简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How Much More Can S&P 500 Rise, USD Fall after Very Cautious Fed?

Abstract:What does it mean for financial markets if the US economy maintains its healthy pace while external headwinds noted by the Fed abate? The S&P

Fed, S&P 500 and US Dollar Talking Point

After relatively dovish Fed, S&P 500 may struggle finding further reasons to rally

What does it mean if external headwinds abate while US economy maintains pace?

The equity risk premium in the US is still low, AUD/USD and NZD/USD are at risk

See our study on the history of trade wars to learn how it might influence financial markets!

The Federal Reserves most recent monetary policy announcement and accompanying press conference from Chair Jerome Powell caught the US Dollar off guard as Wall Street soared. In short, the central bank continued emphasizing its cautious data-dependent approach. Anticipated adverse impact from the US shutdown and external risks such as slowing global growth, trade wars and a hard Brexit were noted as potential headwinds.

Towards the end of last year, worries about policy tightening resulted in the S&P 500 ending 2018 more than 6% lower. Now, market expectations of a hike this year plummeted as chances of a cut increased. This was supportive for the pro-risk Australian and New Zealand Dollars. They largely outperformed against the Greenback as equities in Asia and Europe rebounded in January.

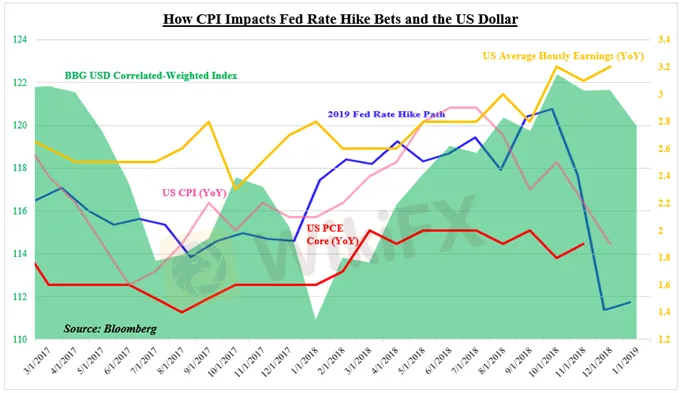

With that in mind, where does this leave sentiment and where can it go form here? Let us not forget that the US economy is generally in a good place for the Fed. Unemployment is low and inflation is more-or-less within the central banks target. While headline CPI has been trending lower, average hourly earnings have been on the rise (see chart below).

So, if the economic situation in the US may be supportive of Fed rate hikes, how about the external risks? The US and China are still holding trade talks and if a deal is reached, the former may not raise tariffs further. In recent weeks, the British Pound has been rising as chances of a no-deal Brexit fell while those of a second referendum rose. Mr. Powell also noted that in Q2, lost GDP from the shutdown should be regained.

All else being equal, this could make it trickier for equities to continue paring losses from last year‘s decline. On the one hand, if global growth is slowing and that permeates into the world’s largest economy, that could trigger panic and send AUD/USD and NZD/USD lower given the greenbacks status as a safe haven. On the other hand, if external headwind frets abate, does that mean that the central bank can proceed with hiking?

On the next chart below is the relationship between the US Dollar (candles), S&P 500 (green line) and the implied 2019 Fed rate hike path (blue line). The latter is calculated by taking the difference between the yield in Fed funds futures at the beginning of 2020 from the beginning of 2019. If the central bank reopens the door to gradually lifting interest rates, the S&P 500 might fall as USD gains and the blue line rises.

DXY Daily Chart

Chart created in TradingView

Another warning sign that may come to haunt US stocks in the future is the declining equity risk premium. In short, that is the advantage the S&P 500 has over government bond yields from a perspective of expected stock returns (earnings yield). Back in October, I noted that the equity risk premium in the US has been on the decline and sure enough, this preceded Decembers downturn.

A falling equity risk premium may send investors looking for higher returns elsewhere. Looking at the last chart below, the roughly 20% decline in the S&P 500 during Q4 2018 helped push the equity risk premium higher as bond yields tumbled. Since the beginning of January, not only has that been back on the decline, but the equity risk premium remains low by historical standards.

As that aims lower again, the S&P 500 and US benchmarks stock indexes may struggle to find further room to rally. On top of that, if global economic conditions do improve, that would hypothetically incentivize domestic investors to seek returns abroad again. In the end, monetary policy is arguably the most influential force for a currency. Perhaps it wont be too long until the US Dollar finds a bid again as rates rise.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

Can someone earn $1 million at once on forex trading? If yes, how can this be done?

In conclusion, while it is theoretically possible to make $1 million at once in forex trading, achieving such a remarkable feat requires exceptional expertise, meticulous risk management, and a deep understanding of the complexities of the market. Aspiring traders should approach forex trading with rational expectations, a focus on continuous improvement, and an emphasis on preserving capital as the foundation for long-term success in this dynamic and challenging market.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator