简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro and Yen Crosses Trading

Abstract:The euro and the yen are the most traded currencies after the US dollar.

The euro and the yen are the most traded currencies after the US dollar.The euro and the yen, like the US dollar, are held as reserve currencies by several governments.As a result, outside of the U.S. dollar-based “majors,” the euro and yen crosses are the most liquid.Trading the Euro Crosses

The most popular EUR crosses are EUR/JPY, EUR/GBP, and EUR/CHF.

EUR crosses will feel the effects of news that affects the euro or Swiss franc more than EUR/USD or USD/CHF.

The news out of the United Kingdom will have a significant impact on the EUR/GBP exchange rate.

Surprisingly, news from the United States influences the movement of the EUR crosses. The GBP/USD and USD/CHF currencies both react strongly to news from the United States.

This has an impact not only on the value of the GBP and CHF versus the USD, but also on the value of the GBP and CHF against the EUR.

A significant increase in the USD tends to result in greater EUR/CHF and EUR/GBP, and the same is true in the opposite way.

Confused? Let's break this down, shall we?

Assume that the United States releases positive economic data, causing the USD to soar.

GBP/USD would decline as a result, lowering the value of the GBP. At the same time, the USD/CHF rate would rise, lowering the CHF's value.As the value of the pound falls, the EUR/GBP exchange rate rises (since traders are selling off their GBP).EUR/CHF would climb when the price of the Swiss franc fell (since traders are selling off their CHF).If the United States' economic data was negative, this would work in the reverse direction.

Yen Crosses Investing

The JPY is one of the most widely used bridge currencies, and it can be exchanged for virtually any other major currency.

According to the Bank for International Settlements' latest Triennial Central Bank Survey, EUR/JPY has the biggest number of JPY crosses.

The carry trade currencies GBP/JPY, AUD/JPY, and NZD/JPY are appealing because they have the biggest interest rate differentials against the JPY.

Always keep an eye out for the USD/JPY while trading JPY currency cross pairs.

When important levels on this pair are broken or resisted, it often spills over into the JPY cross pairs.

If the USD/JPY crosses above a significant resistance level, for example, traders are selling their JPY.

This could lead to the JPY being sold versus other currencies. As a result, EUR/JPY, GBP/JPY, and other JPY crosses are likely to climb as well.

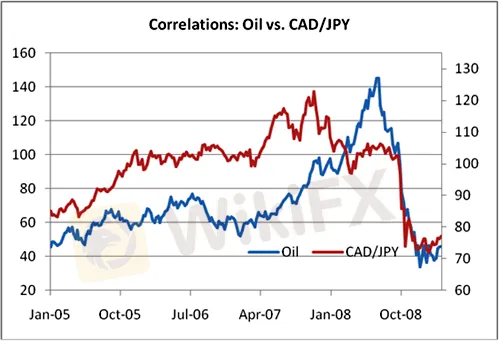

The CAD/JPY exchange rate

This currency cross has grown in popularity in recent years, becoming highly associated with the price of oil.

Canada has benefited from the surge in oil prices as the second-largest owner of oil reserves.

Japan, on the other hand, is largely reliant on oil imports. In fact, because Japan has essentially no natural oil reserves, it imports almost 99 percent of its crude oil.

The price of oil and the CAD/JPY have an 87 percent positive association as a result of these two factors.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator