简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Sterling (GBP) Price, Brexit News and Pivot Points Analysis

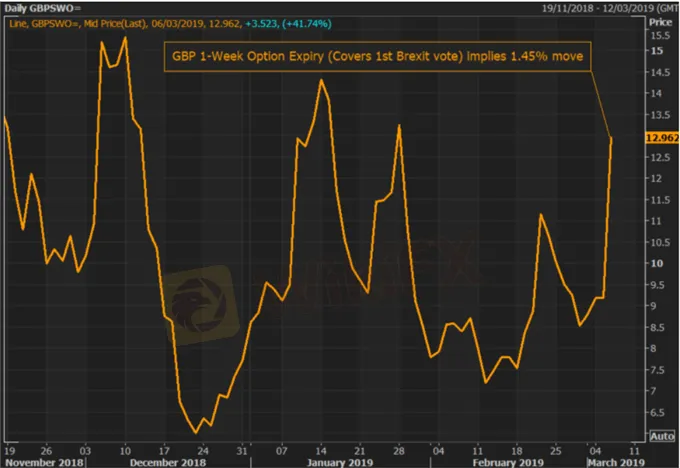

Abstract:The British Pound remains rangebound as Brexit talks continue but Sterlings implied volatility highlights price risks for the week ahead.

GBPUSD Price, Volatility and Pivot Point

Cable trades either side of 1.3150.

Volatility likely to ramp up next week as MPs vote.

Q1 2019 GBP Forecast and USD Top Trading Opportunitie

Sterling price action remains muted in early trade, but volatility is expected to ramp-up over the next week as we head into three consecutive days of Brexit votes in Parliament next week, starting on Tuesday, March 12. These votes will give Sterling traders greater clarity on the current standing of EU-UK negotiations and the likelihood of either a soft Brexit, PM Mays bill with/without a short extension of Article 50, or if the UK is likely to leave on March 29 without a settlement.

The British Pound got a marginal boost yesterday when Bank of England governor Mark Carney said that the market is currently underestimating interest rate hike expectations as forecasts show that inflation is above the central banks three-year forecast.

GBPUSD is trading either side of 1.3150, after just nudging below 1.3100 Tuesday, and is likely to remain rangebound ahead of important US data releases, including the monthly labor report (non-farm payrolls) on Friday. The Fed‘s Williams and Meister speak later in today’s session ahead of the release of the Federal Reserves Beige Book.

DailyFX Calendar.

The daily classic pivot points show pivot at 1.3158 with R1 and S1 at 1.3219 and 1.3118 respectively.

GBPUSD Daily Price Chart (June 2018 – March 6, 2019)

Retail traders are 52.4% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however currently suggest a mixed trading bias for GBPUSD.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GBP/USD (CABLE) 4Hour Anticipation

Daily wise bearish structure, but as 4H shown shift in structure to the topside

Weekly British Pound Forecast: Inflation Report Due Ahead of BOE Meeting; Brexit Talks Ongoing

As Brexit talks persist, the BOE remains sidelined. And with the UK parliament prorogued, all attention is on UK PM Johnson's talks with his EU counterparts.

GBPUSD Price Rallies to a Six-Week High, Brexit Latest

GBPUSD has just hit its highest level since late-July and is eyeing further gains on a combination of a marginally stronger Sterling complex and a weak US dollar.

EURGBP Price Outlook Tracks ECB Monetary Policy and Brexit News

Two weak currencies that are currently looking ahead to potentially defining moments that will provide a clear signal for both. How will they compare against each other?

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Currency Calculator