General Information

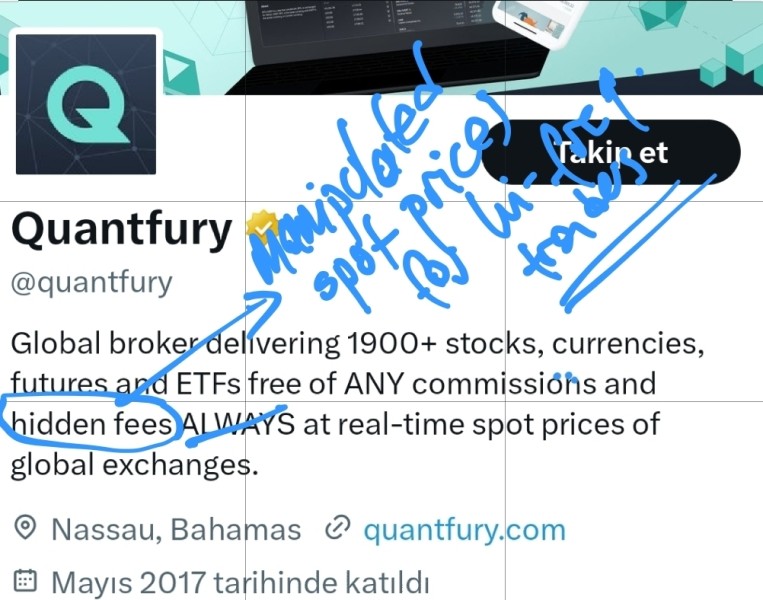

QUANTFURY is an offshore regulated broker based in the Bahamas, catering to traders interested in a diverse range of market instruments. They offer an extensive selection of trading options, including stocks, crypto pairs, ETFs, index futures, commodity futures, and currency pairs. Traders can take advantage of potential opportunities in these markets to make informed trading decisions.

One of the key features of QUANTFURY is their smartphone trading app, which allows users to trade on the go. The app offers commission-free trading, meaning users are not charged any fees for executing trades. This can be appealing to traders looking to minimize their transaction costs and maximize their potential profits.

In terms of trading tools, QUANTFURY provides users with charts, volume indicators, and a highlighter tool to aid in their analysis. These tools can assist traders in understanding market trends, gauging asset liquidity, and making more informed trading decisions. However, it's important to note that the broker has received negative reviews on WikiFX, raising concerns about hidden fees, delays, slippage, account lockouts, and the removal of profits. These reviews highlight potential issues that traders should consider before engaging with QUANTFURY.

Is QUANTFURY Legit?

Quantfury Trading Limited is regulated by the Securities Commission of The Bahamas (SCB) with a retail forex license. The license number associated with Quantfury is SIA-F204. The company is a licensed institution under the offshore regulatory jurisdiction of The Bahamas.

It's important to note that Quantfury is an offshore regulated entity, which means it operates under different regulations compared to brokers regulated by onshore financial authorities. Offshore regulations may have different requirements and levels of investor protection.

The licensed institution, Quantfury Trading Limited, is located at Bayside Executive Park, No. 3, West Bay Street & Blake Road, Nassau, Bahamas. Unfortunately, the provided information does not include the phone number of the licensed institution.

The website of Quantfury Trading Limited is https://quantfury.com/. However, it's worth mentioning that the information provided indicates that the broker does not currently have a trading software. It's advisable to verify this information and consider the associated risks before engaging in any transactions or investments.

Pros and Cons

Market Instruments

Quantfury offers a wide range of market instruments for trading. Traders on the platform have access to 1515 individual stocks, 46 different crypto pairs, allowing users to participate in the growing cryptocurrency market.

Stocks:

Quantfury enables users to go long on stocks they believe will increase in value and short stocks they anticipate will decline. This allows users to potentially profit from both rising and falling stock prices.

Crypto Pairs:

With 46 available crypto pairs, users can navigate the dynamic and 24/7 cryptocurrency markets. This offers opportunities for trading and investment in different cryptocurrency pairs.

ETFs:

Quantfury provides exposure to ETFs, which allow users to manage risks by gaining exposure to multiple stocks within a single investment. This diversification can help users mitigate the impact of individual stock performance.

Index Futures:

Users can speculate on global market movements through index futures. These instruments enable users to take positions on the performance of various market indices, such as the S&P 500 or the FTSE 100.

Commodity Futures:

Quantfury allows users to identify opportunities in the global trade of commodities. Commodity futures enable users to speculate on the price movements of commodities like gold, oil, or agricultural products.

Currency Pairs:

Quantfury facilitates participation in the global marketplace for exchanging national currencies. Users can take part in currency pairs, allowing them to speculate on the relative value of different currencies and potentially benefit from foreign exchange fluctuations.

Account Types

How to open an account?

To open an account with Quantfury, you can follow these general steps:

1. Visit the Quantfury website: Go to the official Quantfury website using a web browser. Sign up: Look for the “Sign Up” or “Register” button on the website and click on it. You will be directed to the account registration page.

2. Secondly, you will need to provide your phone number as part of the registration. After entering your phone number, you will typically receive a verification code via SMS. To proceed with the account setup, enter the verification code received on your phone into the designated field on the registration page. This step helps confirm that the phone number provided belongs to you and allows Quantfury to enhance the security of your account.

3. Provide personal information: Fill out the required fields on the registration form, which typically include your name, email address, and password. Make sure to provide accurate information.

4. Agree to terms and conditions: Read through the terms and conditions of Quantfury and agree with them by checking the appropriate box or clicking on the provided button.

5. Fund your account: After completing the account setup, you can proceed to fund your Quantfury account. Follow the instructions provided on the platform to deposit funds using the available payment methods.

6. Start trading: Once your account is funded, you can explore the trading features and start trading the available market instruments on Quantfury.

Leverage

The maximum leverage offered by this broker is capped at 1:20, which is conservative. However, since margin trading is full of risks, it is important that forex traders learn how to manage leverage and employ risk management strategies to mitigate forex losses.

Spreads & Commissions

Quantfury claims that it operates on a pricing model where clients can trade at real-time spot prices of global and cryptocurrency exchanges. However, no clear information on spreads and commissions is presented.

Trading Platform Available

Quantfury offers a smartphone trading app that enables users to trade a wide range of financial instruments, including cryptocurrencies, fiat pairs, equities, and futures. The app stands out by providing commission-free trading, meaning users are not charged any fees for executing trades.

Trading Tools

Quantfury provides a range of trading tools to help users analyze and make informed trading or investment decisions. These tools are available in the Instrument View and include charts, volume indicators, highlighter tool, and order book (for cryptocurrency pairs).

Charts: Quantfury offers two types of charts - Line Chart and Candlestick Chart. The Line Chart displays the 5-minute closing prices for the previous 20 hours, with a horizontal line representing the previous day's closing price. The Candlestick Chart provides detailed information about the asset's price during a specific time period, including the open, close, high, and low prices.

Volume Indicator: Users can access the volume indicator symbol, located next to the candlestick symbol, which provides shading on the chart to represent the trading volume of the asset. By activating the chart highlighter, users can see the specific quantity that was traded at a particular time.

Highlighter Tool: The highlighter tool allows users to toggle it on or off or activate it by tapping and holding anywhere on the chart. Once activated, users can drag the highlighter to a specific time period to view the asset details at that point, including the volume (if the volume indicator is turned on). The displayed information varies depending on the chart view:

- Line Chart: Closing price for the selected time period, price change since the previous close, and percentage change since the previous close.

- Candlestick Chart: Open price, close price, highest price, and lowest price.

Time Intervals: Users have the flexibility to select the time interval for the charts. The available options include 5 minutes (default), 15 minutes, 1 hour, 4 hours, or 1 day. The corresponding time period covered by the chart is displayed above the time interval options.

Deposit & Withdrawal

Quantfury offers multiple methods for depositing and withdrawing funds. Users have the flexibility to choose from various options based on their preferences. The available methods are as follows:

- Cryptocurrency Funding: Quantfury allows users to fund their spot wallet with 11 different cryptocurrencies. These cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Dash (DASH), Dai (DAI), Tether (Erc-20 and Solana), USD Coin (USDC), TrueUSD (TUSD), Chainlink (LINK), and Solana (SOL). This provides users with a wide range of choices and flexibility when it comes to depositing and withdrawing funds.

- Wire Transfer: Users can also deposit funds into their Quantfury spot wallet by initiating a wire transfer in their national currency. This method allows for direct transfer of funds from a bank account to the Quantfury account. It provides an option for users who prefer traditional banking methods.

- Cryptocurrency Transfer: Another option for funding the Quantfury spot wallet is by sending cryptocurrency from a third-party wallet. Users can transfer their preferred cryptocurrency from their external wallet to their Quantfury account. This method is for those who already hold cryptocurrencies in other wallets.

- Bank Card Purchase: Quantfury enables users to buy cryptocurrency directly with their bank cards. This feature allows for a seamless and quick process of converting fiat currency into cryptocurrency, which can then be deposited into the Quantfury spot wallet.

Pros and Cons

Customer Service

Quantfury provides customer support options to assist clients with their inquiries and concerns. Clients can reach out to the broker's customer support team through several channels, including online chat and email. This allows for direct communication with the support staff, enabling prompt assistance and resolution of any issues that may arise.

In addition to traditional communication methods, Quantfury maintains a presence on several social media platforms, such as Facebook, Twitter, LinkedIn, and others. This provides an alternative means for clients to connect with the broker and receive support or stay updated on the latest news and announcements.

Quantfury also offers a comprehensive “HELP CENTER” that covers a wide range of topics and frequently asked questions. This resource serves as a self-help tool for clients, enabling them to find answers to common queries and gain a better understanding of the platform's features and functionalities.

Educational Resources

The Quantfury Daily Gazette is an educational resource provided by Quantfury, covering a wide range of topics that are of interest to Quantfurians. It is a financial markets and lifestyle blog that publishes content every day, including blogs, videos, podcasts, and more. The Gazette aims to keep users informed about the latest news and trends in various fields.

The Gazette offers a diverse range of categories to cater to different interests. These categories include technology, sports, finance, health, entertainment, fashion, environment, and travel. This ensures that users can find content that aligns with their specific areas of interest and stay updated on the latest developments in those fields.

Some of the recent articles published in the Gazette include “Steel dynamics war for steel,” which discusses the competitive landscape of the steel industry, “The rise of the solar industry,” which highlights the growth and potential of the solar energy sector, and “Nike: beyond Phil Knight to Travis Knight?” which explores the transition of leadership within the Nike company.

FAQs

Q: Is Quantfury regulated?

A: Yes, Quantfury is regulated by the Securities Commission of The Bahamas (SCB) with a retail forex license.

Q: What market instruments are available on Quantfury?

A: Quantfury offers stocks, crypto pairs, ETFs, index futures, commodity futures, and currency pairs.

Q: What leverage does Quantfury offer?

A: Quantfury offers a fixed leverage of 1:20.

Q: What is the minimum deposit requirement for Quantfury?

A: The minimum deposit requirement is based on the Bitcoin equivalent of $100.

Q: What deposit and withdrawal methods are available on Quantfury?

A: Quantfury offers cryptocurrency funding, wire transfer, cryptocurrency transfer, and bank card purchase options.

Q: What trading platforms does Quantfury provide?

A: Quantfury offers a smartphone trading app for commission-free trading of various financial instruments.

Juan4142

Spain

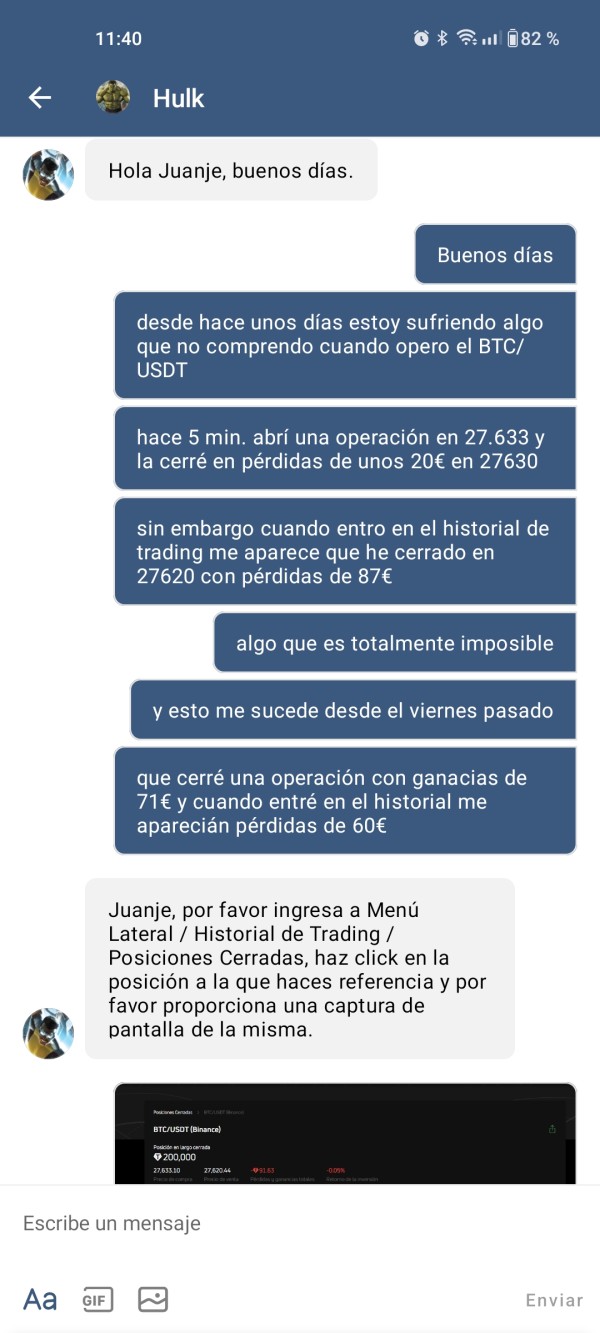

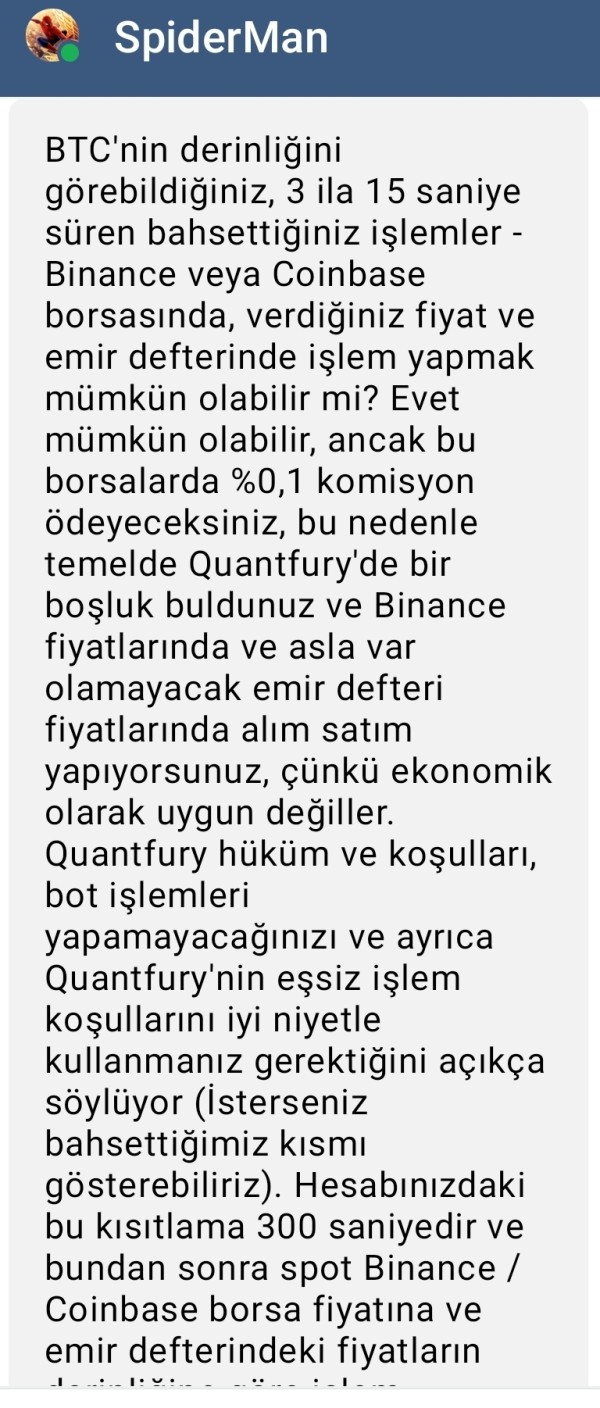

When you start making profits, these are Quantum's practices: - They delay the closing time, causing you to lose money: - They freely modify the trading power, causing you to lose money - They manipulate the closing price to make you lose money - They prevent stop losses, so you cannot operate safely- They said they don't charge commission, it's fake, they increased the price difference. Everything they announced was fake. All of this was done without any notice, and its usage policy did not mention this. They are completely fraudulent art. In addition, they also organized a customer recruitment system through influencers and YouTube, mentioning it three times a month, and paying 3000 euros per month. Imagine what they have achieved through deception. Many users have experienced the same thing.

Exposure

2023-10-05

HappyTrader

Turkey

Quantfury has some unwritten rules that discourage scalping. While their system technically allows it, they begin to manipulate spot prices after an unspecified amount of trading, without any prior announcement or warning. This can lead to financial losses, and if you're not aware of this practice, you could end up losing your entire balance. Additionally, the transaction fees are quite steep, ranging from around $10 to $20 USD.

Exposure

2023-09-19

Thommi Motola

Chile

I was making 9,000.00 and suddenly they took all my profits and closed my account. I was lucky to run with my initial deposits. My guess... they make money with trader that lose money (90% of traders as we know, right) but if you are a ssucceful trader, they lose money, so the force you to leave. No a very honest broker. If you make money, don’t go there.

Exposure

2020-09-27

FX6284672920

Argentina

the app is full of hidden fees, such as severe delays (up to 9 seconds till the order is executed ), large slippage, etc when I was having a good strike, they locked my account and took my funds. they took 1300usd from me

Exposure

2020-08-02

Yurona

United Kingdom

Dropping anchor on QUANTFURY's trading platform, I found myself momentarily challenged. A stunning view undeniably soured by the glaring lack of live chat support – a disappointing ghost ship in the digital age. Unexpectedly turbulent waters emerged with whispers of alleged scam exposures, the uncharted territory lacking transparency on several fronts, from trading conditions to details on their trading platforms, and deposit & withdrawal processes. The QUANTFURY sail indeed proved to be an adrenaline-fueled high seas adventure - thrills, spills, and heart-stopping moments - an undeniably unforgettable trading journey.

Neutral

2023-12-05

Minhs

Nigeria

Ventured into the trading seas with QuantFury. The offshored regulation by SCB felt like walking a thin tightrope, but a unique one at that. The trading choices certainly caught my eye - stocks, crypto pairs, to indices and commodity futures... it was a broad horizon. What the absence of commissions felt like the wind pushing the boat along smoothly. But this longstanding trading voyage isn't open to all... alas, residents of USA and Canada are left at port. And the lack of transparency about trading conditions keeps one on their toes. Certainly, the journey with QuantFury does keep one leaning in!

Neutral

2023-12-04

刀

Spain

Please, for the safety of your capital, do not approach an unregulated forex broker. It will be like playing with fire to invest with this type of company!

Neutral

2023-02-14

Liz

Venezuela

Although some of this company's trading conditions seem safe, like being limited to 1:20 leverage, when it comes to regulatory licenses, I found out that it's not actually regulated by any... probably a scammer.

Neutral

2022-12-02

Carlos Meza

Venezuela

This is the best platform to invest from Latin America. It has 0 commissions and does not have any hidden charges. The withdrawal is immediate and they have good traging power

Positive

2023-07-05

保持微笑31182

Taiwan

This is wonderful and very hard to believe. I really appreciate this platform as I thought it was all scams but I found it to be true. I am coming back in a big way to invest in this platform as I believe it will get me out of my incessant financial incapability.

Positive

2023-02-22