简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Deal with Fakeouts

Abstract:Support and resistance levels generated by trend lines, chart patterns, or past daily highs and lows are common places to look for potential fakeouts.

To fade breakouts, you must first understand where possible fakeouts can occur.

Support and resistance levels generated by trend lines, chart patterns, or past daily highs and lows are common places to look for potential fakeouts.

Lines of trend

Always remember that there should be SPACE between the trend line and the price when fading breakouts.

If there is a gap between the trend line and the price, it signifies the price is moving away from the trend line and more in the direction of the trend.

Having room between the trend line and price, like in the example below, allows the price to retrace back towards the trend line, maybe breaking it, and give fading possibilities.

The SPEED with which prices fluctuate is also crucial.

A false breakout is possible if the price is creeping towards the trend line like a caterpillar.

A rapid price movement towards the trend line, on the other hand, could indicate a successful breakout.

Momentum can carry price past the trend line and beyond with a fast price movement pace.

In this case, it is preferable to refrain from fading the breakout.

What is the best way to fade trend line breaks?

It's actually quite straightforward. Simply enter when the price returns to the inside.

This will allow you to avoid jumping the gun by taking the safe route. You don't want to sell above or below a trend line only to discover that the breakout was false later.

Let's use the first chart to highlight prospective entry positions by zooming in a little.

Patterns in Charts

Chart patterns are physical groupings of prices that may be seen with the naked eye. They're a vital aspect of technical analysis, and they may also help you make decisions.

There are two basic patterns in which false breakouts occur:

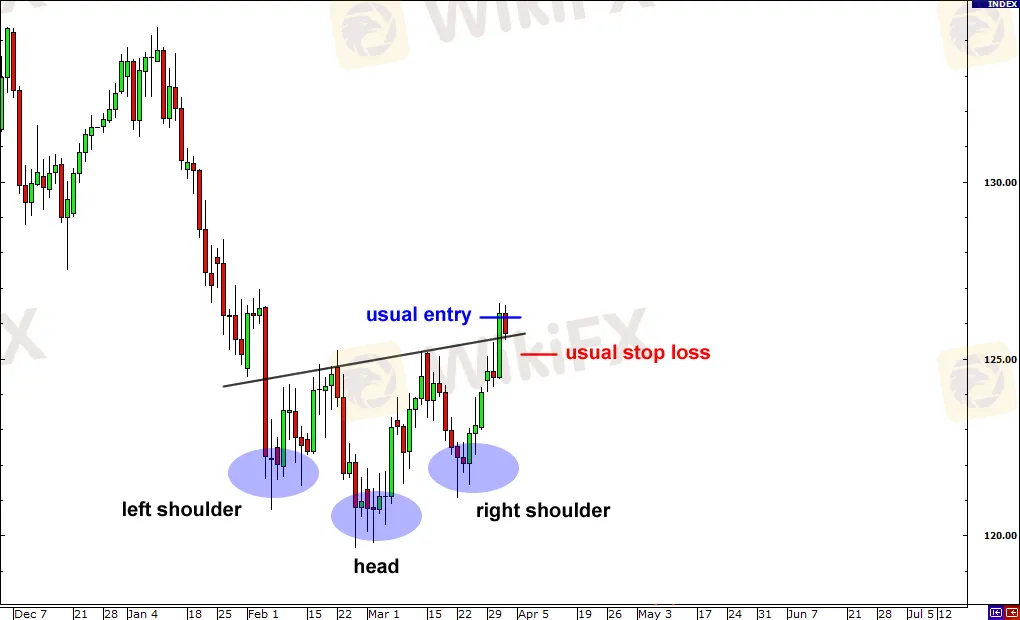

Shoulders and Head

Bottom/Top/Bottom/Bottom/Bottom/Bottom

The head and shoulders chart pattern is one of the most difficult for inexperienced traders to recognize. However, with practice and patience, this pattern can become a valuable addition to your trading toolkit.

A reversal is a pattern in which the head and shoulders pattern is reversed.

It could indicate a negative reversal if it forms near the end of an upswing. If it forms at the conclusion of a downtrend, on the other hand, it could indicate a positive turnaround.

Fakeouts (false breakouts) and great possibilities for fading breakouts are common with head and shoulders.

False breakouts are typical with this pattern because many traders who spot it place their stop loss very close to the neckline.

When a pattern has a false breakout, prices normally bounce back.

When prices move against traders' positions, their stops will be triggered, whether they sold the downside breakout or bought the upward breakout.

This is frequently induced by institutional traders who wish to get money out of people's hands.

You can presume that the first break in a head and shoulders pattern is bogus.

With a limit order back in the neckline and a stop above the peak of the fakeout candle, you can fade the breakout.

Your goal could be a little below the high of the second shoulder or a little above the low of the inverse pattern's second shoulder.

The double top or double bottom is the next design.

These patterns are extremely popular among traders. Why are you inquiring? It's because they're the easiest to identify!

When the price breaks below the neckline, it indicates that the trend may be reversing.

As a result, many traders put their entry orders very close to the neckline in the event of a reversal.

The issue with these chart patterns is that many traders are aware of them and place orders in similar areas.

This allows institutional traders to scavenge money from ordinary people's pockets.

You can place your order once the price goes back up to catch the bounce, just like the head and shoulders pattern. Just beyond the fakeout candle, you can set your stops.

What types of markets should I avoid fading breakouts in?

In a range-bound market, the best results are more likely to materialize. Market sentiment, big news events, common sense, and other sorts of market analysis, on the other hand, cannot be ignored.

Financial markets spend a lot of time bouncing back and forth between a range of prices, rarely deviating significantly from these highs and lows.

A support level and a resistance level define price ranges, and buyers and sellers constantly push prices up and down within those levels.

In these range-bound circumstances, fading breakouts can be quite beneficial.

However, one side will finally have the upper hand, and a new trending stage will emerge.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator