Score

Shin

Japan|15-20 years|

Japan|15-20 years| http://shin-sec-sakamoto.jp/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Japan 2.97

Japan 2.97Contact

Licenses

Licenses

Licensed Entity:株式会社しん証券さかもと

License No. 北陸財務局長(金商)第5号

Single Core

1G

40G

1M*ADSL

- The current information shows that this broker does not have a trading software. Please be aware!

Basic Information

Japan

JapanUsers who viewed Shin also viewed..

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

PU Prime

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

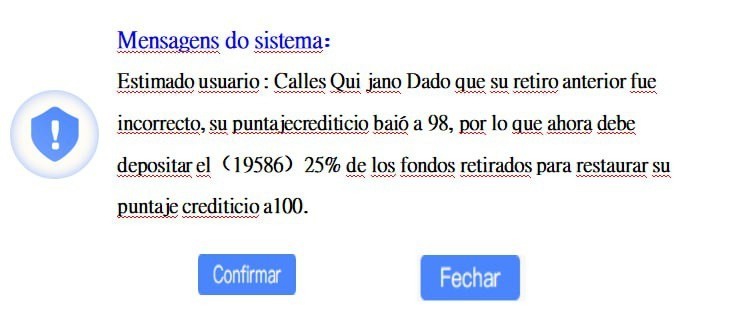

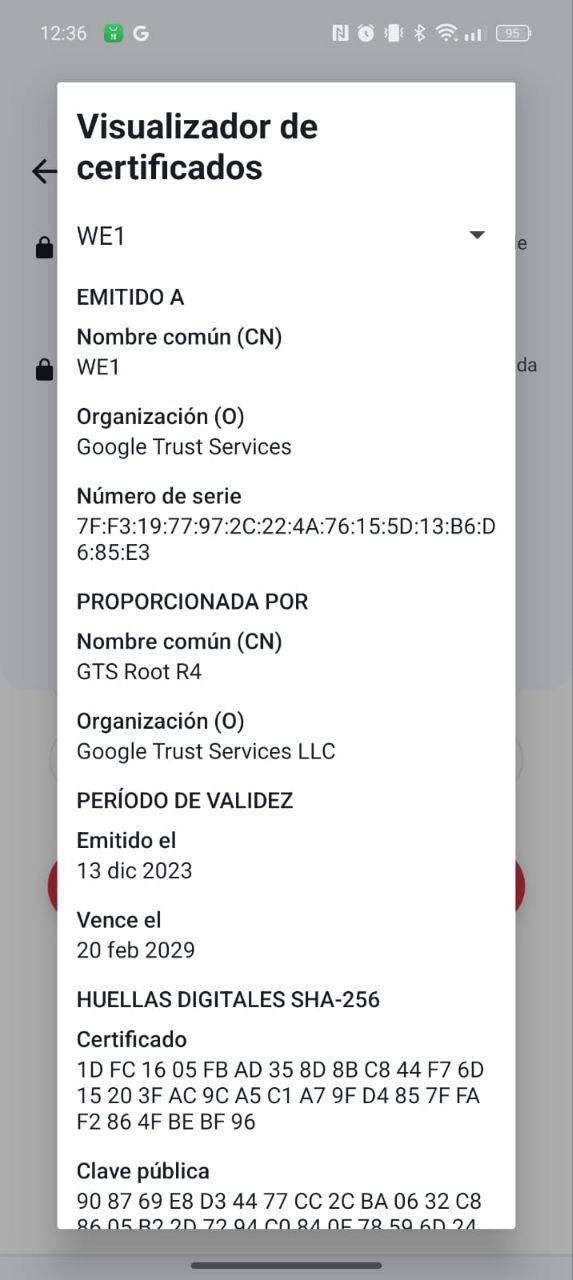

Website

shin-sec-sakamoto.jp

Server Location

Japan

Website Domain Name

shin-sec-sakamoto.jp

Website

WHOIS.JPRS.JP

Company

JAPAN REGISTRY SERVICES

Domain Effective Date

2014-10-23

Server IP

124.146.219.96

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

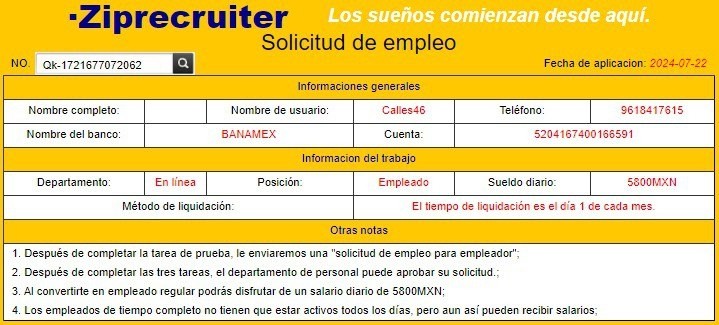

| Shin Review Summary | |

| Founded | 1890 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Services & Products | Domestic and Foreign Stocks, Investment Trusts, NISA, Transfer and Inheritance and Gifts, Securities Trading, Stock Index Options Trading, Brokerage, Agency, Solicitation, or Sale of Securities Processing, Receipt or Payment of Securities Investment Trust Beneficiary Certificates, Redemption and Partial Cancellation |

| Demo Account | Unavailable |

| Leverage | N/A |

| Trading Platforms | N/A |

| Minimum Deposit | N/A |

| Customer Support | Telephone: 0120-739-679/ 0120-660-544 (8:30-17:00) |

What is Shin?

Shin Securities Sakamoto Inc., known as Shin Securities for short, is a Japanese securities firm with a long history in the financial industry. It was originally established in January 1890 under the name Sakamoto Securities. Over the years, the company went through various name changes and mergers, eventually becoming Shin Securities Sakamoto Inc. in 2004.

Shin Securities is regulated by FSA, which ensures compliance with financial regulations and protects investors' interests. The company offers a wide range of services and products. They also provide processing, receipt, and payment of securities investment trust beneficiary certificates, redemption, and partial cancellation.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros of Shin Securities:

- Long-standing History: Shin Securities has a history dating back to 1890, indicating its stability and experience in the financial industry.

- Diverse Range of Services: Shin Securities offers a wide range of services and products, including trading in domestic and foreign stocks, investment trusts, NISA accounts, transfer and inheritance services, securities trading, and stock index options trading. This allows investors to access a variety of investment opportunities through a single platform.

- Regulated by FSA: The company is regulated by the Financial Services Agency (FSA), which ensures that it operates within the legal framework and follows industry standards. This regulation adds an additional layer of security for investors.

Cons of Shin Securities:

- Limited Information Availability: Some key information, such as minimum deposit requirement, leverage, trading platforms, and demo accounts, is currently unavailable. This lack of information may make it difficult for potential clients to evaluate their offerings and compare them with other brokers.

- Limited Customer Support Hours: While Shin Securities provides customer support via telephone, the operating hours are limited from 8:30 to 17:00. This may not be convenient for clients who require assistance outside of these hours.

Is Shin Safe or Scam?

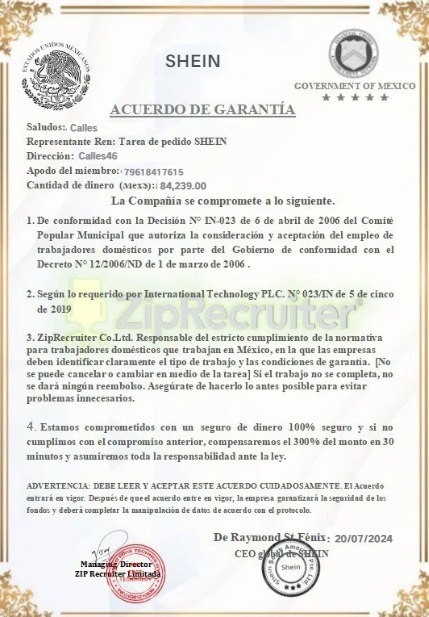

Shin Securities is regulated by the Financial Services Agency (FSA), which is responsible for overseeing all financial services providers, including Forex brokers, in Japan. The company holds a retail forex license with license number 北陸財務局長(金商)第5号.

With its regulation by reputable authorities and several years of operation, Shin Securities has built a positive reputation among many customers. This suggests that the broker is reliable and trustworthy.

Services & Products

Shin offers a wide range of services and financial products, catering to the diverse needs of its clients. These instruments include:

- Domestic and Foreign Stocks: Shin provides the opportunity to trade stocks from both domestic and international markets, allowing clients to diversify their portfolios and access a wide range of investment opportunities.

- Investment Trusts: Clients have the option to invest in investment trusts, which are professionally managed portfolios of various securities such as stocks, bonds, and other assets, providing diversification and professional asset management.

- NISA (Nippon Individual Savings Account): Shin offers NISA investment accounts, which provide tax advantages for individuals investing in designated assets in Japan.

- Transfer and Inheritance and Gifts: Shin provides services related to transfer, inheritance, and gifts, likely referring to facilitating the transfer or gifting of financial assets and investments.

- Securities Trading: This encompasses the buying and selling of various financial securities, including stocks, bonds, and other financial instruments.

- Stock Index Options Trading: Shin offers the trading of stock index options, which are financial derivatives that give the holder the right, but not the obligation, to buy or sell the value of an underlying index.

- Brokerage, Agency, Solicitation, or Sale of Securities Processing: Shin provides brokerage and agency services, including solicitation and facilitation of security sales and purchases.

- Receipt or Payment of Securities Investment Trust Beneficiary Certificates: This likely involves handling the receipt or payment of beneficiary certificates related to securities investment trusts.

- Redemption and Partial Cancellation: Shin likely facilitates the redemption and partial cancellation of various financial instruments and investment products for its clients.

Account Types

Shin Securities provides investors with three types of accounts: General Securities Account, Specific Account, and NISA Account.

General Securities Account:

- Investors can buy and sell securities based on their investment strategies and preferences.

- This account is suitable for investors who want flexibility in their investment choices and do not require specific tax benefits.

Specific Account:

- The Specific Account is designed for customers who want to easily file tax returns related to their investments.

- By using this account, investors can automatically calculate and report their capital gains, losses, and other tax-related information to the authorities.

- This account is especially beneficial for individuals who have a higher trading activity or a complex investment portfolio, as it simplifies the tax reporting process.

NISA Account:

- The NISA (Nippon Individual Savings Account) Account is a tax-advantaged account aimed at promoting long-term investments in Japan.

- By utilizing this account, investors can take advantage of tax benefits, such as tax exemption for capital gains and dividends on eligible investments, up to a certain limit set by the government.

- The NISA Account has a specific investment period (currently set at 5 years), and investors can contribute a maximum amount of funds each year.

- It allows trading in stocks and investment trusts that meet the NISA criteria.

- Similar to the other accounts, no minimum capital requirement is imposed for opening a NISA Account.

How to Open an Account?

To open an account with Shin, there are several options available to applicants. One can initiate the account opening procedure by visiting the nearest Shin store or by arranging for a home visit by one of Shin‘s employees. The process involves completing the account opening application form, which requires the applicant’s signature and seal.

| Requirements for Opening an Account with Shin | Additional Information |

| Account Opening Procedure Options | Visit nearest store or request a home visit by a Shin employee |

| Account Opening Application Form | Complete and sign the form |

| Identity Verification Documents | - My Number (Individual Number) verification documents (e.g., Individual Number Card, Individual Number Notification Card) |

| - Identification documents (e.g., drivers license, certificate of residence, health insurance cards, pension handbooks) | |

| Note: Ensure documents have valid expiration dates or are within 6 months from the time of confirmation | |

| Personal Seal | Provide a seal (Shachihata seal; rubber stamps not accepted) |

| Financial Institution Account Details | Present a passbook showing account number, cash card, or relevant documents for designated bank transfer account |

| “Tsumitate NISA” and “Regular Investment Trust” Customers | Submit a “Deposit Account Transfer Request Form” provided by Shin |

| Completion of the Procedure | Usually takes around 3 days for the trading account to be opened |

| Mail Application Option | Contact the nearest Shin store for instructions on opening an account via mail |

Fees

Shin charges fees for its services, and these fees are typically determined based on the trading amount of each financial instrument. Additionally, as part of Shin's fee service, there is a flat fee of 1.1% (including tax) applied to the purchase of investment trusts for all customers. This fee is applicable regardless of the trading amount and ensures transparency in the cost structure.

Furthermore, Shin has introduced a fee waiver for customers under the age of 50 in relation to the purchase of domestic listed stocks, effective from July 1, 2022. This fee exemption demonstrates Shin's commitment to providing competitive pricing and attracting younger investors to participate in the stock market.

Customer Service

Customers can get in touch with customer service line using the information provided below:

Telephone: 0120-739-679/ 0120-660-544 (8:30-17:00)

Conclusion

In conclusion, Shin Securities, with its long-standing history, offers a diverse range of financial services and products. The company is regulated by FSA, adding an element of security and trust for investors.

While there is limited information available about certain aspects of the company, such as minimum deposit requirements and customer support hours. As with any investment, there is inherent risk, and it is very important to do your own research and consider your options carefully.

Frequently Asked Questions (FAQs)

| Q 1: | Is Shin regulated? |

| A 1: | Yes. It is regulated by FSA. |

| Q 2: | How can I contact the customer support team at Shin? |

| A 2: | You can contact via telephone: 0120-739-679/ 0120-660-544 (8:30-17:00). |

| Q 3: | Does Shin offer demo accounts? |

| A 3: | No. |

| Q 4: | What services and products Shin provides? |

| A 4: | It provides domestic and foreign stocks, investment trusts, NISA, transfer and inheritance and gifts, securities trading and so on. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 15-20 years

- Regulated in Japan

- Retail Forex License

- Suspicious Scope of Business

- Medium potential risk

Comment 3

Content you want to comment

Please enter...

Comment 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now