简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MT4 vs MT5: A comprehensive comparison in terms of functionality

Abstract:As the Forex market continues to expand and attract more and more traders, the demand for efficient and user-friendly trading platforms is growing exponentially, with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) being two of the most popular choices amongst Forex traders due to their power and ease of use. To help you choose the option that best suits your trading needs and preferences, we will explore a comprehensive comparison between MetaTrader 4 and MetaTrader 5 here.

As the Forex market continues to expand and attract more and more traders, the demand for efficient and user-friendly trading platforms is growing exponentially, with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) being two of the most popular choices amongst Forex traders due to their power and ease of use. To help you choose the option that best suits your trading needs and preferences, we will explore a comprehensive comparison between MetaTrader 4 and MetaTrader 5 here.

What is MetaTrader 4 (MT4)?

MetaTrader 4 (MT4) is arguably the most well-known Forex trading platform in the world. It is part of the MetaTrader suite of trading platforms developed by MetaQuotes Software Corp. In the nearly 20 years since its launch (2005), MT4 has become known for its customisable features, wide range of in-built technical indicators, integrated programming language, automated trading functionality and sophisticated analytical tools.

MetaTrader 4 is not a broker; it is a third-party trading platform that connects to forex brokers for forex trading. Whether you use MT4 or MT5, you still need to choose a good forex broker.

What is MetaTrader 5 (MT5)?

MetaTrader 5 is the next generation trading platform, the successor to MetaTrader 4. Like MT4, MT5 is free to use (as long as your forex broker has paid to licence the platform for its clients). Whilst the two platforms are similar in appearance, MT5 has a wider range of tradable instruments to better meet the needs of multi-asset traders looking to trade instruments such as commodities, equities, CFDs, futures, options and bonds.

MT5 also offers more in-depth advanced tools and features such as the MQL5 programming language, additional graphical objects and indicators, new statistical functions, an enhanced strategy tester and the ability to hedge and net trades.

Here are the upgrades and comparisons of the functionality of the two platforms:

| Feature | MT4 | MT5 |

| Launch Year | 2005 | 2010 |

| Primary Focus | Forex Trading | Multi-Asset Trading |

| Built-in Indicators | 30 | 38 |

| Timeframes | 9 | 21 |

| Pending Order Types | 4 | 6 |

| Economic Calendar | No | Yes |

| Market Depth | No | Yes |

| Additional Order Types | Limited | More |

| Coding Language | MQL4 | MQL5 |

| Automated Trading | Expert Advisors (EAs) | Expert Advisors (EAs) |

| Complexity | Simpler | More Comple |

What is The Difference Between MT4 Vs. MT5?

1. Technical Features

Built-in Indicators: MT4 has about 30 built-in indicators and 33 analytical objects. MT5 has 38 built-in indicators and 44 analytical objects that help to determine price trends of financial instruments. MT5 also offers built-in DailyForex signals. MT5 also offers built-in DailyForex signals.

‘Inserts/Indicators. The ’Trend tab has six additional indicators. In addition to the standard Moving Averages, Bollinger Bands and Parabolic Turning Indicators, there are also variants of them, such as Fractal Adaptive Moving Averages, Bi-Exponential Moving Averages, and others.

There are also two new oscillators: the Chaikin Oscillator and the Triple Exponential Moving Average.

Insert/Objects. The analysis objects are complemented by a separate ‘Elliott’ tab and additional objects in other tabs.

Charting Tools: MT5 offers a wider range of charting tools. It has 44 graphical objects, including advanced tools such as Gann, Fibonacci, and Elliott wave analysis. These additional tools allow for a more accurate prediction of future price movements. MT4 has a solid set of 31 graphical objects that meet the basic needs but lacks the specialized options offered by MT5.

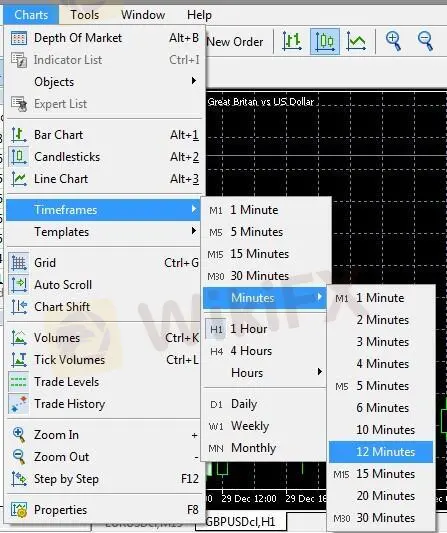

Time Ranges: MT5 offers 21 different time ranges. You can analyze assets down to the minute (e.g. M1, M2, M3) or across multiple hours and days. This makes it much easier to perform detailed market analyses. In contrast, MT4 only supports 9 time ranges, which limits the level of detail in the analysis.

Order Types: MT5 allows 6 types of pending orders, which gives you more flexibility in setting their entry and exit points. It includes Buy Stop, Buy Limit, Sell Stop, and Sell Limit, which are common in MT4, but with the addition of Buy Stop Limit and Sell Stop Limit. These additional order types give you more precise control over your trades. MT4 only offers 4 basic order types, which may leave you feeling limited if you are using a more advanced strategy.

Economic Calendar: MT5 has a built-in economic calendar, which provides real-time information on financial news that may affect the market, MT4 lacks this feature.

2. User Interface and Design

The user interface and design of a trading platform can have a significant impact on the trading experience; MT4 has an intuitive interface that is favored by many traders due to its ease of use and familiarity. On the other hand, MT5 has a more modern and visually appealing design, which may appeal to traders who prefer a sleeker interface. In terms of user interface, the choice between these two platforms usually comes down to personal preference and trading style.

This is what the MT4 interface looks like:

This is what the MT5 interface looks like:

3. Speed of Order Execution

Order execution speed is a key factor for forex traders, especially those engaged in scalping or high-frequency trading, both MT4 and MT5 offer fast and reliable order execution, but MT5 has been optimized for faster trade request processing. This increase in order execution speed is likely to be more noticeable in more volatile markets or when traders need to execute fast trades.

4. Forex Market Coverage

The Forex market is large and diverse, with a wide range of trading instruments to choose from, and MT4 is recognised as the top platform in this regard, as it is primarily used for Forex trading. MT5, on the other hand, goes beyond Forex trading and allows for the trading of other instruments such as stocks, commodities and futures. As such, traders with more diversified portfolios or those interested in exploring other financial markets may find MT5 more suited to their needs.

| Feature | MT5 | MT4 |

| Market Range | Forex, futures, stocks and options markets | Forex and CFDs |

| Technical Indicators | 38 | 30 |

| Timeframes | 21 | 9 |

| Graphical Objects | 44 | 31 |

| Order Fill Policy | Fill or Kill, Immediate or Cancel, Return | Fill or Kill |

| Partial Order Fill Policy | ✅ | ❌ |

| Pending Order Types | 6 | 4 |

| Economic Calendar | ✅ | ❌ |

| Programming Language | MQL5 | MQL4 |

| Hedging | ✅ | ❌ |

| Netting | ✅ | ❌ |

| Exchange trading | ✅ | ❌ |

5. Community Support and Resources

A strong and active user community can significantly influence the popularity of a trading platform. MT4 is a more mature platform with a larger user base, which means there is more community support, forums, and online resources available. In addition, because MT4 has been around for much longer, there are many expert advisors and custom indicators available to traders for free. MT5's community is also growing, but it may take some time before it reaches the broad level of support that MT4 enjoys.

6. Pending Order

MT4 and MT5 also have different order quantities. MT4 has four types of pending orders: buy stop/sell stop or buy limit/sell limit. MT5 has six types of pending orders.

A Buy Stop Limit Order is a combination of a Buy Stop Order and a Buy Limit Order. Once the ask price reaches the value set in the ‘Price’ section, the platform will automatically place a ‘Buy Limit Order’ at the price specified in the ‘Stop Limit’ box.

A Sell Stop Limit Order is a combination of a Sell Stop Order and a Sell Limit Order. Once the bid price reaches the value specified in the ‘Price’ section, the platform will automatically place a ‘Sell Limit Order’ at the price specified in the ‘Stop Limit’ box.

For professional traders, these pending orders provided by MT5 may be interesting. For novice traders, these pending orders provided by MT4 are sufficient.

How Can I Speed up MetaTrader's Performance?

MetaTrader is a powerful trading platform, but sometimes it can slow down. Here are some tips to optimize its performance:

Hardware Considerations

Processor: A faster processor, especially a multi-core processor, can significantly improve MetaTrader's performance.

RAM: Make sure you have enough RAM for the platform, especially when running multiple charts or complex indicators.

Storage: Use solid state drives (SSDs) for faster data access and reduced load times.

Software Optimisation

Minimise background processes: Close unnecessary applications that may be competing for resources.

Update drivers: Make sure your graphics drivers and other system drivers are up to date.

Disable antivirus real-time protection: Temporarily disable real-time scanning when using MetaTrader as it can sometimes affect performance.

Limit indicators: Reduce the number of indicators used on each chart. Too many charts can slow down the platform.

Optimise charts: Adjust chart settings to reduce the amount of data to be processed. For example, consider using a lower time range or reducing the number of history bars displayed.

Use a VPS: Virtual Private Servers (VPS) provide a dedicated server environment that offers faster processing speeds, and lower latency, which can greatly improve MetaTrader's performance. Be sure to optimise MetaTrader for your Forex VPS to maximise these benefits.

FAQ

Which is better, MT4 or MT5?

MT5 is the latest version of the MetaTrader platform and as such is fully supported by the developers.

Unless you are still using a specific plugin or algorithm that has not yet been imported into MT5, there is simply no reason to choose MT4.

Can I use MT4 and MT5 at the same time?

Yes, you can use both MT4 and MT5 at the same time, as long as the broker you choose is licensed by MetaQuotes Software to offer the full suite of MetaTrader platforms. Not all brokers offer both MetaTrader platforms.

Which platform is better for beginners, MT4 or MT5?

MT5 is widely supported by developers and I would recommend it to beginners who have not yet started learning both platforms. Brokers usually offer a wider market and better pricing on their MT5 than they do on MT4.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator