简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

S&P 500 Drops Reversal Warning, Equities Brace. Yen to Extend Rise

Abstract:The S&P 500 left behind a reversal warning amidst rising EU-US trade war concerns and the IMF downgrading the 2019 outlook. Equities are bracing in Asia as the Yen may extend gains.

The anti-risk Japanese Yen was the best-performing major on Tuesday, rising alongside a downturn in market sentiment as anticipated. This was triggered by a trio of concerning developments. First, the United States escalated trade tensions with the European Union, threatening to impose $11b in tariffs on their imports because of EU subsidies for Airbus, a major commercial aircraft maker.

Then later in the day, Italy trimmed 2019 GDP estimates to 0.1% from 1.0% as it raised this years budget deficit forecast to 2.5%. The latter has been a sticking issue between the country and with Brussels, increasing concerns about a Eurozone debt crisis. Lastly, the IMF cut the 2019 global outlook to its weakest since the 2008 financial crisis.

After the German DAX 30 tumbled by the most in over two weeks (as expected), the S&P 500 followed suit as it ended its longest winning streak (8 days) since early October. US front-end government bond prices rallied, signaling risk aversion that engulfed the markets. The haven-linked US Dollar was little changed though, mainly due to losses during the first half of the trading session.

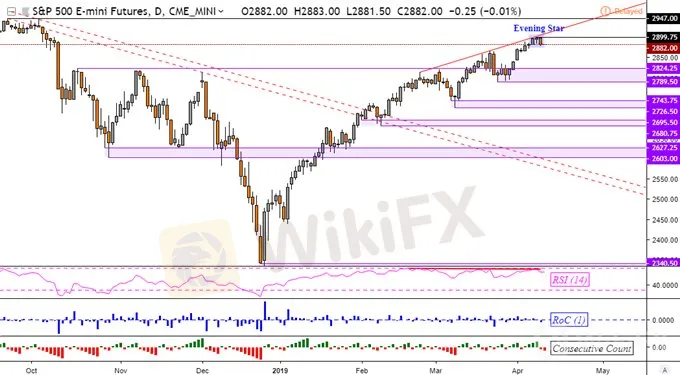

S&P 500 Technical Analysis

Taking a look at the more liquid futures, the S&P 500 left behind a bearish reversal warning at its latest peak just under 2900. That would be an Evening Star that is coupled with negative RSI divergence, signaling fading upside momentum. This may precede a turn lower towards a range of support between 2789 and 2824 on the daily chart below.

S&P 500 Daily Chart

Chart Created in TradingView

Wednesdays Asia Pacific Trading Session

The downturn on Wall Street poses as a risk for Asia Pacific equities, particularly with rising concerns about another trade war front and slowing global growth. It wouldnt be too surprising to see the Japanese Yen extend its advance while the pro-risk Australian Dollar takes a hit. The latter will also be looking to local consumer confidence which may surprise higher, extending AUD/NZDs bullish reversal.

US Trading Session Economic Events

Asia Pacific Trading Session Economic Events

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Can someone earn $1 million at once on forex trading? If yes, how can this be done?

In conclusion, while it is theoretically possible to make $1 million at once in forex trading, achieving such a remarkable feat requires exceptional expertise, meticulous risk management, and a deep understanding of the complexities of the market. Aspiring traders should approach forex trading with rational expectations, a focus on continuous improvement, and an emphasis on preserving capital as the foundation for long-term success in this dynamic and challenging market.

Type of Accounts Offered by Giraffe Markets

Each type of account is tailored to meet the diverse needs and preferences of traders, ensuring that there's an option suitable for every level of expertise and trading style with Giraffe Markets.

Commodity Trading for Beginners: A Comprehensive Guide

At Giraffe Markets, we provide the tools and resources to help you confidently navigate the commodity markets. Whether you're interested in trading gold, oil, or agricultural products, our platform offers a seamless experience for new and experienced traders.

OnEquity Unveils New Website: Simplified CFD & FX Trading for Global Markets

Unlock Global Markets with Simplified CFD & FX Trading at OnEquity. Our new website offers a powerful platform, competitive spreads & commissions, and 24/7 multilingual support. Trade CFDs on currencies, stocks, indices & more. Join our thriving trading community today!

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator