简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Holding Critical Support, EURUSD Eyes Rebound, GBPUSD Outperforms - US Market Open

Abstract:Gold Holding Critical Support, EURUSD Eyes Rebound, GBPUSD Outperforms - US Market Open

MARKET DEVELOPMENT – Gold Holding Critical Support, EURUSD Eyes Rebound, GBPUSD Outperforms

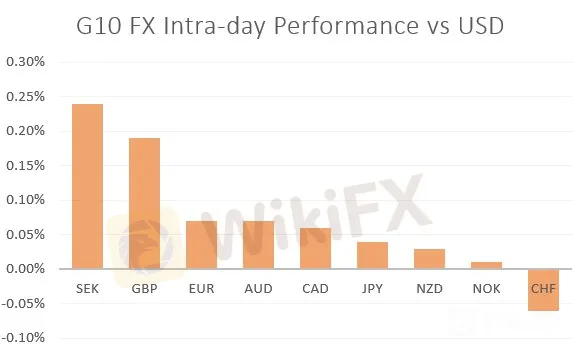

USD: Major FX pairs have been trading in relatively tight ranges with news flow on the lighter side. The USD is slightly softer as the boost to risk sentiment weighs, however, moves have been marginal at best. Given that this will be a holiday shortened week, volumes may indeed be on the lighter side.

GBP: The Pound has been among the outperformers this morning, having made a move above the 1.31 handle. Following last weeks agreement to extend the Brexit deadline and with the UK parliament in recess, the Brexit concerns have eased slightly for now. As such, focus will be placed on the upcoming data points throughout the week.

EUR: In light of the recent Chinese data, the Euro has continued to maintain a foothold above 1.13. The latest COT report showed speculators added to their net shorts, which may begin to raise questions that positioning could be somewhat stretched and could add fuel to a modest Euro rebound, provided Euro-Area data shows signs of a recovery in Q2. Eyes on German ZEW and Euro-Area PMIs.

TRY: Investors were once again reminded of the concerns that Turkey are facing with today‘s jobs report showing the unemployment rate rising to a 10yr high. Consequently, downside risks remain prominent for the Turkish Lira, while volatility is likely to pick-up ahead of next week’s rate decision, in which the focus on central bank independence will be brought back into question.

Gold: Given the improvement in risk sentiment, Gold prices have begun the week on the backfoot and thus is holding onto key support area at 1280-84/oz. A closing break below however, could pave the way for a move towards the 50% Fibonacci retracement situated at 1262/oz.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Economic Calendar Events for This Week (August 5-9, 2024)

This week's economic events include: Japan's Monetary Policy Minutes and U.S. Services PMI on Monday, impacting JPY and USD. Tuesday's RBA Interest Rate Decision affects AUD, with German Factory Orders influencing EUR. Wednesday sees German Industrial Production and U.S. Crude Inventories impacting EUR and USD. Thursday: RBA Governor speaks, with U.S. Jobless Claims. Friday: China's CPI and Canada's Unemployment Rate affect CNY and CAD.

Anticipating the Nonfarm Payroll Report

As we approach the Nonfarm Payroll (NFP) report on August 2, 2024, market participants are keenly observing the data for insights into the U.S. labor market. The report is expected to show an increase of 194,000 to 206,000 jobs for July, indicating modest growth. This suggests potential softening in the labor market. A weaker-than-expected report could prompt the Fed to consider rate cuts, influencing the USD. Major currency pairs and gold prices will likely see volatility around the NFP release

High Volatility Economic Events for This Week (GMT+8)

This week, key economic events expected to generate high volatility include China's Q2 GDP and retail sales data, impacting CNY. The US will release Core Retail Sales and Philadelphia Fed Manufacturing Index, affecting USD. The UK's CPI data will influence GBP, and the ECB Interest Rate Decision and Press Conference will impact EUR. These events will drive significant market movements due to their influence on monetary policy and economic outlooks.

Global Market Insights: Key Events and Economic Analysis Part 2

This week's global market analysis covers significant movements and events. Fed Chairman Powell's cautious stance on interest rates impacts the USD. TSMC benefits from Samsung's strike. Geopolitical tensions rise with Putin's diplomacy. PBOC plans bond sales to stabilize CNY. Key economic events include Core CPI, PPI, and Michigan Consumer Sentiment for the USA, and GDP data for the UK. These factors influence currency movements and market sentiment globally.

WikiFX Broker

Latest News

eToro Adds ADX Stocks to Platform for Global Investors

Why Do You Keep Blowing Accounts or Making Losses?

B2BROKER Launches PrimeXM XCore Support for Brokers

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Checkout FCA Warning List of 21 FEB 2025

Google Bitcoin Integration: A Game-Changer or Risky Move?

IG 2025 Most Comprehensive Review

Why Should Women Join FX Market?

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator