简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

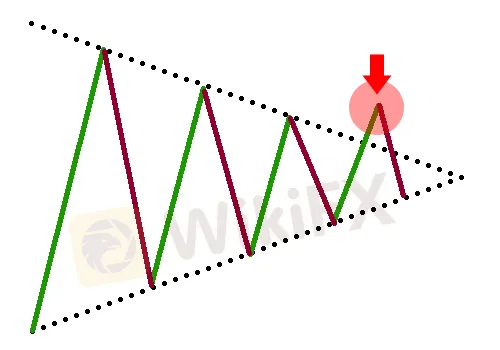

Disappear the Breakout

Abstract:Trading in the opposite direction of a breakout is known as fading breakouts. Trading FALSE breakouts is the same as trading fading breakouts.

You want to fade the breakout, right? Was that a mistake? “Trade the breakthrough,” did you mean to say?

Nope!

Trading in the opposite direction of a breakout is known as fading breakouts.

Trading FALSE breakouts is the same as trading fading breakouts.

If you believe a breakthrough from a support or resistance level is fake and unable to continue in the same direction, you should fade it.

When a strong support or resistance level is broken, fading breakouts may be a better option than trading the breakout.

It's important to remember that fading breakouts is an excellent short-term approach. Breakouts are notorious for failing the first few times they are attempted, although they can finally succeed.

REPEAT: Fading breakouts is an excellent short-term trading approach.

It's not the best option for long-term trading.

You can avoid being whipsawed by knowing how to trade false breakouts, often known as fakeouts.

Many forex traders enjoy trading breakouts. Why?

Price floors and ceilings are expected to be defined by support and resistance levels. If these levels are broken, pricing is likely to continue in the same direction as the break.

When a support level is breached, it indicates that the market is moving lower and that people are more inclined to sell than buy.

If a resistance level is broken, on the other hand, the audience feels that price will continue to rise and will prefer to purchase rather than sell.

Greed is a mentality that exists among independent retail forex traders.

They believe in trading in the breakout's direction. They believe in massive gains from massive moves. Forget about the tiny fries and go after the big fish.

This would be true in an ideal world. However, the world is not without flaws. Princesses and frogs do not live happily ever after.

In reality, the majority of breakaway attempts fail.

Breakouts fail because the smart minority is forced to profit from the majority.

Don't be so downhearted. Big players with large accounts and buy/sell orders usually make up the savvy minority.

There must be a buyer for something to be sold.

The market maker, on the other hand, must take the other side of the equation if everyone wants to purchase above a resistance level or sell below a support level.

Let us also tell you that the market maker is no fool.

Breakouts are popular among retail traders.

The smarter traders, the institutional and more experienced ones, seek to avoid breakouts.

Smarter forex traders take advantage of the crowd's or naive traders' collective thinking to profit at their expense.

As a result, trading with more experienced forex traders can be extremely beneficial.

Would you rather be a member of the winning minority that fades breakouts or the losing majority that gets caught in fake breakouts?

Let's take a look at how to fade breakouts now.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator