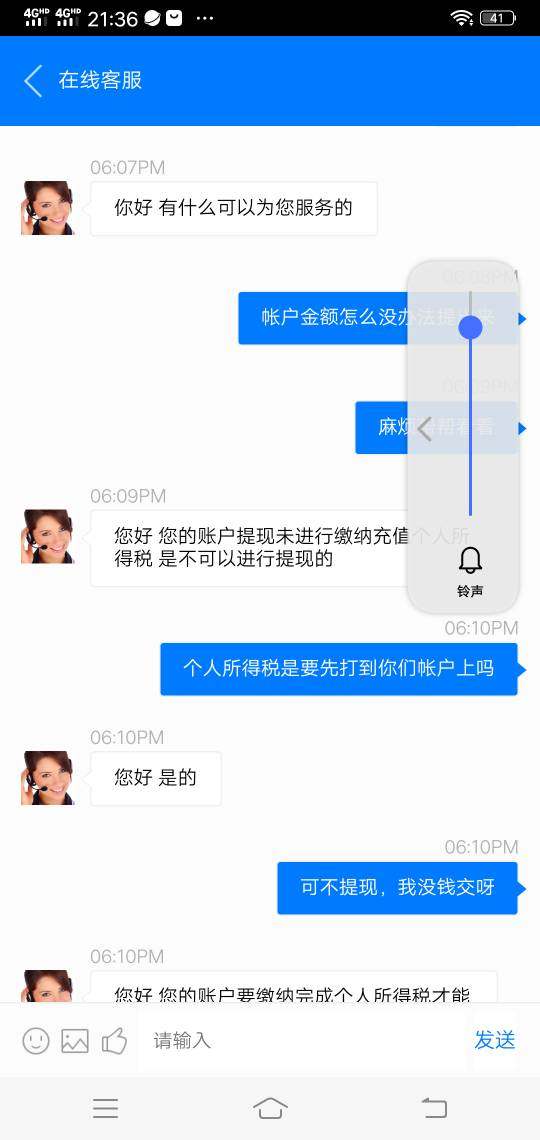

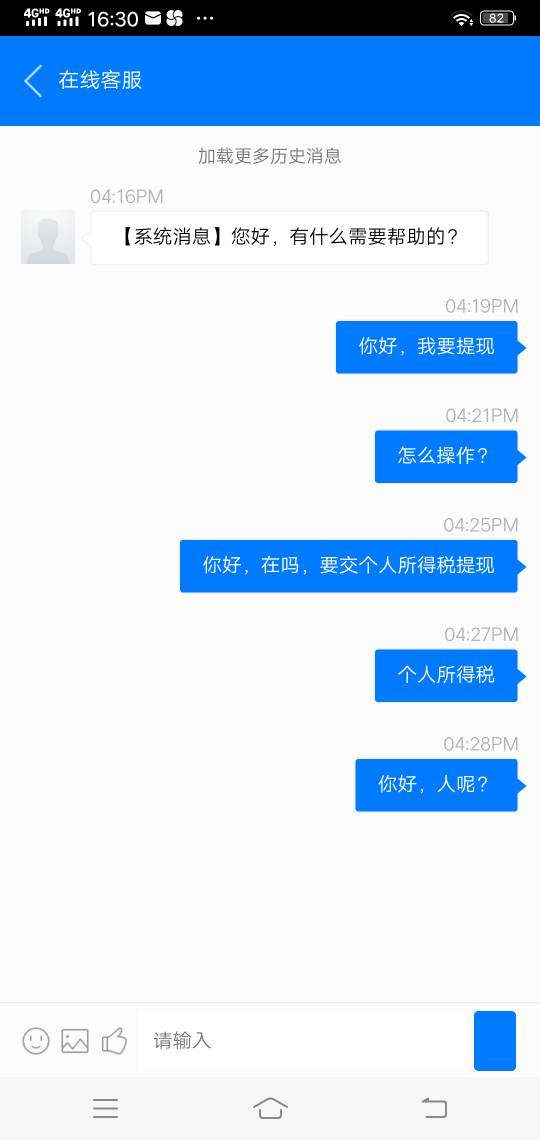

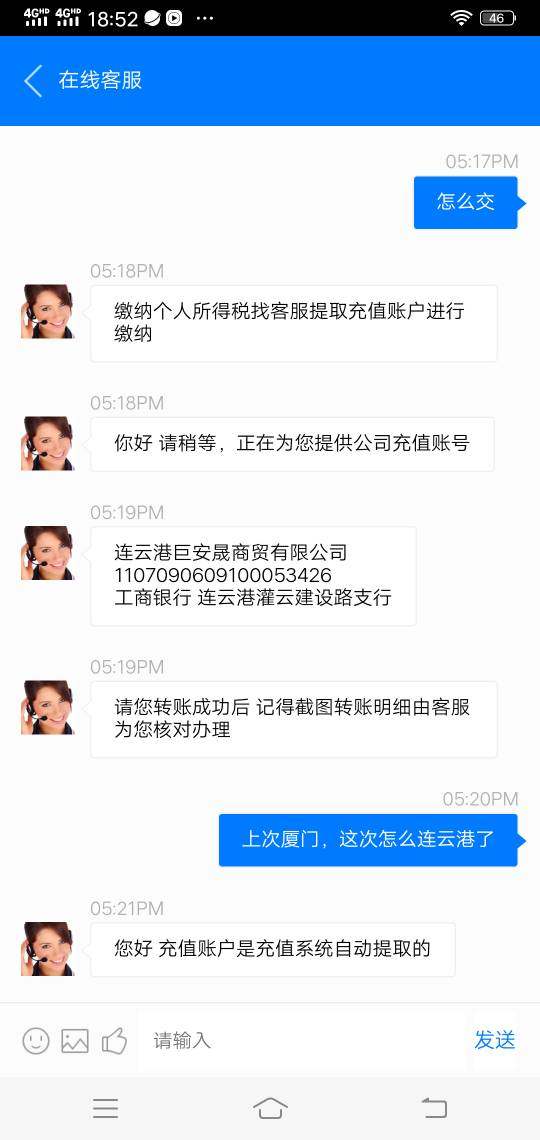

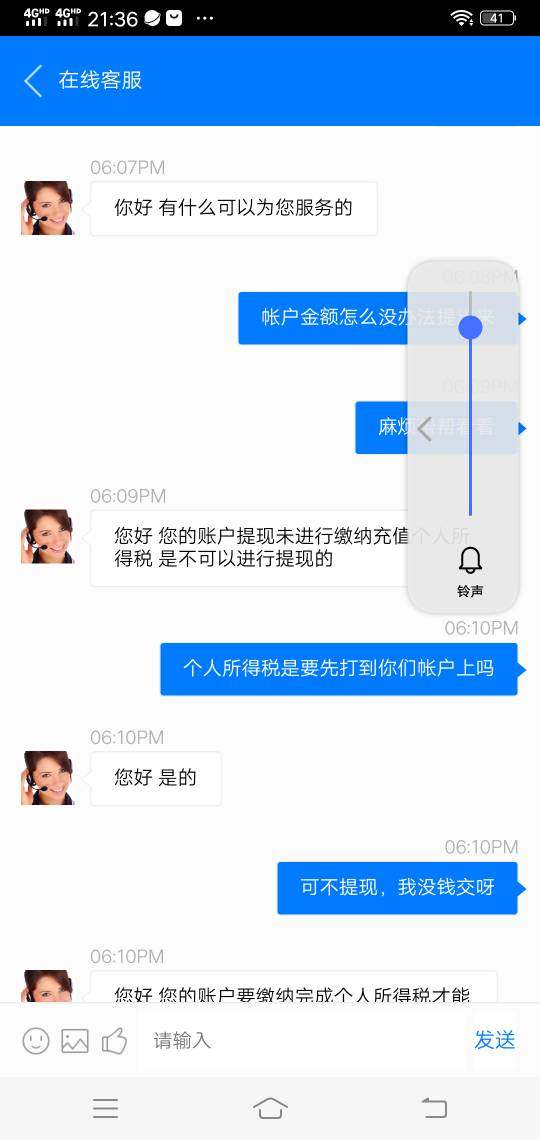

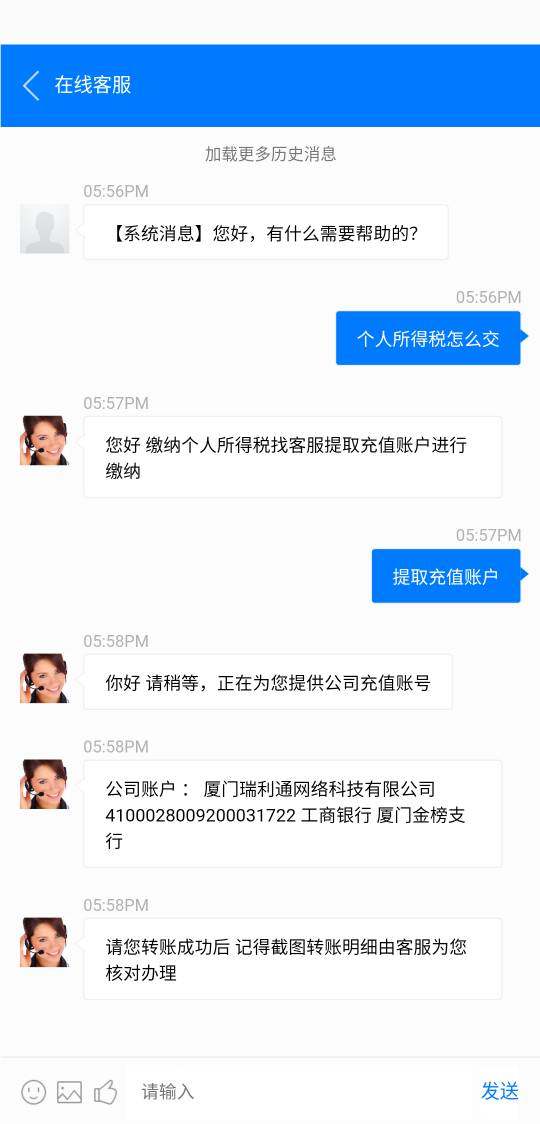

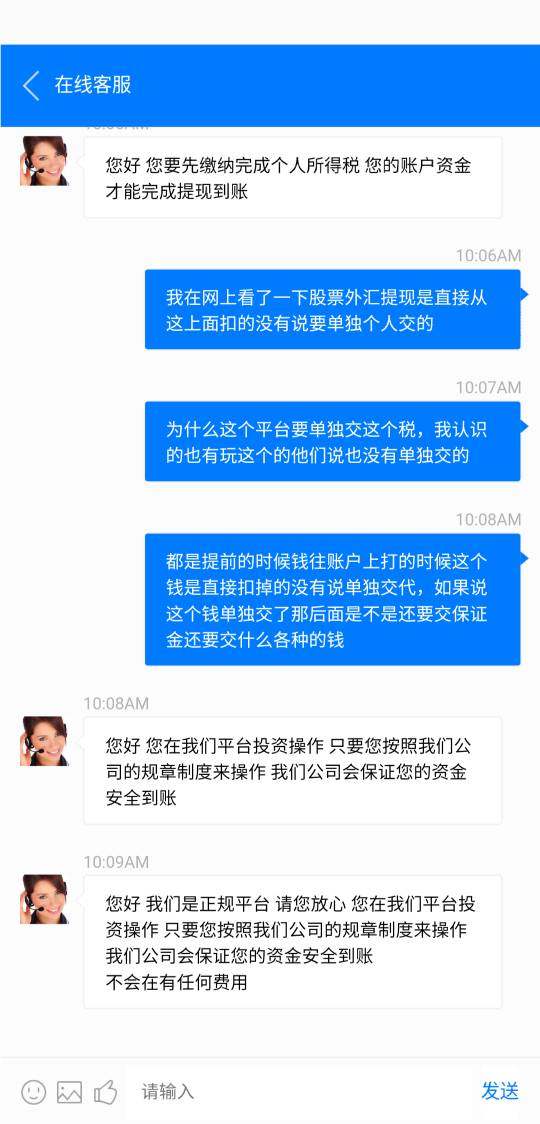

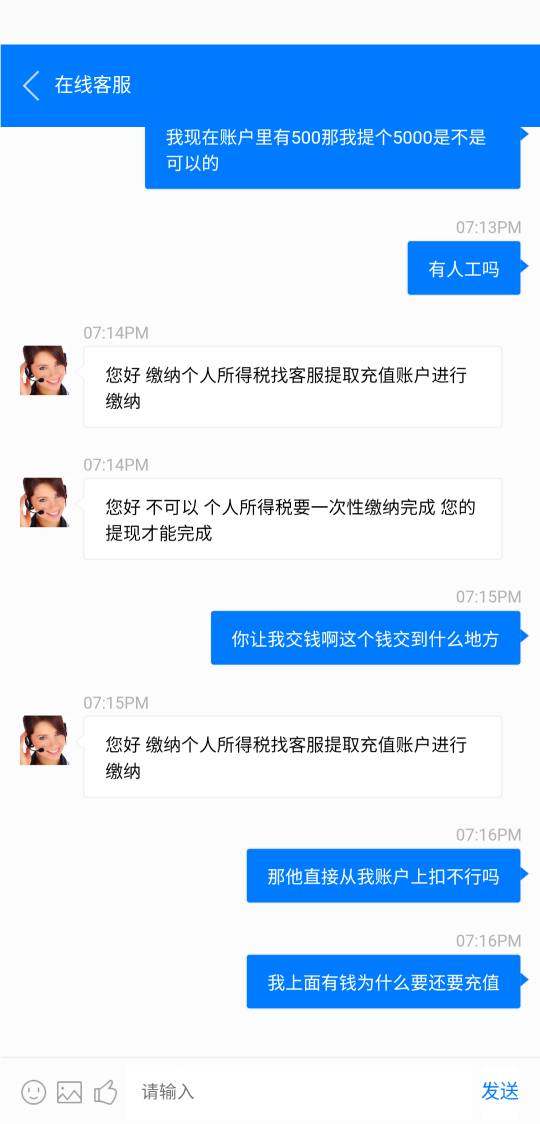

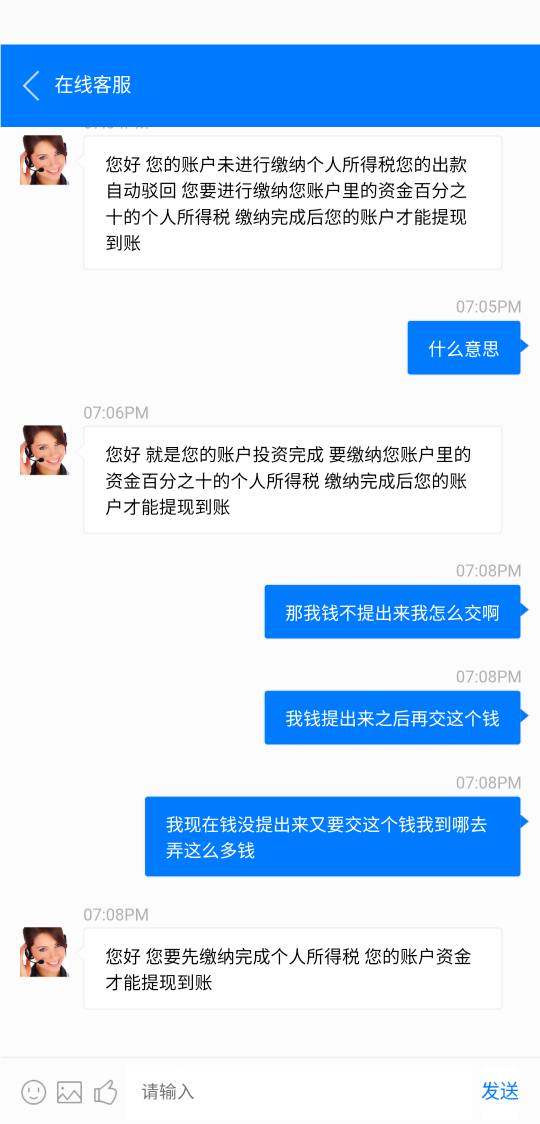

- Withdrawal Difficulty

According to a report on WikiFX, users encountered significant difficulties with fund withdrawals. The issue remained unresolved despite the request being pending for a long time.

Negative Z.com Bullion Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there are many pieces of Z.com Bullion exposure.

Exposure. Cannot withdraw

| Classification | Unable to Withdraw |

| Date | 2020-2023 |

| Post Country | Hong Kong, China |

The user said that he was unable to withdraw, and it was still pending after a long time. You may visit: https://www.wikifx.com/en/comments/detail/202005071332653509.html.

Conclusion

Trading with Z.com Bullion may pose security risks as they have many negative comments about withdrawals and the official website is inaccessible, despite the company being regulated.

Keywords

- 10-15 years

- Regulated in Hong Kong

- Leveraged foreign exchange trading

- United Kingdom Straight Through Processing (STP) Revoked

- High potential risk

Comment 11

Content you want to comment

Please enter...

Comment 11

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

爱拼才会赢72943

Hong Kong

After paying the required individual tax, I still couldn’t withdraw fund.

Exposure

2020-05-07

假如59427

Hong Kong

When I was to withdraw fund on April 14th, the platform asked me to pay 10% individual tax to the appointed account. It could deduct the fee off my balance. As of today, I still couldn’t withdraw my fund. The online service is unavailable. Who can give me a shoulder?

Exposure

2020-05-01

假如59427

Hong Kong

The withdrawal is unavailable for 15 days. I was even asked to pay 10% margin.

Exposure

2020-04-29

FX2818271179

Hong Kong

An individual tax is asked before withdrawing fund.

Exposure

2020-04-15

小太阳54676

Hong Kong

The withdrawal is unavailable. I was asked to pay the verification fee for twice.

Exposure

2020-04-13

袁修强

Hong Kong

2019.2.27 How big is the fluctuation of gold today? My this reached 1750 points.

Exposure

2019-02-27

FX6469792798

Hong Kong

Serious slippage—over 800 pips! 800 pips slippage on the same platform!

Exposure

2018-11-23

hei040

Hong Kong

Deposits and withdrawals are safe, but the spread is large and there is a slippage problem.

Neutral

2023-07-18

개미-근酱

Hong Kong

The broker says that you can start with only 5 dollars, and they also offers flexible leverage up to 1:500, as well as competitive spreads and the industry-standard mt4 platform. However, they are all just their advertisements. The fact is that you can’t withdraw your funds smoothly and even you have to pay some unspecified fees.

Neutral

2022-11-16

孑然一身29483

United Kingdom

Great combination of everything a trader needs. Best experience! My experience with GMO from the Support regarding a problem with my credit card. Very Nice, Fast and very Kind.

Positive

2023-02-20

高山流水30187

Colombia

I really wanted to trade gmo before but gave up after seeing other people's reviews on wikifx. I can't risk my money.

Positive

2022-11-23