简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Central Bank Weekly: After Fed Meeting, One Cut Priced-In for 2020

Abstract:The March Fed meeting produced a large reaction by both US Treasury yields and the US Dollar.

Talking Points

- The Fed eliminated the chance of a 25-bps rate hike in 2019, initially knocking the US Dollar lower in the process.

- However, rates markets were already pricing in a 27% chance of a rate cut before the end of the year, and pricing hasnt become materially more dovish since yesterday.

- Retail traders are shifting into neutral positions across USD-pairs – in EURUSD, GBPUSD, and USDJPY.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

The March Fed meeting produced sizeable reactions across global financial markets – Gold prices and US Treasury rates had notable reactions, as did the US Dollar. With Fed Chair Jerome Powell throwing in the towel on a potential rate hike in 2019 – a dramatic departure from the December 2018 Summary of Economic Projections that revealed one to two hikes were possible this year – an initial visceral by markets was almost guaranteed.

Rates Markets Are Not Getting Significantly More Dovish

Less than 24-hours after the FOMC concluded their March gathering, the US Dollar has essentially reversed all of its losses. One needs to look no further than rates markets for the reason why. Prior to yesterdays Fed meeting, rates markets were pricing in a 27% chance of a 25-bps rate cut before the end of the year.

Now, the odds of a rate cut by December are at 33%. Despite all the fire and fury around yesterdays Fed meeting, no can objectively say that pricing has changed all that significantly. The Fed has simply arrived at a place where the market has been for many months now – including prior to the 2018 US midterm elections (see section: How Quickly Do Traders Spot Shifting Fed Narrative?).

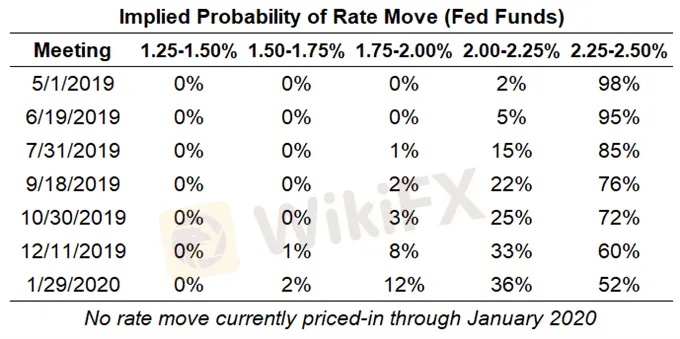

Federal Reserve Rate Hike Expectations (March 21, 2019) (Table 1)

But it‘s not just Fed funds futures that have budged little since yesterday, perhaps underscoring why the US Dollar hasn’t seen further downside, and in fact, reversed higher. We can measure whether or not a rate cut is being priced-in for 2020 by examining the difference in borrowing costs for commercial banks over a one-year time horizon in the future.

The spread between the Eurodollar June 2019 and 2020 contracts as well as the Eurodollar December 2019 and 2020 contracts has remained below zero for much of this year– and while these spreads have widened out this week around the Fed meeting…

Eurodollar December 2019/2020 Spread: Daily Timeframe (October 2018 to March 2019) (Chart 1)

…the Eurodollar December 2019 and 2020 contract spread is flat today, after falling from about -19-bps priced-in to -26-bps priced-in. While it may be true that the period of “patience” dictated by Fed Chair Powell is still being observed, markets are forward looking, and as such, a full rate cut has been priced-in by the end of 2020. But thats all; there has been no significant follow through today. In a sense, this confirms the pre-FOMC notion that all of that dovishness was essentially priced-in.

DXY Index Chart: Daily Timeframe (June 2018 to March 2019) (Chart 2)

Prior to the Fed meeting, it was noted that “given the pricing of a potential December cut, potential downside opportunities for the US Dollar may be limited.” After the Fed meeting this week, and given the volatile price action seen in the past 24-hours, it seems appropriate that the near-term forecast for the DXY Index remains neutral. The weekly candle will be of particular importance as price grapples with not only breaking the triangle its consolidated in since November, but also losing the uptrend from the 2018 low.

Read more: GBPUSD Price Limited as BOE Remains Sidelined by Latest Brexit News

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 26 August: Bitcoin (BTC) Breaks Out Above $60,000, Faces Resistance at $72,000

Bitcoin traded above $60,000 on Friday, gaining over 4% this week but staying within a $57,000 to $62,000 range for the past 15 days. On-chain data reveals mixed signals, with institutions accumulating while some large holders are selling. Inflows into US spot Bitcoin ETFs and potential volatility from ongoing Mt.Gox fund movements could impact Bitcoin's price in the coming days.

Gold Price Tops $2500 For the First Time

Gold prices soared above the $2,500 mark for the first time, driven by expectations of potential interest rate cuts, which have weakened the dollar to its recent low levels. Market participants are now focused on Wednesday’s FOMC meeting minutes for insights into the Fed’s next monetary policy moves.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Exposed by SC: The Latest Investment Scams Targeting Malaysian Investors

Currency Calculator