简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Indicators that are leading vs. those that are behind

Abstract:We want you to know everything there is to know about each tool so you can figure out which ones work for you and which ones don't. Let's start with the fundamentals. Leading and lagging indicators are the two sorts of indicators.

Popular chart indications were discussed in the preceding grade.

Many tools have already been discussed that can assist you in analyzing prospective trending and range-bound trade opportunities.

Are you doing well so far? Let's get this party started. Greetings from Grade 6!

We'll streamline your use of these chart markers in this session.

We want you to know everything there is to know about each tool so you can figure out which ones work for you and which ones don't.

Let's start with the fundamentals. Leading and lagging indicators are the two sorts of indicators.

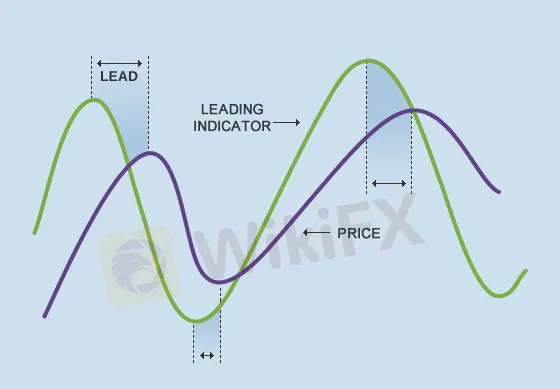

A leading indicator signals the start of a new trend or reversal before it happens.

These indicators assist you in making money by forecasting future price movements.

Leading indicators are often used to determine whether something is “overbought” or “oversold.”

This is based on the belief that if a currency pair is “oversold,” it will recover.

A lagging indicator sends out a signal after the trend has begun, essentially saying, “Hey buddy, pay attention, the trend has begun, and you're missing the boat.”

When prices move in relatively lengthy trends, lagging indicators perform well.

They do not, however, warn you of impending price changes; instead, they just inform you of what prices are doing (increasing or falling) so that you can trade accordingly.

“I'm going to get rich using leading indicators!” you're presumably thinking, because you'll be able to profit from a new trend right from the outset.

If the leading indicator was correct 100% of the time, you'd “catch” the full trend every time. However, this will not be the case.

There will be a lot of fakeouts if you employ leading indications. Leading indicators are renowned for sending false indications that might “lead” you astray.

Is that clear? Leading signs that “leave you in the dark”?

Haha. We're so amusing that we're laughing at ourselves.

Another option is to use lagging indicators, which are less likely to generate false signals.

Only after the price movement has clearly formed a trend does a lag indicator issue a signal. The disadvantage is that you'd be a little late in applying for jobs.

Because the majority of a trend's profits occur in the first few bars, utilizing a lagging indicator may cause you to miss out on a significant portion of the profit. And that's a bummer.

It's like believing you're so cool and hip with fashion in the 1980s because you're wearing bell-bottoms...

It's like finding Facebook for the first time when all of your pals are already on TikTok...

When the iPhone 11 Pro was released, it was like getting enthusiastic about getting a new flip phone that now takes photos...

You purchase and sell late with lagging indicators. However, they dramatically lower your risk by putting you on the right side of the market in exchange for missing any early possibilities.

Let's classify all of our technical indicators into one of two categories for the sake of this lesson:

· Oscillators or leading indicators

· Indicators that lag or follow the trend

While they might be supportive of one another, they are more prone to have disagreements.

In sideways markets, lagging indicators are useless.

But do you know what does? Leading indications, to be sure!

Yes, in sideways or “ranging” markets, leading indicators perform best.

When trading in trending markets, you should use trailing indicators, and when trading in sideways markets, you should use leading indicators.

We're not suggesting that one or the other should be taken exclusively, but you should be aware of the risks associated with both.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator