简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

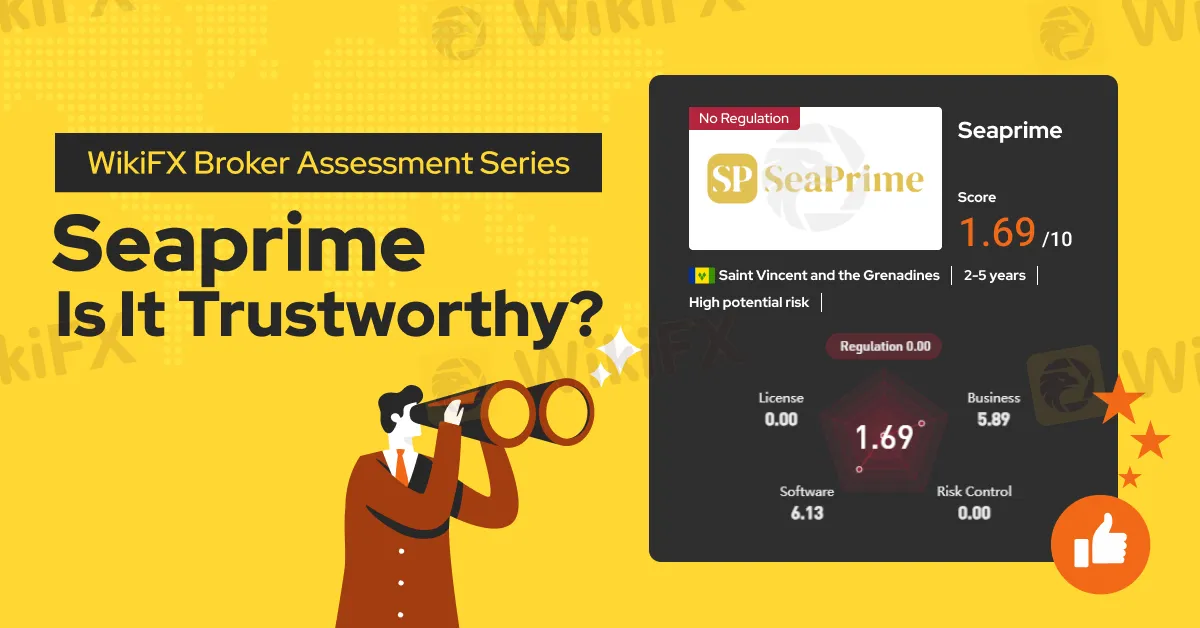

WikiFX Broker Assessment Series | Seaprime: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Seaprime, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform

Background:

Founded in 2022, Seaprimecapitals LLC (Seaprime) operates as an online brokerage specializing in the trading of exchange-traded CFDs.

According to Seaprime's official website, its registered address is Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent and the Grenadines. The physical address is Seaprime Capitals LLC, 2nd Floor, Office Numbers 11, 13, and 14, CBD Bank Building, Sharaf DG, Dubai, UAE.

Seaprime offers a diverse range of over 200 tradable assets, including currency pairs, commodities, cryptocurrencies, and stocks.

Additionally, Seaprime provides several partnership programs for introducing brokers and affiliates to earn commissions by referring new clients to the company, along with MAM (Multi-Account Manager) and PAMM (Percentage Allocation Money Management) services.

It is important to note that Seaprime currently does not offer its services in Australia, the United States, Cuba, Iraq, Myanmar, North Korea, and Sudan.

Types of Accounts:

Seaprime offers three account options: the Micro Account, the Standard Account, and the Premium Account. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

Seaprime offers a range of payment options, including bank transfers, Neteller, Skrill, Visa, and Mastercard.

The timeframe for funds to reflect in the account is contingent upon the chosen withdrawal method. The specifications for each deposit and withdrawal method can be referred to from the images below:

Trading Platforms:

Seaprime offers only one trading platform, the MetaTrader 5 (MT5) platform, available on PC, mobile, and web. Renowned for its technological sophistication, MT5 provides access to a depth of market data and various advanced solutions. It features buy and sell flexibility with six types of pending orders, 38 technical indicators, 44 analytical objects, and 21 timeframes, offering a customizable platform with numerous online tools for integration. The platform also provides quick order execution, an economic calendar for tracking global macroeconomic news, one-click trading, mobile trading capabilities, and an intuitive market search and grouping functionality, all contributing to a comprehensive and user-friendly trading experience.

Research and Education:

Upon browsing Seaprimes official website, no research or educational resources were found. This suggests that the broker does not offer these resources, unlike its competitors.

Customer Service:

Clients can contact Seaprime via email at ceo@seaprimecapitals.com or by submitting an inquiry through the broker's online form. Additionally, trading clients can reach Seaprime by phone at +971569518280. However, Seaprime does not offer customer service through messenger or live chat. When selecting a trading broker, it is advisable to choose one that provides timely customer support.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned Seaprime a WikiScore of 1.69 out of 10.

Upon examining Seaprimes license, WikiFX found that the broker is not regulated by any regulatory bodies.

When choosing a trading broker, it's crucial to prioritize one that is regulated and has a strong reputation. A regulated broker is overseen by financial authorities, ensuring they adhere to stringent standards designed to protect your investments. This oversight reduces the risk of fraud or unethical practices, giving traders peace of mind that their funds are secure. Moreover, a broker with an established reputation signals stability and trustworthiness, having successfully navigated the market over time. Brokers that have withstood the test of time often demonstrate resilience, experience, and reliability, key indicators of their commitment to transparency and long-term client satisfaction. In a constantly evolving financial landscape, these factors are vital for safeguarding your trading experience.

Therefore, WikiFX would urge our users to opt for a broker that has a higher WikiScore for better protection.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

CFI’s New Initiative Aims to Promote Transparency in Trading

A new programme has been launched by CFI to address the growing need for transparency and awareness in online trading. Named “Trading Transparency+: Empowering Awareness and Clarity in Trading,” the initiative seeks to combat misinformation and equip individuals with resources to evaluate whether trading aligns with their financial goals and circumstances.

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator