简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Technical Analysis: Appropriate Buying Levels

Abstract:Implementation of the world’s fears of the outbreak of a Russian war in Ukraine contributed to an important turnout for investors to buy gold as a safe haven. Gold rose to the resistance level of 1975 dollars an ounce immediately after the war. Before the end of trading last week, the price of gold collapsed amid quick profit-taking to the support level of 1883 dollars an ounce . Amidst the chances of strict sanctions against Russia, Russia ignored those sanctions and with the expansion of the scope of military operations, it was natural for the price of gold to rise again towards the resistance level of 1926 dollars an ounce at the beginning of this week’s trading.

Implementation of the world‘s fears of the outbreak of a Russian war in Ukraine contributed to an important turnout for investors to buy gold as a safe haven. Gold rose to the resistance level of 1975 dollars an ounce immediately after the war. Before the end of trading last week, the price of gold collapsed amid quick profit-taking to the support level of 1883 dollars an ounce . Amidst the chances of strict sanctions against Russia, Russia ignored those sanctions and with the expansion of the scope of military operations, it was natural for the price of gold to rise again towards the resistance level of 1926 dollars an ounce at the beginning of this week’s trading.

As for the price of silver, the sister commodity of gold, it is trying to stay above $24. Silver futures fell to $24.035 an ounce. The white metal is still poised for a weekly push of 0.35%, taking its 2022-to-date rally to nearly 3%.

Financial markets declined by the end of last week and then went through an impressive turnaround to end the session in positive territory. The stock yard extended those gains on Friday, with major benchmarks posting triple-digit gains. This has affected the prices of gold and other traditional safe-haven assets, sending these compounds lower as investors believe that the worst of the war between Ukraine and Russia is over. Will metallic commodities continue their downward trajectory?

Advertisement

A weak dollar failed to support the metals market, with the US Dollar Index (DXY) dropping 0.39% to 96.76, from the opening of 97.00. When the index, which measures the US dollar against a basket of other major currencies, it makes dollar-denominated gold more attractive because it is cheaper for foreign investors to buy. Also, the US Treasury market was mostly in the green at the end of last week's trading. The benchmark 10-year bond yield rose to 1.983%. One-year yields fell to 1.592%, while 30-year yields fell by 0.013%. Gold is usually sensitive to a high interest rate environment because it raises the opportunity cost of holding non-yielding bullion.

Relative to the prices of other metals, copper futures rose to $4.4845 a pound. Platinum futures fell to $1059.40 an ounce. Palladium futures fell to $2340.00 an ounce.

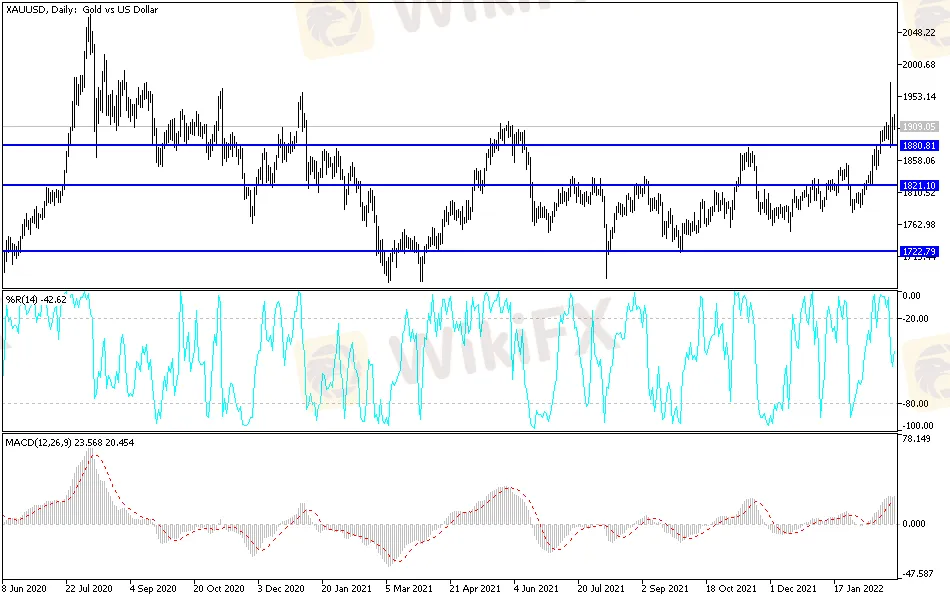

According to the technical analysis of gold: Despite the recent performance, the general trend of the gold price is still bullish. The bulls stuck to the psychological resistance of 1900 dollars an ounce, which highlights the importance of their control over the trend. Their willingness to test stronger ascending levels which the closest to them are currently 1925, 1955 and 1980 dollars, respectively. The last level is important to move towards the next historical peak of 2000 dollars per ounce.

On the downside, the most prominent support levels in the event of profit-taking were the areas of 1895 and 1875 dollars, respectively. I still prefer buying gold from every bearish level as long as the Russian war continues. In the environment of global geopolitical tensions, buying gold is the most important for investors.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

Currency Calculator