简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

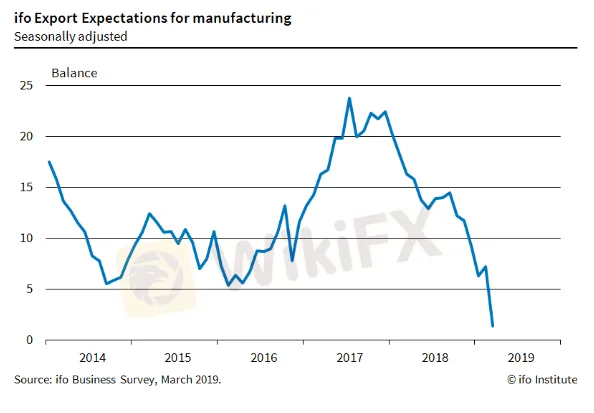

EURUSD Price Pushed Lower as German Export Sentiment Crumbles

Abstract:Business confidence in Germany has ‘clearly deteriorated’ according to the latest ifo Export Expectations, weighing further on an already weak Euro.

EURUSD Price, Chart and ifo News

EURUSD weakness persists after more German export woes.

ECB speakers tomorrow may shed some more light on the EZ economy.

Q1 2019 EUR Forecast and USD Top Trading Opportunities

German exports continue to suffer and business confidence among German exporters has 'clearly deteriorated' according to the latest ifo export expectations survey released earlier today. The export expectations in manufacturing fell to the lowest value since October 2012, with the slowdown in the global economy cited. According to ifo President Clemens Fuest, ‘After the caution expressed in the previous month, export expectations in the automotive industry have weakened considerably, and declines in exports are expected. The same applies to the metals industry. No further growth in exports is foreseen in the mechanical engineering sector, but also no further declines. The chemical industry remains well positioned in foreign business and anticipates additional orders. The electrical industry also expects growth’.

Euro Weekly Technical Outlook: EURUSD Rejected by 200-DMA Again.

EURUSD remains just above the 1.13 handle Tuesday but there is little in the way of hard data to help prop the pair up. Tomorrow, ECB President Mario Draghi speaks in Frankfurt at 08:00 GMT, followed by ECB board members Peter Praet, Luis de Guindos and Yves Mersch, while board member Pentti Hakkarainen speaks in Stockholm and Sabine Lautenschalger speaks in Vienna. A further round of negative news on the Euro-Zone economy could see the pair test initial horizontal support around 1.1273 before 1.1216 and 1.1176 come into play.

EURUSD Daily Price Chart (July 2018– March 26, 2019)

Retail traders are 51.9% net-long EURUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however give us a mixed trading bias for EURUSD.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.comor via Twitter @nickcawley1.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Today's analysis: USDJPY Set to Rise Amid Bank of Japan Policy Shift

USD/JPY (USD/JPY), an increase is expected as the Bank of Japan may reduce bond purchases and lay the groundwork for future rate hikes. Technical indicators show an ongoing uptrend with resistance around 157.8 to 160.

GemForex - weekly analysis

A Rat Race to the bottom in the rescue of the Dollar

GemForex - weekly analysis

Analysis for the week ahead: Markets remain worried by global recession fears

Euro (EUR) Price Outlook: No End Yet in Sight for EUR/USD Weakness

EUR/USD continues to tumble, with no sign yet of a rally or even a near-term bounce.. The pair has dropped already beneath the support line of a downward-sloping channel in place since late May this year to its lowest level since July 2020 and there is now little support between here and 1.1170. From a fundamental perspective, the Euro is suffering from a continued insistence by the European Central Bank that much higher Eurozone interest rates are not needed.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator