简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Should Stock Market Investors Listen to the ‘Sell in May and Go Away’ Anomaly?

Abstract:History shows that equity returns are lower on average beginning in May which has led to the 'Sell in May and Go Away' stock market anomaly. What might this mean for stocks now?

SELL IN MAY AND GO AWAY STOCK MARKET ANOMALY – TALKING POINTS

在5月卖出并走出股票市场异常 - 谈话要点

Historically-speaking, the Dow Jones experiences lackluster returns in May and summer months

从历史上讲,道琼斯指数在5月和夏季经历了低迷的回报

More recently, the ‘Sell in May and Go Away’ anomaly has deviated from the historical average

最近,“五月卖出和走出去”异常偏离历史平均水平

{3}

Download the free DailyFX Q2 Equity Forecast for comprehensive fundamental and technical outlook on the major global stock indices over the second quarter

下载免费的DailyFX Q2股票预测,了解第二季度全球主要股指的综合基本面和技术展望

The phrase 'Sell in May and Go Away' refers to the stock market anomaly coined by investors that suggests equity returns tend to falter beginning annually in the month of May – and statistical evidence from history tends to bear out that unusual norm. Another example of a stock market anomaly is the January Effect.

“五月卖出并走出去”这句话是指投资者创造的股票市场异常,表明股票收益往往在五月开始每年都有所动摇 - 历史上的统计证据倾向于证明这种不同寻常的规范。股票市场异常的另一个例子是1月份的影响。

SELL IN MAY AND GO AWAY ANOMALY – DOW JONES INDEX RETURNS

5月卖出并走出异常 - 道琼斯指数退货

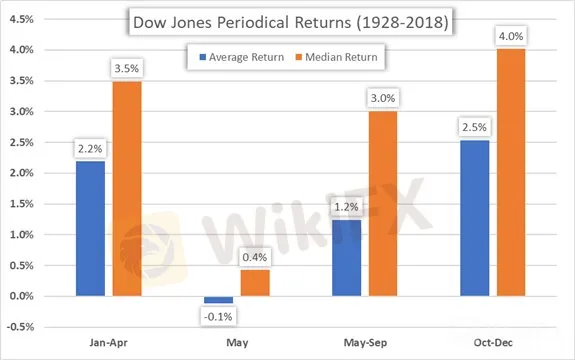

As shown in the chart above, the Dow Jones Index has recorded an average return of -0.1 percent during the month of May and only a modest gain of 1.2 percent on average over May through September – the period often termed ‘the Summer months’ – dating back to 1928. This performance compares to other periods throughout the year like January through April (the ‘winter’ period) and October through December (‘fall’) which see average returns of 2.2 percent and 2.5 percent respectively. The median return for May and May through September are both lower than the returns inked during these other seasonal periods of year.

如上图所示,道琼斯指数在5月份的平均回报率为-0.1%,而在5月至9月期间平均只有1.2%的适度增长 - 这个时期通常被称为'夏季月份 - 可追溯到1928年。这一表现与全年其他时期相比,如1月至4月(“冬季”期间)和10月至12月(“秋季”),平均回报分别为2.2%和2.5% 。 5月和5月至9月的中位数回报率均低于其他季节性季节的回报率。

Drawing on historical context, a series of negative economic events have occurred during May and subsequent summer months which helps explain the lackluster returns during this time of year. For example, Greece was on the verge of defaulting on its debt in May 2010. Summer of 2011 saw the ECB stave off the Eurozone credit blowup by implementing its bond-buying program to save Italy and Spain. China slashed its GDP growth estimates mid 2015 as it announced plans to restructure its economy for more sustainable growth.

借鉴历史背景,发生了一系列负面经济事件在五月和随后的夏季月份,这有助于解释缺乏在这一年的这个时候返回。例如,希腊在2010年5月即将面临债务违约的边缘。2011年夏季,欧洲央行通过实施债券购买计划来挽救意大利和西班牙,从而避免欧元区信贷爆发。中国在2015年中期削减了GDP增长预测,因为它宣布了重组其经济以实现更可持续增长的计划。

The history of financial crises details several additional events that proved bearish for equities over the years during May through September.

金融危机的历史详细介绍了一些事件,这些事件证明了对股票的利空。 5月到9月期间。

DOW JONES INDEX AVERAGE PERIODICAL RETURNS

DOW JONES INDEX AVERAGE PERERODICAL RETURNS

However, stock market performance has begun to show a much brighter picture as of late and serves as evidence that contradicts the ‘Sell in May and Go Away’ anomaly. In fact, the Dow Jones 3-year average return for May through September is an impressive 6.5 percent while the 5-year and 10-year averages are also positive at 2.7 percent and 1.9 percent respectively.

然而,股市表现已经开始最近显示出更加明亮的画面,并作为与“五月卖出”和“走出去”异常相矛盾的证据。事实上,道琼斯5月至9月的3年平均回报率为令人印象深刻的6.5%,而5年和10年的平均回报率分别为2.7%和1.9%。

{13}

One possible explanation for this could be the change in economic regimes witnessed by markets since the Global Financial Crisis. The theme that stands out most prominently over the last decade is the new era of quantitative easing (QE) and extremely low interest rates adopted by global central banks.

{13}

THE SELL IN MAY ANOMOLY AND CURRENT MARKET CONDITIONS

5月出售的资产非常重要和当前的市场条件

This new era of easy-money monetary policy has aimed at smoothing out the business cycle by providing loose financial conditions in hopes of encouraging business activity, bolstering asset prices and restoring market confidence. In turn, there have been less severe stock market drawdowns over recent times leading to higher average returns over shorter lookback periods.

这个宽松货币政策的新时代旨在通过提供宽松的金融条件来平息商业周期,希望鼓励商业活动,提高资产价格和恢复市场信心。反过来,近期股票市场的下跌幅度较小,导致较短的回顾期间的平均回报率较高。

That being said, there are still several unresolved market risks that loom – unsustainable debt loads, landing a smooth Brexit, uncertainty surrounding US trade policy with partners such as China, Canada, Mexico and the EU in addition to deteriorating global fundamentals shown by an uninspiring downtrend in economic indicators (just to name a few).

话虽如此,仍有几个未解决的市场风险隐约可见 - 不可持续的债务负担,降落a英国脱欧,与中国,加拿大,墨西哥和欧盟等合作伙伴的美国贸易政策的不确定性,以及经济指标中令人沮丧的下降趋势所显示的全球基本面恶化(仅举几例)。

{17}

GROWING DEPENDENCE ON ACCOMODATIVE POLICY AND INVESTOR COMPLACENCY

{17}

Consequently, this new game of chess between global central bankers and the foundations of market cycle dynamics looks to be at its next pivotal tipping point. Investors have now grown accustomed to these accommodative policies and have ‘easy-money addiction’ withdrawals following any small shift towards tightening. Around the world fiscal policies remain accommodative shown by ballooning government deficits while central banks are shifting away from normalizing monetary policy.

因此,全球央行行长和市场周期动态基础之间的这一新的国际象棋游戏似乎将在下一个关键的临界点。投资者现在已经习惯了这些宽松的政策,并且在收紧任何小规模的转变后都会“轻松上瘾”。世界各地的财政政策仍然保持宽松,政府赤字膨胀,而央行正在摆脱正常化的货币政策。

Meanwhile, global equities remain elevated near all-time highs which makes it difficult to overlook the possibility of investor complacency. Placing such incredible reliance on government and central bank policies to completely eliminate business cycles has potential of proving to be a dangerous strategy, particularly if these already accommodative policies fail to instill market optimism.

与此同时,全球股市仍然处于历史高位附近,这使得它成为历史最高点。很难忽视投资者自满的可能性。如此令人难以置信地依赖政府和央行的政策来彻底消除商业周期,这有可能被证明是一种危险的策略,特别是如果这些已经宽松的政策未能灌输市场的乐观情绪。

In sum, while there are historical averages to fall back on to support this favorite investor parable, recent deviations and the wealth of fundamental risks that have arisen warrants less complacency and instead closer observation of the market's developments as 2019 wears on.

总而言之,虽然有历史平均值可以支持这个最受欢迎的投资者比喻,但最近出现的偏差以及已经出现的基本风险的丰富保证了更少的自满情绪,而是随着2019年的发展而更加密切地观察市场的发展。

- Written by Rich Dvorak, Junior Analyst for DailyFX

- 由DailyFX初级分析师Rich Dvorak撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Can someone earn $1 million at once on forex trading? If yes, how can this be done?

In conclusion, while it is theoretically possible to make $1 million at once in forex trading, achieving such a remarkable feat requires exceptional expertise, meticulous risk management, and a deep understanding of the complexities of the market. Aspiring traders should approach forex trading with rational expectations, a focus on continuous improvement, and an emphasis on preserving capital as the foundation for long-term success in this dynamic and challenging market.

Type of Accounts Offered by Giraffe Markets

Each type of account is tailored to meet the diverse needs and preferences of traders, ensuring that there's an option suitable for every level of expertise and trading style with Giraffe Markets.

Commodity Trading for Beginners: A Comprehensive Guide

At Giraffe Markets, we provide the tools and resources to help you confidently navigate the commodity markets. Whether you're interested in trading gold, oil, or agricultural products, our platform offers a seamless experience for new and experienced traders.

OnEquity Unveils New Website: Simplified CFD & FX Trading for Global Markets

Unlock Global Markets with Simplified CFD & FX Trading at OnEquity. Our new website offers a powerful platform, competitive spreads & commissions, and 24/7 multilingual support. Trade CFDs on currencies, stocks, indices & more. Join our thriving trading community today!

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator