Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

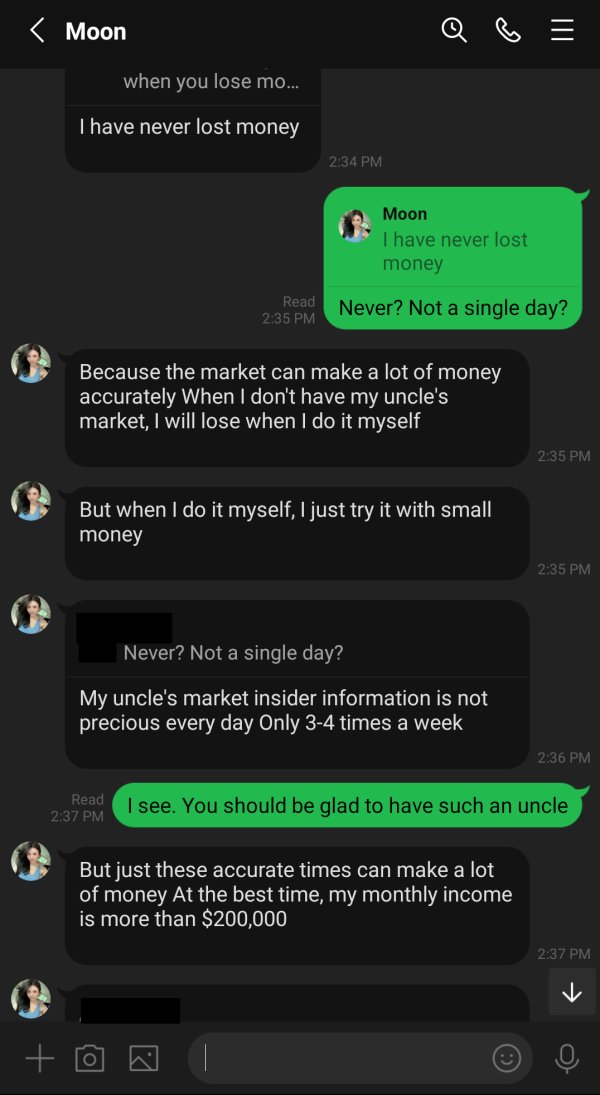

สมพง พระประแดง

Thailand

There was an invitation to trade foreign exchange. I checked it and found it had no license.

Exposure

2021-08-12

kinder

Tunisia

Been trading with Meiji Yasuda for a while now and I gotta say, I'm impressed! They've got years of experience, so you know they've seen it all. Plus, they're regulated by the FSA, which gives me a lot of confidence in their reliability. The best part? Their fees are competitive, so I'm not losing money left and right. The only downside is that their website construction is a bit backward. But hey, if you want a solid broker that knows what they're doing, Meiji Yasuda is a great choice.

Positive

2023-04-23

FX1478979502

Malaysia

Meiji Yasuda is a legit brokerage firm, no doubt about it. They've been around for ages, so you know they're doing something right. Their trading conditions are pretty good too - I don't feel like I'm getting ripped off every time I make a trade. But the downside is that their customer service is a bit of a mystery. There's not much info about it on their site, which can be frustrating. But overall, I'm happy with Meiji Yasuda and would recommend them to anyone looking for a solid broker.

Positive

2023-04-23

AA资治通鉴

Morocco

I am very impressed with this company! It has a long history, rich trading products, and is strictly regulated by the FSA... After all, safety is the most important thing.

Positive

2022-11-22

Miguel Pinesela

Hong Kong

8 months into live trading and i dont see anything out of the ordinary, broker keeps up as advertised, good trading instruments, good process... Over all they are really good.

Positive

2022-11-16