简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Forex Brokers' Use of the "Hybrid Model"

Abstract:We discussed why forex brokers prefer B-Book execution over A-Book execution in the last lesson, despite the fact that it is riskier because the broker can go bankrupt if risk management is bad.

We discussed why forex brokers prefer B-Book execution over A-Book execution in the last lesson, despite the fact that it is riskier because the broker can go bankrupt if risk management is bad.

But what if you could have the best of both worlds as a broker?

So far, we've learnt that when a broker executes your order, it has the option of filling it in one of the following ways:

· Prior to hedging (A-Book)

· By not hedging in the first place (B-Book)

· Internalize first, then choose one of the options above.

· By initially hedging (STP)

A forex broker, on the other hand, is not limited to just one type of hedging.

Depending on the order and/or customer, it may select any of the options above.

Different factors, such as trade size and a customer's profitability profile, influence how a broker choose who to choose for which model.

For social traders, news traders, API traders, and screen traders, a broker can produce independent price streams and hedging models.

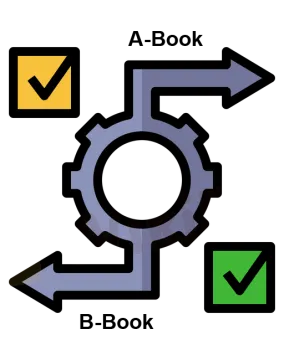

Most brokers have at least an A and B-Book, which allows them to choose which trades are internalized and which are hedged with an LP.

This is called the “hybrid model.”

While your forex broker is always the counterparty to your trades, a hybrid method allows the broker to either carry out or offset your trades internally or externally to a liquidity provider.

A broker can use a “hybrid” method to:

· Offset orders with other customers

· Hedging orders with a third-party counterparty (liquidity providers)

· Alternatively, you might choose not to hedge and take full market risk.

Market risk refers to the possibility of losing money on a trade due to market fluctuations. Here's where you can learn more about the dangers of market risk.

Here are two cases of how a broker might work in a hybrid situation:

· The broker can split its customers and send some of their trades to an LP (A-Book or STP) while keeping the remainder “in-house” (B-Book).

· The broker can choose to outsource all trades of a specific size or more to a liquidity provider while keeping the remainder “in-house” (B-Book).

Profiling of Customers

The forex broker must pick which customers move to A-book and which go to B-book in the hybrid model. And why is that?

Once these rules and criteria have been established, the broker will have a “order routing system” or “order execution engine” that will manage orders by automatically delivering them to A-Book or B-Book.

Losing traders' trades will most likely be held by the broker, while profitable traders' trades will be hedged.

This means that profitable traders will be A-Booked, while losing traders will be B-Booked, keeping market risk “in house.”

Forex brokers use software to assess how consumers trade in order to successfully identify profitable and unprofitable traders.

They can categorize traders based on the size of their deposit, the notional value of each transaction, the leverage employed, the risk incurred with each trade, the use of protective stops or the lack thereof, and so on.

There seems to be a general pattern of activity among traders who were not successful, for example.

· Depositing a small amount of cash, resulting in a small initial account balance (typically less than $1,000), is one of these practices.

· Per trade, they're risking 10% or more of their meager account balance.

· Stop losses are not used.

· Adding to the losses of previous trades.

They use a lot of leverage on their small accounts, which makes them vulnerable to margin calls and stop outs.

Brokers can evaluate trading trends and profile each customer's trades with the help of computer algorithms.

To various customers, brokers can be distinct “brokers.”

To some, it may be a B-Book broker, but to others, it may be an A-Book broker.

The reasons for customer profiling are straightforward.

Customers who are A-Booked are more successful and trade in greater lot sizes, therefore completely offsetting these orders with an external counterparty removes market risk while still collecting a (small) spread fee.

Customers who are B-Booked, on the other hand, will typically place small orders, most of which will result in losses, and the broker will be able to store market risk because the trade size is modest.

This permits the broker to profit from B-Book customers' losing trades as well as the price markup from A-Book customers.

Forex Brokers of a Significant Size

Larger forex brokers are able to internally offset (“internalize”) a large portion of their order flow because they have a large number of customers opening trades in both (long and short) directions. This allows them to minimize market risk WITHOUT having to hedge with an external counterparty.

If not all of the positions can be hedged, the excess market risk exposure is externally hedged.

Because of their enormous customer base, most large forex brokers can theoretically offset the majority of their customers' trades.

This permits money to be derived from customers' transaction fees (from the spread), implying that revenue is generated by volume of client trading rather than losses.

If a smaller broker cannot hedge your trade with another customer, they will “B-Book” (take the other side of) the trade up to their market risk limit. Anything above this point would be hedged from the outside.

Better order execution is achieved by combining B-Book with just externally hedging over a specified risk limit (since it allows the broker to execute your trade promptly) while minimizing latency and costs (because it doesn't have to A-Book or STP every trade, which would require paying the LP's spread every time).

The majority of Forex brokers employ a hybrid strategy.

We don't see anything wrong with a broker running both an A-Book and a B-Book operation. In reality, most brokers employ a hybrid strategy.

Brokers who utilize a hybrid method can offer all of their customers very competitive spreads thanks to the earnings generated by traders put in the B-Book.

The key disadvantage of this strategy is that it is vulnerable to poor B-Book risk management by the broker. The broker may go out of business as a result of the explosion.

New retail traders' trades will almost certainly be B-Booked. This is understandable given that the majority of new traders lose money. For the broker, it's easy money.

A retail FX broker that is 100% A-Book is quite rare. It's a difficult business model to follow.

The A-Book model has a substantially lower profit margin than the B-Book model, therefore brokers must concentrate on customers that trade frequently and in large amounts while keeping costs as low as possible.

A B-Book model gives an extra source of money with so many unproductive traders.

There's nothing wrong with a retail broker using a combination of A-Book and B-Book systems. When a forex broker begins to manipulate deals in its favor, something is awry.

The most crucial aspect for a retail broker should be to ensure fair pricing and the best order execution for their consumers, at least in a well-regulated jurisdiction.

What matters most, regardless of the broker's execution strategy, is that retail traders get transparent prices that match the “real”(institutional)FX market in real-time AND that their orders are completed at these prices (or better) without delay.

In following classes, we'll go into pricing and order execution quality in greater depth, but first, let's look at another “risk management” strategy used by forex brokers.

Regardless of whether an A or B book model is used.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator