简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBPUSD Struggles Ahead of EU Summit Despite Vote for Brexit Extension

Abstract:GBP/USD struggles to hold its ground ahead of the EU Summit even though the UK votes to delay Brexit, with the exchange rate still threatening the bull trend from late-2018.

British Pound Talking Points

The British Pound struggles to retain the rebound from earlier this week even though the U.K. Parliament votes 420 to 110 to delay Brexit, and GBP/USD may exhibit a more bearish behavior going into the European Union (EU) Summit as the exchange rate continues to threaten the upward trend from late last year.

The deadlock in Parliament may keep GBP/USD under pressure as negotiations are set to resume after the Brexit summit, and the push for a June 30 deadline may do little to heighten the appeal of the British Pound as members of Parliament show little to no interest for a second referendum.

It seems as though the EU will grant the Article 50 extension as European Council President Donald Tusk proposes delaying Brexit by another year with an option of an early exit, but it seems as though even European officials are unconvinced the stalemate will be resolved any time soon as Mr. Tusk warns that ‘the deep divisions within the House of Commons, give us little reason to believe that the ratification process can be completed by the end of June.’ With that said, data prints coming out of the U.K. may do little to influence the near-term outlook for GBP/USD, but the recent pickup in British Pound volatility continues to shake up market participation amid the ongoing shift in retail interest.

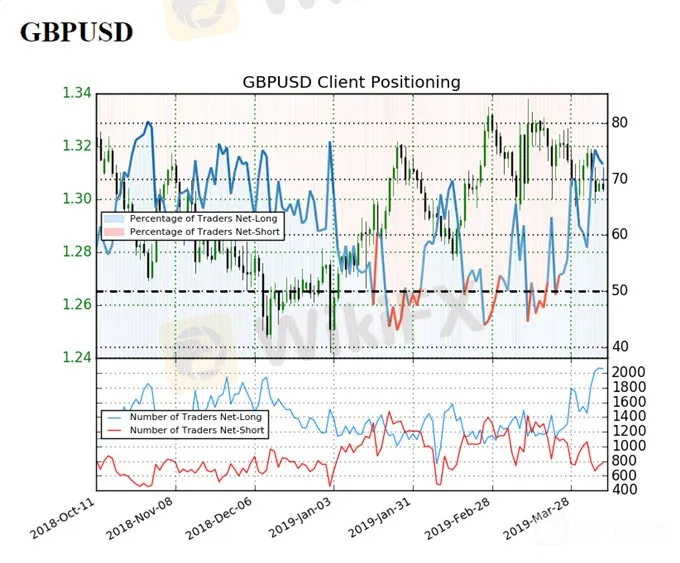

The IG Client Sentiment Report shows 72.7% of traders are still net-long GBP/USD compared to 71.2% at the start of the week, with the ratio of traders long to short at 2.66 to 1. Keep in mind, traders have been net-long since March 26 when GBP/USD traded near 1.3200 handle even though price has moved 1.3% lower since then.

The number of traders net-long is 1.8% lower than yesterday and 15.7% higher from last week, while the number of traders net-short is 8.3% lower than yesterday and 13.4% lower from last week. The drop in net-short position points to profit-taking behavior ahead of the EU Summit as GBP/USD struggles to retain the advance from earlier this week, but the extreme reading in net-long interest indicates that the retail crowd is still positioning for near-term rebound in the British Pound as the exchange rate continues to track the range-bound price action carried over from late-February.

However, a further shift in retail interest may foreshadow a broader change in GBP/USD behavior, with recent developments raising the risk for a further decline as the exchange rate continues to threaten the upward trend carried over from late last year. At the same time, recent developments in the Relative Strength Index (RSI) suggest the bearish momentum is gathering pace is the oscillator continues to track the downward trend carried over from the previous month.

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

GBP/USD Rate Daily Chart

Keep in mind, the broader outlook for GBP/USD is no longer bullish as both price and the Relative Strength Index (RSI) appear to be breaking the upwards trends from late last year, and the advance from the 2019-low (1.2373) may continue to unravel following the string of failed attempts to close above the Fibonacci overlap around 1.3310 (100% expansion) to 1.3370 (78.6% expansion).

In turn, the 1.2950 (23.6% retracement) to 1.3000 (61.8% retracement) area remains on the radar, with the next downside region of interest coming in around 1.2880 (50% retracement) to 1.2890 (23.6% expansion).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

Currency Calculator