Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

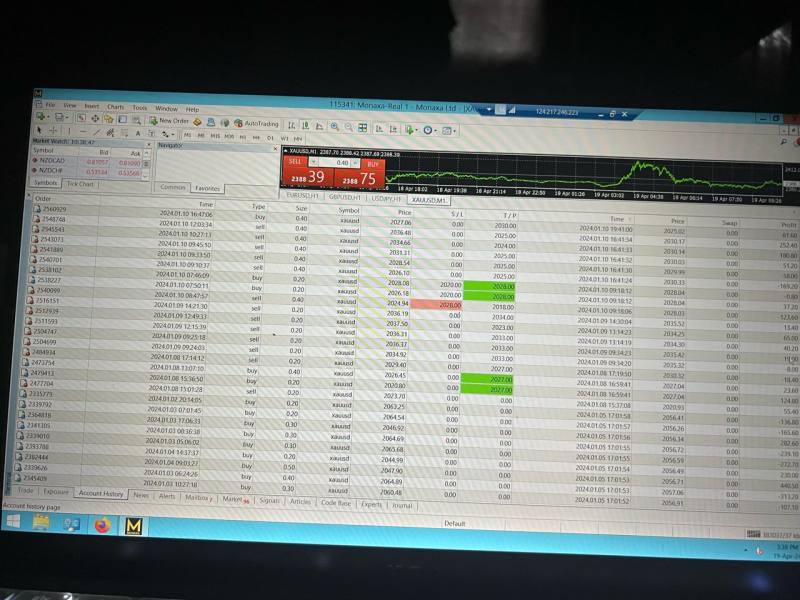

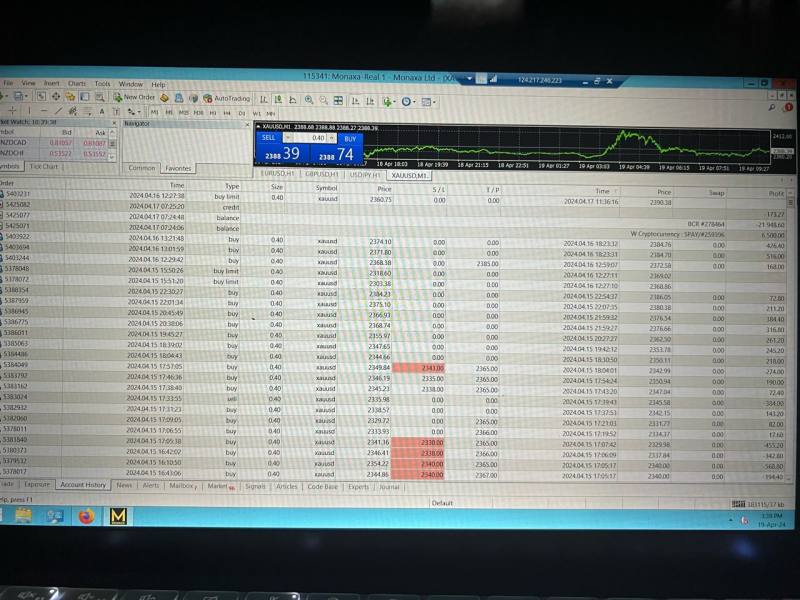

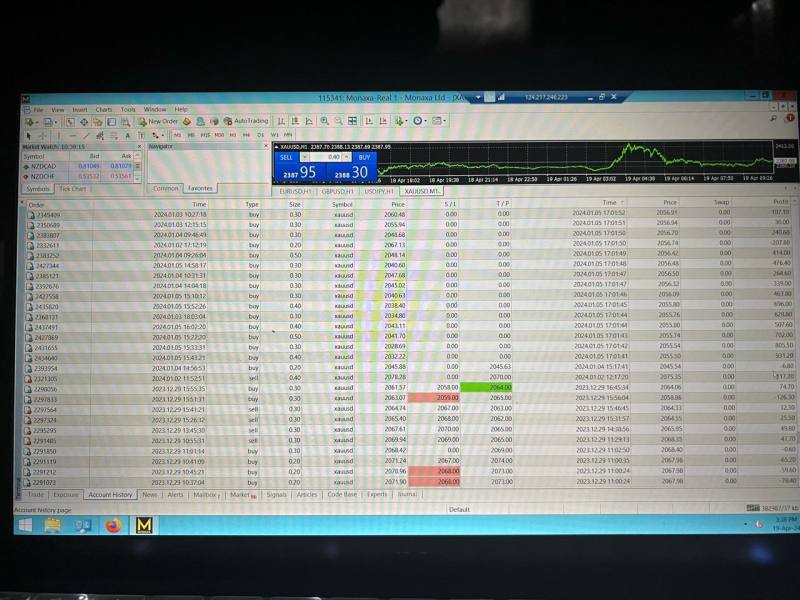

FX2248113605

Malaysia

Suddenly said i break their Rules that im multiple log in with same vps and directly deducted all my credit around 22k USD!!!! i ask for live chat service to asist me and they ask me via email to contact them but everytime i contact them they doesnt wan to answer my email and directly deducted all my credit. since i start trade from so many month.BTW i have too much transaction tht i been trade in this broker so i just roughly took some photo.

Exposure

2024-04-19

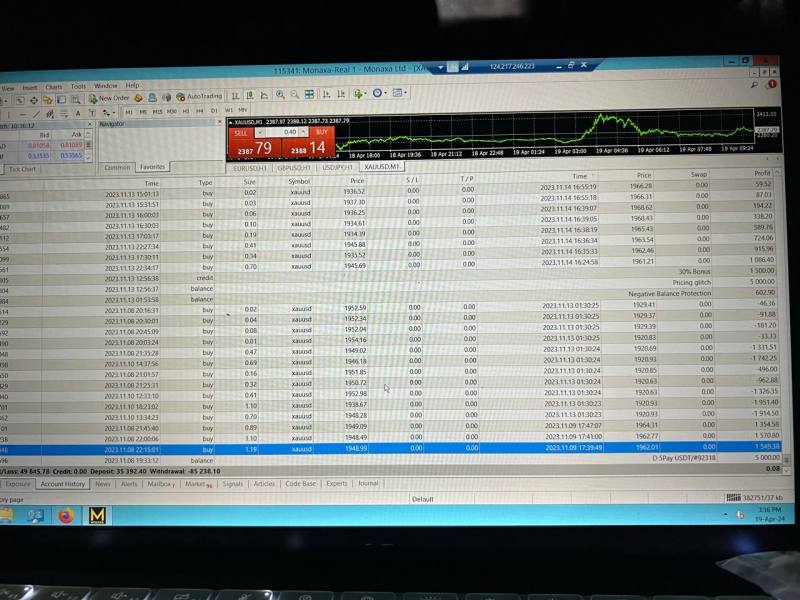

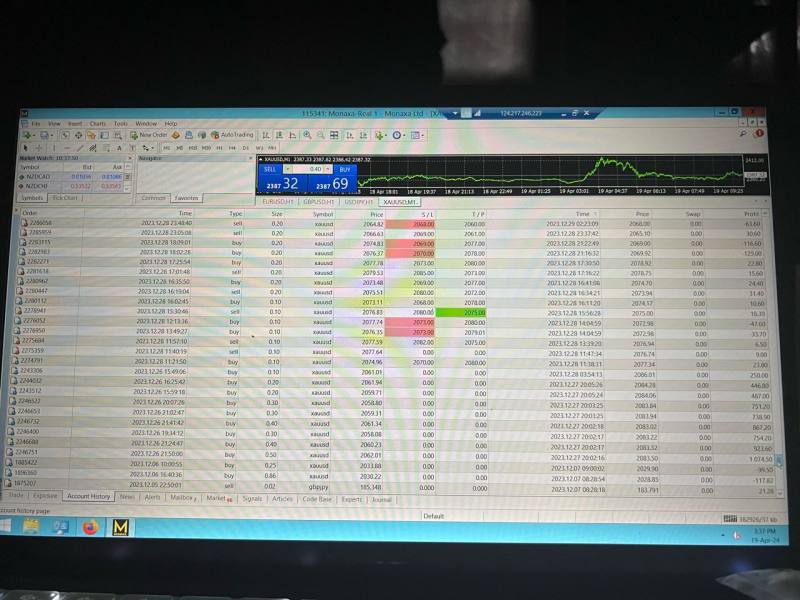

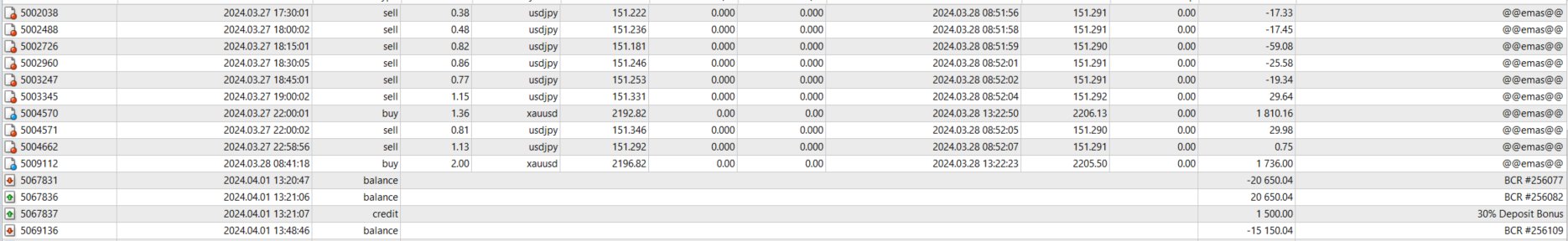

FX3149209943

Malaysia

22/3/2024- Deposit $5500 to Monaxa01/04/2024- $15150.04 was removed from MT4 without any notice.02/04/2024- Received a call from broker Business Development Manager. Claim that I won too much.

Exposure

2024-04-11

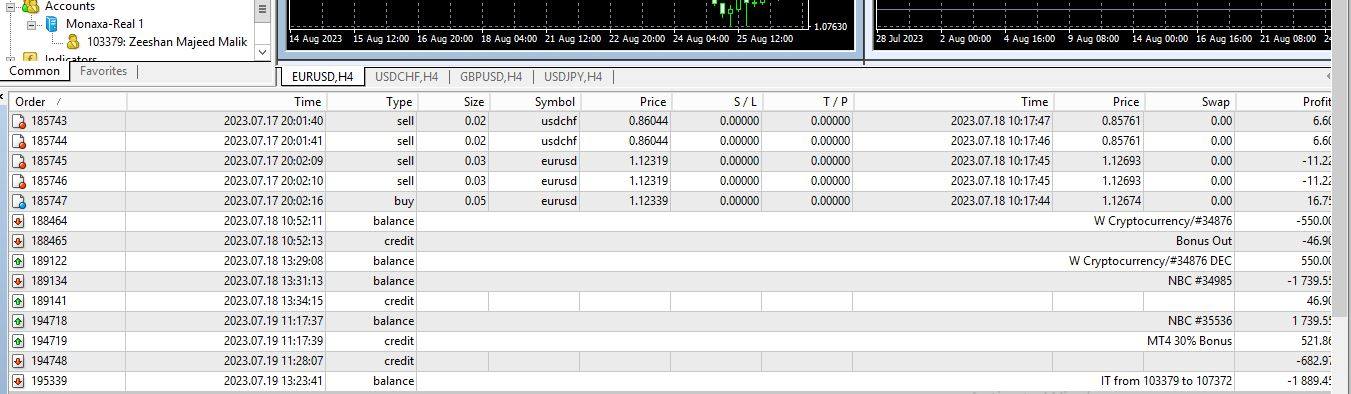

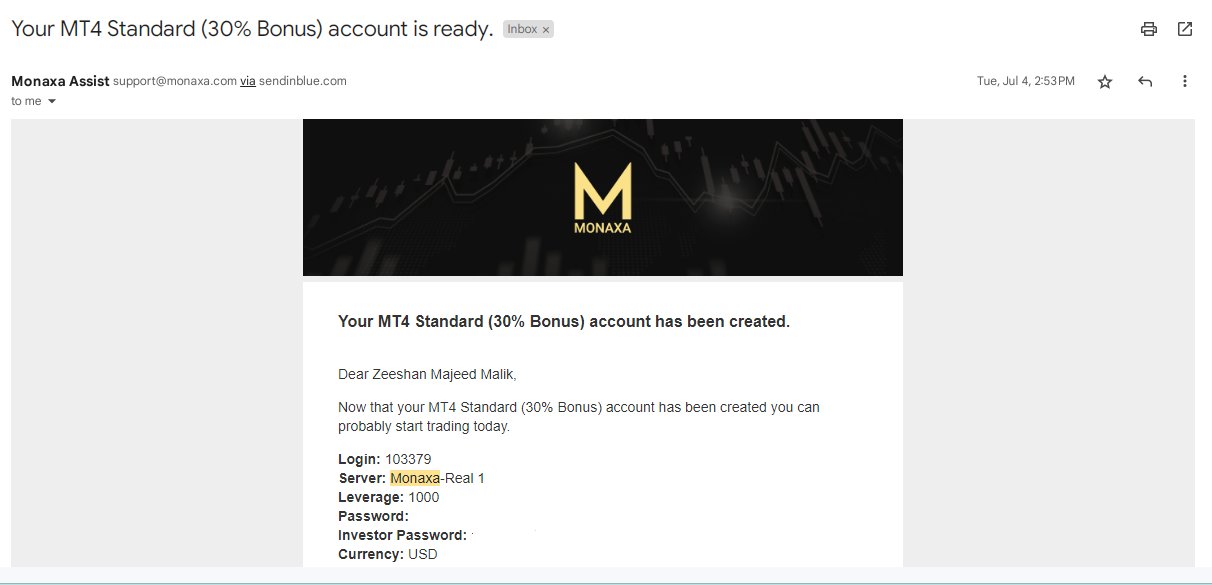

Zeeshan5435

Pakistan

Hi All Traders Avoid This borker Please! Monaxa broker has done SCAM with me and my friends also ,,,,, He close my account Mt4 103379 , my fund about 682 USD in the account but they close and disable mt4 also ,,, , I always referred to couple of friends and family members,This broker is a biggest scam in market,,,,,, but they SCAM 682USD , this amount is big amount for me return my amount and close my account

Exposure

2023-09-20

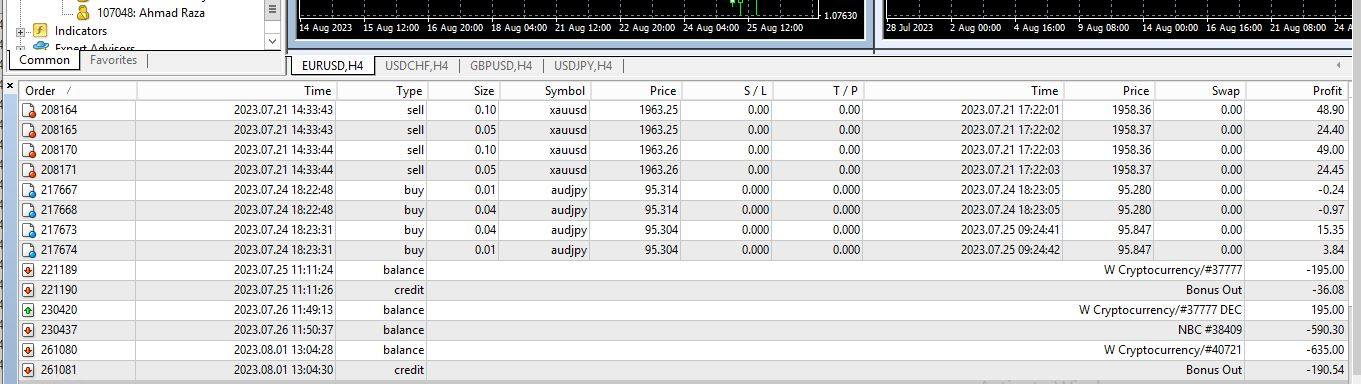

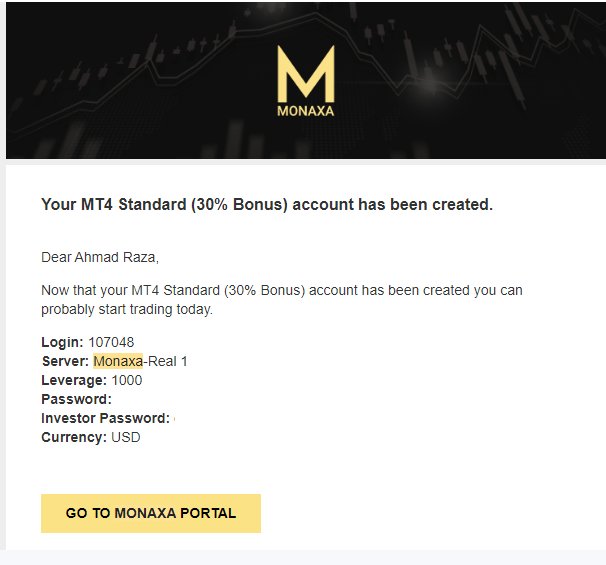

Ahmad5242

Pakistan

Hi Avoid All Traders: This Monaxa brooker is a biggest scam in market,,, Monaxa broker has done SCAM with me and my friends also ,,,,, He close my account Mt4 107048 , my fund about 590USD in the account but they close and disable mt4 also ,,, , I always referred to couple of friends and family members,,,, but they SCAM 107048 USD , this amount is big amount for me,,return my amount and close my account

Exposure

2023-09-20

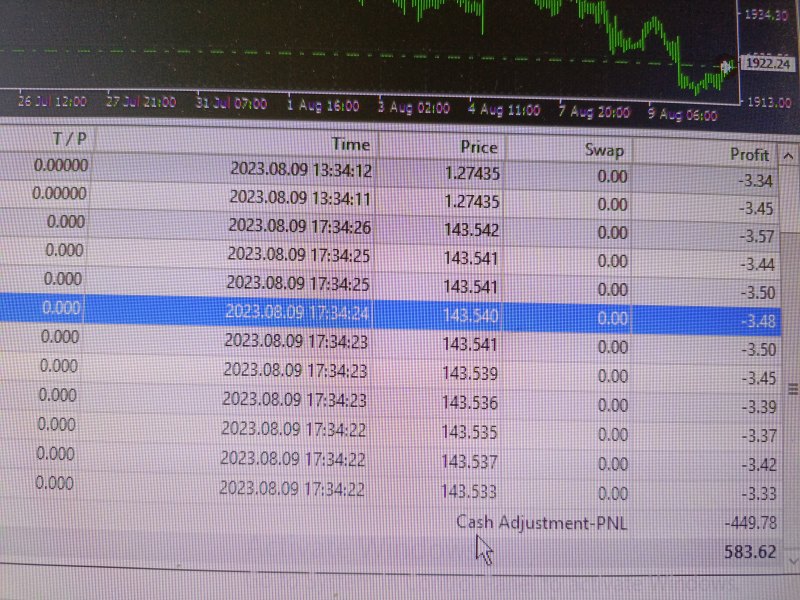

FX2414998452

Pakistan

BIGGEST SCAM BROkER MONAXA BROKER SCAM FUND Hi Avoid All Traders: This brooker is a biggest scam in market Hi All traders,,, Monaxa broker has done SCAM with me and my friends also ,,,,, He close my account Mt4 106743 , my fund about 1071 USD in the account but they close and disable mt4 also ,,, , I always referred to couple of friends and family members,,,, but they SCAM 1071USD , this amount is big amount for me,,return my amount and close my account

Exposure

2023-08-26

Cherrie

Malaysia

Monaxa has some solid leverage options, which is cool if you're into that kind of thing. And their customer service is really good, they're always there to help if you need it. Overall, Monaxa's got some good things going on.

Neutral

2024-07-09

Alonso599

Ecuador

I am happy with this broker, I got a great broker with a lot of experience who helped me generate profits. With my verified account, the withdrawal was done in a matter of minutes. We work a lot with the raw material gold, in which they provided me with great analysis and risk management.

Positive

2024-06-28

Alonso599

Colombia

What I like is that withdrawals are very fast

Positive

2024-06-04

sam9939

India

I find it good broker in terms of Deposit and Withdrawal and user friendly interface.

Positive

2023-09-01

FX1483014107

New Zealand

I've been trading with Monaxa for a few months now, and I'm really happy with them. The trading instruments are off the chain, from forex to cryptos, they got it all. And let me tell you, their platform is smooth like butter! Opening an account was a breeze, and I love that flexible leverage. I can go big or go home! The best part? Instant deposits, no waiting around. Monaxa got my back when it comes to trading, and I'm lovin' it!

Positive

2023-07-18

Andyo

United States

Yo, I gotta give Monaxa some props! Their platform is pretty slick, man! Opening an account was a breeze, and they got all those tradin' instruments I'm into. Plus, the flexible leverage up to 1:4000 is dope! But, here's the bummer - their customer support ain't that great. It's like waitin' for a snail to finish a marathon. And they need to step up their game with trading signals, bro. Gotta keep my eyes peeled without 'em. Still, overall not bad, but they gotta work on the support side!

Positive

2023-07-18