What is Absa?

Absa is a South Africa-based financial services provider that offers a wide array of services, including Credit Cards, Loans, Investments, Insurance, and Rewards Programs. As per the regulatory standards, it currently exceeds the business scope as regulated by FSCA, the Financial Sector Conduct Authority of South Africa. Absa is committed to providing diverse market instruments catering to various trading needs and customer experience levels. They also offer comprehensive customer support via multiple channels, including phone, email, and social media.

Pros & Cons

Pros:

Multiple Market Instruments: The platform offers diverse Market Instruments, including Credit cards, Loans, Invest, Insurance, and Rewards, catering to various trading needs and experience levels.

Multiple Customer Support Channels: Absa provides various customer support channels including phone, email, and social media, enhancing accessibility and assistance for clients.

Cons:

Is Absa Safe or Scam?

Absa, despite being a recognized name in the South African financial market, has recently come under scrutiny. This due to the fact that it reportedly operates beyond the business scope of its license (License No. 45849) as regulated by the Financial Sector Conduct Authority (FSCA) of South Africa.

Alongside this, concerns have been raised about issues related to withdrawal processes. These significant points up for consideration cast a shade of doubt on the safety and credibility of Absa in its operations.

However, it's important to thoroughly investigate these allegations before forming any conclusions. Contacting Absa directly, reaching out to FSCA for further confirmation on licensing scope, and seeking advice from financial experts would be advisable steps towards a more informed decision. Do keep in mind that while a situation might seem uncertain, it does not immediately label a company a 'scam'. Transparency and clarity should be the aim while dealing with such concerns.

Services

Credit Cards: Absa offers numerous credit card options catering to different user requirements and financial capabilities. These cards can be tailored to meet your lifestyle needs, whether it's for everyday purchases, travel, or business expenses.

Loans: With Absa, customers can avail of a variety of loans designed to meet different financial needs. Whether it's a personal loan for unexpected expenses, a home loan for a new property, or a business loan for expansion, Absa aims to provide tailored solutions for its diverse clientele.

Investment Products: Absa facilitates a variety of investment options to help customers grow their wealth. Whether you're starting your journey with a small investment or you're an established investor looking to diversify your portfolio, Absa can provide options that fit your strategy and risk profile.

Insurance: To help clients mitigate risk and protect what's important, Absa provides a range of insurance options. They offer everything from vehicle and home insurance to life and business insurance, ensuring you have the coverage that best suits your circumstances.

Rewards Program: To enrich the customer experience, Absa offers a rewards program that allows clients to earn points that can be redeemed for a variety of rewards, such as cash back on card purchases, discounts on travel bookings, vouchers for shopping, and much more.

Account Types

Absa offers a range of accounts suited to different customer needs, each with its own pricing structure:

Smart Account: This account targets customers seeking intelligent, simple banking solutions. For a monthly fee of R75.00, customers can access a range of banking services tailored for everyday use and cost-effectively manage their finances.

Tax-Free Savings Account: Designed for long-term savers, Absa's Tax-Free Savings Account encourages customers to save in a tax-efficient manner. One of the key features of this account is that it doesn't charge a monthly fee, allowing customers to maximize their savings. All the interest, dividends, and capital gains made on investments within the account are tax-free as per the individual savings allowance limits set by the government.

Exchange Traded Fund Account: This account provides an easy, cost-effective way to invest in Exchange Traded Funds (ETFs), which track various asset classes or market sectors. Absa does not charge a monthly fee for this account, making it a cost-effective investment solution. The costs associated are usually dependent on the purchase or sale of ETF shares.

World Trader Account: This account is designed for clients interested in trading in international markets. Absa doesn't have a standard fixed monthly fee for this account. Instead, the fees are based on a schedule that varies depending on the type of trade, currency, and market. This allows customers to pay for their specific trading needs and activities.

Monthly Fee & Brokerage

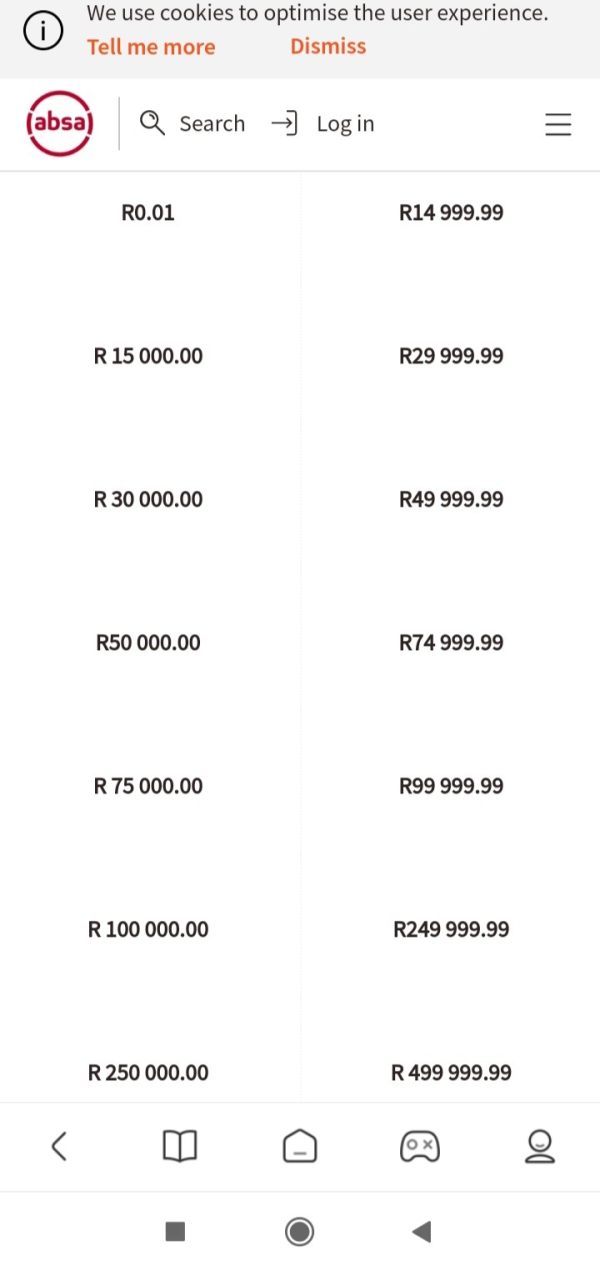

Absa has meticulously crafted a versatile brokerage fee structure to accommodate the distinctive financial needs of its clients across various account types. Each account offers a different fee arrangement tailored to specific preferences:

Smart Account:

For the Smart Account, clients can expect a monthly fee of R75.00. In terms of brokerage, Absa charges a competitive 0.4% of the trade amount, with a minimum of R120. This account is suited for those who engage in online trading within the local market, providing a straightforward and transparent fee structure.

Tax-Free Savings Account:

The Tax-Free Savings Account stands out with its fee structure. It comes with no monthly fees, offering a cost-effective option for long-term investors. The brokerage fee is set at 0.2% of the trade amount, with a minimum of R15. This account is perfect for those looking to benefit from tax-free gains while minimizing trading costs.

Exchange Traded Fund Account:

The Exchange Traded Fund (ETF) Account also comes with no monthly fees, making it an attractive choice for investors interested in building a portfolio primarily with ETFs. The brokerage fee is 0.2% of the trade amount, with a minimum of R60. This account is designed for those who prefer to invest in ETFs without incurring additional monthly charges.

World Trader Account:

The World Trader Account is tailored for clients looking to trade in global markets, including offshore shares and ETFs. The monthly fee varies and can be found in the fee schedule, allowing flexibility based on trading activity. Brokerage fees are determined according to the offshore fee schedule, making it suitable for traders and investors seeking international diversification.

Customer Service

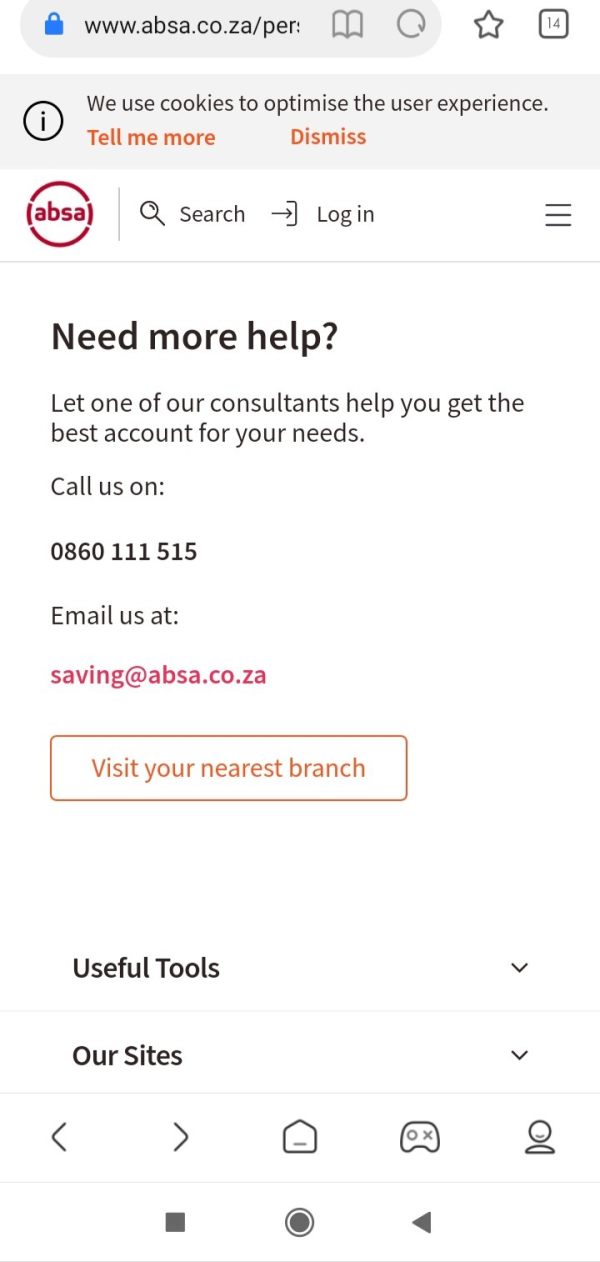

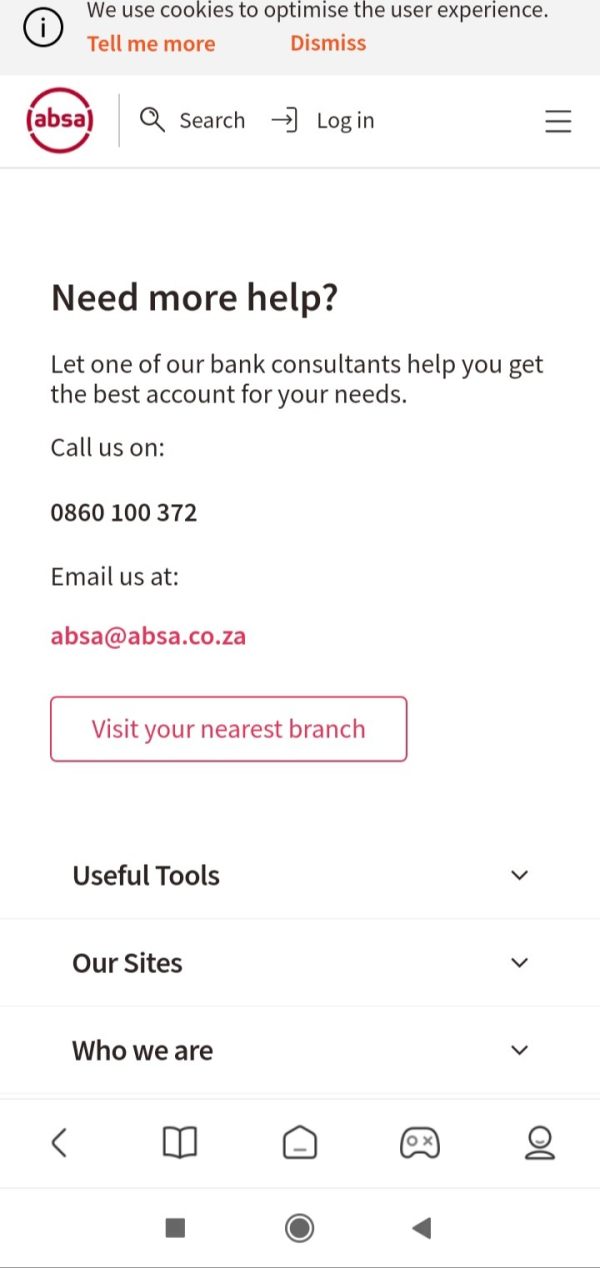

Absa provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Phone Number: +27 11 225 8018;

Email:equities@absa.co.za;

Social Media: Twitter, Facebook, LinkedIn, Blog.

Conclusion

In conclusion, Absa allows customers to access diverse financial services tailored to various needs. However, exceeding the business scope as regulated by FSCA and withdrawal-related issues have been noted. Therefore, while Absa's offerings and customer support are substantial, every trader should ensure understand all risks and regularly check the company's most updated policies.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.