简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Use Oscillators to Predict When a Trend Will End

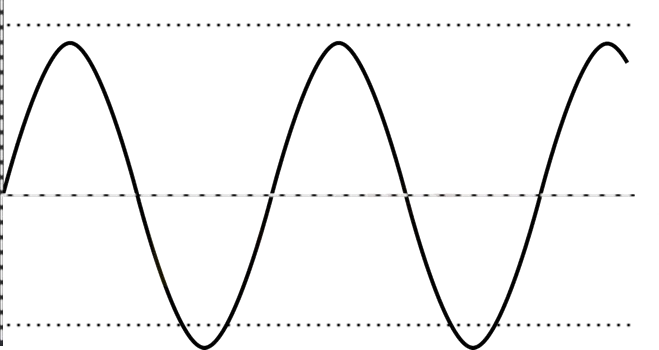

Abstract:Any object or data that oscillates between two points is called an oscillator. To put it another way, it's something that will always fall someplace between point A and point B.

Any object or data that oscillates between two points is called an oscillator.

To put it another way, it's something that will always fall someplace between point A and point B.

Consider what happens when you turn on your electric fan's oscillation switch.

Consider our technical indicators to be either “on” or “off.”

The only exception is when the oscillator is not clear at either end of the buy/sell range, in which case the oscillator will normally signal “buy” or “sell.”

Is this something you've heard before? It certainly should!

Oscillators include the Williams percent R, Stochastic, Parabolic SAR, and Relative Strength Index (RSI).

Oscillators are based on the idea that as momentum slows, fewer buyers (in an uptrend) or sellers (in a downtrend) will be willing to trade at the current price.

A shift in momentum is frequently seen as a sign that the present trend is fading.

Each of these signs is intended to indicate a potential trend reversal, in which the previous trend has run its course and the price is about to shift direction.

Let's look at a handful of scenarios.

On the daily chart of the GBP/USD, we've applied all three oscillators.

Remember how we talked about how to use the stochastic, parabolic, and RSI indicators?

We'll send you back to fifth grade if you don't!

Regardless, as shown on the chart, all three indicators produced purchase signals near the close of December.

Taking that transaction would have resulted in a profit of roughly 400 pips.

The Stochastic, Parabolic SAR, and RSI all issued sell signals in the third week of January.

And, based on the subsequent three-month decrease, you would have made a lot of pips if you had taken that short trade.

Around mid-April, all three oscillators issued another sell signal, prompting the price to plummet once again.

Now, just to show you that these signals aren't flawless, let's look at the same oscillators mucking up.

As you can see in the chart below, the indicators may offer you inconsistent messages.

In mid-February, for example, the Parabolic SAR issued a sell signal, but the Stochastic produced the exact opposite indication.

Which path should you take?

Because it didn't produce any buy or sell signals at the time, the RSI appears to be just as indecisive as you are.

When you look at the chart above, you can see that there were a number of false signals.

Both the Stochastic and the RSI gave sell signals in the second week of April, whereas the Parabolic SAR did not.

The price continued to rise from then, and if you had launched a short trade immediately away, you could have lost a lot of money.

If you had followed the Stochastic and RSI purchase indications and ignored the sell signal from the Parabolic SAR, you would have suffered another loss around the middle of May.

Where did such a superb set of indicators go?

The method of calculation for each one holds the key to the answer.

Stochastic is based on the time period's high-to-low range (in this case, hourly), but it ignores changes from one hour to the next.

The Relative Strength Index (RSI) measures the difference in closing prices from one day to the next.

Parabolic SAR has its own set of calculations, which can lead to even more controversy.

Oscillators are by their very nature oscillators. They believe that a certain price movement always leads to the same reversal.

That, of course, is nonsense.

While understanding why a leading signal may be incorrect is helpful, there is no way to eliminate them.

You're better off doing nothing than making a “best guess” if you're getting confusing signals. Don't force a transaction if a chart doesn't fulfill all of your criteria.

Move on to the next one that meets your requirements.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator