Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is Alvexo?

Alvexo.com is operated by HSN Capital Group Ltd which is regulated as a securities dealer by the Financial Services Authority of Seychelles with License Number SD030 located at HIS Building, Office 5, Providence, Mahe, Seychelles.

Alvexo is an established broker that stands out for its learning and service-oriented focus. They combine a two-pronged approach that is at the forefront of technological and platform innovation to deliver what traders need most. Alvexo aims to empower and educate their ever-expanding client base by providing access to leading technologies -essential to support clients' endeavours and facilitate fast, timely and reliable trading.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

Alvexo Alternative Brokers

There are many alternative brokers to Alvexo depending on the specific needs and preferences of the trader. Some popular options include:

BlackBull Markets - A reputable forex broker known for its low spreads, fast execution, and comprehensive trading tools, making it an excellent choice for traders seeking a reliable and feature-rich trading experience.

Eightcap – Atrusted broker that offers competitive trading conditions, including tight spreads, flexible account options, and a user-friendly trading platform, making it a top choice for both beginner and experienced traders looking for a seamless trading experience.

FOREX TB - A reliable forex broker that provides a user-friendly platform, educational resources, and a wide range of tradable assets, making it a suitable option for traders of all levels who prioritize accessibility, learning, and diversified trading opportunities.

Is Alvexo Safe or Scam?

Alvexo is regulated by FCA. The Financial Conduct Authority (FCA) is a financial regulatory body in the United Kingdom, but operates independently of the UK Government, and is financed by charging fees to members of the financial services industry. It focuses on the regulation of conduct by both retail and wholesale financial services firms.

However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

Market Instruments

Alvexo offers a variety of trading instruments across different asset classes, including currencies, indices, commodities, shares and cryptocurrencies.

- Currencies: they are financial products that enable participants to trade and speculate on the value of different currencies in the foreign exchange market.

- Indices: TIndices are calculated based on the market capitalization of the component companies. A variety of factors, including commodity prices, company announcements and financial results all play an important role in determining the indexs price. Indices traders speculate on the price movements of stock Indices. Indices are traded in large volumes and they are very popular amongst investors.

- Commodities: Alvexo provides traders with access to a range of other commodities, including metals, agricultural products, and energy products like oil. Commodities are traded on the futures markets, and their values can be impacted by a variety of factors, such as supply and demand, geopolitical events, and weather patterns.

- Shares: Alvexo allows traders to invest in major global stocks from companies like Google, Apple, and Amazon, among others. Trade CFDs on the shares of global companies and benefit from fast order execution and dividend payments on long positions.

- Cryptocurrencies: The platform offers traders access to major cryptocurrencies such as Bitcoin, Ethereum, and Ripple. Cryptocurrencies only exist in the blockchain and are accessible through codes called private and public keys.

Accounts

Alvexo offers four live account types including Classic account, Gold account, Prime account and Elite account with the minimum deposit requirement of €500, €10,000 and€50,000 respectively. Besides, the minimum deposit requirement of Elite account can be learned by contacting them.

Classic Account:

The Classic account is designed for traders who are new to the market or prefer a smaller initial investment. With this account, traders gain access to the Alvexo trading platform and a wide range of trading instruments. They can benefit from competitive spreads, real-time market analysis, and 24/5 customer support.

Gold Account:

The Gold account is suitable for intermediate-level traders who are comfortable making a moderate investment. They may also receive personalized support from a dedicated account manager. Moreover, the Gold account may provide improved trading conditions, including lower spreads and priority customer support.

Prime Account:

The Prime account is tailored for more experienced traders or those who prefer higher deposit levels. Traders with the Prime account benefit from advanced trading tools, comprehensive market analysis, and potentially lower transaction costs. This account type may offer exclusive features such as premium customer support, invitations to educational webinars or events, additional trading platforms, research materials, and trading signals.

Elite Account:

The Elite account is the highest-tier account offered by Alvexo, providing personalized services and exclusive benefits. The minimum deposit requirement for the Elite account is not specified and can be learned by contacting Alvexo directly. Traders with the Elite account can expect the highest level of support, custom-tailored trading solutions, and premium features. This account type is likely designed for professional traders or high-net-worth individuals seeking a comprehensive and exclusive trading experience.

Leverage

Alvexo offers a maximum leverage of 1:300 to its traders. Leverage is a tool provided by brokers to amplify the trading position of traders, allowing them to control larger positions in the market with a smaller amount of capital.) With a maximum leverage, Alvexo enables traders to potentially amplify their trading positions up to 300 times their initial investment amount. This means that for every €1 in the trading account, traders can potentially control €300 worth of positions in the market. Leverage can significantly enhance the profit potential of successful trades. However, it is important to note that leverage also amplifies the risks associated with trading.

See the table below:

Spreads & Commissions

Alvexo offers a variety of spreads and commissions depending on the trading instrument and account type. For example, the average EUR/USD spread is 2.9 pips on the Classic account, 2.2 pips on the Gold account, 1.8 pips on the Prime account, and 1.4 pips on the Elite account.

The ECN Gold commission is 18 USD per lot and the ECN VIP commission is 13 USD per lot.

The ECN Gold commission is 18 USD per lot and the ECN VIP commission is 13 USD per lot.

Below is a comparison table about spreads and commissions charged by different brokers:

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

Alvexo offers Alvexo trading platform and the mobile app.

Alvexo Trading platform offers a faster, clearer, and smarter way to trade through a web browser, providing convenience and accessibility to traders. The platform is designed to deliver a seamless and efficient trading experience. The platform incorporates smart features that enhance the trading process. These include advanced order types, such as stop-loss and take-profit orders, as well as alerts and notifications to keep traders informed about market developments and price movements. Smart trading algorithms may also be available to automate specific trading strategies, saving time and effort for traders.

Stay connected to your trading account and the global markets with Alvexos Mobile App. A powerful and intuitive interface which allows you to buy and sell CFDs on Currencies, Stocks, Indices, Commodities and Cryptocurrencies. Assets such as Facebook, Google, Amazon, major and minor currency pairs, NASDAQ, Dow Jones, CAC 40 and FTSE 100 and many more are available for trading directly from the convenience of your mobile device.

Overall, Alvexo's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

Trading Tools & Educational Resources

Alvexo offers trading signals, news, academy, webinars, financial Web TV, ebooks, economic events and blog. These trading tools offered by Alvexo aim to provide traders with comprehensive resources and information to help them make informed trading decisions. Traders can utilize these tools according to their needs, preferences, and trading strategies to enhance their overall trading experience.

News: Alvexo provides traders with access to real-time market news and analysis. Traders can stay up-to-date with the latest economic events, market trends, and news that may impact their trading decisions. This information can be valuable for fundamental analysis and keeping track of market sentiment.

Academy: Alvexo‘s academy offers educational resources to enhance traders’ knowledge and skills. It provides comprehensive learning materials, including tutorials, courses, and guides on various aspects of trading. Traders can access educational content tailored to different skill levels to improve their understanding of trading strategies, technical analysis, risk management, and more.

Webinars: Alvexo conducts webinars presented by financial experts and experienced traders. These online seminars cover a wide range of topics, including market analysis, trading strategies, risk management, and industry insights. Traders can attend live webinars or access recorded sessions to expand their knowledge and learn from seasoned professionals.

Financial Web TV: Alvexo provides a Financial Web TV platform that offers video content related to financial markets. Traders can watch live market analysis, interviews with experts, economic updates, and other informative videos. This visual medium allows traders to stay informed and gain valuable market insights.

eBooks: Alvexo offers eBooks that cover various trading topics in detail, providing in-depth knowledge and strategies. Traders can access these digital books to deepen their understanding of technical analysis, chart patterns, risk management techniques, and other essential concepts in trading.

Economic Events: Alvexo provides a calendar of economic events, allowing traders to stay informed about upcoming releases of economic indicators, central bank announcements, and other crucial events that can impact the financial markets. This tool helps traders plan their trading activities around significant market-moving events.

Blog: Alvexo maintains a blog that covers a wide range of trading-related topics, including market analysis, trading tips, trading psychology, and industry news. Traders can access the blog to gain valuable insights, stay updated with market developments, and enhance their trading skills.

Deposits & Withdrawals

There are various payment methods that are enabled as the transfer option to the live trading accounts, these funding methods including popular Credit and Debit Cards, selection of electronic payments and Bank Transfers. Besides, Alvexo deposit fee charges are free that are applied to most of the funding methods. There are no withdrawal charges as well, however, make sure to check with their payment provider as there are some internal fees that might appear by the payment providers.

Alvexo minimum deposit vs other brokers

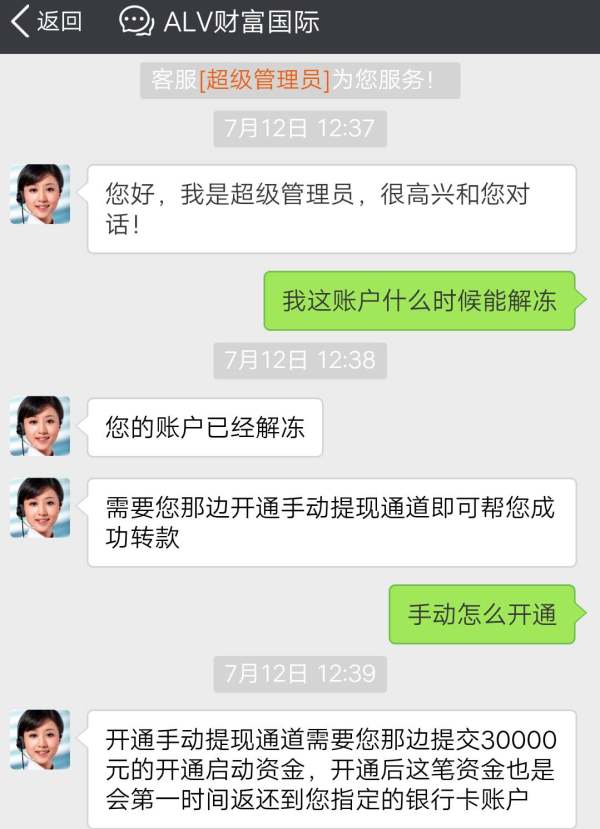

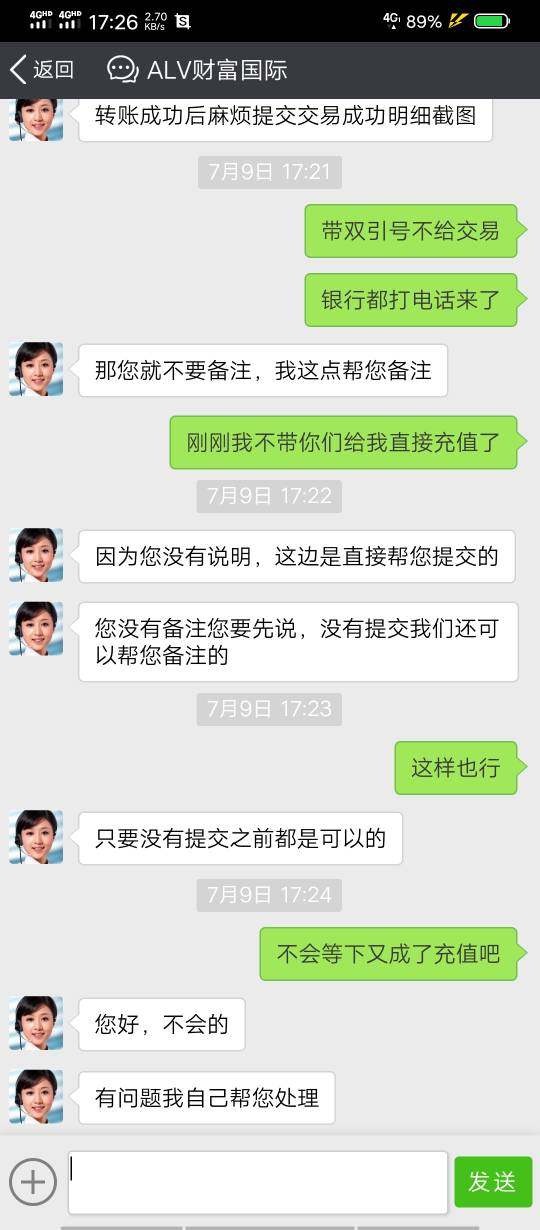

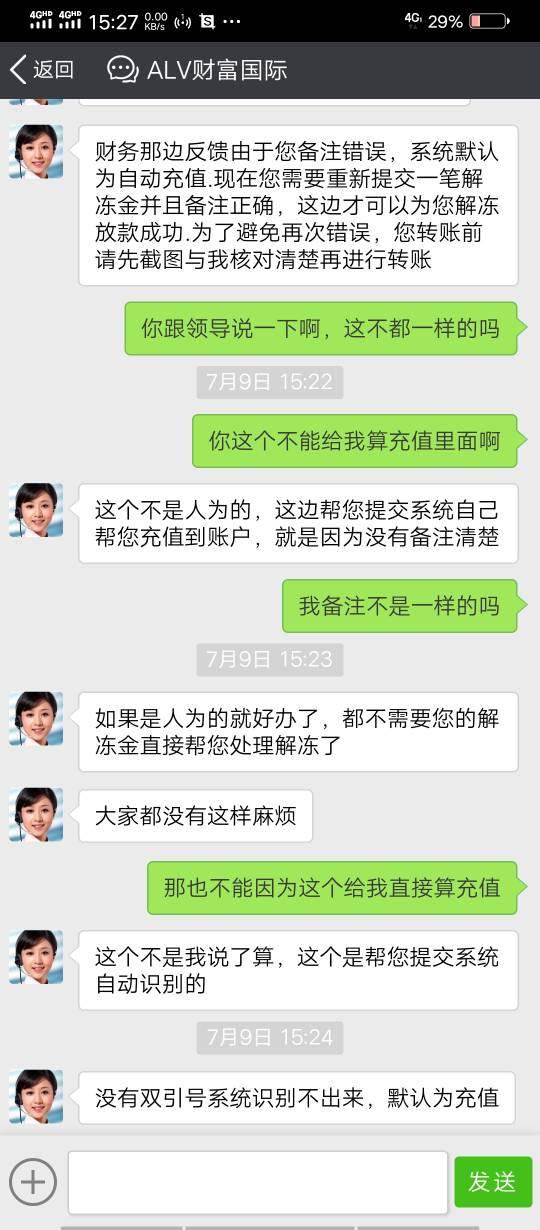

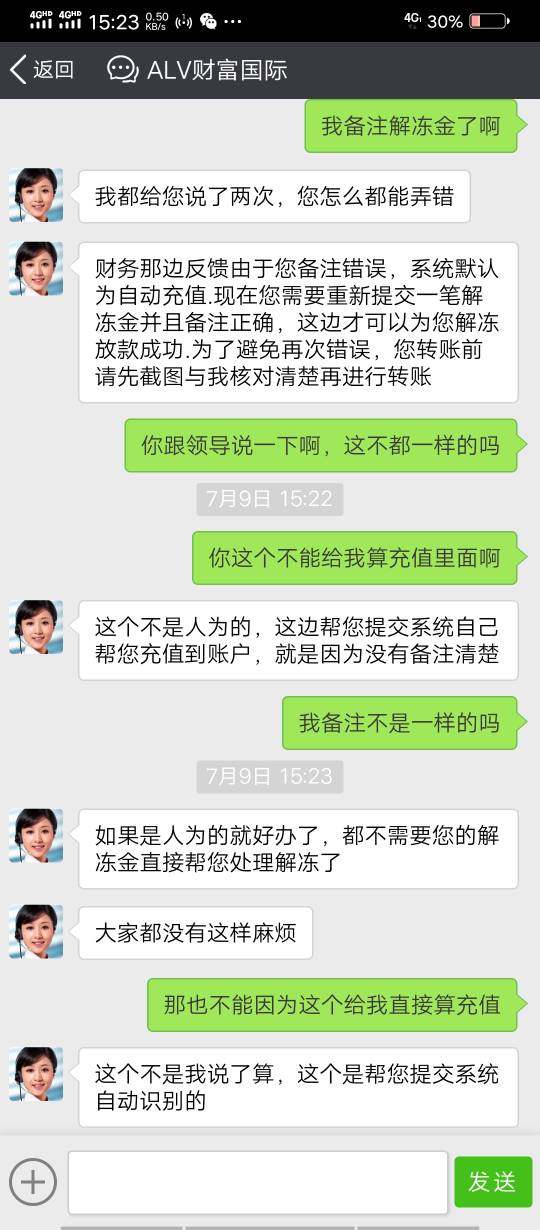

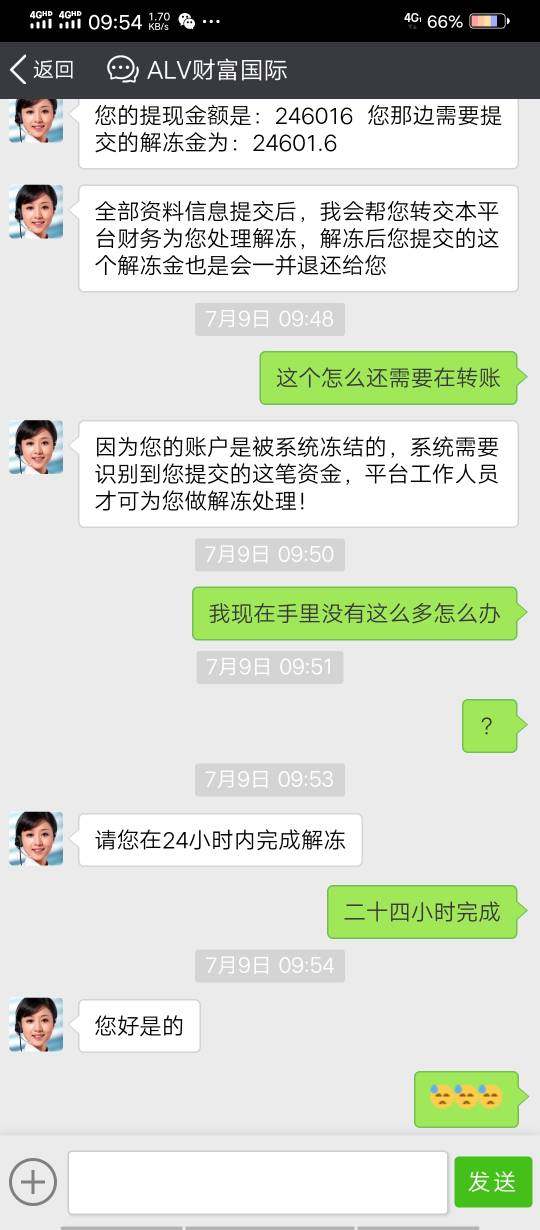

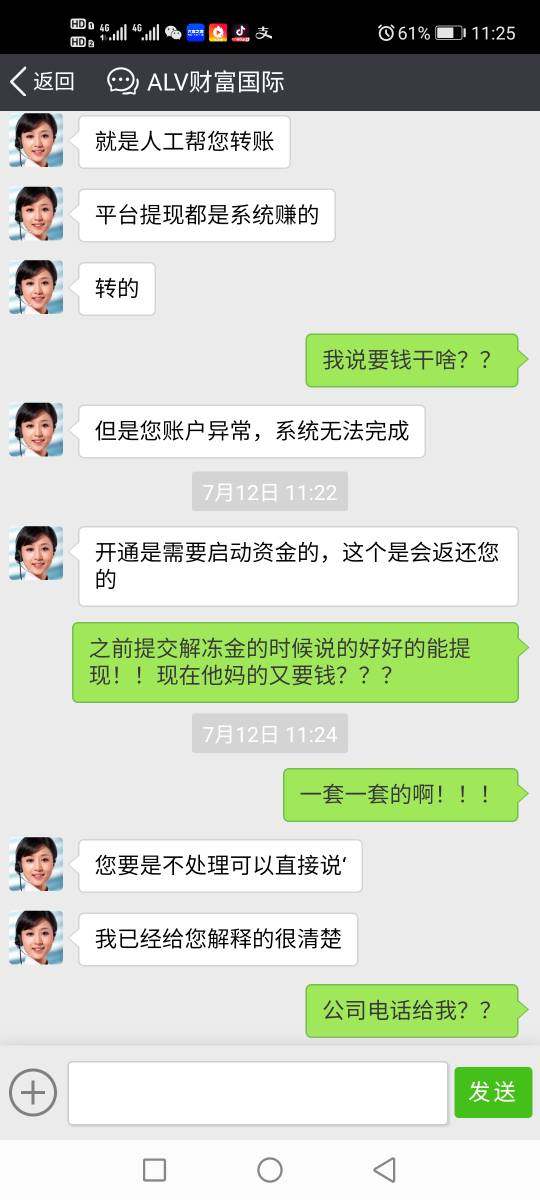

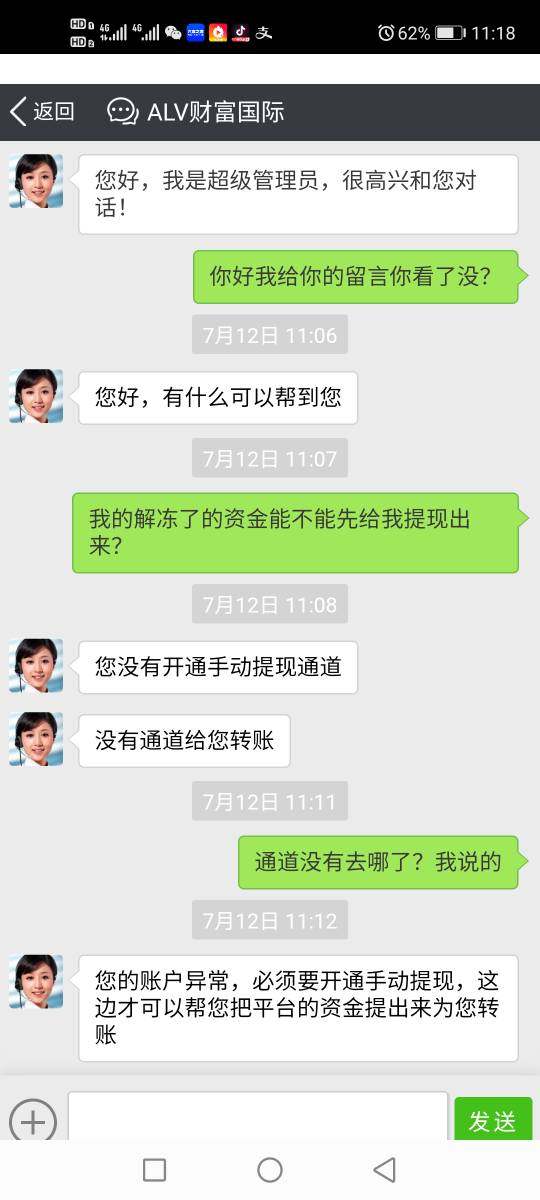

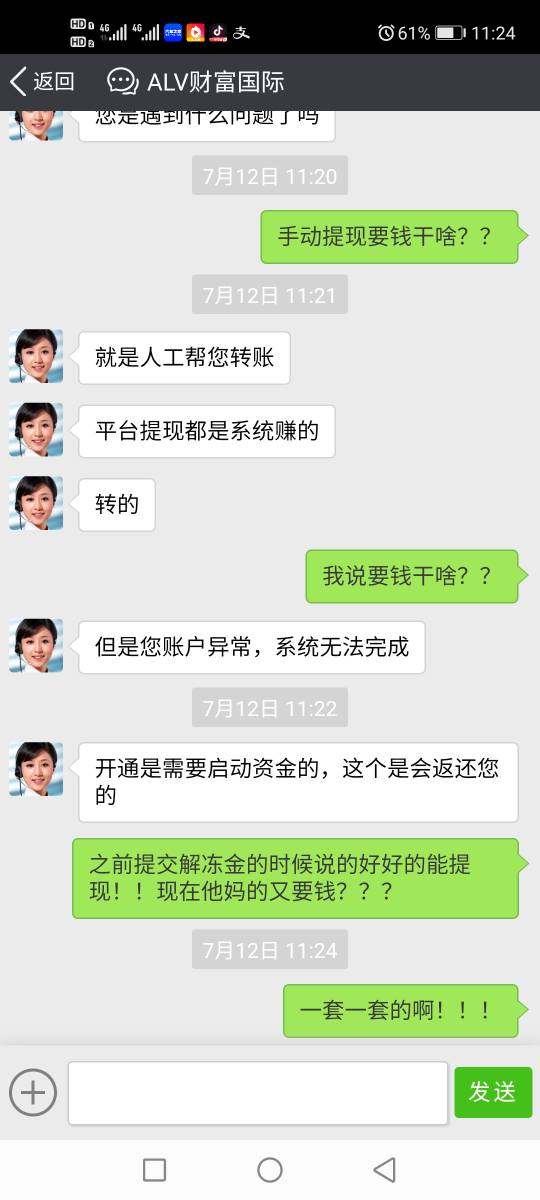

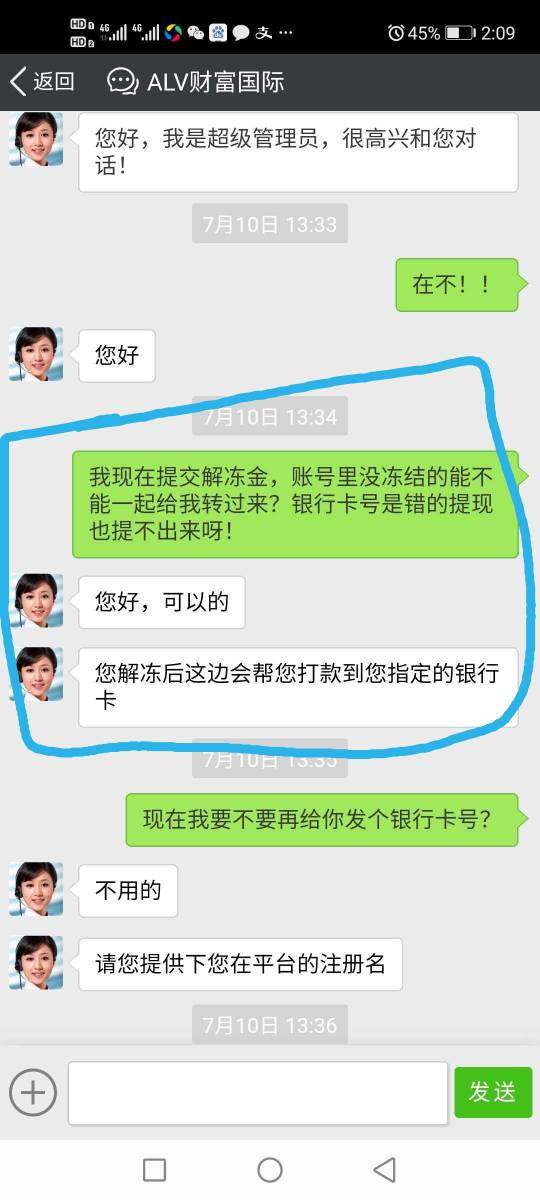

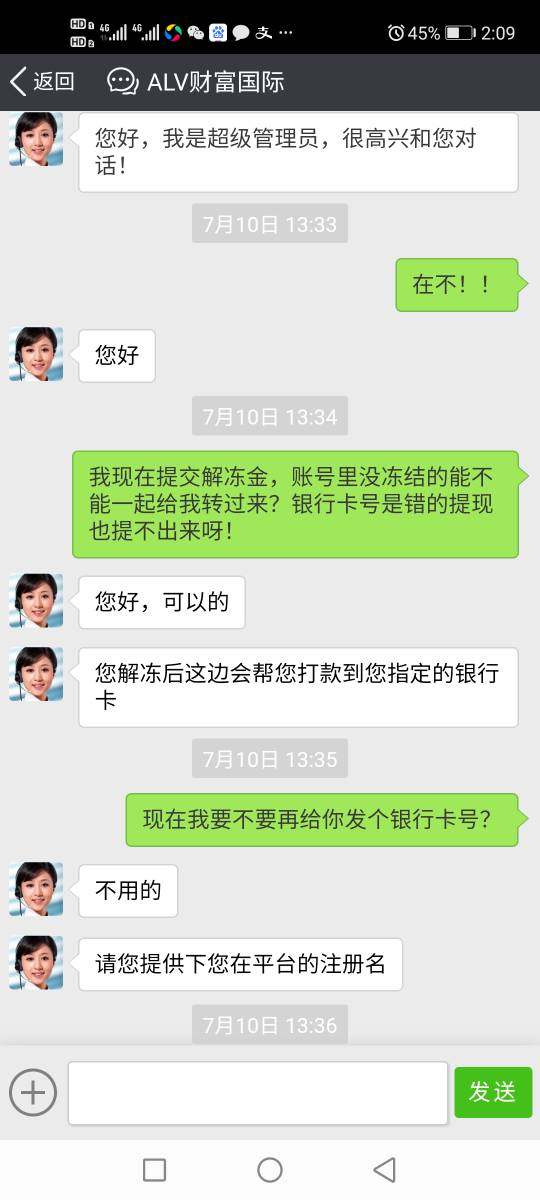

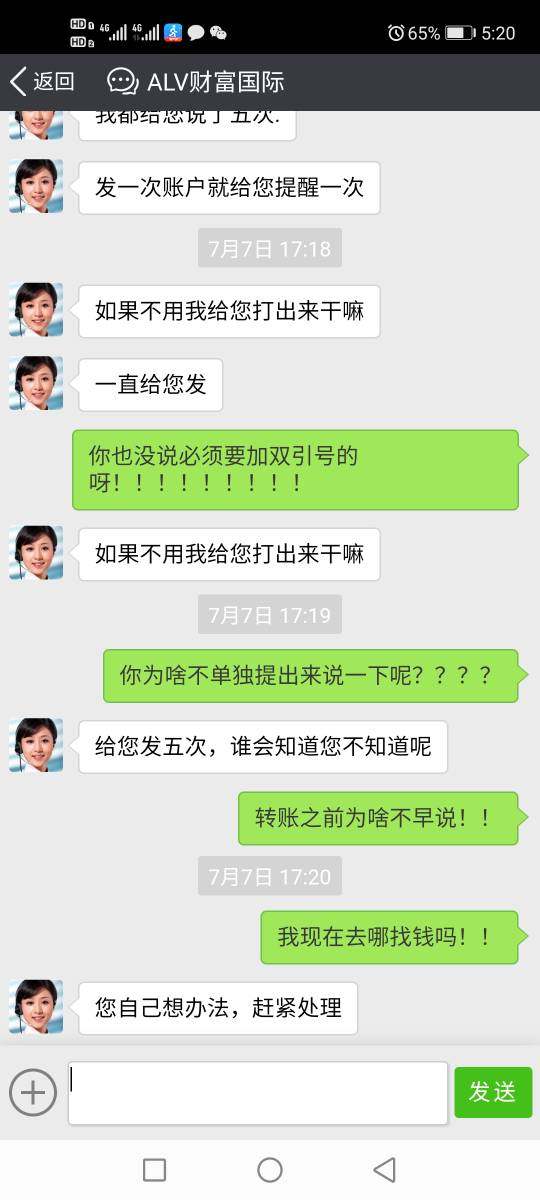

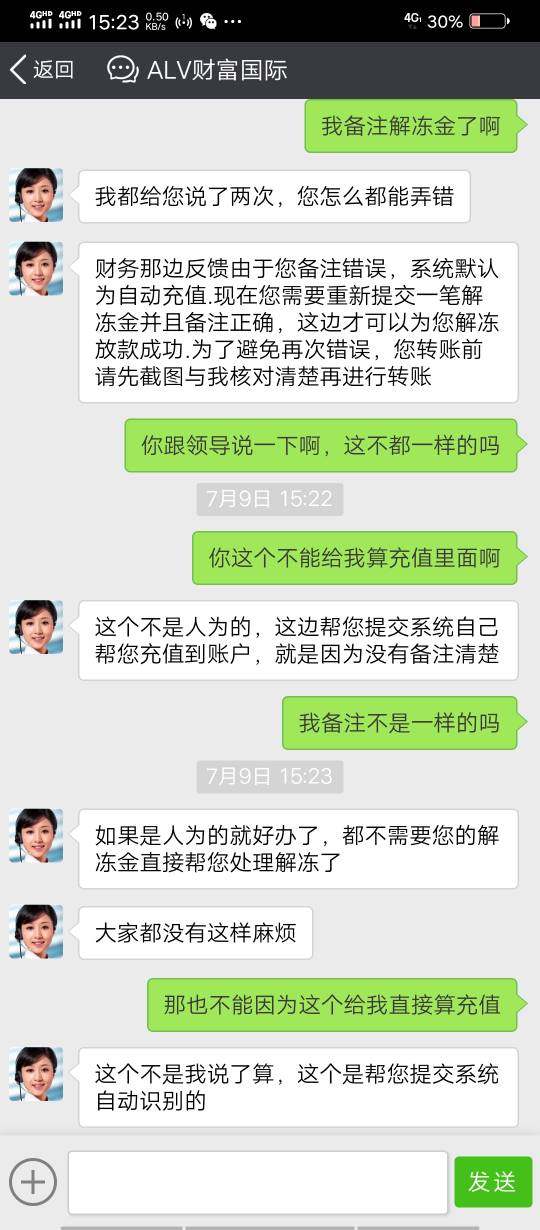

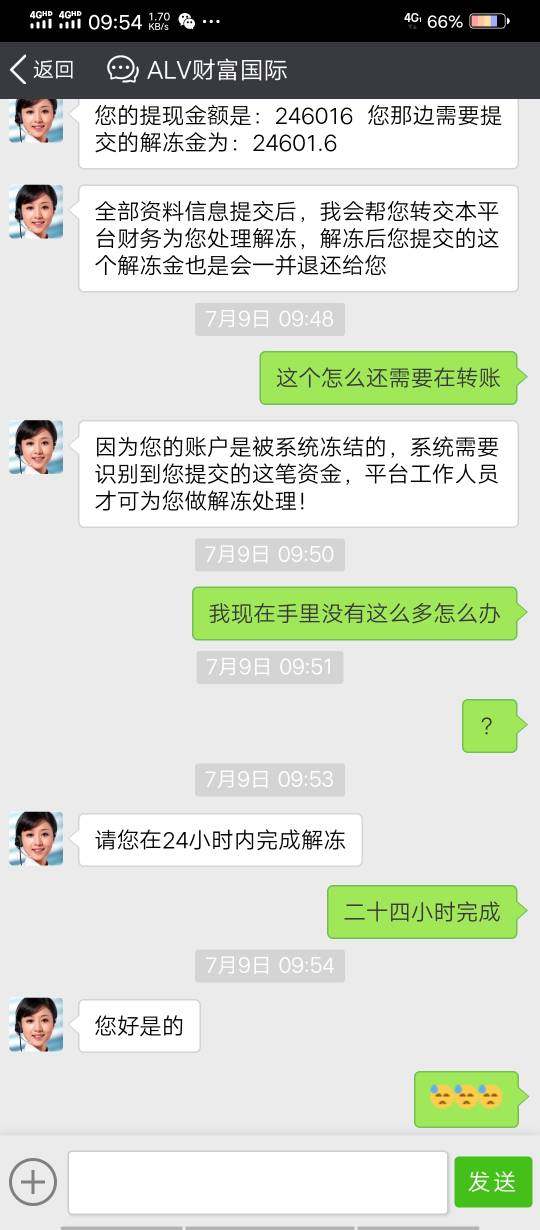

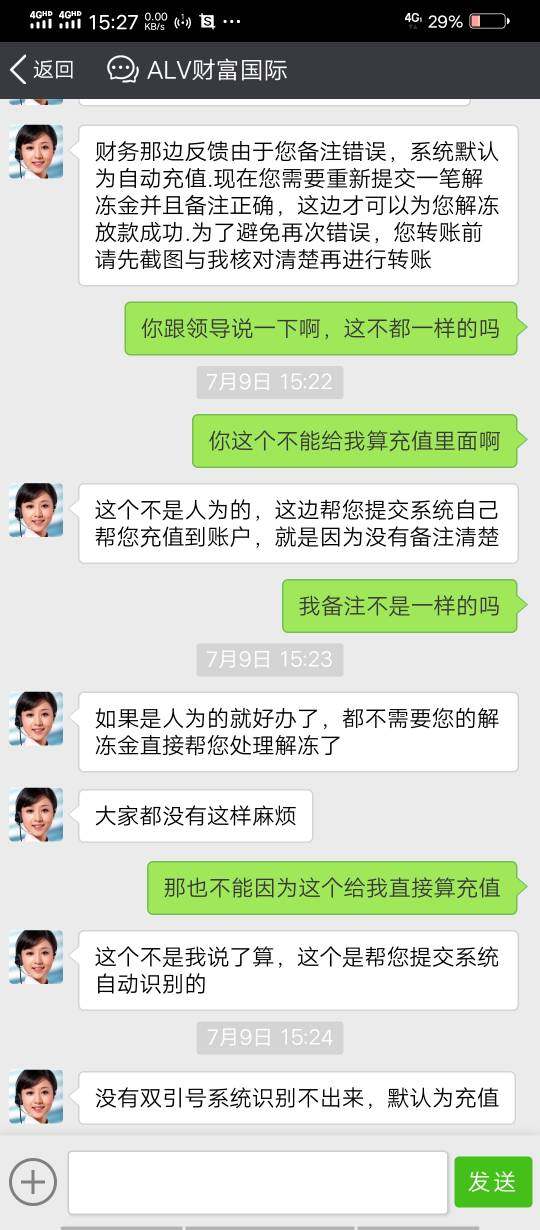

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Alvexo offers accepts customer service in many ways, including phone, email and online message.

Phone:

Email: support@alvexo.com,compliance@alvexo.com

support@alvexo.com

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram and Linkedin.

Twitter: https://twitter.com/Alvexo_Trade

Facebook: https://www.facebook.com/AlvexoTrading

Instagram: https://www.instagram.com/alvexo

YouTube: https://www.youtube.com/AlvexoTrading

Linkedin: https://www.linkedin.com/company/alvexo

Overall, Alvexos customer service is considered reliable and responsive, with various options available for traders to seek assistance.

Note: These pros and cons are subjective and may vary depending on the individual's experience with Alvexo's customer service.

Conclusion

In conclusion, Alvexo is a reputable online broker that offers a variety of trading services and features to cater to the needs of traders. With its range of live account types, traders can choose an account that suits their experience and investment preferences. Alvexo's maximum leverage of 1:300 provides traders with the potential to amplify their positions, although it is crucial to be aware of the associated risks.

Alvexo also provides an array of trading tools to support tradersThese tools help traders stay informed, enhance their knowledge, and make informed trading decisions.

In terms of regulation, Alvexo operates under the jurisdiction of FCA. This regulatory oversight ensures that Alvexo complies with strict standards and follows industry best practices to protect the interests of its clients. Traders can have confidence in Alvexo's commitment to transparency, security, and fair trading practices.

Frequently Asked Questions (FAQs)

Hemana

United Arab Emirates

Always this happen there system is not so good always freeze , I am afraid to lose my funds

Exposure

2023-04-05

十一年承諾℡

Hong Kong

Alvexo modified clients’ account number to rip them off and then asked for margin.

Exposure

2020-07-23

你不去苟且,世界就没有暧昧!

Hong Kong

The withdrawal is unavailable. Alvexo asked for fund with varied excuses, keeping backing out!!

Exposure

2020-07-12

十一年承諾℡

Hong Kong

Alvexo has frozen my account for many times and asked for unfreezing fee.

Exposure

2020-07-12

Derekkk

South Africa

Alvexo is so unreliable! I set a buy stop and sell stop order with 0.2 lot size on my $300 account. However, my sell stop was rejected with no money description. The market later went over 200 pips after my sell stop but it later filled in my buy stop during Tokyo session and I lost all my funds.

Neutral

2023-02-20

FX1023300450

United Kingdom

Alvexo asks for so high minimum deposit, as high as 500 Euros, not friendly to most regular traders. Here I suggest that you should first open a demo account to test its trading platform, then start real trading. As for its benefits, Alvexo does offer a commission-free trading environment, only spreads calculated. Finally, you had better choose some other brokers who require lower initial capital.

Neutral

2022-11-18

糖铃

Singapore

With Alvexo, I started out with a "Classic" account and worked my way up to a "Prime" account. I thought that all three accounts I used helped me a lot.

Positive

2022-12-11