简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Yabo Market Limited “disappeared” when the Turkish trader asked for withdrawal.

Abstract:Yabo Market Limited is an online forex broker registered in China. It was newly established. Recently this broker has caught our attention because one trader from Turkey told WikiFX that Yabo Market Limited does not allow him to withdraw. Protecting the legitimate rights and interests of forex traders are always the primary concern of WikiFX. In this article, we will expose this case to you in detail based on the evidence provided by the victim.

About WikiFX

WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

About Yabo Market Limited

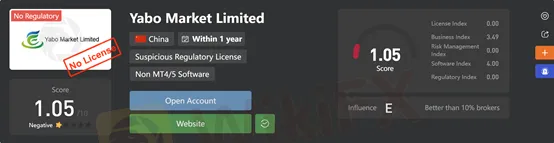

Yabo Market Limited is an online forex broker registered in China. It was newly established and doesn't hold a legitimate license. You need to note that this broker does not use either MT4 or MT5 trading platforms. According to WikiFX, Yabo Market Limited has been given a very low rating of 1.05/10.

Description of the case in brief

One trader from Turkey told WikiFX that he deposited $224 in Yabo Market Limited. When he tried to withdraw $150, this broker refused the withdrawal. Then the trader wanted to withdraw $100. Yabo Market Limited gave no response. Even worse, the customer service team of this broker was not helpful.

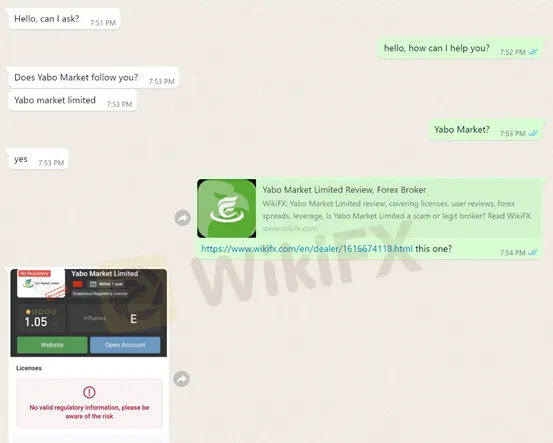

This trader contacted WikiFX and reported the fraud of Yabo Market Limited to WikiFX. He hoped to get WikiFX's help.

Based on the pictures above, you can see that this trader showed us the deposit record and he wanted to withdraw $100 but Yabo Market Limited refused it. Even worse, this broker did not give any response to this trader.

This Turkish trader has asked for withdrawal many times, and the amount required for each time is different. But Yabo Market Limited refused the victim's withdrawal request. using the excuse of “a lot of work to do”, Yabo Market Limited stopped responding to this trader.

Conclusion

We believe that Yabo Market Limited is getting involved in a scam. This broker eventually took the victim's money away fraudulently without giving any response to the victim. The reason why WikiFX exposed this case to the public is to remind all traders of the potential risks. After all, what happened to this Turkish trader could happen to any of us. All traders should be vigilant when investing in a broker.

WikiFX is actively reaching out to the victim and other traders hoping to find more evidence to help him resolve the problem. Please stay tuned for more information.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Exness: Revolutionizing Trading with Cutting-Edge Platforms

Exness offers traders seamless experiences with its Exness Terminal and Exness Trade app, providing flexibility, advanced tools, and low-cost trading.

ACY Securities Expands Global Footprint with South Africa Acquisition

ACY Securities acquires Ingot Brokers, South Africa, enhancing its global presence and launching LogixTrader in the South African market.

BSP Shuts Down Uno Forex Over Serious AML Violations

BSP cancels Uno Forex’s Inc. registration, marking its fifth shutdown this year over failure to comply with anti-money laundering laws, raising concerns.

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

This acquisition attempt by AxiCorp Financial Services Pty Ltd, Axi’s parent company, values SelfWealth at AUD 0.23 per share and is notably higher than a recent bid made by Bell Financial Group Limited (ASX), which offered AUD 0.22 per share.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

ACY Securities Expands Global Footprint with South Africa Acquisition

BSP Shuts Down Uno Forex Over Serious AML Violations

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

Exness: Revolutionizing Trading with Cutting-Edge Platforms

Currency Calculator