简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Forex Trading Sessions in Nigeria Time

Abstract:The forex market is divided into four trading sessions: Sydney, Tokyo, London, and New York. Each trading session has its own characteristics, and traders should decide on the session based on their trading style and strategy. For Nigerian forex traders, it's important to consider the time difference in West Africa and plan their trading activities accordingly.

Overview of Nigeria

In recent years, forex trading has gained significant traction in Africa, and Nigeria stands as one of the continent's largest forex market players. With a GDP surpassing $400 billion in 2023, Nigeria ranks first among African nations, and its robust economy underpins a thriving forex market.

For forex traders interested in the Nigerian market, understanding the country's forex trading sessions is crucial. This review delves into the forex market trading sessions in Nigerian time, providing information to enhance your forex trading experience.

Nigeria is a West African nation, placing it in the West Africa Time (WAT) zone. Therefore, Nigeria's standard time zone is (GMT+1). This means that Nigeria's time zone is 6 hours ahead of the expected time in New York. On the other hand, Nigeria's time zone is 10 hours behind Sydney. If you are a trader in Nigeria, you would experience an 8-hour time difference with the Tokyo (Asia) session. Lastly, Nigerian traders may also need to consider the 1-hour time difference between this West African nation and the London time zone.

4 Major Forex Trading Sessions

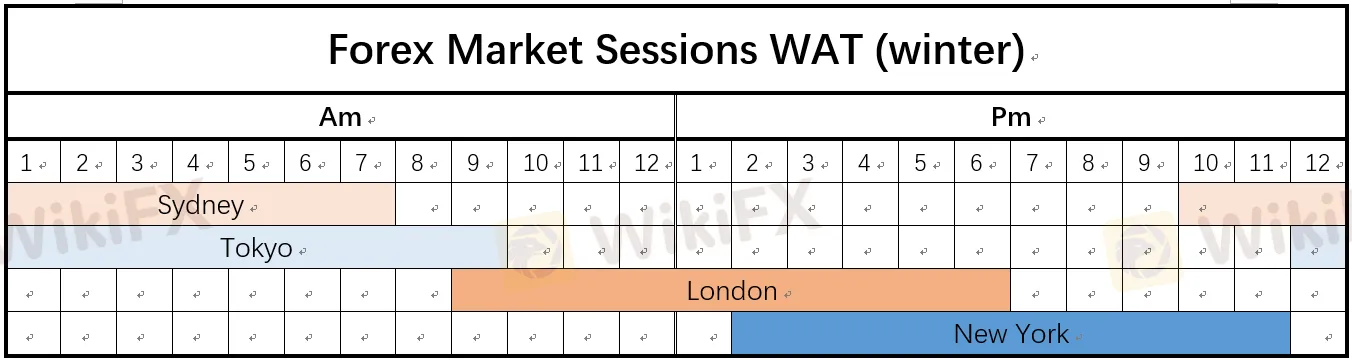

The foreign exchange market is divided into four major trading sessions: Sydney session, Tokyo session, London session, and New York session. They open at different times during the day.

Using West Africa Time (WAT) as a reference, the opening times for each trading session are as follows (both during standard time and daylight saving time):

Standard Time

| Trading Session | Time Open WAT (winter) |

| Sydney | 10:00 pm to 7:00 am |

| Tokyo | 12:00 pm to 9:00 am |

| London | 9:00 am to 6:00 pm |

| New York | 2:00 pm to 11:00 pm |

Daylight Saving Time

| Trading Session | Time Open WAT (summer) |

| Sydney | 11:00 pm to 8:00 am |

| Tokyo | 12:00 pm to9:00 am |

| London | 8:00 am to 5:00 pm |

| New York | 1:00pm to 10:00 pm |

In theory, the foreign exchange market indeed lacks a central exchange, allowing individuals to buy or sell currencies at any time during the day or any day of the week. However, to trade forex currency pairs, you need a counterparty. To make a purchase, you need someone else to sell what you want to buy, and vice versa. Therefore, if you are not aware of the active times for each currency, you may struggle to execute trades smoothly. For instance, attempting to buy USD/JPY in the middle of the night when the United States or Japan is dormant might result in your order not being executed or being filled with significant slippage, significantly increasing your trading costs.

As a retail forex trader with limited capital, you have no control over the market. You will rely on larger participants such as banks and institutional investors to create trends and hope to capitalize on some of these trends. This is why short-term retail forex traders should only engage in trading during active banking hours and avoid seeking trading opportunities when the forex market is at a standstill.

In practice, you should choose trading sessions that align with the currency pairs you are trading. The following will outline the differences in terms of volume, volatility, and active currency pairs during four distinct trading sessions.

Sydney Trading Session

Traditionally, the international date line marks the start of a new calendar day, and with New Zealand being a major financial center, the forex market opens here on Monday morning while it is still Sunday in most parts of the world. Despite being potentially the smallest market compared to others, the Sydney trading session often experiences relatively high volatility, especially after the weekend pause. It is advisable to consider trading the Australian Dollar (AUD) and New Zealand Dollar (NZD) during the Sydney session.

Tokyo Trading Session

This trading session, also known as the Asian session, is characterized by relatively slow price movements. During this time, most trading platforms regularly widen their spreads. The market during this phase is often overlooked by retail forex traders seeking volatility arbitrage due to increased costs and lower liquidity and volatility. However, the lower volatility makes predicting price movements during this period relatively easier. Consider trading currency crosses involving the Japanese Yen (JPY), Australian Dollar (AUD), Singapore Dollar (SGD), and New Zealand Dollar (NZD) as they tend to be relatively active during the Asian session.

London Trading Session

Among all existing trading sessions, this is the period with the highest volatility, the largest trading volume, and the fastest price movements. The trading volume during this session constitutes over 35% of the total daily trading volume. The market volatility during the London session can work either in your favor or against you. It becomes relatively challenging to establish positions when prices are rapidly changing, making certain predictions difficult. Trends sometimes reverse as the London or European session concludes, as European traders lock in some of their profits.

However, if your trend analysis is accurate, you may appreciate the volatility during this specific period. Due to high liquidity and volatility, you can trade almost any currency pair during this session. The most actively traded currency pairs during this period include Euro/US Dollar (EUR/USD), British Pound/US Dollar (GBP/USD), US Dollar/Swiss Franc (USD/CHF), US Dollar/Japanese Yen (USD/JPY), Euro/Japanese Yen (EUR/JPY), and British Pound/Japanese Yen (GBP/JPY).

New York Trading Session

New York is the central city for the US trading session, accounting for approximately 15% of the total daily forex trading volume worldwide. The New York trading session begins after the opening of the New York Stock Exchange. This session's market is primarily driven by the activities in the United States and contributions from Mexico, Canada, and other South American countries. The volatility in the New York forex market is second only to the London session, and the major currencies traded during this period include the British Pound, Euro, Australian Dollar, and US Dollar.

As the US Dollar is involved in about 85% of forex trades, the New York trading session is highly significant, as most of the Dollar's fluctuations occur during the US trading hours. Major economic reports and data are released during the US trading session, often causing significant fluctuations in the US Dollar. Towards the end of the New York market, as the Sydney trading session joins, trading volume gradually diminishes, and price volatility significantly decreases.

FAQs

Is forex trading legal in Nigeria?

Forex trading is not illegal in Nigeria, but the country lacks local regulations. Due to the absence of oversight, the U.S. Securities and Exchange Commission warns the public about the risks of forex trading. That's why you should trade with brokers holding top-tier overseas regulations.

What causes spreads to widen at certain times?

Volatility or low liquidity is the main cause of spread widening, often occurring during news events or between trading sessions.

When is the most active time for the forex market in Nigerian time?

The forex market is most active during the overlap of London and New York, typically from 2:00 PM to 6:00 PM (WAT), when trading volume and volatility often peak.

Which time period is best for a scalping trading strategy?

With the support of directional commitments from institutional participants, the New York session often produces the most tradable patterns in terms of volatility.

Can I trade part-time while maintaining my regular job?

Yes, since trading sessions are open and close around the clock, you can engage in part-time trading, requiring only 1-2 hours of trading per day with the right strategy.

Bottom Line

The forex market in Nigeria is thriving, with its unique trading sessions intersecting global markets. For Nigerian traders passionate about forex, understanding market opening times is crucial. Considering the time difference, strategically choosing trading sessions and aligning them with market characteristics will optimize trading plans. Always remember, the forex market never sleeps, and each session presents unique opportunities, making it an endless journey to explore the financial world.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Interactive Brokers introduces Forecast Contracts in Canada, enabling investors to trade on economic, political, and climate outcomes. Manage risk with ease.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator