简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

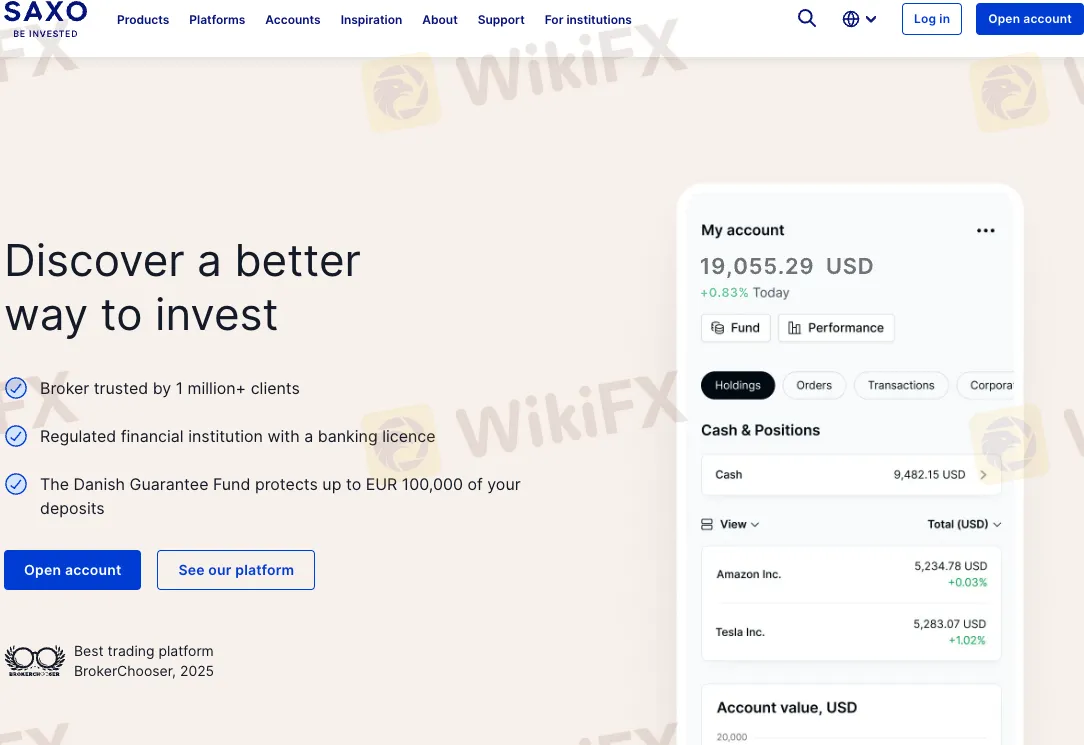

Saxo Bank Review: Accounts, Fees, and Withdrawal Analysis

Abstract:Saxo Bank, founded in 1992 and headquartered in Copenhagen, Denmark, is a modern investment bank focused on online investing. The bank also has offices in Beijing, London, Spain, Hong Kong, and Singapore. In 1998, Saxo Group launched one of the first online trading platforms in Europe.

Saxo Basic Information

Saxo Bank, founded in 1992 and headquartered in Copenhagen, Denmark, is a modern investment bank focused on online investing. The bank also has offices in Beijing, London, Spain, Hong Kong, and Singapore. In 1998, Saxo Group launched one of the first online trading platforms in Europe.

In 2018, Saxo Bank expanded its business further by acquiring the popular online broker BinckBank. Today, Saxo Bank offers a wide range of investment options, including stocks, ETFs, mutual funds, bonds, and more sophisticated financial instruments across 50 different exchanges.

Is Saxo Bank Safe?

Saxo Bank operates under the supervision of multiple global regulatory bodies, including those in major markets such as Australia, the UK, Japan, France, Switzerland, Singapore, and the UAE. Its trading activities comply with legality and security standards.

However, Saxo Bank has faced regulatory issues, particularly after the Swiss National Bank unpegged the Swiss Franc from the Euro in 2015. This event led Saxo Bank to adjust the order prices for CHF currency pairs, resulting in additional losses for some clients. The Danish Financial Supervisory Authority (DFSA) issued two warnings due to Saxo Bank‘s failure to provide adequate information to clients regarding the limitations and difficulties in executing orders. Although these issues had some impact on the bank’s reputation, Saxo Bank has taken steps to improve transparency and client communication.

Despite these challenges, Saxo Bank‘s investor protection scheme provides up to €20,000 in protection for clients’ assets, and its cash balances are also protected by a deposit guarantee scheme, up to €100,000. These measures offer additional security, further enhancing Saxo Banks position as a safe and reliable trading platform. Overall, it remains a trustworthy financial services provider.

Here is a list of the regulatory bodies it is regulated by:

| Regulatory Agency | Current Status | License Type | Regulated By | License No. |

| Australia Securities & Investment Commission | Regulated | Market Making (MM) | Australia | 280372 |

| Financial Conduct Authority | Regulated | Market Making (MM) | United Kingdom | 551422 |

| Financial Services Agency | Regulated | Retail Forex License | Japan | 関東財務局長(金商)第239号 |

| The Autorité des Marchés Financiers | Regulated | Retail Forex License | France | 71081 |

| National Commission for Companies and the Stock Exchange | Regulated | Market Making (MM) | Italy | 296 |

| Swiss Financial Market Supervisory Authority | Regulated | Financial Service | Switzerland | Unreleased |

| Monetary Authority of Singapore | Regulated | Retail Forex License | Singapore | Unreleased |

| Dubai Financial Services Authority | Revoked | Common Financial Service License | United Arab Emirates | F001886 |

| Australia Securities & Investment Commission | Exceeded | Common Business Registration | Australia | 126373859 |

Account Types

RoboForex offers three account types: Classic, Platinum, and VIP.

The Classic account has the highest transaction fees and no minimum deposit, making it ideal for beginners. The Platinum account offers lower transaction fees and adds priority customer support, with a minimum deposit requirement of SGD 300,000.

The VIP account offers the lowest fees and the best benefits, including a potential interest on uninvested cash, but requires a significantly higher deposit of SGD 1,500,000. Traders should choose based on their trading volume and desired level of service.

| Features | Classic | Platinum | VIP |

| Transaction Fees - US stock and ETFs | 0.08% | 0.05% | 0.03% |

| Transaction Fees - US stock options | USD 2 | USD 1 | USD 0.75 |

| Transaction Fees - US stock CFDs | 0.06% | 0.05% | 0.04% |

| Transaction Fees - Major FX pairs | from 0.6 pips | from 0.5 pips | from 0.4 pips |

| Minimum Deposit | No minimum funding | SGD 300,000+ | SGD 1,500,000+ |

| Benefits | 24/5 technical and account support | 24/5 technical and account support, Priority customer support | 24/5 technical and account support, Priority customer support, Earn up to 3.55% interest on uninvested cash, Invitations to exclusive events |

Demo Account

As a beginner trader, one of the smartest steps you can take is to make use of the broker‘s demo account. This feature allows you to trade with virtual funds, giving you the opportunity to practice until you’re comfortable with skills like market analysis, placing orders, and testing strategies, without the risk of losing real money while you're still learning.

By signing up for a Saxo demo account, you'll be able to get acquainted with their trading software and platform in a completely risk-free setting. You can explore different order types, use charts and tools, and get a feel for their entire trading ecosystem before stepping into live markets.

There are usually two options when setting up a demo account with brokers. The first allows you to register directly for a demo platform without the need for a full live trading account. The process is straightforward and typically involves providing basic personal details, including identity verification.

The second option involves additional steps. With certain brokers, you must first open a valid cash trading account before activating the demo mode. This means going through the entire account setup process, including providing detailed personal and financial information, completing KYC checks, and funding the account with real money. Once the live account is approved and operational, youll be able to access their demo platform.

Is Saxo's Demo Account Useful?

Saxo does offer a demo version of its trading platform, but it has quite a few limitations compared to a real account.

Saxo's demo account allows you to trade with $100,000 in virtual funds within 20 days, covering around 1,000 stocks, CFDs, and forex pairs.

While the demo account provides most of the features that traders typically want, the market range is limited. For example, you cannot trade indices or commodities. Additionally, when you first access it, you only have access to around 150 stocks. Furthermore, there is a delay in pricing.

How to Obtain a Verified Account?

First, you need to visit Saxo Bank's website and fill out the registration form to apply for an account. The broker will take some time to review and verify your application—typically 1 day—after which you can make your first deposit and start trading.

The account opening process with Saxo Bank is quick and easy, including three steps:

- Online application

- Approval process

- Funding

To verify your identity and residency, you must upload the following documents:

- Proof of identity: National ID card or passport

- Proof of residence: Tax or bank statement

After approval, you need to fund your account to activate it, which may take 0 to 5 business days depending on the deposit method. You wont receive a separate notification about this requirement.

Once your identity is verified, the process typically involves:

- Completing a trading experience survey—this is a standard step to ensure you understand trading risks and have basic financial knowledge.

- Choosing an account type and base currency.

- Funding your account to begin trading.

How to Deposit and Start Trading?

After successful account verification, you need to fund your account to begin trading.

- Choose your funding method.

- Enter the amount to deposit and other necessary details for the transaction.

- Carefully check if the payment details are correct.

- If everything looks good, click to submit your deposit request.

At Saxo Bank, the minimum deposit amount is $0. This means you can deposit any amount, with no required minimum. Brokers that don't set a minimum deposit do so to encourage people to try their services without a large initial investment.

Fees

In 2024, Saxo Banks fees are multifaceted, but overall, they are competitive, especially after the bank reduced fees for several types of securities. For example, the commission for US-listed ETFs has been lowered to $1. Below is a breakdown of the various fees:

Account Creation Fee

- Creating an account is free, and Saxo Bank only charges transaction fees when you buy or sell assets.

- Saxo Bank offers three account types: Bronze, Silver, and Gold (the names may vary by country). The more you trade, the lower your fees. The specific fees vary depending on the account type and trading volume.

- Saxo Bank does not charge inactivity fees.

- Stocks, ETFs/ETCs, and Bonds Custody Fees: Singapore residents and Singapore-registered entities are not required to pay custody fees for accessing SGX stocks and ETFs. For other stocks and securities, custody fees are based on actual usage of the platform.

Account Types and Fees

Custody Fees

Transaction Fees

| Product | Spread | Commission | Details |

| FX | from 0.5 pips | No commission | 185 FX spot pairs and 140 forwards, no commission |

| CFDs | N/A | from $3 on US stock CFDs | 8,600+ instruments with tight spreads |

| Stocks | N/A | from $1 on US stocks | 23,000+ stocks on 50 exchanges worldwide |

| Commodities | N/A | as low as $1.25 per lot | Wide range of commodities as CFDs, futures, options |

| Futures | N/A | as low as $1 per lot | 250 futures covering equity indices, energy, metals |

| FX options | from 3 pips | N/A | 45 FX vanilla options with maturities from 1 day to 12 months |

| Listed options | N/A | as low as $0.75 per lot | 3,100 listed options across multiple sectors |

| ETFs | N/A | from $1 on US stocks | 7,400+ ETFs from 30+ exchanges |

| Bonds | N/A | from $5 on US govt. bonds | 5,200+ government and corporate bonds |

| Mutual funds | N/A | Commission, custody and platform fees at $0 | Access to 500+ top-rated mutual funds |

Funds Withdrawal Information

Saxo Markets has clear withdrawal policies, with funds only being able to be withdrawn to a bank account under the account holder's name, not third-party accounts.

The platform supports withdrawals through SaxoTraderGO, and for manual requests, a processing fee of SGD 50 applies. Withdrawals via the online module are free. The company only covers the charges for bank transfers initiated on their end, with any fees from intermediary or receiving banks deducted from the payment.

Saxo Markets supports various withdrawal methods, including telegraphic transfers for USD and multiple other currencies, with processing times ranging from 1 to 5 business days depending on the currency and method.

The following are the supported currencies, withdrawal methods, and processing times, with the fee details clearly outlined in the table below:

Withdrawal Currency and Method

| Currency | Method | Arrival Time |

| SGD | MEPS | 0 - 2 business days |

| USD | Telegraphic Transfer | 1 - 5 business days |

| HKD | Telegraphic Transfer | 1 - 5 business days |

| AUD | Telegraphic Transfer | 1 - 5 business days |

| EUR | Telegraphic Transfer | 1 - 5 business days |

| JPY | Telegraphic Transfer | 1 - 5 business days |

| CHF | Telegraphic Transfer | 1 - 5 business days |

| CAD | Telegraphic Transfer | 1 - 5 business days |

| CNH | Telegraphic Transfer | 1 - 5 business days |

| NZD | Telegraphic Transfer | 1 - 5 business days |

| GBP | Telegraphic Transfer | 1 - 5 business days |

General Charges Imposed by Intermediaries

| Currency | General Charges |

| SGD | Free |

| USD | USD 25 |

| EUR (HSBC) | EUR 19.50 (HSBC Group bank accounts) |

| EUR (Others) | EUR 31.50 (other banks) |

| JPY | JPY 3,000 - JPY 50,000 |

| CHF | CHF 22 |

| CAD | CAD 18.50 |

| CNH | CNH 10 - CNH 12 |

| NZD | NZD 25 |

| GBP | GBP 15 |

How to Withdraw Funds from Saxo Account?

- Access the Withdrawal Menu:

- SaxoTraderGO & SaxoInvestor: Click Withdraw funds.

- SaxoTraderPRO: Click Deposits and Transfers > Withdraw funds.

- Enter Withdrawal Details:

- Select the Saxo account for withdrawal.

- Enter amount and currency.

- Choose your external account (or register a new one if needed).

- Complete Transfer:

- Click Transfer and confirm via the SMS code sent to your phone.

- Enter the code and click Confirm.

- Processing Time:

- Withdrawals are typically processed the same day but may take longer due to factors like incorrect payment details or unsettled transactions.

- Joint Accounts:

- Funds from joint accounts can be withdrawn to an external account in one of the account holders' names.

- Corporate Clients:

- Corporate clients need to request the online withdrawal module via the SaxoGroup_Cash_Module_Form or use the Funds Transfer Request Form.

Tradable Assets

You can trade over 150 currency pairs, approximately 8,600 CFDs, more than 11,000 foreign stocks (including US stocks and ETFs), foreign stocks, forex, and precious metals options, among others.

- StocksTrade stocks from New York, Hong Kong, London, and 50+ other global markets.

- ETFsGain diversified exposure across global markets and major sectors like tech, healthcare, and more.

- BondsAccess over 5,200 government and corporate bonds across exchanges and OTC markets.

- Mutual FundsInvest in highly-rated funds from some of the worlds top money managers.

- Other Products

- Options

- Futures

- Forex

- Crypto

- CFDs

- Commodities

- Turbos

Trading Platform

| Platform | Features | Available On |

| SaxoInvestor | Easy-to-use, invest in stocks, bonds, ETFs, and mutual funds, inspirational content and market analysis | Mobile app, web |

| SaxoTraderGO | Access to all asset classes, including leveraged products, detailed analytics and charting, market analysis | Mobile app, web |

| SaxoTrader PRO | Designed for professionals, powerful features, fully customizable experience | Desktop (with multi-screen setup) |

Restricted Countries

It is significant to note that Saxo Bank only provides services to the following countries:: Australia, Austria, Belgium, Croatia, Czech Republic, Denmark, Estonia, Faroe Islands, Finland, France, Germany, Greece, Greenland, Hong Kong, Hungary, Iceland, Ireland, Israel, Italy, Japan, Latvia, Lithuania, Luxembourg, Malaysia, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Qatar, Romania, Saudi Arabia, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, Thailand, UAE, United Kingdom.

Conclusion

Saxo Bank is an experienced and reliably regulated online investment bank, offering a wide range of financial products, including stocks, ETFs, mutual funds, and more.

Saxo Bank provides various account types, including joint and business accounts, and also offers a demo account for beginners. Its trading fees are competitive, especially for frequent traders, and there is no minimum deposit requirement. Saxos trading platform is user-friendly, offering access to a broad range of asset classes, making it suitable for both beginners and experienced traders.

FAQs

Does Saxo Bank offer business accounts?

Yes, Saxo Bank allows the creation of company accounts.

How much of your assets are protected by the investor protection scheme?

Your assets are protected up to €20,000.

Does Saxo Bank do securities lending?

Yes, Saxo Bank participates in securities lending. You can lend your stocks, but you must opt-in for the service. The process is transparent, unlike some brokers who automatically lend out shares.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

What Can Expert Advisors Offer and Risk in Forex Trading?

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

The Most Effective Technical Indicators for Forex Trading

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Currency Calculator