简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What Could Collapsing Currency Volatility Spell for the Forex Market?

Abstract:Why has currency market volatility plunged to multi-year lows and what could it mean for forex traders going forward?

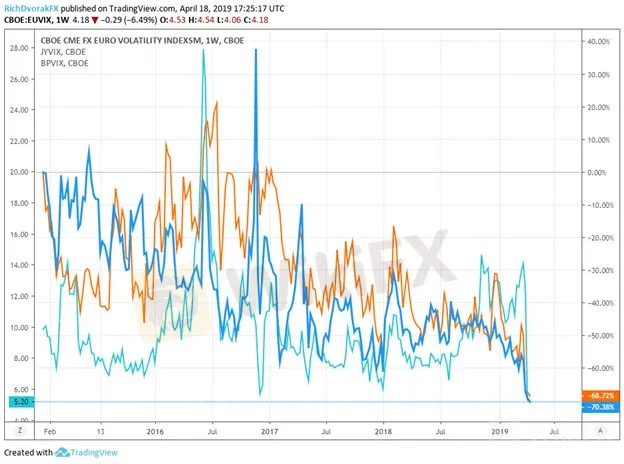

Forex market volatility has cratered to lows not seen in years. In fact, the Cboe Currency Volatility Index for the Euro, Yen, and British Pound have all plunged to their lowest levels on record since the financial instruments began trading in 2015.

EURO, YEN, AND STERLING VOLATILITY INDEX PRICE CHART: WEEKLY TIME FRAME (JANUARY 12, 2015 TO APRIL 18, 2019)

Although British Pound price action was on the rise as Brexit uncertainty sent the Sterling swinging in response to the latest headline, delaying the UKs departure date to October 31 has sent GBPUSD implied volatility nose-diving.

Rebounding market optimism with the help of central bank dovishness subsequent to last years widespread selloff has similarly contributed to the collapse in volatility for the Euro and Yen.

EURUSD PRICE CHART: WEEKLY TIME FRAME (JUNE 23, 2013 TO APRIL 18, 2019)

EURUSD‘s average-true-range has dropped to a mere 14 pips which is the metric’s lowest reading since September 8, 2014. Although, the last time spot EURUSD price action was this muted, currency traders subsequently experienced a sharp return in volatility between August 2014 and June 2015.

USDJPY PRICE CHART: WEEKLY TIME FRAME (JUNE 23, 2013 TO APRIL 18, 2019)

Likewise, the average-true-range for USDJPY has also collapsed to its lowest level since September 8, 2014. However, similar to the proverbial law of physics ‘what goes up must come down,’ volatility can only stay so low for so long before a catalyst emerges that sparks a significant market move.

The most recent occurrence of this was at the beginning of the year when Apple lowered its earnings guidance which sent a shockwave across APAC markets and ignited a currency flash-crash in the Japanese Yen.

Now with Brexit delayed for another 6 months, the US-China trade war supposedly coming to an end and rebounding global economic growth expectations, several of the markets largest risks have dwindled. These developments have contributed to the overarching risk rally and has increased the relative attractiveness for currency carry trades due to dissipating uncertainty and related volatility.

That being said, these risks albeit less prevalent are still unresolved. If uncertainty regarding these issues flares up or factor jolts market sentiment and risk appetite, this could just be the ‘calm before the storm.’

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

eToro Expects to Close Q4 2021 with 33% Higher Commission Revenue

The company is expecting the commissions to be between $285 million and $295 million. It added 2.1 million new users in Q4 alone.

SEC Indicts 5 Russians for $82M Hacking and Insider Trading Scheme

The accused hacked into the systems of two US filing agencies. They generated a profit of $82 million in around 3 years.

OANDA CONFIRMS CHIEF REVENUE OFFICER DAVID HODGE RESIGNED

OANDA has confirmed the news and will certainly be looking to fill his position at the helm of the EMEA operation as well as the Chief Revenue Officer for the global operation.

USGFX UK CEO Simon Quirke Leaves the Company

Quirke joined the company in 2018 and previously worked at Credit Suisse and Lehman Brothers.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Most Effective Technical Indicators for Forex Trading

What Can Expert Advisors Offer and Risk in Forex Trading?

IG 2025 Most Comprehensive Review

Currency Calculator