简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IDR Eyes Bank of Indonesia as USD May Appreciate on Soft EU Data

Abstract:ASEAN currencies mostly fell this past week against the US Dollar. USD/IDR eyes the Bank of Indonesia with the threat that soft European economic data

ASEAN Fundamental Outlook

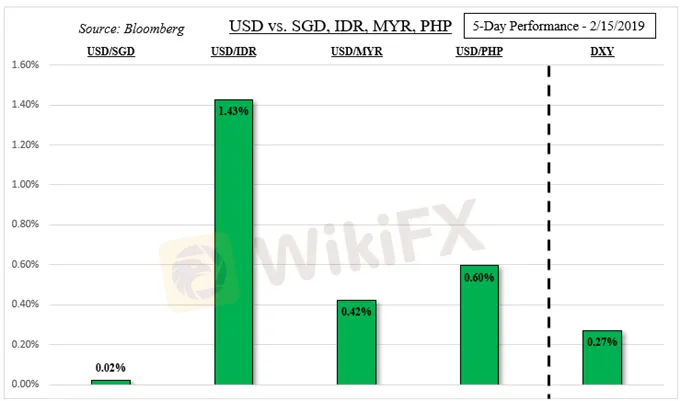

Most ASEAN currencies weakened as US Dollar narrowly edged higher, especially IDR

Indonesian Rupiah may not weaken if its associated central bank doesnt see a hike soo

MYR, SGD and PHP may weaken as USD gains on more dismal European economic new

Trade all the major global economic data live and interactive at the DailyFX Webinars. Wed love to have you along.

Last week, the US Dollar ended cautiously higher (if you are looking at DXY) and this was felt across most ASEAN currencies. The highly liquid and yielding Greenback saw seesawing price action as rising stock prices and ebbing haven demand competed for its attention. Factors such as weak economic data from Europe, mixed news on trade wars and the US avoiding going back into a shutdown all contributed to this.

The Indonesian Rupiah was the notable underperformer, falling with the Jakarta Stock Exchange Composite Index. This was partially due to Indonesian exports dropping by the most since June 2017, with the trade deficit widening by more than expected. The Malaysian Ringgit also depreciated despite a better-than-expected GDP report in Q4. The Bank of Malaysia noted that the MYR outlook could be affected by external uncertainties.

Next week, the regional and external economic event docket notably thins out. Most important, USD/IDR will be eyeing a Bank of Indonesia monetary policy announcement. Rates are anticipated to be left unchanged with inflation running within their parameters. Meanwhile, the Fed has considerably reduced its hawkish stance. Keep an eye out for what the Indonesian central bank has to say about the state of IDR.

They have consistently upheld that they see it as undervalued. As such, a lack of a clear-cut signal to hike again may not necessarily depreciate the Rupiah. Its performance will more likely depend on how the central bank feels about its performance which - granted - has been appreciating since October. Technically speaking, USD/IDR has cleared a key resistance barrier but intervention to keep it down presents a persistent threat.

For what may impact the US Dollar next week - and thus USD/MYR - keep an eye on the FOMC minutes from the January monetary policy announcement. Reiteration of their more cautious approach may hurt the Greenback. Lately, more attention has been placed on European economic data after Italy went into a technical recession and Germany narrowly avoided one.

With that in mind, watch out for the German and Eurozone ZEW sentiment surveys. Data has been tending to underperform relative to economists expectations, opening the door to a downside surprise. If the US Dollar gains as equities turn lower, the Singapore Dollar may succumb to selling pressure relatively speaking. Fundamentally, the S&P 500 could be heading for a reversal in the medium term which leaves equities vulnerable.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator