简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro Eyes GDP Revision, US Dollar May Rise on Retail Sales Data

Abstract:The Euro is looking to revised Eurozone GDP data having shrugged off disappointing performance in Germany. The US Dollar may rise if retail sales data

TALKING POINTS – EURO, GDP, US DOLLAR, RETAIL SALES, BREXIT, BRITISH POUND

Euro ignores German GDP miss, might still move on region-wide data

US Dollar may rise if retail sales tops forecasts, improving Fed outlook

British Pound eyeing another round of votes on Brexit deal amendment

A second revision of Eurozone GDP data headlines the economic calendar in European trading hours. It is expected to confirm that output grew 0.2 percent in the fourth quarter, confirming initial estimates. The analogous print out of Germany fell short of expectations show the currency blocs largest economy ground to a standstill in the final three months of 2018.

That might open the door for disappointment on the region-wide measure, echoing over five months of steady deterioration in data outcomes out of the currency bloc relative to economists‘ projections. The Euro shrugged off Germany’s result but may yet come under pressure in the event of a potent-enough miss when the broader-based release comes across the wires.

RETAIL SALES DATA MAY BOOST US DOLLAR

The spotlight then shifts to December‘s US retail sales data. A slowdown in receipts growth is expected, with a rise of 0.1 percent marking the worst showing in three months. An upside surprise extending over two months of outperforming statistical results out of the world’s largest economy might help prolong the recent shift in Fed policy bets to a less-dovish setting, sending the US Dollar upward.

BRITISH POUND EYES ANOTHER ROUND OF BREXIT DEAL VOTE

Meanwhile, the UK Parliament will vote on another set of amendments to the Brexit withdrawal plan negotiated by Prime Minister Theresa May. The ordeal has lost a bit of its luster after Ms May said yet another vote is to be held on February 27. Asking MPs to make a call on the so-called Cooper-Boles amendment aimed at delaying Brexit if no deal with the EU is finalized will now be delayed until then.

Besides that, policymakers will take up a host of amendments. These include motions to: enshrine the February 27 vote into law (as of now it is merely promise from the PM); offer MPs a secret ballot to express their views on a preferred Brexit path before opining Ms May‘s approach; cancel Brexit altogether; publish updated projections on the divorce’s economic impact; and hold a second national referendum.

Most of these efforts seem rather fanciful and unlikely to pass. The Brexit saga has been replete with surprises bucking conventional wisdom however, including the outcome of the fateful 2016 referendum itself. If one or more of the amendments meaningfully shifting power over the EU/UK split from the government to Parliament succeeds, the British Pound might celebrate.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

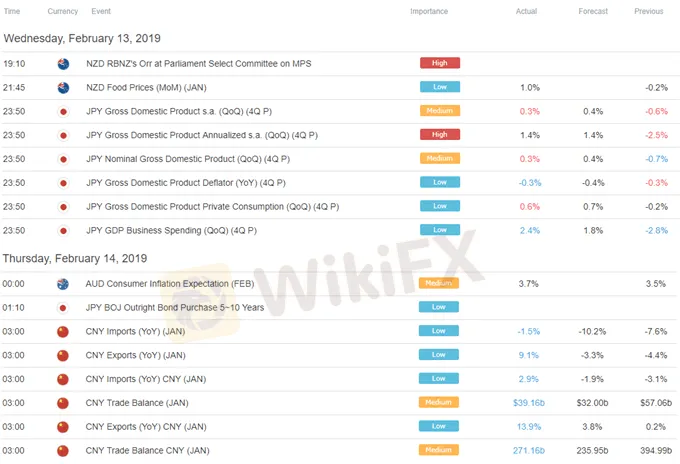

** All times listed in GMT. See the full economic calendar here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

High Volatility Economic Events for This Week (GMT+8)

This week, key economic events expected to generate high volatility include China's Q2 GDP and retail sales data, impacting CNY. The US will release Core Retail Sales and Philadelphia Fed Manufacturing Index, affecting USD. The UK's CPI data will influence GBP, and the ECB Interest Rate Decision and Press Conference will impact EUR. These events will drive significant market movements due to their influence on monetary policy and economic outlooks.

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

US Dollar Leaps on Fed Re-Nomination Pumping Up Treasury Yields. Will USD Keep Going?

The US Dollar rode higher as US yields rose across the curve. Crude oil prices recovered after OPEC+ threw a curve ball. With Thanksgiving almost here, where will USD go on holiday?

Euro (EUR) Price Outlook: No End Yet in Sight for EUR/USD Weakness

EUR/USD continues to tumble, with no sign yet of a rally or even a near-term bounce.. The pair has dropped already beneath the support line of a downward-sloping channel in place since late May this year to its lowest level since July 2020 and there is now little support between here and 1.1170. From a fundamental perspective, the Euro is suffering from a continued insistence by the European Central Bank that much higher Eurozone interest rates are not needed.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

Currency Calculator