简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBPUSD Volatility Rising, CAD Drops as Oil Prices Collapse - US Market Open

Abstract:GBPUSD Volatility Rising, CAD Drops as Oil Prices Collapse - US Market Open

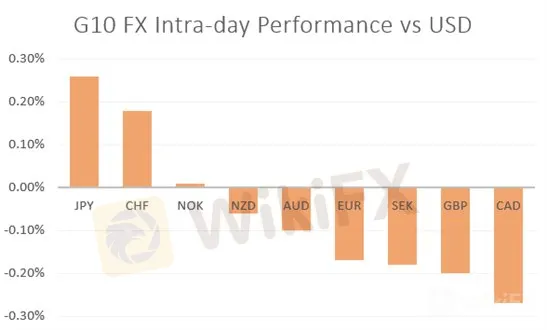

MARKET DEVELOPMENT – JPY and CHF Advance, Crude Oil Prices Extend Losses

市场发展 - 日元和瑞士法郎上涨,原油价格延续跌势

DailyFX Q2 2019 FX Trading Forecasts

DailyFX Q2 2019年外汇交易预测

JPY / CHF: Risk aversion is evident across financial markets with both the Japanese Yen and Swiss Franc outperforming as a result. USDJPY tests 110.00 on the downside with the drop in US Treasury yields also weighing on the pair, eyes on for a test of the weekly low at 109.80.

日元/瑞士法郎:金融风险厌恶情绪明显因此,日元和瑞士法郎的市场表现优于大市。美元兑日元在下行方向测试110.00,美国国债收益率下跌也拖累该货币对,关注每周低点109.80的测试。

{5}

EUR: The Euro is slightly softer this morning as Eurozone PMIs on the whole had disappointed market expectations with optimism over a rebound in the Eurozone slowly dissipating. Elsewhere, the latest ECB minutes remains dovish with rate setters highlighting concerns over uncomfortably low inflation and also signalling their lack of confidence that the Eurozone economy will rebound as they had expected in H2 19.

{5}

GBP: As pressure ramps up for Theresa May to hand in her resignation, volatility in the Pound is back on the rise with option implied vols edging higher (still some way from the March highs), while demand is starting to pick up for GBP puts as markets begin to price in the rising risk of a no-deal.

英镑:随着Theresa May提出辞职压力加剧,英镑的波动性回升,期权隐含的股价小幅上涨(仍然从3月份的高点开始),而英镑的需求开始回暖随着市场开始为不成交的风险上涨定价。

Oil: Losses in the energy complex have continued with Brent and WTI crude breaking below $70 and $60 respectively. After yesterdays bearish DoE report which showed a surprise build of 4.7mln barrels (also above the 2.4mln build in API) oil prices took a further knock on the softer sentiment in equity markets. Consequently, the drop-in oil prices have weighed on the Canadian Dollar, which underperforms in the G10 space.

石油:能源综合体的损失继续,布伦特原油和WTI原油分别跌破70美元和60美元。在昨天看跌的DoE报告显示出意外建造的470万桶(也高于API的240万桶)之后,油价进一步打击了股市疲软的情绪。因此,油价贬值加重了加元,后者在G10领域表现不佳。

Source: DailyFX, Thomson Reuters

来源:DailyFX,Thomson路透社

DailyFX Economic Calendar: – North American Releases

DailyFX经济日历: - 北美版本

IG Client Sentiment

IG客户情绪

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

GemForex - weekly analysis

A week of consolidation Ahead amid renewed USD strength

British Pound Technical Analysis - GBP/USD. Trend to Resume or Reversal For Sterling?

GBP/USD Technical Analysis - the pair has bounced back after making a new low for the year. The Pound has seen increased volatility as it looks to hold ground. Will Sterling continue to be undermined and make fresh lows again?

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

ED Exposed US Warned Crypto Scam ”Bit Connect”

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

Currency Calculator