简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Recognize Reversals

Abstract:When you discern between retracements and reversals correctly, you can reduce the number of losing trades and even increase the number of winning trades. It's crucial to identify if a price movement is a retracement or a reversal. It's right up there with paying taxes in terms of importance.

When you discern between retracements and reversals correctly, you can reduce the number of losing trades and even increase the number of winning trades.

It's crucial to identify if a price movement is a retracement or a reversal. It's right up there with paying taxes in terms of importance.

There are a few key differences between a temporary price change retracement and a long-term trend reversal.

| RETRACEMENTS | REVERSALS |

| It usually happens after a large price movement in one direction. | It can happen at any time.. |

| Short-term, short-lived reversal. | Long-term price movement |

| The macroeconomic environment (i.e., the fundamentals) do not alter. | The catalyst for the long-term reversal is frequently a change in fundamentals. |

| In an uptrend, buying interest is present, making it likely for the price to rally. In a downtrend, selling interest is present, making it likely for the price to decline. | In an uptrend, there is very little buying interest forcing the price to fall lower. In a downtrend, there is very little selling interest forcing the price to rise further. |

They are as follows:

Recognizing Retracements

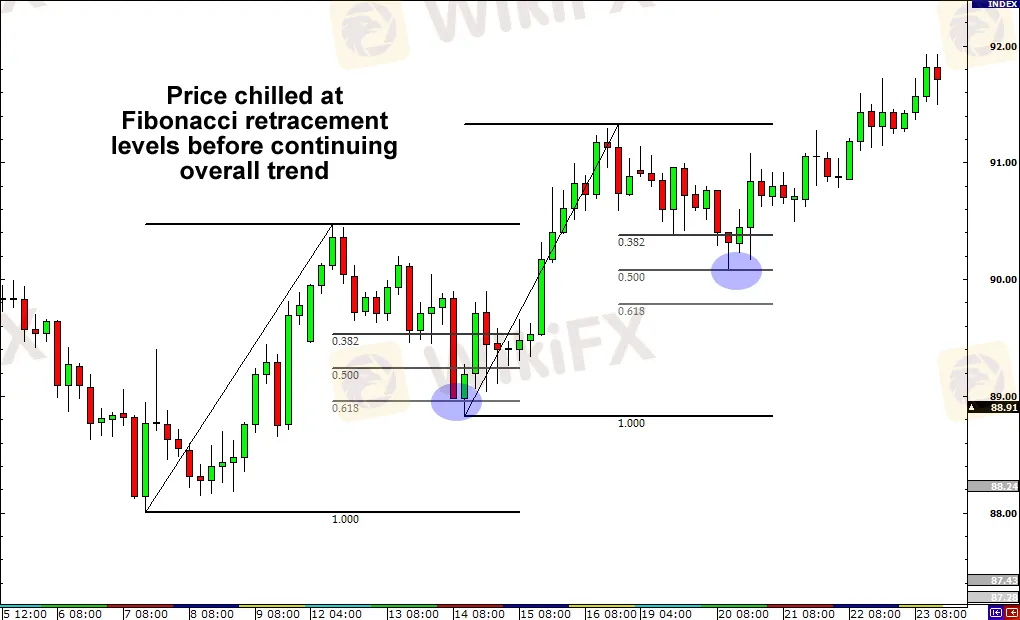

Method #1 for Identifying Retracements: Fibonacci Retracement

Fibonacci levels are a popular approach to determine retracements.

Price retracements tend to loiter around the Fibonacci retracement levels of 38.2 percent, 50.0 percent, and 61.8 percent before continuing the overall trend.

If the price rises above these levels, it could indicate a trend reversal. It's worth noting that we didn't state “will.”

As you may have guessed, technical analysis isn't an exact science, thus nothing is certain, especially in the forex markets.

Before resuming the rise, the price took a breather and rested at the 61.8 percent Fibonacci retracement level.

It dropped back after a time and steadied at the 50% retracement level before continuing higher.

Pivot Points (Method #2)

Using pivot points is another approach to assess if the price is preparing for a reversal.

Traders will look at the lower support points (S1, S2, S3) in a UPTREND and wait for it to break.

During a DOWNTREND, forex traders will watch for the higher resistance points (R1, R2, R3) to break.

If it is broken, a reversal may be on the way! Check out the Pivot Points lesson for further information or a refresher!

Trend Lines are the third method.

The final technique is to employ trend lines.

A reversal may occur when a significant trend line is broken.

A forex trader may be able to achieve a high likelihood of a reversal by employing this technical tool in conjunction with the candlestick chart patterns explained before.

These strategies can help you spot reversals, but they aren't the only one. Nothing, at the end of the day, can replace practice and experience.

With enough screen time, you can develop a system for recognizing retracements and reversals that suits your forex trading style.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator