简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is a Stop Loss and how does it work?

Abstract:The most important obligation you have as a trader is to manage and safeguard your trading capital.

What is stop-loss in forex trading?

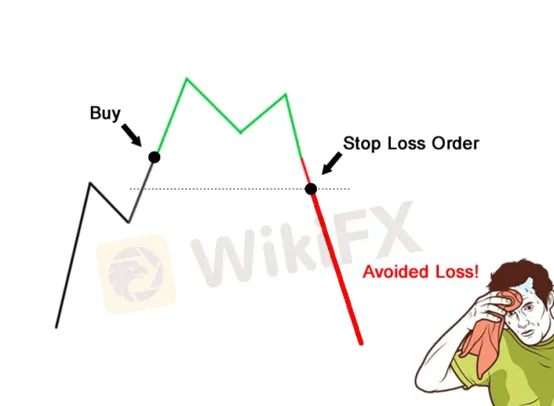

The stop-loss is an order to sell an asset when a certain price level is reached, also known as “stop order” or “stop-market order”. It serves to limit losses and reduce risk exposure. With stop-loss order, an investor give instructions to his brokerage to sell a security as soon as the price reaches a preset limit.

Consider this intuitive example: you bought 100 shares for $1, 000 several years ago, and recently, it went up over $6,000 in value, with a current price of $60 per share. You do think it will keep rising. Your intention is to sell it, but you don't want to miss out on the rise. In this case, you are recommended to use a stop-loss order. Put the stop at $50, so that if the price falls below that level, the order is triggered. Otherwise, nothing happens.

Where to place a stop-loss order when buying and selling?

It is not advisable to place a stop-loss level arbitrarily. Ideally, a stop-loss place allows for some fluctuation while taking you out of your position if the price turns against you.

A stop-loss order can be placed easily by placing it below a “swing low,” which occurs when the price falls and then bounces back up. Such a level signifies that price has found support. This is the price direction in which you want to trade.

As a common stop-loss order in short selling is above a “swing high,” so too does a swing low find support at a bottom price level and a swing high finds resistance at a top price level. When prices rise and then fall, this occurs. The trend should be followed when trading. A short trade is one where swing highs are moving down.

Anyway, the most important obligation you have as a trader is to manage and safeguard your trading capital. If you lose all your trade money, you're out of the game; there's no way to make up the difference.

Why is stop-loss order important?

Being in a losing position is sometimes unavoidable, but we have influence over what we do when we're there.

Having a specified point at which to quit a losing trade not only allows you to cut losses and move on to fresh possibilities, but it also removes the worry that comes with being in a losing trade without a strategy.

Consider Kylie and Kendall, two merchants.

They both trade the same exact trading strategy with the only difference being their stop loss size.

| Kylie | Kendall | |

| Stop Loss Size(% of total account balance) | 10%2% | 2% |

The trading method only has two possible outcomes for each trade: A gain or a loss.

This implies that when the stop loss (SL) or profit objective (PT) is reached, the strategy leaves the transaction.

Consider what would happen if both Kylie and Kendall were on a losing streak.

Both of them have lost ten deals in a row!

Kendall's account will be down 20%, while Kylie's account has completely blown up!

Kylie has retired from the FX market.

While the term “stop-loss” sounds like an ideal solution for preserving value, it does not always work.

As a first matter, setting a stop-loss order does not limit an investor's loss to the difference between the purchase price and the predetermined sale price. For example, if a company reports disappointing earnings after the market closes, its share price may be well below a stop-loss level the next day.

Another risk of stop-loss orders is that the stock price may sink just slightly below their trigger point before quickly rebounding. A stop-loss order can be triggered if a stock's price is fluctuating or if another event occurs that causes a brief sell-off by other investors.

The many various techniques to place stops will be discussed in the next section.

You have the option of using one of four methods:

Percentage stop

Volatility stop

Chart stop

Time stop

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Currency Calculator