Score

GTSEnergyMarkets

Mauritius|5-10 years|

Mauritius|5-10 years| https://gteprime.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

Singapore

SingaporeContact

Single Core

1G

40G

1M*ADSL

- The AustraliaASIC (Regulatory number: 000513758) Institution Forex License (STP) held by belongs to the scope of institutional business, excluding retail business. It cannot open accounts for individual investors. Be aware of the risks!

Basic Information

Mauritius

Mauritius

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed GTSEnergyMarkets also viewed..

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Website

gtseforex.com

Server Location

China

Website Domain Name

gtseforex.com

Server IP

47.57.70.93

gteprime.com

Server Location

United States

Website Domain Name

gteprime.com

Server IP

47.57.156.25

Genealogy

VIP is not activated.

VIP is not activated.ArgusFX

Finame

Acier

Company Summary

Note: GTSEnergyMarketss official site - https://www.gtseforex.com/en/index.html is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| GTSEnergyMarkets Review Summary | |

| Founded | 2018 |

| Registered Country/Region | United Kingdom |

| Regulation | ASIC |

| Market Instruments | Foreign exchange, precious metals, stock index CFDs, energy and many other financial trading products |

| Demo Account | Unavailable |

| Leverage | 1:500 |

| EUR/ USD Spreads | N/A |

| Trading Platforms | MT5 |

| Minimum Deposit | N/A |

| Customer Support | Phone, email |

What is GTSEnergyMarkets?

GTSEnergyMarkets, an online trading platform authorized by ASIC, offers a diverse range of trading instruments across various asset classes. With a maximum leverage ratio of 1:500, GTSEnergyMarkets aims to provide traders with ample flexibility in their investment strategies.

However, it is important to note that their official website is inaccessible, indicating a potential issue with the platforms availability and raising concerns about the ability to withdraw funds. These reports of difficulties with fund withdrawals, coupled with the limited information available, suggest increased risk and uncertainty when investing with GTSEnergyMarkets.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Regulated by ASIC | • Website is unavailable |

| • A range of trading instruments | • Some reports of scam and withdrawal issues |

| • MT5 supported | • No demo accounts |

| • No social media presence |

GTSEnergyMarkets Alternative Brokers

There are many alternative brokers to GTSEnergyMarkets depending on the specific needs and preferences of the trader. Some popular options include:

eToro - A popular social trading platform that allows traders to follow and copy the trades of other successful traders.

Axi – A well-regulated and respected trading broker with a range of advanced trading tools, making it an excellent choice for professional traders seeking advanced trading capabilities.

Equiti - A trusted global broker specializing in online trading of forex, commodities, and indices, offering cutting-edge technology, superior execution, and comprehensive market analysis.

Is GTSEnergyMarkets Safe or Scam?

GTSEnergy Markets is authorized by the Australian Securities and Investments Commission (ASIC), with the AR Authorised Representative Licence 001284404.

However, the official website of GTSEnergyMarkets is inaccessible, indicating that the trading platform may have absconded. This makes investing with them risky.

If you are considering investing with GTSEnergyMarkets, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision.

Market Instruments

GTSEnergyMarkets offers a variety of trading instruments across different asset classes, including foreign exchange, precious metals, stock index CFDs, energy and many other financial trading products.

Foreign Exchange (Forex): Trading major currency pairs, such as EUR/USD, GBP/USD, or USD/JPY, as well as minor and exotic currency pairs.

Precious Metals: Trading in popular metals like gold, silver, platinum, and palladium.

Stock Index CFDs: Contracts for Difference on major stock indices, allowing traders to speculate on the price movements of indices like the S&P 500, FTSE 100, or Nikkei 225.

Energy Products: Trading in energy commodities like crude oil, natural gas, or heating oil.

Commodities: Potential trading opportunities in agricultural products like soybeans, corn, or wheat, among others.

Individual Stocks: Trading CFDs or other financial derivatives based on the share prices of individual companies listed on stock exchanges.

Bonds: The ability to trade bonds, which are fixed-income securities issued by governments or corporations.

Leverage

GTSEnergyMarkets offers a maximum leverage ratio of 1:500 to its traders. Leverage allows traders to control a larger position in the market with a smaller amount of capital. With a 1:500 leverage ratio, traders can open positions that are 500 times larger than their initial investment.

High leverage has the potential to amplify profits, as even small price movements can result in substantial gains. However, it is crucial to note that leverage also comes with inherent risks. Even a small adverse price movement can result in significant losses, potentially exceeding the initial investment. It is essential for traders to fully understand the risks associated with leverage and use it judiciously.

Trading Size & Mechanics

GTSEnergyMarkets allows clients to place mini-trades of 0.01 lots, i.e. a minimum order of 10,000 units at a time. The company also offers a T+0 trading facility, which means that clients can trade multiple times during the trading day at any time to earn spread gains by taking advantage of exchange rate market fluctuations.

Trading Platforms

GTSEnergyMarkets provides the popular trading platform MetaTrader 5 (MT5) for its clients. MT5 is a comprehensive and user-friendly platform that offers advanced features and tools for effective trading.

The MT5 platform allows traders to access a wide range of financial markets, including forex, commodities, stocks, and indices. It provides real-time market quotes, interactive charts, and numerous technical indicators to assist traders in analyzing price movements and making informed trading decisions.

MT5 is available for desktop applications (Windows and Mac), web-based trading, and mobile devices (iOS and Android), ensuring that traders have access to the platform anytime and anywhere.

See the trading platform comparison table below:

| Broker | Trading Platform |

| GTSEnergyMarkets | MT5 |

| eToro | Proprietary |

| Axi | MT4 |

| Equiti | MT4, MT5 |

Trading Hours

The Forex trading market is actually a continuous 24-hour trading market. Clients can use the customer portal and website at any time, but the trading hours depend on the specific market. For Chinese clients, 20:00-24:00 BST is the most active time for forex trading.

Deposits & Withdrawals

| Payment Method | Deposit Time | Withdrawal Time | Fee |

| Bank Wire | 2-5 business days | 2-5 business days | $25+ |

| Credit Card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Cryptocurrency | 24 hours | 24 hours | Fee depends on crypto |

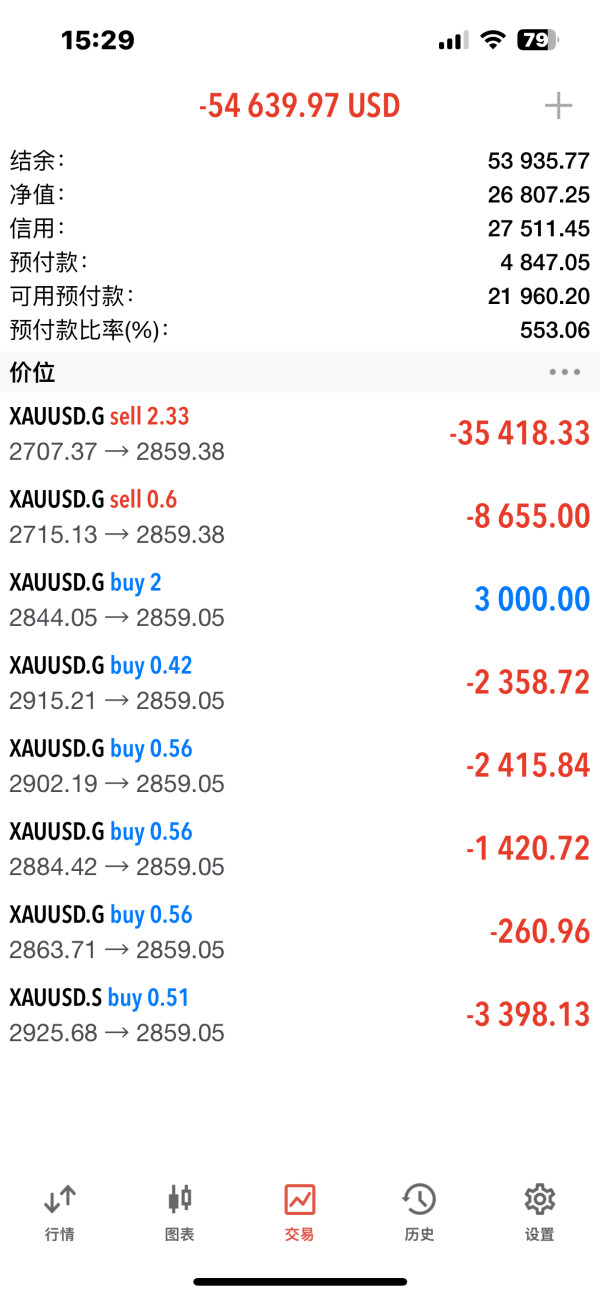

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +15645445905

Email: support@mail.gtseforex.com

Conclusion

In conclusion, GTSEnergyMarkets is a trading platform that offers a range of services to its clients. The platform provides access to various financial markets, allowing traders to diversify their portfolios and capitalize on different trading opportunities. With its user-friendly interface and advanced charting tools, GTSEnergyMarkets's trading platform, MT5, caters to the needs of both beginner and advanced traders. Besides, it is regulated by ASIC.

However, it is worth noting that there have been reports of GTSEnergyMarkets‘ official website being inaccessible, which raises concerns about the platform’s reliability and the ability to withdraw funds.

Frequently Asked Questions (FAQs)

| Q 1: | Is GTSEnergyMarkets regulated? |

| A 1: | Yes. It is regulated by ASIC. |

| Q 2: | How can I contact the customer support team at GTSEnergyMarkets? |

| A 2: | You can contact via phone, +15645445905 and email, support@visionforexglobal.com. |

| Q 3: | Does GTSEnergyMarkets offer demo accounts? |

| A 3: | No. |

| Q 4: | Does GTSEnergyMarkets offer the industry leading MT4 & MT5? |

| A 4: | Yes. It supports MT5. |

| Q 5: | Is GTSEnergyMarkets a good broker for beginners? |

| A 5: | No. It is not a good choice for beginners. Though it is regulated, its website is inaccessible, which make trade not transparent and safe enough. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Regulated in Cyprus

- Regulated in Australia

- Straight Through Processing (STP)

- Institution Forex License (STP)

- MT5 Full License

- Regional Brokers

- Medium potential risk

News

News Global Market Volatility as Fed Rate Cuts Loom, Middle East Tensions, and Corporate Shakeups

Federal Reserve Chair Powell confirms upcoming rate cuts, driving global market volatility and heightened investor focus on key earnings reports. Asian stocks drop as Nvidia's earnings loom, while Middle East tensions rise with Israel-Hezbollah skirmishes. Corporate sectors face challenges, from PDD Holdings' sharp stock drop to HSBC's planned management overhaul. Tech and energy markets remain in flux.

2024-08-28 16:14

News Market Reactions to Fed’s Rate Cut Indications Amid Global Economic Tensions

Fed Chair Powell’s confirmation of upcoming rate cuts has triggered mixed reactions across global markets. While Asia’s stock markets rallied on the news, ongoing tensions in the Middle East and cautious central bank policies in China and Singapore have kept investors on edge. Meanwhile, PDD Holdings’ historic stock drop and Nvidia’s anticipated earnings add further uncertainty to the market outlook.

2024-08-27 12:51

News Global Market Reactions as Fed Prepares for Rate Cuts Amid Rising Geopolitical Tensions

Fed Chair Powell signals upcoming rate cuts, driving bond market speculation and influencing global markets. Asian stocks rise, while yen strengthens due to safe-haven demand. Meanwhile, Australia's central bank faces skepticism over its tightening stance.

2024-08-26 15:34

News Global Financial Market Dynamics Amid Geopolitical Tensions and Economic Shifts

Kamala Harris makes history at the Democratic National Convention, while global markets react to central bank policies and geopolitical developments. Alibaba's listing upgrade and Japan's currency movements highlight Asia's financial dynamics. Meanwhile, Russia faces military and economic challenges as Ukraine escalates attacks. Key market players like Uber and Canadian rail companies respond to industry disruptions.

2024-08-23 17:21

News Global Market Dynamics: Key Economic Movements and Geopolitical Influences

This week's financial landscape is shaped by Kamala Harris’s record-breaking campaign fundraising, Walmart’s strategic exit from JD.com, and rising market anticipation of the Federal Reserve's rate decisions. Meanwhile, geopolitical tensions and shifts in Asia's economic policies continue to impact global trade and investment flows. Key developments include strong South Korean exports, potential Canadian rail strikes, and the ongoing effects of inflationary pressures in Australia and Europe.

2024-08-22 16:25

News Global Markets and Geopolitical Developments: Key Highlights

Former President Obama’s speech at the Democratic National Convention bolstered Kamala Harris's campaign. Walmart plans to sell JD.com shares, ending an 8-year partnership, while Chinese cities slashing new home prices stir market fears. The Fed’s anticipated rate cuts drive aggressive bond trading. In international news, U.S. and Israeli officials work on Gaza ceasefire talks, and Japan’s export growth accelerates, fueled by a weaker yen.

2024-08-21 12:57

Comment 27

Content you want to comment

Please enter...

Comment 27

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

HTL

Hong Kong

从2024年8月份到现在一直无法出金

Exposure

Three days ago

小鱼儿9559

Hong Kong

从去年四月份开始就一直挂单,亏损严重,找了各种借口都无法出金

Exposure

03-01

乐乐7624

Hong Kong

从2024年4月份到至今都无法出金,账户都差不多被打爆仓了,很多小账户已经被公司交易团队打爆仓了,领导人都无法联系上,已经10个月都无法出金了,公司老总和领导每天各种忽悠,就是实实在在的诈骗,

Exposure

02-09

刺猬没刺

Hong Kong

GTSE四个月了无法出金 提现一分没到 公司跑路 有图有真相

Exposure

2024-11-14

dazeng

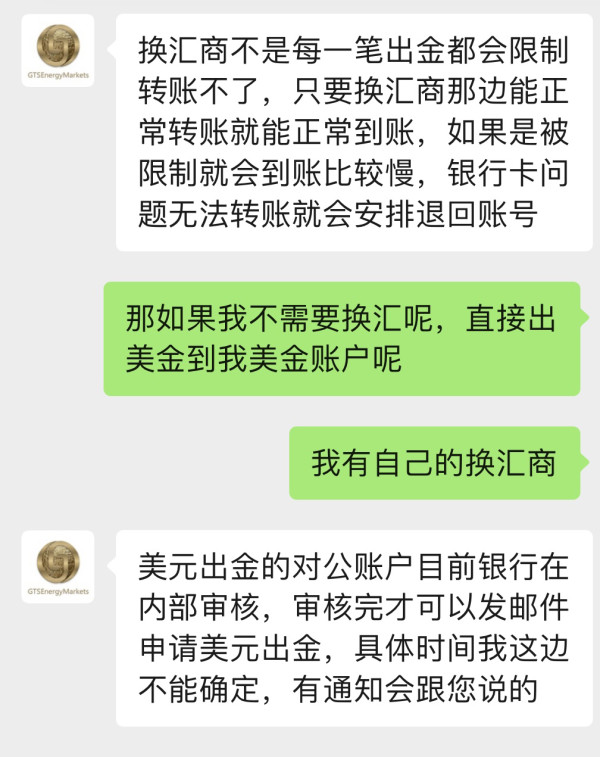

Hong Kong

提现两个月不到账,平台一直说是换汇商出问题了,别的平台都正常。

Exposure

2024-11-07

官方提醒13451

Hong Kong

无法出金,客服说联系外汇商至今没有结果,已经一个月了也没有回复

Exposure

2024-11-04

bank5357

Hong Kong

GTSE七月到现在无法出金老板姓聂 把责任推给三方就是个大骗子

Exposure

2024-10-25

莱芜湖

Hong Kong

出金一个多月快两个月了,一直没到账,客服不处理

Exposure

2024-10-24

dd645

Hong Kong

联系客户经理一直说什么银行在维护,什么对公账户,一直拖延就是不到账几个月了

Exposure

2024-10-22

莱芜湖

Hong Kong

我在上个月即9月2号在贵平台申请出金2000💲,9月4号审核通过,但是直到现在10月18号都没有到账,在本月即10月12号申请出金4669.22💲,10月16号审核通过,出金正常从申请到到账就4个工作日,以上两笔出金申请已通过审核,但是一直没有到账,期间也一直有联系客服咨询,但是客服一直都是同一个回复,一直在推脱,没有明确时间,现在已经一个多月了,请尽快处理

Exposure

2024-10-21

莱芜湖

Hong Kong

我在上个月2024年9月2号申请出金,4号出金审核通过,到现在10月12号,已经一个多月都还没有到账,期间一直有问客服,客户都是一个回复,银行监管严格,还在处理,一直都没有结果,正常都是4个工作日都能到账的

Exposure

2024-10-12

FX2723565658

Hong Kong

本人于2023年4月初被一个微信名叫“大陆”的陌生人拉入一个名称为“黄金学堂97”的微信群(也不知他们是怎样获悉的客户信息),随后不久又被转移到“黄金学堂98”(号称是实盘操作群),这个群里他们的主要团伙人员微信名分别是:”江涛VIP”、”花开富贵”、“0.2”、“大陆”、“最胖的瘦子”等,他们打着有老师指导黄金交易策略(号称胜率98%)的旗号,诱导我们一部分交易者在他们的平台开户并入金,但在开户的时候就发现他们的交易平台在MT4官网里面却搜寻不到,只有下载他们发的链接才能完成注册开户,这点已经露出不正常的端倪。本人于4月初在他们平台开户入金后至4月27日共交易了三周多的时间,在此期间我通过实操验证,他们所谓的胜率98%的策略纯粹是胡吹瞎扯,随后我一直按照自己的交易思路操盘,并陆续有了一些盈利,中间我尝试过三次出金都未能兑付,估计应该是有人为操控,更为恶劣的是4月27日北京时间晚8:50左右,我下了一单美元兑日元的货币对交易,三四分钟后随着行情波动当时的浮亏应该是30.98美金,但此刻这个黑平台却人为恶意操控,把浮亏给放大了100倍而成了3098美金,导致我账户瞬间被强平爆仓,与此同时我也立马被他们从“黄金学堂98”群里移出,随后我立刻跟他们的官网客服和群客服“江涛VIP”等分别投诉并详细说明情况,起初几天他们还含糊其辞回信搪塞推诿,说过了五一假期后再说,等过了五一假期一周后便销声匿迹、杳无音信,赤裸裸的露出了骗子的嘴脸和本性。在此郑重提醒正在做外汇交易的朋友们,千万注意并远离这伙人渣骗子!如果遇到随时曝光他们的丑恶嘴脸!

Exposure

2023-08-26

东哥86

Hong Kong

GTSE平台系统时间2023年04月27日15:50,本人以成交价133.838做空0.53手美日,15:51时市价显示为133.904,按照GTSE平台的交易规则和美日品种的合约数量属性,该笔订单的浮亏应为-34.98;但系统却恶意把该笔订单的浮亏加大100倍,错算成-3498;并直接导致账户爆仓! 出现该问题后,本人立即和平台客服和客户经理反应此事;但直到今天(2023年08月26日)未得到解决!如此低劣的恶意系统错误,GTSE却不愿意承担应有的责任!

Exposure

2023-08-26

尘3658

Hong Kong

代理公司的业务员找到我开户说有老师带,后来一步一步骗我入大资金,老师的策略根本赚不到钱,本来想走他又骗我说老师国外有内幕消息,后来他直接在我不知情没允许的情况下操作我的账户故意买卖比特币导致我爆仓,后来警察打电话说我进了杀猪盘才反应过来,他们的后台可以随意进出我的本金,他们那个平台和软件都是独立的,代理商故意不让我和客服联系,偷偷操作我账户让我爆仓,其实后台他们已经拿走了我真实的本金。

Exposure

2023-08-16

FX2723565658

Hong Kong

本人在该平台注册账户是16661341,今年4月27日晚北京时间20:50左右我下了一单美元兑日元的交易,三四分钟后随着行情波动,当时浮亏应该是34.98美元,但平台却把浮亏给放大了100倍而成了浮亏3498美元,因这个低级严重的错误导致我账户被强平爆仓。随后我跟平台官网客服反应过,也跟网名叫“江涛VIP”的指派客服反应过,但一直搪塞拖延迟迟不予解决,另外该平台的出金情况也是处处设置障碍,一直是人为把控,很难顺利出金。请贵处核实情况帮助解决为盼!

Exposure

2023-06-17

恒赢资本

Hong Kong

www.gtseforex.net,本人在这个平台注册账户,入金一万美金,交易两周后盈利和本金一共28200美元,平台通知单子抛不出去为由不能出利润只给本金,封了我们的后台,已经拖了一个半月了。

Exposure

2022-06-06

恒赢资本

Hong Kong

本人通过武汉中海大厦的业务员开立的GTSE交易账户,当时业务员各种保证和承诺资金安全问题,我入金了一万美金交易了两周,有盈利后准备出金试一下,结果平台以各种理由不给出金把已扣款出金资金又退回去了,并通知只给本金,这种没有任何信用的无耻平台,大家请远离!

Exposure

2022-06-02

山 水

Hong Kong

3月2号,正常交易日平台停盘18小时,造成亏损2万美金,平台答应赔付始终没有解决,经查询域名2020年注册,主牌公司没有任何联系,三无平台,现已立案调查中

Exposure

2022-05-08

FX2166894871

Hong Kong

现在连后台都无法登录,账户也登陆不上,后台账号都没有记录,发邮件石沉大海,没有客服。

Exposure

2021-12-22

FX2166894871

Hong Kong

账户后台登录不上,直接无效账户,改密码也改不了,不能交易也不能出金,发送邮件也没反映,平台根本联系不到人

Exposure

2021-12-10