Score

MC

China|5-10 years|

China|5-10 years| https://www.xtmcic.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

China

ChinaUsers who viewed MC also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

xtmcic.com

Server Location

Hong Kong

Website Domain Name

xtmcic.com

Server IP

124.156.140.143

Company Summary

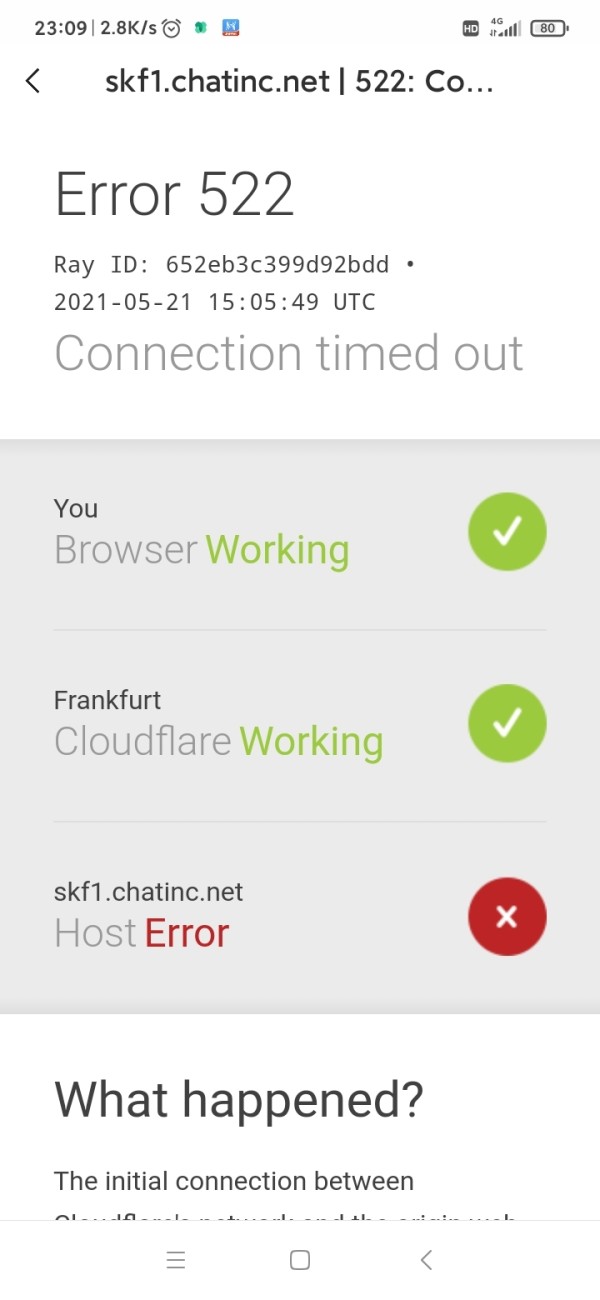

Note: MC's official website: https://www.xtmcic.com/ is normally inaccessible.

MC Information

MC is an unregulated brokerage company registered in China. While the broker's official website has been closed, so traders cannot obtain more security information.

Is MC Legit?

MC is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with the company.

After a Whois query, we found that this company's domain name is for sale, which shows that this company has not registered it securely.

Downsides of MC

- Unavailable Website

The website of MC is inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since MC does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

MC is not regulated, which is less safe than a regulated one.

- Withdrawal Difficulty

According to a report on WikiFX, a user encountered significant difficulties with fund withdrawals. The issue remained unresolved despite the request being pending for a long time.

Negative MC Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review the information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

Currently, there are 9 pieces of MC exposure in total.

Exposure. Cannot withdraw/Others

| Classification | Unable to Withdraw/Others |

| Date | 2020-2023 |

| Post Country | Hong Kong, China |

In addition to being unable to withdraw funds, there are other issues such as unreasonable quotes, login freezes, etc. You may visit: https://www.wikifx.com/en/comments/detail/202009186582183011.html https://www.wikifx.com/en/comments/detail/202106229472617182.html https://www.wikifx.com/en/comments/detail/202104189352721421.html.

Conclusion

MC Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status and unregistered domain name indicate that the broker's trading risks are high. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 10

Content you want to comment

Please enter...

Comment 10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

奈何88261

Hong Kong

The opening position was 1724.05, the opening position was 1729.05, and there was a video showed it. The customer service manager said that it was a spread of 5 points, which was very abnormal. It even reached 1669 at the end of the day, which is not available on all platforms.

Exposure

2021-08-09

简单79267

Hong Kong

The quotations here are different from the prices in MT4. Customer service won't help me solve the porblem.

Exposure

2021-06-22

aaaa东东

Hong Kong

Network disconnection.

Exposure

2021-05-21

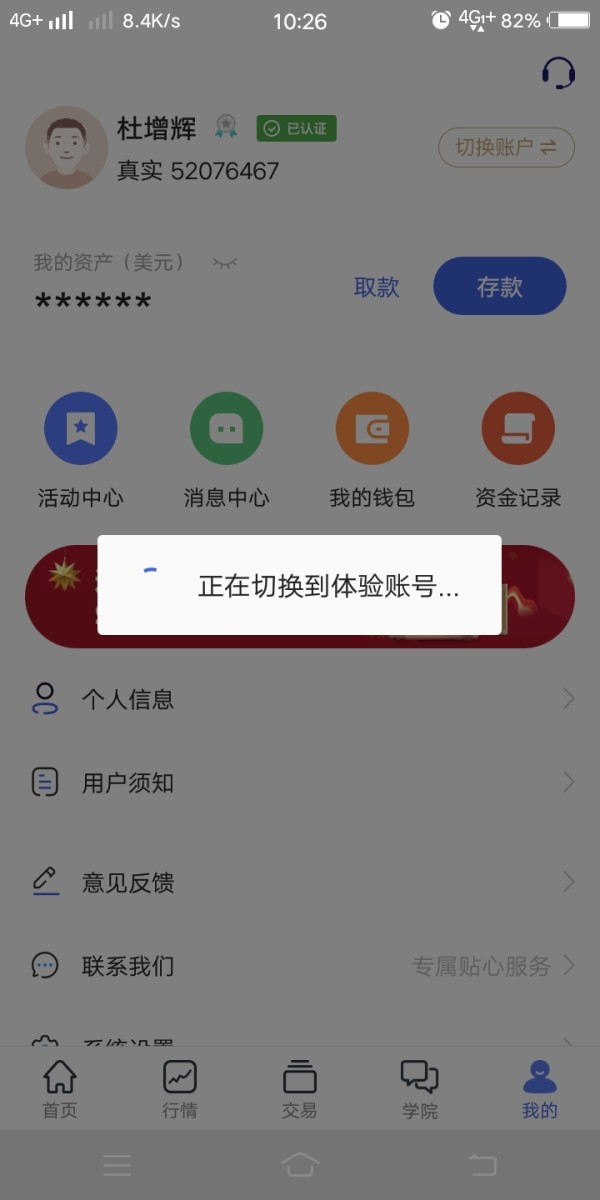

杜增辉

Hong Kong

I can login after I complain about it

Exposure

2021-05-17

杜增辉

Hong Kong

Fake platform. Unable to login

Exposure

2021-05-07

杜增辉

Hong Kong

Let alone trade or withdraw funds.

Exposure

2021-04-20

杜增辉

Hong Kong

Keep loading for over 40 minutes

Exposure

2021-04-19

青天共明月

Hong Kong

No platform has broken new highs. And they still fell all the way. But this platform directly hit the SL and immediately fell.

Exposure

2021-01-27

逸风

Hong Kong

Fraud company. Still can’t withdraw....

Exposure

2020-09-18

Jesse Hamilton

Singapore

M.C. left me feeling like I was in the middle of a guessing game. There were constant discrepancies between the prices they showed and what I saw on the MT4 platform. It's like trying to play chess with missing pieces – impossible to make the right moves. Another hiccup was the absence of a demo account. It's like trying to learn to swim in a storm without a life jacket.

Neutral

2023-10-12