Score

Decho Capital Limited

Australia|1-2 years|

Australia|1-2 years| https://dechocapital.com/?lang=en

Website

Rating Index

Contact

Licenses

Licenses

Licensed Entity:DECHO CAPITAL PTY LIMITED

License No. 001307575

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Australia

AustraliaUsers who viewed Decho Capital Limited also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- Global Business

Website

dechocapital.com

Server Location

United States

Website Domain Name

dechocapital.com

Server IP

172.67.138.227

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| Decho Capital Limited Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Australia |

| Regulation | Unregulated |

| Market Instruments | Forex pairs, stocks, commodities, stock indices, major virtual currencies |

| Demo Account | Not mentioned |

| Leverage | 1:100 |

| Spread | Currency pairs like EUR/USD and GBP/USD: 0.6 -1 pip;Precious metals: 2 - 2.1 pips;Energy: 1 - 8.2 pips |

| Trading Platform | Mobile trading app |

| Min Deposit | Not mentioned |

| Customer Support | Email: support@dechocapital.com |

Decho Capital Limited Information

Established in Australia in 2023, Decho Capital Limited offers a full range of trading assets including forex pairs, equities, commodities, stock indices and major virtual currencies. Clients mainly contact its campany through E-mail by support@dechocapital.com.

Pros and Cons

| Pros | Cons |

| A wide range of financial products from a single account | Unregulated Status |

| Convenient mobile trading app | No live chat or phone support |

| Real-time monitoring of investments | High spread for some assets |

| Clear contact information provided |

Is Decho Capital Limited Legit?

Decho Capital Limited once has been regulated by the Australian Regulatory Authority with the license number of 001307575. However, its license has been revoked.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| ASIC | DECHO CAPITAL PTY LIMITED | Appointed Representative(AR) | 001307575 |

What Can I Trade on Decho Capital Limited?

Decho Capital Limited offers traders the opportunity to trade on forex pairs, energy and commodities(crude oil and natural gas), stock indices(US100 and JP225), major virtual currencies(Bitcoin and Ethereum).

| Tradable Instruments | Supported |

| Forex pairs | ✔ |

| Energy and commodities | ✔ |

| Stock indices | ✔ |

| Major virtual currencies | ✔ |

| Bonds | ❌ |

| Binary Options | ❌ |

| Mutual Funds | ❌ |

| Futures | ❌ |

Account Types

Only ONE type of account is provided for clients of Decho Capital Limited.

Leverage

Decho Capital Limited offers a maximum leverage of 1:100.

The minimum margin is 50.

The minimum lot number.is 0.01 lot.

Forced settlement margin maintenance rate is 100%.

Decho Capital Limited Fees

In the forex market, the spread depends on the currency pair. The EUR/USD spread is 0.6 points, while the GBP/USD spread is 1 point.

In energy and commodity trading, the spread between XTIUSD (crude oil) and XNGUSD (natural gas) was 1 point and 8.2 points, respectively.

For virtual currencies such as BTCUSD (Bitcoin) and ETHUSD (Ethereum), the spread is 28.7 points and 6.2 points, respectively.

In addition, Decho Capital Limited charges a transaction fee of US $11 (tax included) per 100,000 currency transactions (1 lot).

| Spread | ||

| Forex market | EUR/USD | 0.6 |

| GBP/USD | 1 | |

| Energy and Commodity | Crude oil | 1 |

| Natural gas | 8.2 | |

| Virtual currencies | Bitcoin | 28.7 |

| ETHUSD | 6.2 |

Trading Platform

A trading app for smartphones is specially provided by Decho Capital Limited.

| Trading Platform | Supported | Available Devices | Suitable for |

| Trading app | ✔ | smartphones | Investors of all experience levels |

Deposit and Withdrawal

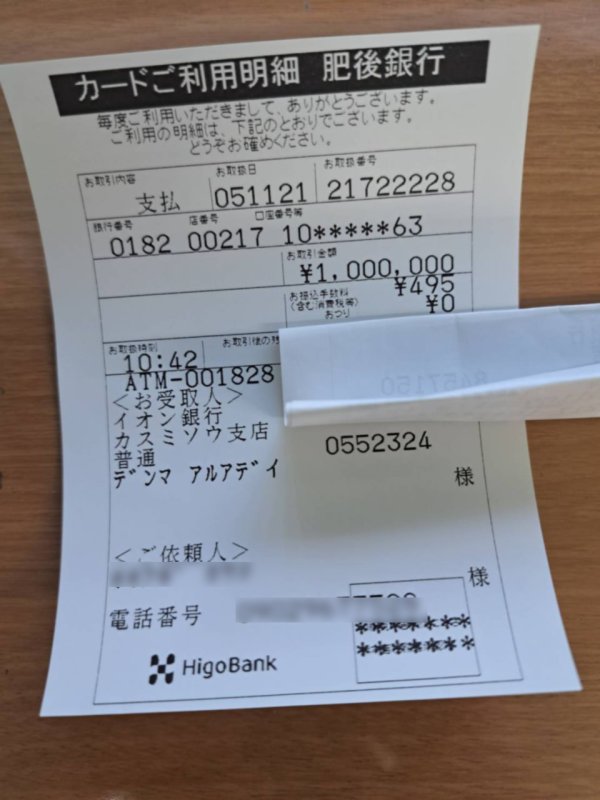

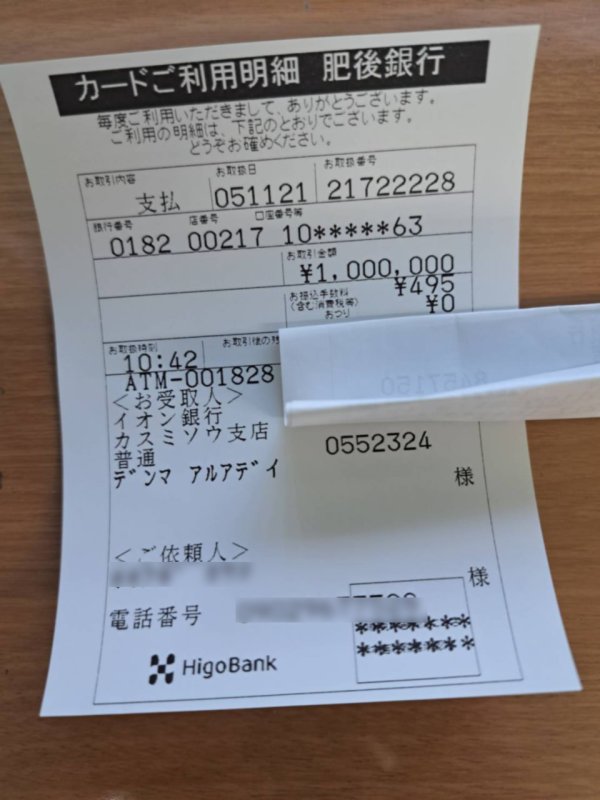

Customers can choose domestic bank transfers and national banks.

Cryptocurrency remittances, especially the use of TRC20 tokens such as USDT, provide an alternative route for deposits.

For domestic bank transfers, the transfer fee is usually borne by the customer, while cryptocurrency remittances require $1 dt plus 3% commission.

Domestic bank transfers are usually completed within 15 minutes of deposit, and any unconfirmed payment, if not confirmed by 5pm, is reflected on the next business day.

Cryptocurrency remittances offer instant processing, usually within 15 minutes, with orders received after 5pm processed on the next business day.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Australia Appointed Representative(AR) Revoked

- High potential risk

Comment 6

Content you want to comment

Please enter...

Comment 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Laulii

Japan

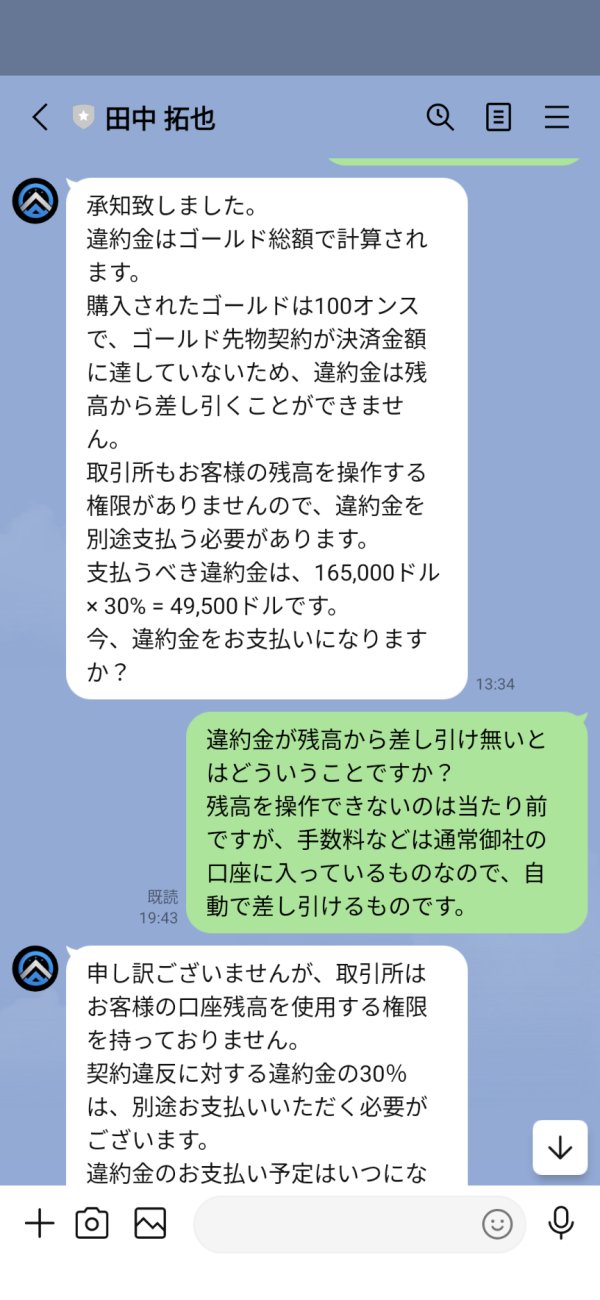

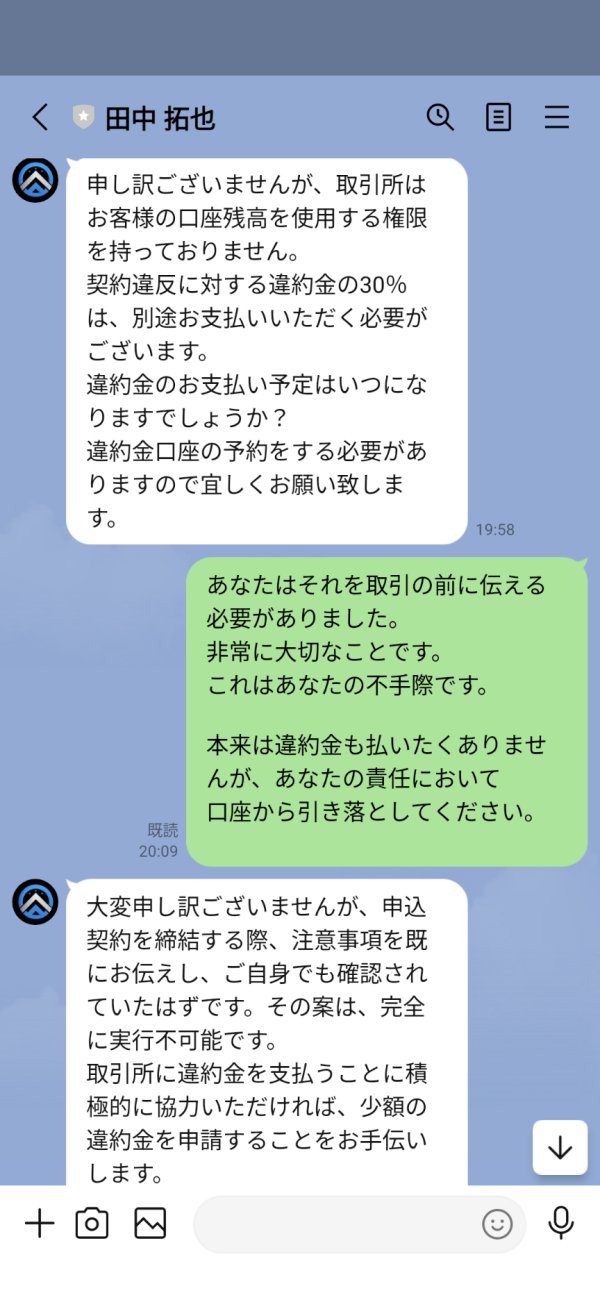

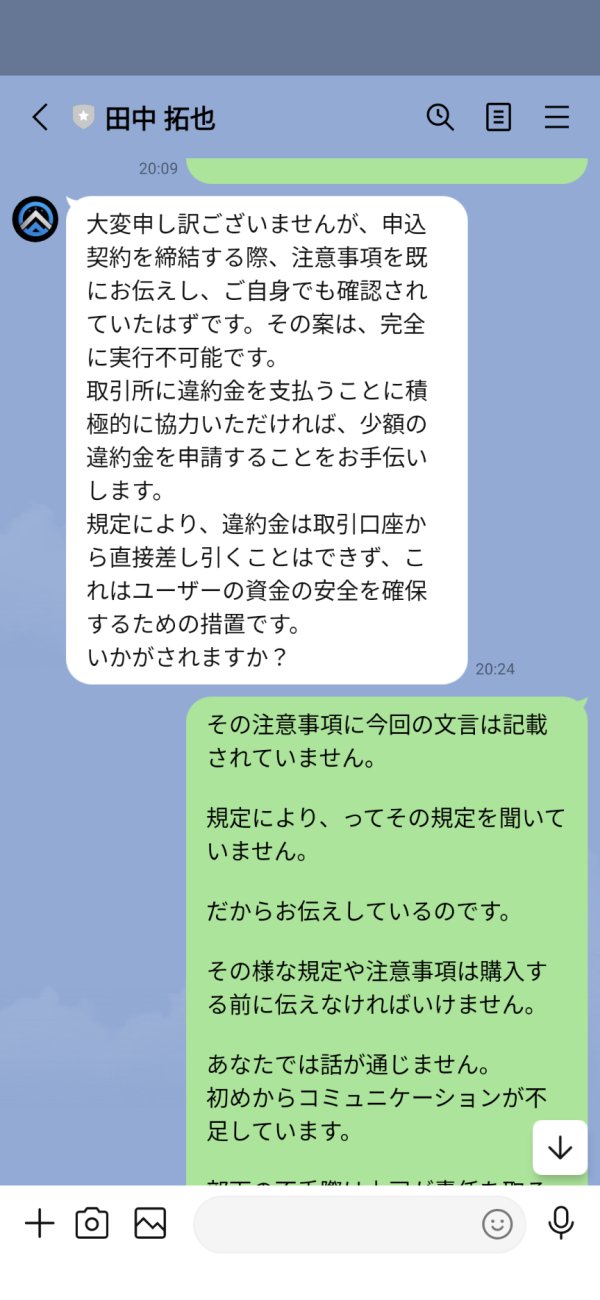

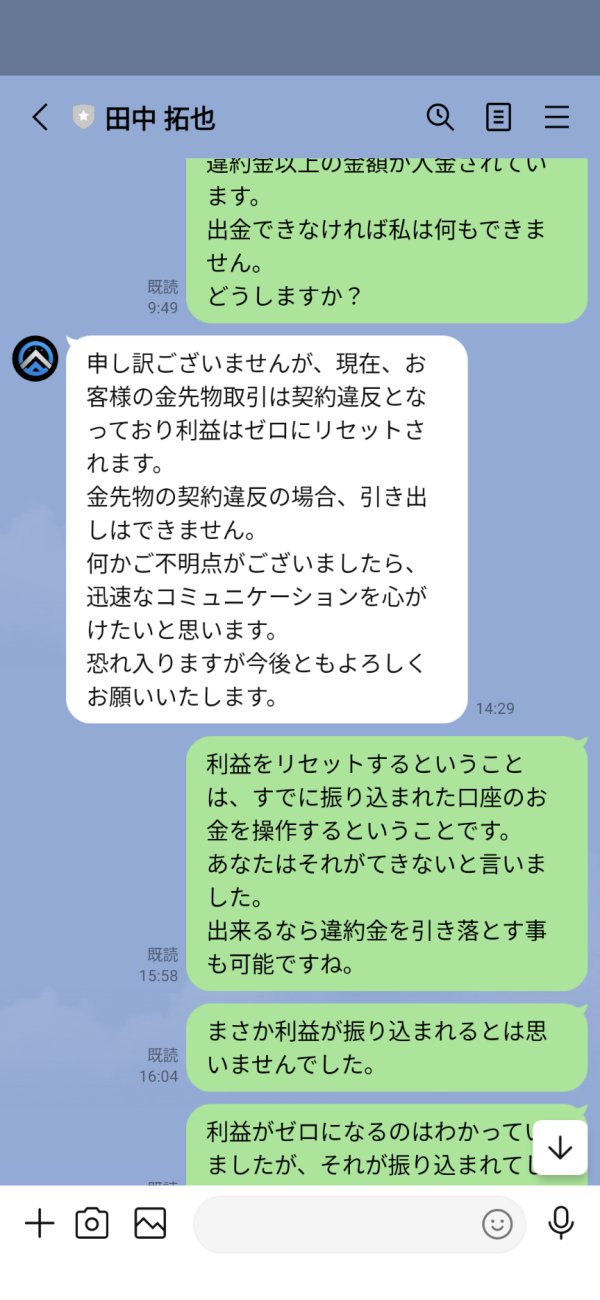

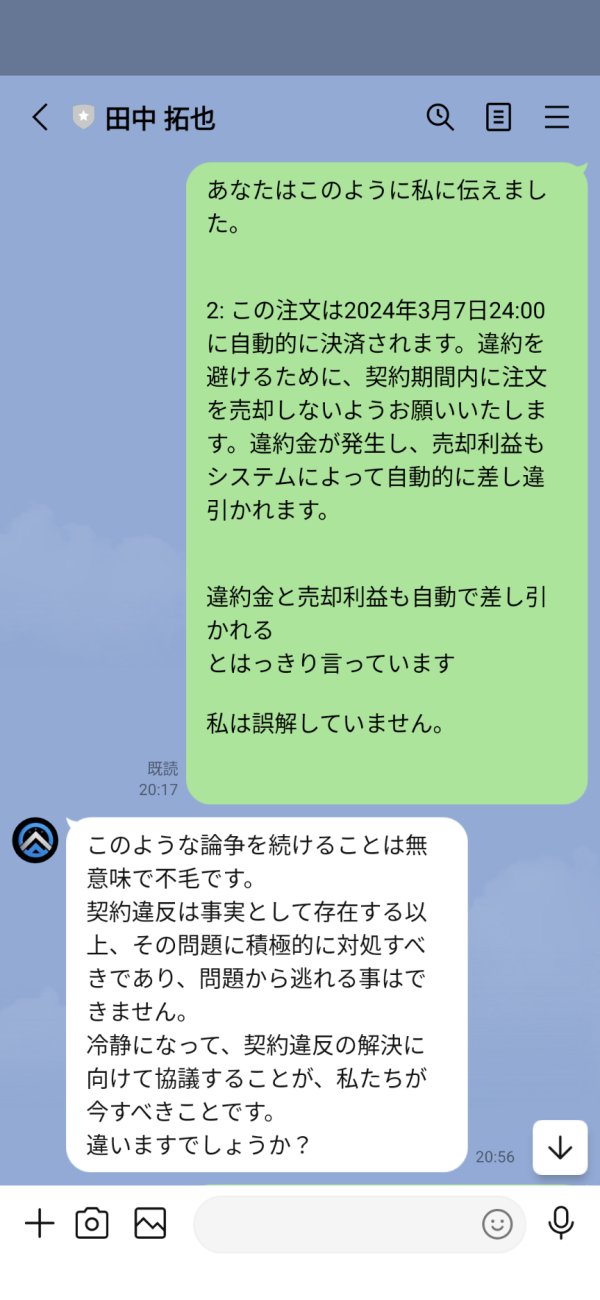

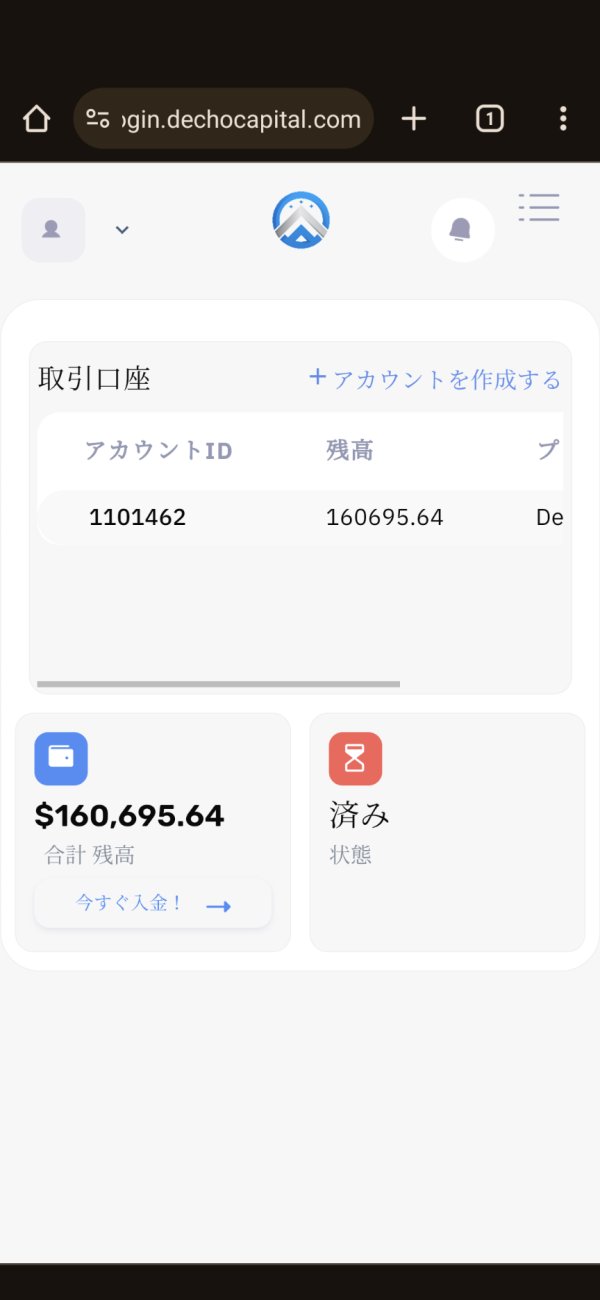

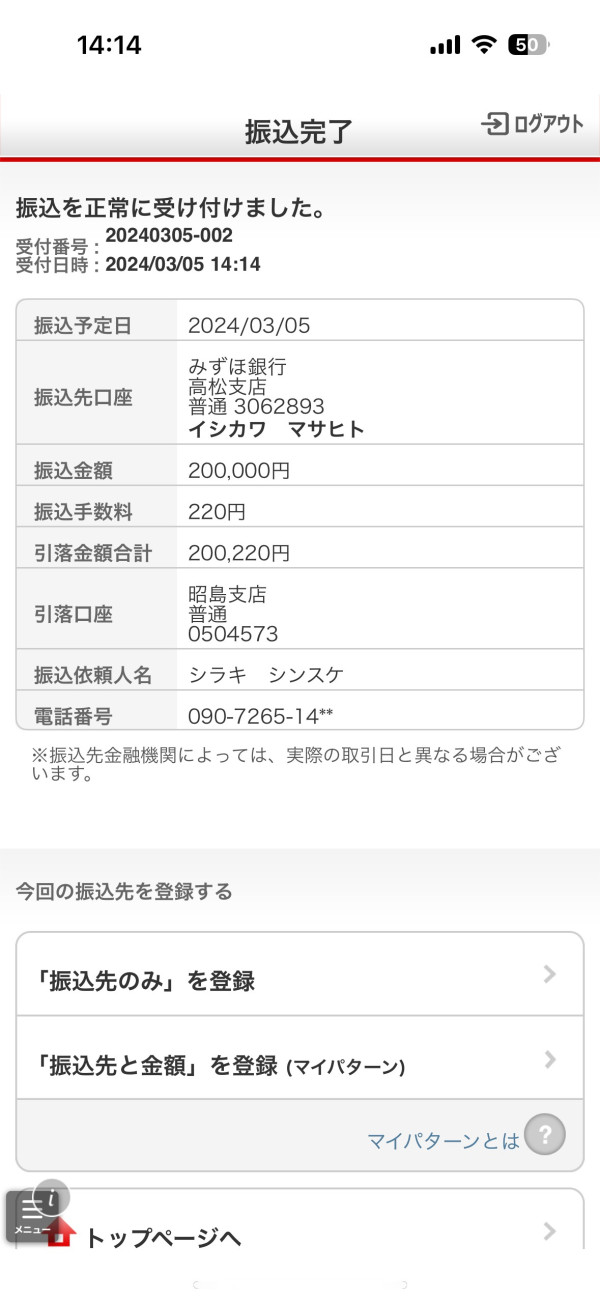

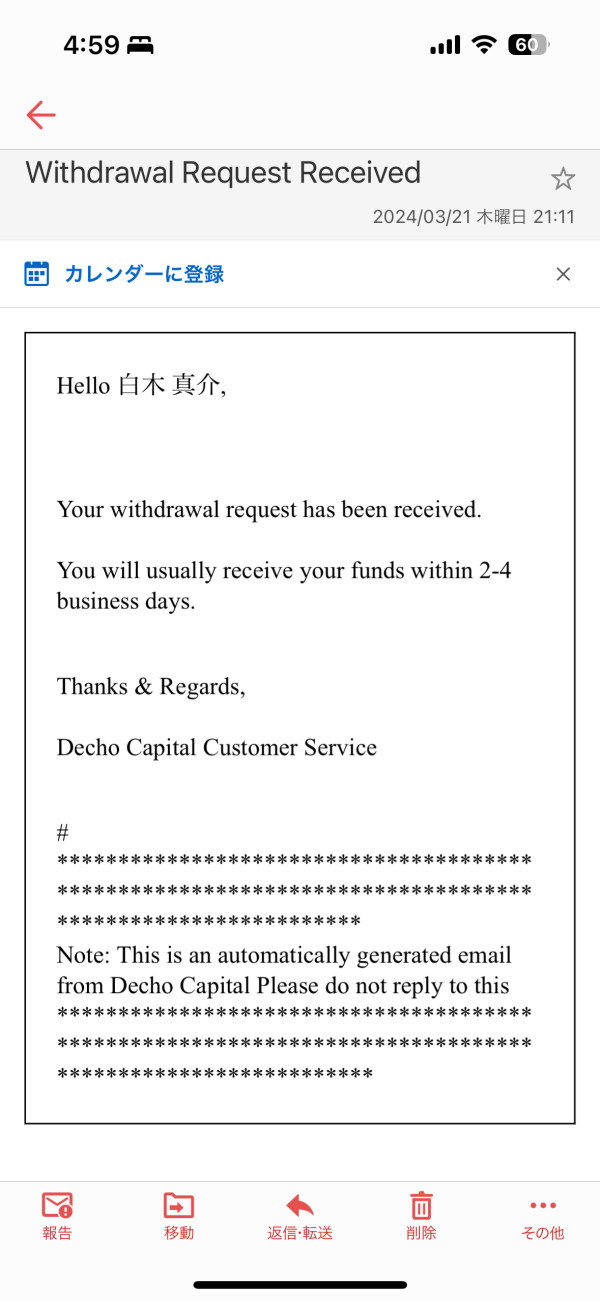

I was invited to the group, and the discussion shifted from high-dividend stocks to FX investment. I saw that Mr. Hongo and his friends posted in the Line group as long-distance drivers. It was immediately canceled, but I took a closer look. It was confirmed that the same content was posted on LINE under different names, and that they were playing multiple roles. Initially, they said that the penalty would be deducted from their FX account, but they changed their story to say that they would have to pay a separate amount of nearly 7 million yen. There was a balance in my account, so even though I asked them to withdraw money from it, they told me that it was a breach of contract and that if I didn't pay, my account would be frozen. I contacted Australian support via email, but when I told them the same thing, they lost contact with me. I can no longer log in to my account. I paid 2.8 million yen and had $160,000 in my account.

Exposure

2024-04-10

gonbei

Japan

I would like to request mediation because the withdrawal process is not progressing.

Exposure

2024-03-26

かおり

Japan

I can't withdraw money. This exchange colludes with a fraudster named Kazuhiko Hongo to solicit investors in the LINE group and deceive them. It's a complete scam. I've reported it to the police and the Financial Services Agency. Please be careful.

Exposure

2024-02-19

かおり

Japan

I was deceived by a scammer named Kazuhiko Hongo and was induced to deposit money into this exchange. But now I can't withdraw money. I have reported this problem to the Japanese Financial Services Agency. I also went to the police. They are currently investigating.

Exposure

2024-02-19

Bambang Soeprijanto

Indonesia

They don't have many complaints or bad records, and their trade history is pretty transparent. It's nice to have that transparency, even if the platform isn't perfect.

Neutral

2024-06-26

Mark Martinez

Netherlands

The mobile app is functional but could benefit from additional features. Account opening process was straightforward, but verification took a bit longer.

Positive

2024-06-28