简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBPUSD Price Analysis: No-Deal Brexit Likely Avoided

Abstract:GBPUSD Price Analysis: No-Deal Brexit Likely Avoided

GBP Price Analysis and Talking Points:

No Deal Risks Recede, GBP to Remain Firm

Options Market Suggest No-Deal Likely Avoided

Uncertainty to Persist Despite Possible Extensio

See our quarterly GBP forecast to learn what will drive prices throughout Q1.

No Deal Risks Recede, GBP to Remain Firm

Since Theresa May promised parliament that MPs will vote on the Withdrawal Agreement (Mar 12th), no-deal (Mar 13th) and an Article 50 extension (Mar 14th), GBP has gained across the board, hitting 7-month highs vs USD and the best level since May 2017 vs EUR. Largely on the basis that no-deal risks have eased quite considerable, while the likelihood of an Article 50 extension have also increased, consequently suggesting that the approach to Brexit is softening. This was further reinforced by MPs voting to pass the cooper amendment yesterday, which puts Theresa Mays pledge to hold a vote on Brexit delay in writing.

Options Market Suggest No-Deal Likely Avoided

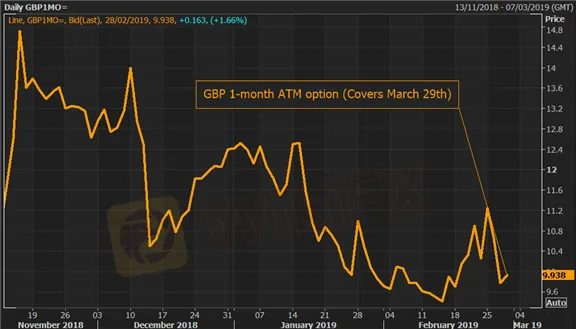

With just one month till the scheduled Brexit date, 1M option expiry now covers this. However, risk premiums have not seen a notable lift, implying that markets do not see a significant risk that the UK will leave the EU with a no-deal. Alongside this, while GBP 1M risk reversals remain in negative (higher premium for puts vs calls), this has not been extended to extreme levels, further suggesting that a no-deal has likely been avoided.

Uncertainty to Persist Despite Possible Extensio

While the probability of a Brexit delay of 2-3 months have increased. This does not necessarily mean that the Brexit uncertainty will not continue to linger given that it is not entirely certain whether a significant change will be made. However, through the process of elimination the threat of a no-deal would continue to recede, which in turn could lift GBPUSD towards 1.35.

GBPUSD 1-MONTH ATM OPTIO

GBPUSD 1-MONTH RISK REVERSAL

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex - weekly analysis

A week of consolidation Ahead amid renewed USD strength

British Pound Technical Analysis - GBP/USD. Trend to Resume or Reversal For Sterling?

GBP/USD Technical Analysis - the pair has bounced back after making a new low for the year. The Pound has seen increased volatility as it looks to hold ground. Will Sterling continue to be undermined and make fresh lows again?

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

GBP/USD Volatility Drops Sharply, USD/JPY Rises on BoJ Sources - US Market Open

GBP/USD Volatility Drops Sharply, USD/JPY Rises on BoJ Sources - US Market Open

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Currency Calculator