Score

GTI Markets

Australia|5-10 years|

Australia|5-10 years| --

Website

Rating Index

Contact

Licenses

Licenses

Licensed Entity:EBC FINANCIAL GROUP (AUSTRALIA) PTY LTD

License No. 000500991

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Australia

AustraliaA Visit to GTI Markets in Australia - Fake Address

It is ascertained by the investigation staff that the address of GTI Markets is inconsistent with that from the regulatory information.Since the broker overruns the business scope regulated by ASIC Common Financial License(No.500991).

Australia

AustraliaA Visit to GTI Markets in Australia - Fake Address

It is ascertained by the investigation staff that the address of GTI Markets is inconsistent with that from the regulatory information.Since the broker overruns the business scope regulated by ASIC Common Financial License(No.500991).

Australia

AustraliaUsers who viewed GTI Markets also viewed..

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

Website

fxgti.com

Server Location

United States

Website Domain Name

fxgti.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2018-07-25

Server IP

13.59.96.118

gtimarket.com

Server Location

Japan

Website Domain Name

gtimarket.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2018-07-25

Server IP

40.74.92.30

Company Summary

| GTI Markets | Basic Information |

| Company Name | GTI Markets |

| Founded | 2018 |

| Headquarters | Australia |

| Regulations | Suspected fake clone |

| Tradable Assets | Forex, Indices, Commodities, Shares, Cryptocurrencies |

| Account Types | Standard, Gold, VIP |

| Minimum Deposit | Not specified |

| Maximum Leverage | 1:500 |

| Spreads | From 0.1 pips |

| Commission | Commission-free |

| Deposit Methods | Credit/Debit Cards, Bank Wire Transfers, E-wallets |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Customer Support | Email (fiona@gtimarket.com, support@gtimarket.com) |

| Education Resources | Webinars, Tutorials, Videos, eBooks, Courses, Articles |

| Bonus Offerings | None |

Overview of GTI Markets

GTI Markets is an Australian-based trading platform that was founded in 2018. The platform offers a wide range of tradable assets, including forex, indices, commodities, shares, and cryptocurrencies, providing traders with various opportunities to diversify their portfolios and engage in different financial markets. Clients can choose from three different account types: Standard, Gold, and VIP, each tailored to cater to different trading preferences and experience levels.

One of the key features of GTI Markets is its provision of the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are well-known in the financial industry for their advanced features, user-friendly interface, and powerful analytical tools, making them suitable for traders of all levels, from beginners to experienced professionals. GTI Markets operates on a commission-free model and offers competitive spreads, especially on major currency pairs like EUR/USD and GBP/USD, which start as low as 0.1 pips.

However, it is important to note that GTI Markets lacks valid regulation and is suspected to be a fake clone. The claim of regulation by the Australia Securities and Investments Commission (ASIC) with license number 500991 is disputed, raising concerns about the broker's legitimacy and safety. Traders should exercise extreme caution when considering GTI Markets as their broker choice, as the absence of proper regulation means there are no guarantees regarding the safety of funds or fair trading practices. As a result, it is highly advisable for traders to thoroughly research and consider alternative regulated brokers to ensure a higher level of security and accountability in their trading activities.

Is GTI Markets Legit?

GTI Markets is not regulated by any valid financial authority. Despite claiming to be regulated by the Australia Securities and Investments Commission (ASIC) with license number 500991, there are suspicions that this regulation is a clone or fraudulent claim. As a result, there is no oversight or supervision provided by a reputable regulatory body, which poses significant risks for traders.

It is crucial for potential clients to be aware of these risks and exercise extreme caution when considering GTI Markets as their broker choice. The lack of regulation means that there are no guarantees regarding the safety of funds, fair trading practices, or proper handling of client complaints, making it essential for traders to thoroughly research and explore other regulated options to ensure a higher level of security and accountability in their trading activities.

Pros and Cons

GTI Markets is a trading platform that raises significant concerns due to its suspected fake clone status and lack of valid regulation. As such, it is essential to approach this broker with extreme caution. Unfortunately, there are no apparent pros to highlight for GTI Markets, which is a significant red flag for potential traders. The lack of regulation is a major concern, as it raises doubts about the broker's legitimacy and the safety of funds. Additionally, the suspicion of being a fake clone broker adds further risk, making it an even riskier choice for traders. Given these drawbacks, traders are advised to avoid GTI Markets and explore other regulated and reputable options to ensure a safer and more reliable trading experience.

| Pros | Cons |

| none | Lack of valid regulation raises concerns about legitimacy and safety |

| Suspected fake clone, further adding to the risk factor | |

| Specific details about minimum deposit |

WikiFX Field Survey

WikiFX field survey staff in Australia paid a visit to this brokers licensed address to see if its licensed address consistent with its real address. However, after scrutinizing the signboard in the lobby, they couldn't find anything about GTI Markets.

Investigation staff took the elevator to the 12th floor to obtain more information and found a shared workplace on the entire floor. The investigation staff inquired of the worker and learned that only when there is a meeting will the crew of GTI Markets operate here.

The investigation staff discovers that the address of GTI Markets differs from the regulatory information, since the broker overruns the scope of business regulated by the ASIC Common Financial License (No.500991).

Customer Reviews

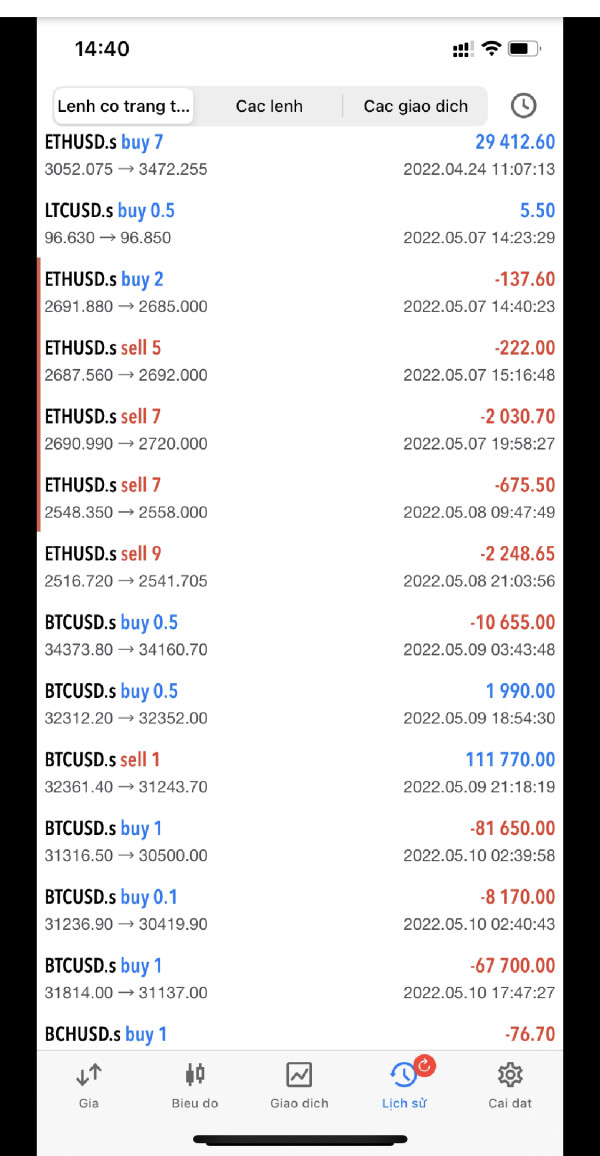

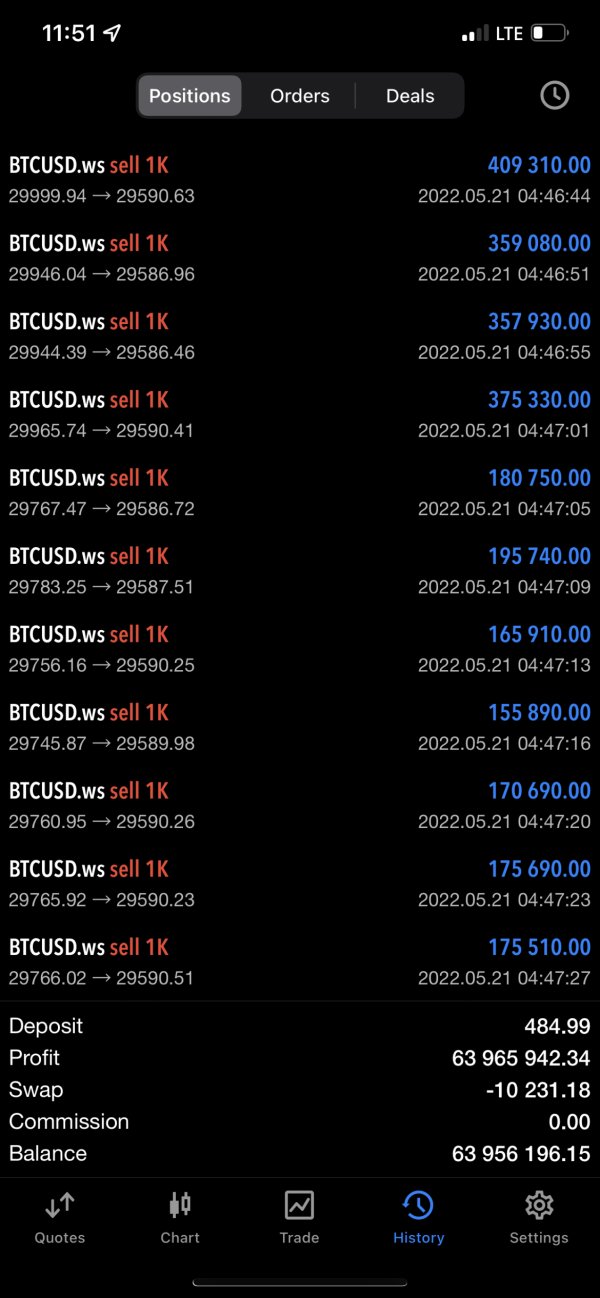

Some traders who used to trade with this broker complained that they cannot withdrawal their deposited money from this brokerage platform, cannot log in their account, and this brokerage has high slippage and more.

Therefore, GTI Markets is not a reliable broker with many negative reviews, please stay away from this platform.

Trading Instruments

GTI Markets offers a diverse range of trading instruments, providing traders with various options to diversify their portfolios and engage in different financial markets. The platform allows traders to access the following trading instruments:

1. Forex Pairs: GTI Markets provides a wide selection of major, minor, and exotic currency pairs for forex trading. Traders can speculate on the exchange rate fluctuations between global currencies, offering potential opportunities to profit from the dynamic foreign exchange market.

2. Indices: Traders can also trade popular indices representing the performance of specific markets or sectors. Indices like the S&P 500, Dow Jones, and FTSE 100 allow investors to gain exposure to broader market trends and make informed trading decisions based on overall market sentiment.

3. Commodities: GTI Markets offers trading in various commodities, including precious metals like gold and silver, energy resources like crude oil, agricultural products like coffee and soybeans, and more. Commodities are often considered safe-haven assets and can act as a hedge against economic uncertainties.

4. Shares: The platform enables traders to trade shares of well-known companies listed on global stock exchanges. By trading individual stocks, investors have the opportunity to benefit from the performance of specific companies they believe in or those demonstrating strong market prospects.

5. Cryptocurrencies: GTI Markets also provides trading in popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). Cryptocurrencies have gained significant attention due to their high price volatility, making them attractive assets for traders seeking opportunities in the digital currency market.

By offering a broad range of tradable instruments, GTI Markets caters to various investment preferences and strategies, providing traders with ample opportunities to explore and participate in different financial markets. However, traders should keep in mind the lack of regulation and potential risks associated with an unregulated broker when considering engaging in trading activities with GTI Markets.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| GTI Markets | Yes | Yes | Yes | No | Yes | Yes | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Pocket Option | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

Account Types

GTI Markets offers three main account types, each designed to cater to different trading preferences and experience levels. These account types provide varying benefits and features to accommodate both beginner and experienced traders:

1. Standard Account: The Standard account is the basic option suitable for new traders starting their trading journey. It offers access to a wide range of tradable instruments, including forex pairs, indices, commodities, shares, and cryptocurrencies. Traders using the Standard account can benefit from competitive spreads and leverage options. This account type is designed to be user-friendly and accessible, making it an ideal choice for those who are new to trading and want to explore the financial markets.

2. Gold Account: The Gold account is a step-up from the Standard account and is tailored for traders seeking additional features and advantages. Traders with a Gold account receive benefits such as lower spreads, faster execution, and priority customer support. The Gold account is more suitable for intermediate traders who have gained some trading experience and are looking for enhanced trading conditions.

3. VIP Account: The VIP account is the premium offering designed for experienced and high-volume traders. It comes with exclusive perks, including the tightest spreads, higher leverage options, personalized trading support, and access to advanced trading tools and analysis. The VIP account aims to provide experienced traders with the best possible trading environment to meet their specific needs and preferences.

It's important to note that while GTI Markets offers these account types with varying benefits, traders should be cautious of the lack of valid regulation, as this can pose potential risks when dealing with an unregulated broker. Traders are advised to conduct thorough research and consider alternative options with proper regulation and oversight to ensure a higher level of security and accountability in their trading activities.

Leverage

GTI Markets provides varying leverage options to traders based on their chosen account type. Leverage is a crucial aspect of trading as it allows traders to control larger positions with a smaller amount of capital. However, it's important to note that higher leverage also amplifies the potential risks and rewards of trading.

For the Standard account, GTI Markets typically offers a moderate leverage level to retail traders, usually around 1:30. This means that for every $1 in the trader's account, they can control a position of up to $30 in the market. For professional traders, the leverage offered may be higher, often reaching up to 1:500. Professional traders are typically required to meet certain criteria, such as a minimum level of trading experience and a substantial portfolio size, to qualify for increased leverage.

The Gold account, being a step-up from the Standard account, generally offers slightly higher leverage levels for both retail and professional traders. Retail traders may have access to leverage of up to 1:50, while professional traders can enjoy leverage of 1:500.

For the VIP account, GTI Markets provides the highest leverage options. Retail traders may have access to leverage of up to 1:100, while professional traders can enjoy leverage of 1:500, depending on their trading experience and qualifications.

While higher leverage can potentially lead to larger profits, traders should be cautious of the increased risk involved. Trading with high leverage can result in significant losses, especially during volatile market conditions. Therefore, it is crucial for traders to carefully consider their risk tolerance and trading strategy before choosing a leverage level. Additionally, traders should be mindful of the lack of valid regulation, as this can pose additional risks when dealing with an unregulated broker like GTI Markets. It's essential for traders to weigh the potential benefits and risks and consider alternative regulated brokers that offer a more secure trading environment.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | GTI Markets | FxPro | IC Markets | RoboForex |

| Maximum Leverage | 1:500 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions

GTI Markets offers spreads on various trading instruments, and the exact spreads may vary depending on the account type and market conditions. Generally, major currency pairs such as EUR/USD and GBP/USD tend to have tighter spreads, often starting as low as 0.1 pips, making them appealing to traders seeking low-cost trading opportunities. However, other instruments like exotic currency pairs or commodities may have wider spreads, reflecting their liquidity and market demand.

As for commissions, GTI Markets typically operates as a commission-free broker. Instead of charging a separate commission on trades, the broker incorporates its earnings into the spreads and other trading-related fees.

It's important to be aware that while commission-free trading can seem appealing, traders should carefully consider the overall trading conditions, including spreads, swaps, and other fees, to determine the broker's overall cost structure. Additionally, traders should bear in mind that GTI Markets is an unregulated broker, and as such, there may be potential risks and concerns associated with trading with an unregulated entity. Therefore, traders should exercise caution and conduct thorough research before deciding to trade with GTI Markets. It is often recommended to consider regulated brokers that offer a higher level of safety and security for traders' funds and trading activities.

Deposit & Withdraw Methods

GTI Markets offers a variety of deposit and withdrawal methods to cater to the diverse needs of its clients. The available deposit methods typically include credit/debit cards, bank wire transfers, and various e-wallet options. Credit and debit card deposits are commonly preferred due to their instant processing, allowing traders to start trading quickly after the transaction is approved. Bank wire transfers offer a reliable and traditional way to transfer funds, but they may take a few business days to reflect in the trading account. E-wallets like Skrill, Neteller, and other popular options provide a fast and convenient way to deposit funds without revealing sensitive financial information.

For withdrawals, GTI Markets generally follows the policy of processing withdrawals using the same method used for deposits. Traders who have used a specific deposit method will need to withdraw funds through the same method to ensure a smooth and efficient withdrawal process.

It is important to note that while GTI Markets offers a range of deposit and withdrawal options, traders should always verify the specific methods available to their region and account type. Additionally, traders should be aware of any potential fees associated with deposits or withdrawals, as these can vary based on the chosen payment method and the broker's policies.

As with any financial transaction, traders are encouraged to use secure and reputable payment methods to safeguard their funds. GTI Markets' unregulated status may raise concerns about the safety and security of funds, making it essential for traders to exercise caution and conduct thorough research before depositing their funds. Traders should consider trading with regulated brokers, as they are subject to strict financial regulations that provide greater protection for client funds and ensure transparent business practices.

Trading Platforms

GTI Markets offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, both of which are well-known and widely used in the financial industry. These platforms are highly regarded for their advanced features, user-friendly interface, and powerful tools that cater to traders of all levels, from beginners to experienced professionals.

The MetaTrader 4 platform is especially favored for its simplicity and versatility. It provides a comprehensive range of technical analysis tools, customizable charting options, and various timeframes, allowing traders to conduct in-depth market analysis and make well-informed trading decisions. MT4 also supports automated trading through Expert Advisors (EAs), enabling traders to implement algorithmic trading strategies and execute trades automatically based on predefined conditions.

On the other hand, MetaTrader 5 is an upgraded version that offers additional features compared to MT4. While MT4 is primarily designed for forex trading, MT5 expands its capabilities to include trading in other financial instruments, such as stocks, commodities, and indices. MT5 also supports more timeframes, economic calendar integration, and an improved strategy tester, making it a preferred choice for traders seeking a broader range of assets and advanced analytical tools.

Both MT4 and MT5 come with a user-friendly interface, making them accessible to traders with varying levels of experience. Traders can access these platforms on desktop computers (Windows and macOS) and mobile devices (Android and iOS) through dedicated applications, providing flexibility and convenience in managing their trades from anywhere at any time.

It is important to note that while MT4 and MT5 are reputable and widely used platforms, traders should be cautious when dealing with GTI Markets due to its unregulated status. Trading with unregulated brokers carries inherent risks, including potential scams or fraudulent practices. Traders should consider using these platforms with regulated brokers, as they offer an additional layer of security and assurance regarding the handling of client funds and fair trading practices. Before making any decisions, traders are advised to thoroughly research and explore other regulated options to ensure a safer and more reliable trading experience.

Customer Support

GTI Markets provides customer support through email communication. Traders can reach out to the support team via two different email addresses: fiona@gtimarket.com and support@gtimarket.com. Email support is a common method used by brokers to assist clients with their inquiries, concerns, and account-related matters.

However, it is important to note that while GTI Markets may offer email support, traders should exercise caution due to the broker's lack of regulation. Dealing with unregulated brokers carries inherent risks, as there are no guarantees regarding the safety of funds or the fair treatment of clients. The absence of proper oversight and supervision means that traders may be exposed to potential fraudulent practices or unscrupulous behavior. As a result, traders are advised to approach the customer support aspect with caution and conduct thorough research before engaging with GTI Markets.

Educational Resources

GTI Markets offers a range of educational resources to assist traders in enhancing their trading skills and knowledge. These educational materials are designed to cater to traders of all levels, from beginners to more experienced individuals.

The educational resources provided by GTI Markets may include webinars, tutorials, videos, eBooks, courses, and articles. Webinars are interactive online seminars conducted by experienced traders or financial experts, where participants can learn about various trading strategies, market analysis techniques, and other relevant topics. Tutorials and videos offer step-by-step guides on using the trading platform, technical analysis, and understanding market trends.

While educational resources are valuable in helping traders improve their trading skills, it is essential to exercise caution when considering GTI Markets as a broker, given its lack of regulation. Unregulated brokers may not adhere to industry best practices, and there are potential risks associated with trading with such entities. Traders are advised to thoroughly research and consider regulated and reputable alternatives that provide both educational support and a higher level of safety and accountability.

Conclusion

In conclusion, GTI Markets is an Australian-based trading platform that offers a wide range of tradable assets and operates on a commission-free model with competitive spreads. However, the broker lacks valid regulation and is suspected to be a fake clone, which poses significant risks for traders. The absence of proper oversight raises concerns about the legitimacy and safety of funds, making it essential for potential clients to exercise extreme caution. Unfortunately, there are no apparent advantages to highlight for GTI Markets, as its unregulated status outweighs any potential benefits. Traders are strongly advised to explore alternative regulated brokers that provide a higher level of security and accountability to ensure a safer and more reliable trading experience.

FAQs

Q: Is GTI Markets a regulated broker?

A: No, GTI Markets is not regulated by any valid financial authority. Despite claiming to be regulated by the Australia Securities and Investments Commission (ASIC) with license number 500991, there are suspicions that this regulation is a clone or fraudulent claim, raising concerns about the legitimacy and safety of the broker.

Q: What tradable assets are available on GTI Markets?

A: GTI Markets offers a diverse range of tradable assets, including forex pairs, indices, commodities, shares, and cryptocurrencies, providing traders with various options to diversify their portfolios and engage in different financial markets.

Q: What are the account types offered by GTI Markets?

A: GTI Markets offers three main account types: Standard, Gold, and VIP. Each account type caters to different trading preferences and experience levels, providing varying benefits and features.

Q: What are the available deposit and withdrawal methods on GTI Markets?

A: GTI Markets offers various deposit methods, including credit/debit cards, bank wire transfers, and e-wallet options. Withdrawals are generally processed using the same method used for deposits.

Q: What trading platforms does GTI Markets provide?

A: GTI Markets offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, both known for their advanced features and user-friendly interface.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 9

Content you want to comment

Please enter...

Comment 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

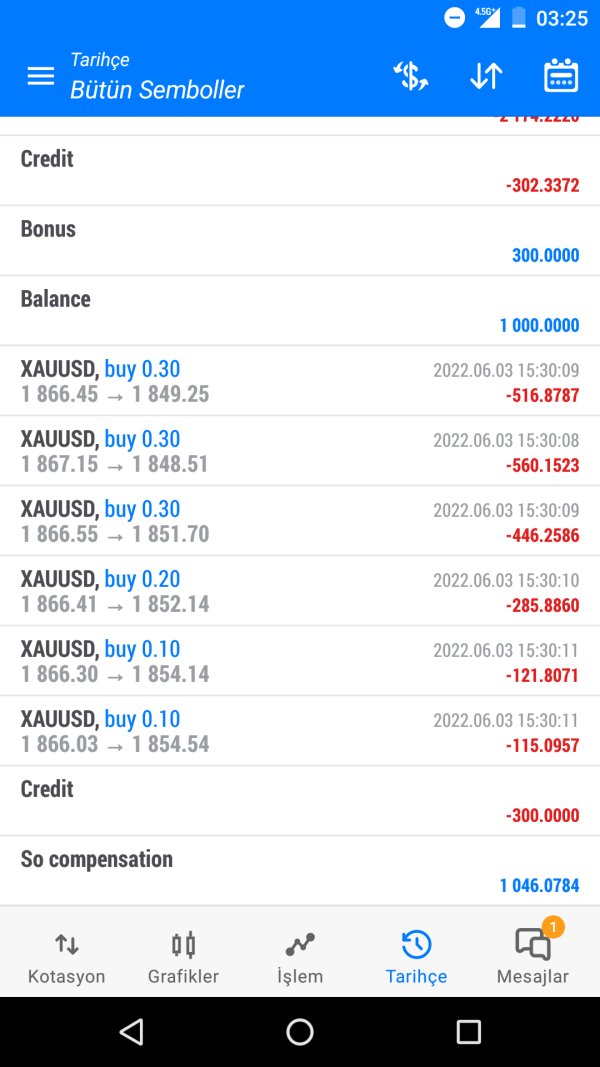

FX244677432

United Kingdom

I was introduced to GTI markets by an online friend and registered and made a deposit. The first deposit and withdrawal were fast, but the second time I tried to withdrew money i was asked to pay 20% tax in order to withdraw my money. After i paid the money as requested, customer service said that the amount i paid was incorrect and i needed to pay again, and that if i don’t pay the tax within 72 hours, i would not be able to withdraw my money. However, a class action lawsuit approved by AssetsClaimBack/ com resulted in my funds being returned. This is obviously a scam stay away from GTI Markets

Exposure

2022-06-20

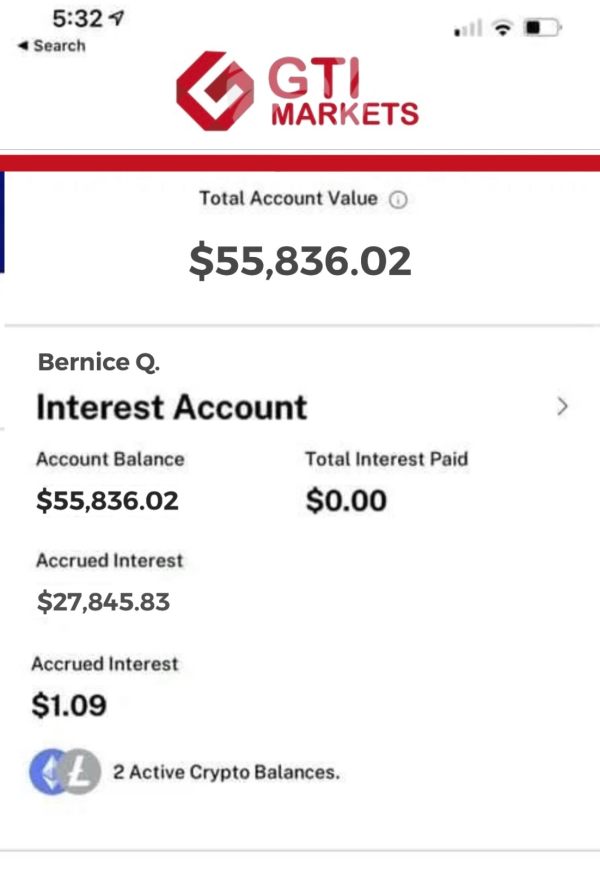

FX4014759757

Canada

I invested over $55,000 within a 4 month period but when I went to withdraw, I was told to pay a 26% fine for early withdrawal. I straightaway launched an investigation with a financial recovery authority fintrack/org, the ill intentions of GTI Markets were exposed and my investment returned to me after a difficult period of struggling with the so called trading website.

Exposure

2022-06-20

FX1353492725

Turkey

global gti is a scam on Friday, at 15.30, while the chart was showing 1858, they closed my transactions in 1849, the chart never came there, don't deposit money here, I'm sharing the documents, don't be a victim.

Exposure

2022-06-07

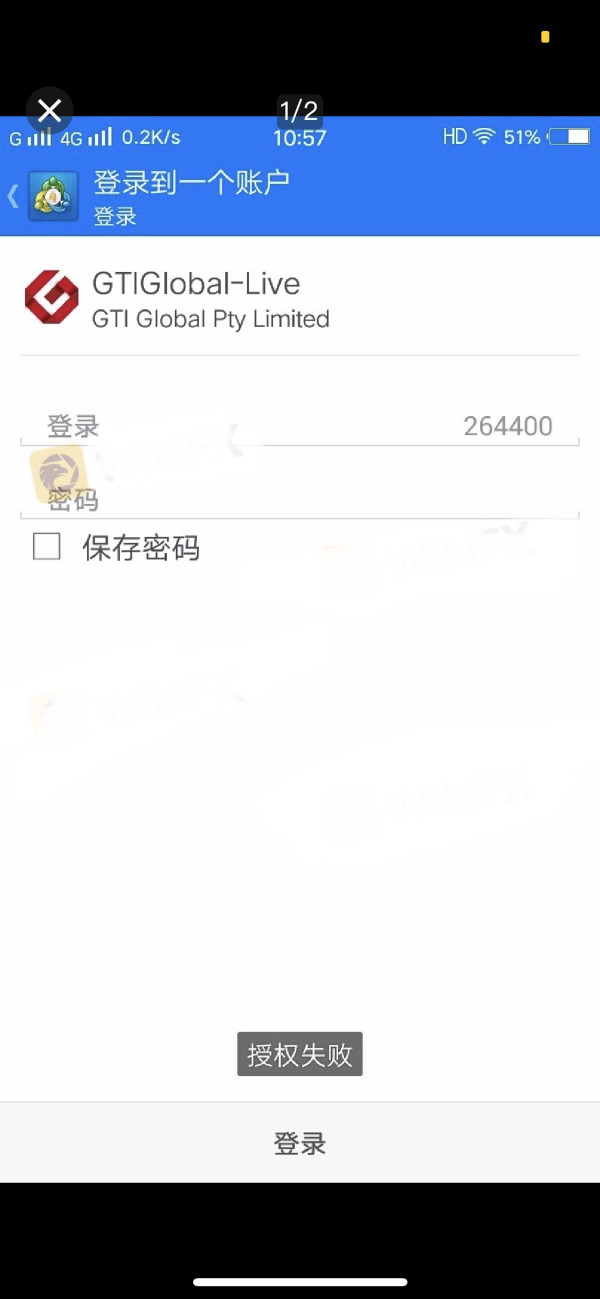

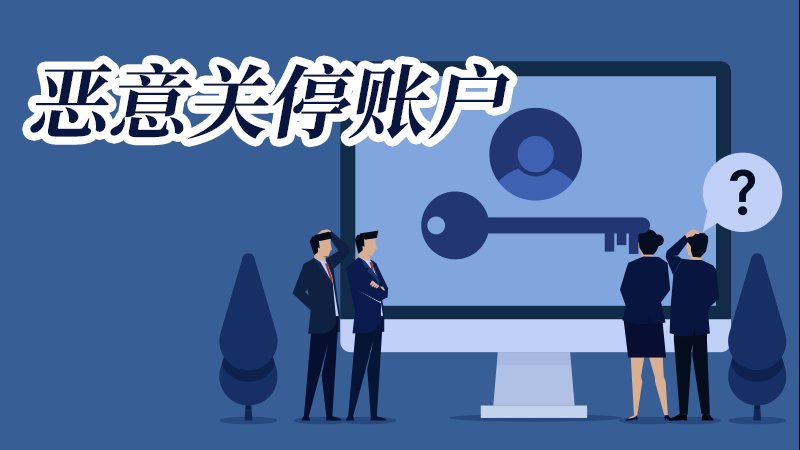

AU小

Hong Kong

The account is abnormal and I can't log in. The customer service is out of contact as well.

Exposure

2020-08-24

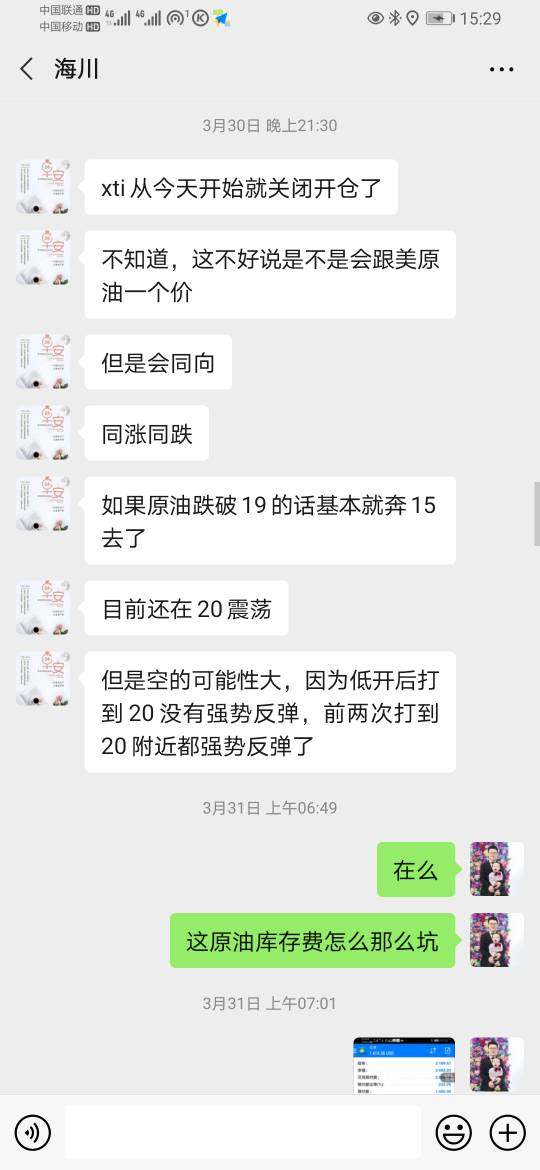

FX1269316531

Hong Kong

It was a big contract. The platform forced me to change to a small contract, which increased the overnight fee by more than ten times. In the end, I couldn’t stand the high overnight fee and made an order in negative directions. I could make 30,000 US dollars, which resulted in losing more than $30,000. The agent has been inducing me to place orders frequently, which made a huge loss.

Exposure

2020-08-22

幸运儿

Hong Kong

My name is Zhu jie and my account number is 601076.I have encountered with stuck system for several times in GTI Markets .But the platform only compensated several bucks,keeping shirking by the excuse of failed verification.And the expected compensation hasn’t been received yet! Who dares to trade in such a platform with bad faith?Hope WikiFX help and bring me justice!Thank you!!

Exposure

2019-11-15

FX6489973389

Hong Kong

The account was unauthorized,thus failed to log in.The customer service was out of contact.

Exposure

2019-08-26

hobby

Hong Kong

My request for withdrawing money was turn down without reasons. The service supporter for opening accounts and depositing is out of touch. The platform harbors high risks.

Exposure

2019-06-14

FX1127470253

Morocco

Claimed to be regulated with many years of experience which I found out is a lie over time and I was completely ignored by the manager after my withdrawal order.

Neutral

2022-12-11