简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Determine a Breakout's Strength

Abstract:There are a few ways to determine whether a trend is nearing its end and a reversal breakout is required.

As you may recall, when a trend advances for a long time and then begins to consolidate, one of two things can happen:

The price could either continue in the same direction (continuation breakout) or

Reverse in the other direction (reversal breakout)

Wouldn't it be great if there was a way to determine whether a breakout was confirmed? If only there was a way to keep fakeouts from happening...

In truth, there are a few ways to determine whether a trend is nearing its end and a reversal breakout is required.

Convergence/Divergence of Moving Averages (MACD)

You should now have a solid understanding of the MACD indicator.

If you don't, you might want to take a look at our MACD tutorial.

MACD is one of the most widely used forex indicators, and with good reason. It's straightforward but dependable, and it might assist you in gaining or losing momentum.

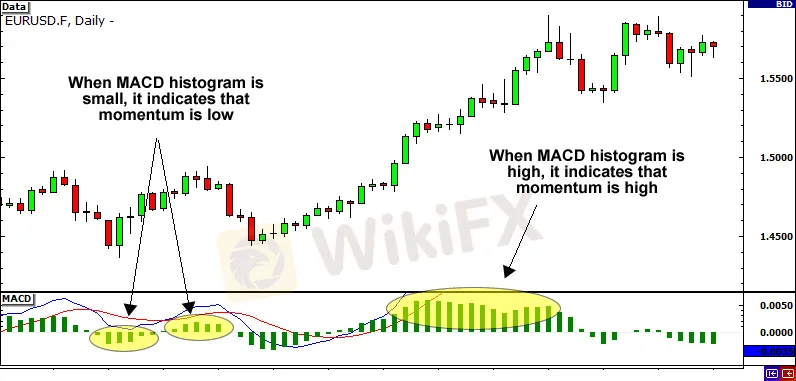

MACD can be displayed in a variety of ways, but one of the most “sexy” is as a histogram.

The contrast between the slow and rapid MACD lines is depicted in this histogram.

When the histogram grows larger, it indicates that momentum is increasing.

When the histogram shrinks, it indicates that momentum is fading.

So, how can we apply this to spotting a trend reversal? I'm glad you inquired!

Remember how we talked about divergences, a trading indication that arises when the price and indicators move in different directions?

Since the MACD indicates that we are moving in the right direction. As the market develops a trend, it makes reasonable that momentum will build.

However, if MACD begins to fall even as the trend continues, you can infer that momentum is fading and the trend may be nearing its end.

The MACD was getting smaller as the price moved higher, as you can see in the chart.

This suggested that, even if the price was still rising, momentum was fading.

We can deduce from this data that a trend reversal is quite likely.

The Relative Strength Index (RSI) is a measure of how strong (RSI)

Another momentum indicator that can be used to confirm reversal breakouts is the RSI.

Basically, this indicator tells us how much higher or lower closing prices have changed over time. We won't go into too much into about it, but if you're interested in learning more, check out our RSI lecture.

In the same way that MACD produces divergences, RSI may be employed in the same way. You can spot potential trend reversals by spotting these divergences.

RSI, on the other hand, is useful for determining how long a trend has been overbought or oversold.

If the RSI is above 70, it's a good indicator that the market is overbought. If the RSI is below 30, on the other hand, it is a classic indicator that the market is oversold.

Because trends are long-term movements in the same direction, the RSI will frequently move into overbought/oversold zone, depending on the trend's direction.

If a trend has been producing oversold or overbought readings for a long time and then begins to move back into the RSI range, it is a good indication that the trend is reversing.

The RSI indicated that the market was overbought for a billion days in the identical case as before (ok not that long).

When the RSI dropped below 70, it was clear that the trend was about to change.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator