简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Pros and Cons of Investing in Companies with Negative PE Ratios

Abstract: Investing in companies with negative price-to-earnings (PE) ratios is an interesting yet challenging subject matter that creates endless debates amongst analysts and investors. The ratio is the market's assessment of a company's earnings against its share price. Generally, investors expect profits in the future when the P/E ratio is positive. That said, there are also cases where companies have negative P/E ratios, and that offers the potential for unique investment opportunities – and challenges.

Investing in companies with negative price-to-earnings (PE) ratios is an interesting yet challenging subject matter that creates endless debates amongst analysts and investors. The ratio is the market's assessment of a company's earnings against its share price. Generally, investors expect profits in the future when the P/E ratio is positive. That said, there are also cases where companies have negative P/E ratios, and that offers the potential for unique investment opportunities – and challenges.

Low P/E companies present tantalising possibilities for outsized profit . Yet low P/E ratios can indicate a chance of being financially unstable or future visions not so bright. This article will explore the pros and cons of investing in companies with negative P/E ratios, delving into the underlying reasons for negative P/E ratios.

Understanding The P/E Ratio

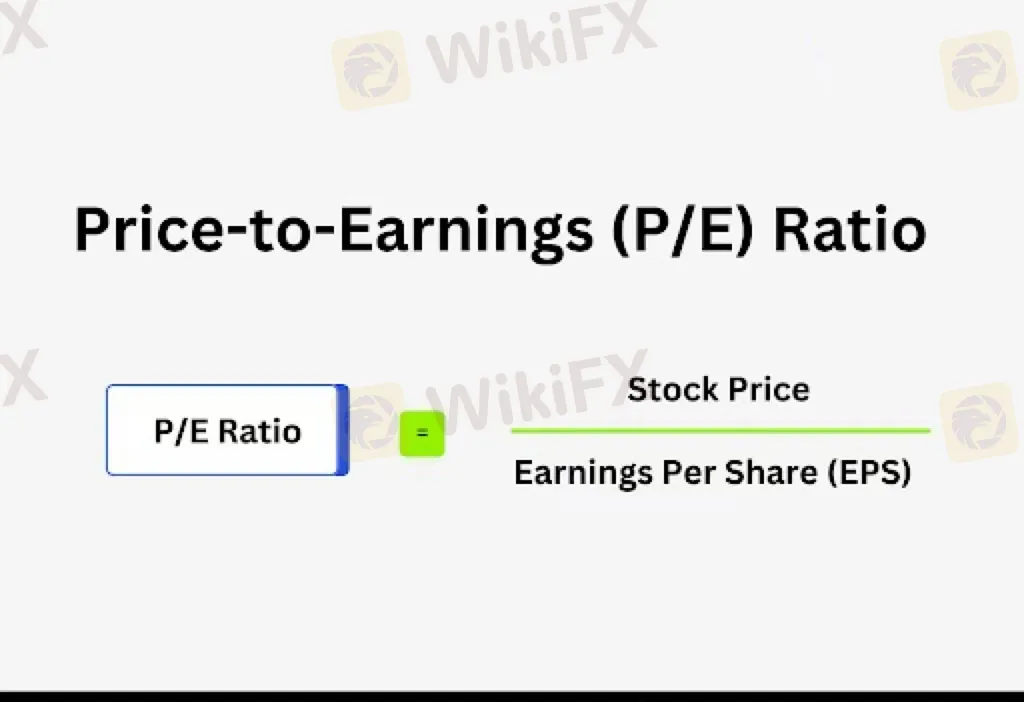

The P/E ratio is simple to calculate: divide a company's current stock price by its earnings per share (EPS). This metric is popular because it allows investors to quickly see how much they are paying for each dollar of earnings.

The formula is:

P/E ratio = stock price / earnings per share (EPS)

When a company is profitable, its earnings are positive and the corresponding P/E ratio is positive. Conversely, if a company is in the red (i.e., negative earnings), the P/E ratio will turn negative, but the concept should be corrected to read ‘negative P/E ratio’ rather than ‘negative P/E ratio’.

Generally speaking, a high P/E ratio tends to reflect a high valuation, while a low P/E ratio may suggest a relatively low valuation. In particular, a negative P/E ratio generally means that the company is currently experiencing a loss-making phase. Having information about a company's P/E ratio can be useful in assessing its target share price.

When exploring the phenomenon of negative P/E ratios, it is important to recognise that the intrinsic value of a stock is never negative. Therefore, the P/E ratio is negative only in the context of negative earnings per share. In other words, when a company fails to make a profit or declares a loss in a quarter, its earnings per share may be negative.

However, in practice, most companies tend to mark negative P/E as ‘not applicable’ rather than entering a negative value.

Why Do Some Companies Have Negative P/E Ratios?

While a P/E ratio indicates that a company is losing money, this does not necessarily mean that the company will go bankrupt. There are many reasons why a company may have a negative P/E ratio.

1. High start-up costs

New companies, especially those in industries such as technology and biotechnology, often need to invest a large amount of money before they become profitable. Companies in a growth phase may prioritise expansion and product development over immediate profits.

2. The company is still growing

If a company is relatively new or in a growth phase, its P/E ratio may be negative. It is not uncommon for a company to take several years to achieve positive earnings, especially in industries such as pharmaceuticals or technology, or companies that h ave recently gone public in an initial public offering on Wall Street.

3. Economic Downturn

Widespread economic issues, including recessions, can impact a company's revenue streams and result in financial losses. Even well-established businesses may temporarily see their earnings turn negative due to such challenges.

4. Costs Associated with Restructuring

Entities undergoing significant transformations, like mergers, acquisitions, or operational overhauls, may face substantial expenses and consequently endure temporary losses.

5. Substantial Debt Load

Companies burdened with heavy debts frequently grapple with high interest payments, which can diminish their profitability and result in negative returns for stakeholders.

6.Newly Emerging Sectors:

Numerous enterprises in burgeoning industries, such as renewable energy or cutting-edge technology, often incur initial losses. Investors might overlook the current lack of profitability, focusing instead on the promising growth prospects of these companies.

7. changes in accounting methods:

P/E ratios may change when a company changes its accounting metrics or policies. This is because the method of calculating earnings per share is different, and earnings per share determines the P/E ratio

8. Changes in depreciation or amortisation:

If a company changes its depreciation or amortisation policy in a particular year, or if there is a market trend, this may cause the company's P/E ratio to temporarily become negative.

When Does a Negative P/E Ratio Not Constitute a Warning Sign?

High Growth Opportunities

For many start-ups and fast-growth companies, especially those in the technology and biotechnology sectors, negative earnings are often a reflection of a large investment in R&D innovation or market expansion. If investors are confident in the company's future growth potential and profitability, they may readily accept short-term financial losses.

Affected by temporary factors

Negative P/E ratios can sometimes be the result of one-off events or special circumstances, such as accounting for asset impairments, costs incurred in restructuring or the cost of resolving legal disputes. If these are seen as non-recurring episodic events, then the company may return to growth.

Strategic turnaround

When a company has a clear turnaround strategy, a negative P/E ratio may be just a transitional phase. An effective management team and solid business structure can alleviate concerns about current losses and signal that the company is about to enter a new chapter of profitability.

Example of a Stock with a Negative P/E Ratio

Let's first look at an example with a positive P/E ratio

Company: Infosys Ltd.

Current Share Price: ₹1,500

Earnings per share (EPS): ₹75

P/E ratio = ₹1,500 / ₹75 = 20

ANALYSIS: A price-to-earnings (P/E) ratio of 20 indicates that investors are prepared to shell out Rs. 20 for each Rs. 1 of a company's earnings. Whether this is deemed sensible or inflated hinges on industry benchmarks and growth potential. Within the technology sector, a higher P/E ratio could be deemed appropriate, given the robust growth expectations.

Negative P/E ratio

Company: Vodafone Idea Ltd.

Current Share Price: ₹10

EPS (earnings per share): -₹5

P/E ratio = ₹10 / -₹5 = -2

ANALYSIS: A negative P/E ratio signifies that Vodafone Idea is incurring losses at present. Various factors like intense competition, elevated debt levels, or substantial operating expenses may be contributing to this. Investors should scrutinize whether the company's financial struggles are fleeting or indicative of a broader, persistent issue.

Should You Buy a Stock If It Has a Negative P/E Ratio?

A negative P/E ratio doesn't automatically signal a poor investment choice.

It doesn't necessarily imply a low valuation or suggest that a company is on the brink of bankruptcy.

When deciding whether to invest in such a stock, it's crucial to align your decision with your portfolio goals and investment approach.

Reflect on your investment aspirations.

For instance, if you seek growth stocks for future profits, you might consider investing in nascent companies that may have a negative P/E ratio.

However, if your goal is to invest in dividend-paying companies, purchasing shares in firms with negative P/E ratios may not align with your portfolio strategy.

Thorough research is paramount.

Before investing in any company, you should delve into various financial metrics, such as the projected P/E ratio, cash flow, growth rate, net income, yield, liquidity, and more. Market perspectives and expert opinions can also provide valuable insights.

The Pros of Investing in Companies with Negative P/E Ratios

Great Growth Potential: Companies with loss-making P/E ratios tend to be start-ups or growth stage companies. They tend to reinvest their earnings in expansion and research and development (R&D) rather than distributing dividends. By investing in this type of business, you can capitalise on its huge growth potential and hopefully get a share of future earnings.

A good opportunity to get in at a low price: A losing P/E ratio may mean that the company's stock is undervalued by the market. This may be due to short-term woes or market sentiment fluctuations and may not be a true reflection of its long-term value. Once market sentiment changes, investing in these undervalued stocks is expected to yield significant returns.

Contrarian Layout: Use a contrarian investment strategy, which is the opposite of the prevailing market view. When a company has a negative price-to-earnings ratio, most investors avoid it because of concerns about its profitability. By going against the grain, you may be able to uncover an investment opportunity that the market has overlooked.

Potential Revival Opportunity: A company with a losing P/E ratio may be at a turning point in its financial struggles. If management takes effective steps to improve profitability and the market environment improves, the value of their shares could rise significantly.

The Cons of Investing in Companies with Negative P/E Ratios

Companies with negative P/E ratios are considered to be dangerous investments. It can be risky because such companies can go under and are not guaranteed to be profitable in the future. If the company never recovers, you could lose your investment.

Uncertainty: Frequently, negative P/E ratios indicate uncertainty surrounding a firms profitability. As such, this uncertainty rarely leads to an accurate conclusion at what stocks will end up doing in the future.

Limited information: For start-up companies and companies with negative P/E ratios, they may not have a long operating history or financials to examine, making it difficult to evaluate their financial health and growth prospects.

Low Liquidity: Due to lower volumes of shares trading for companies with negative P/E ratios, it can lead to lower liquidity. That might make it tougher to purchase This may make it more difficult to buy and sell shares at the desired price, which may affect your ability to exit your position.

Here's a table of the pros and cons of investing in companies with negative P/E ratios:

| Pros | Cons |

| Huge Growth Potential | High Risk |

| Opportunity for Low Entry Price | Uncertainty |

| Contrarian Investment Strategy: | Limited Information |

| Potential for Revival | Low Liquidity |

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator