Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Hendrik G

Netherlands

Solid, but not spectacular. Does the job, but might not exceed expectations.

Neutral

2024-06-28

Lorelei St. James

Malaysia

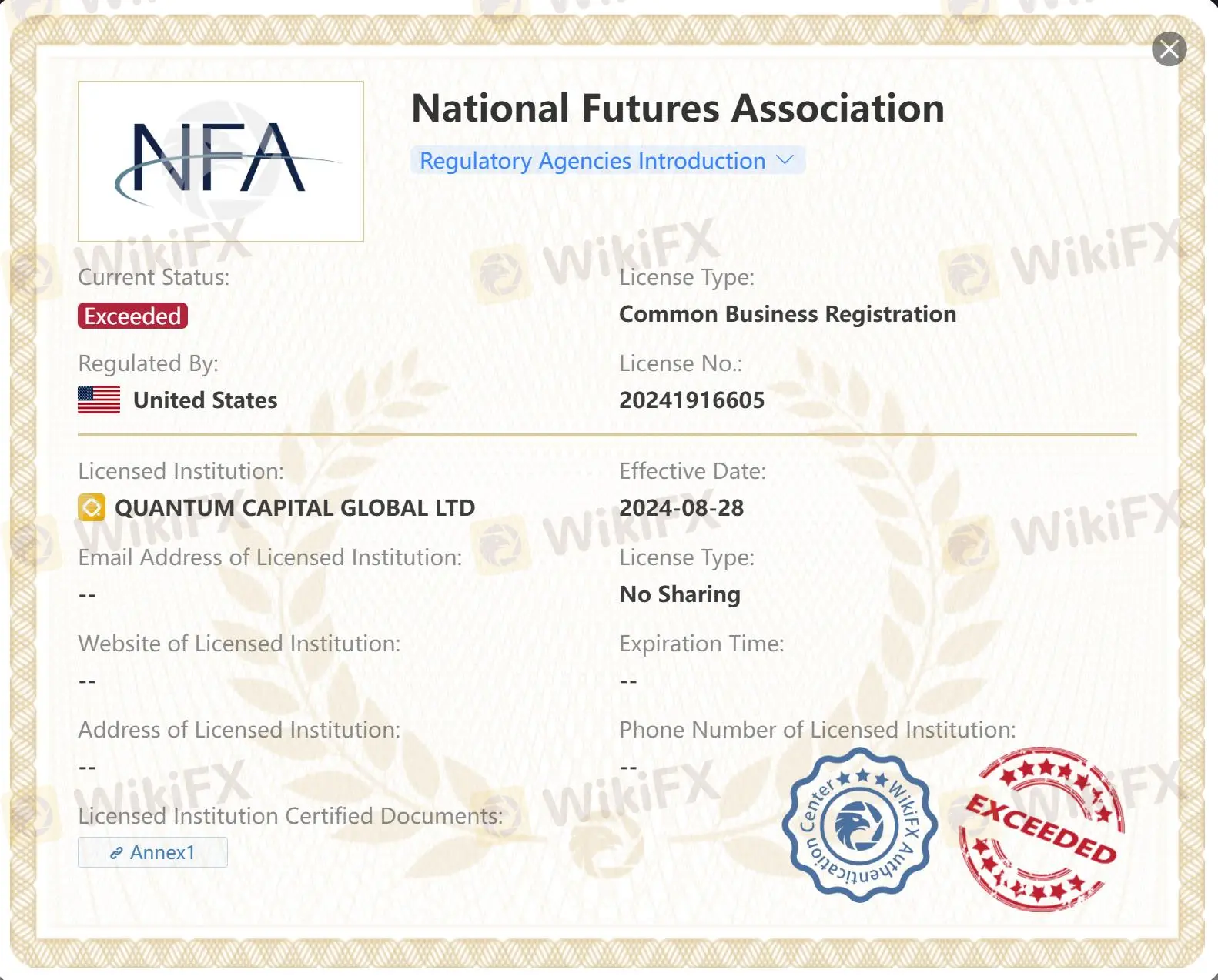

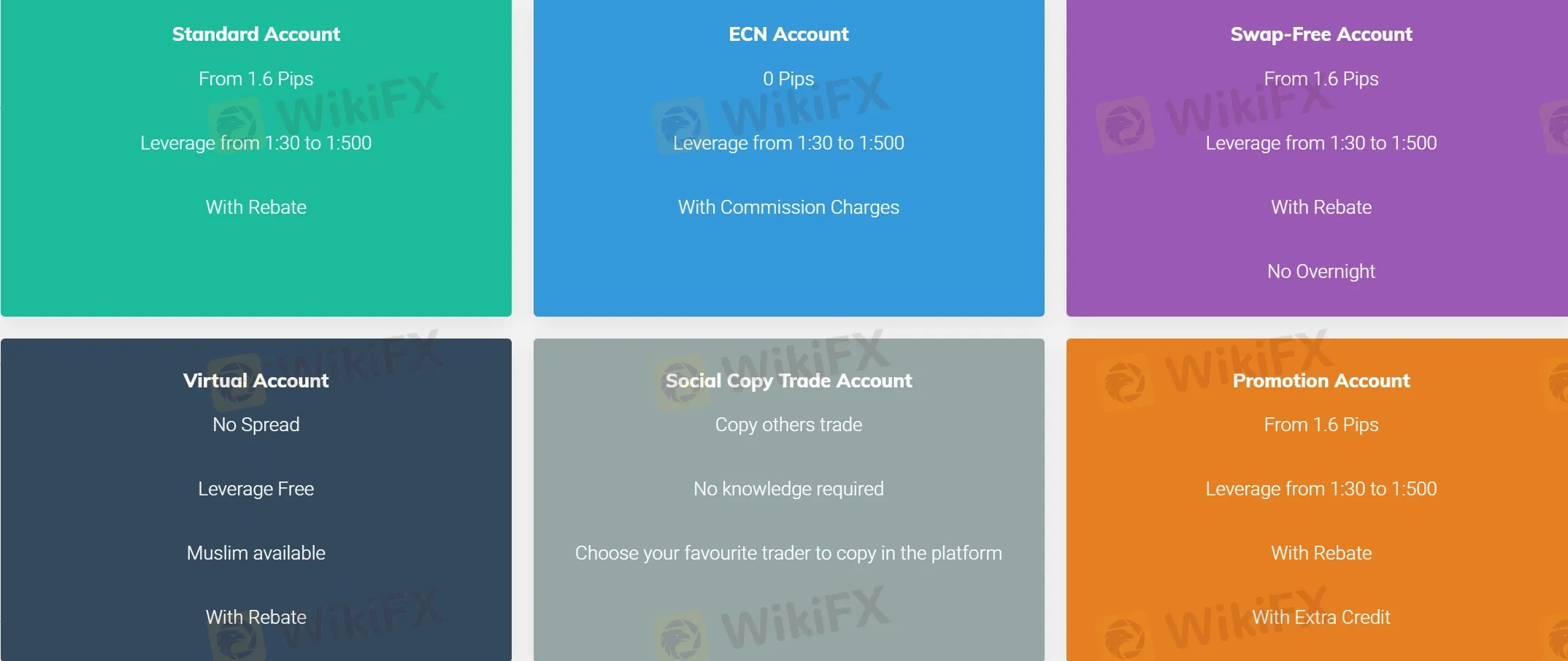

Operating without regulatory oversight is a red flag for me, especially when dealing with a brokerage like QCG. The potential risks associated with trading in such an environment could be significant, and that worries me. That being said, their multiple account offerings and powerful trading platforms deserve a nod in their favor.

Neutral

2023-12-07

Constantine Alistair Fitzroy

Australia

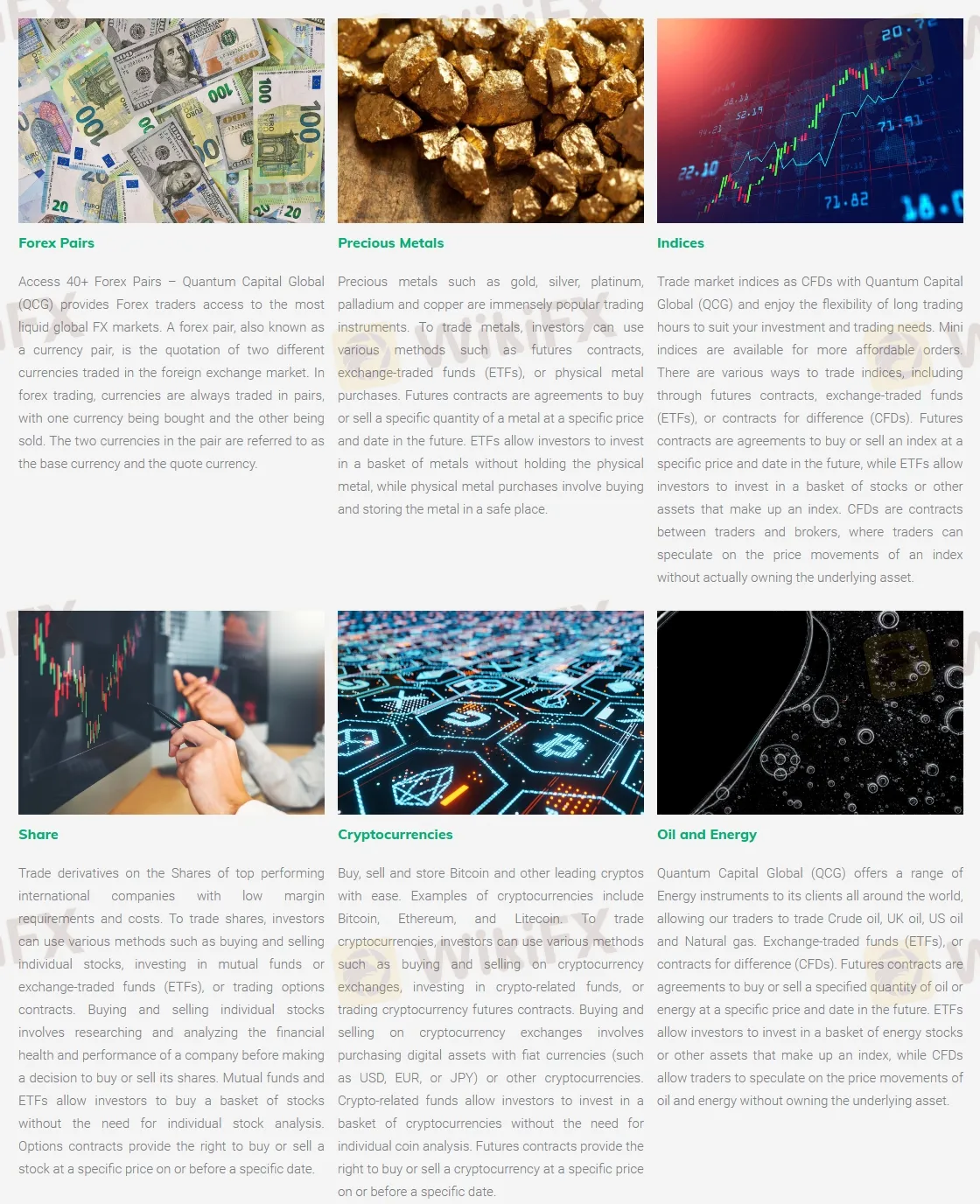

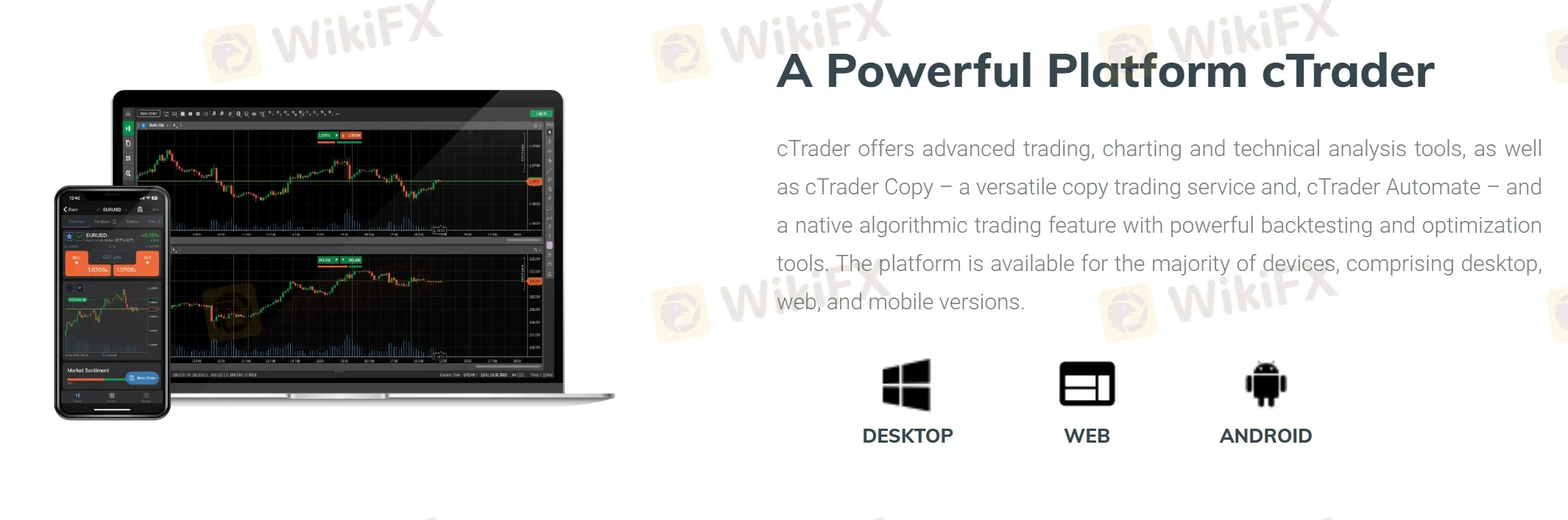

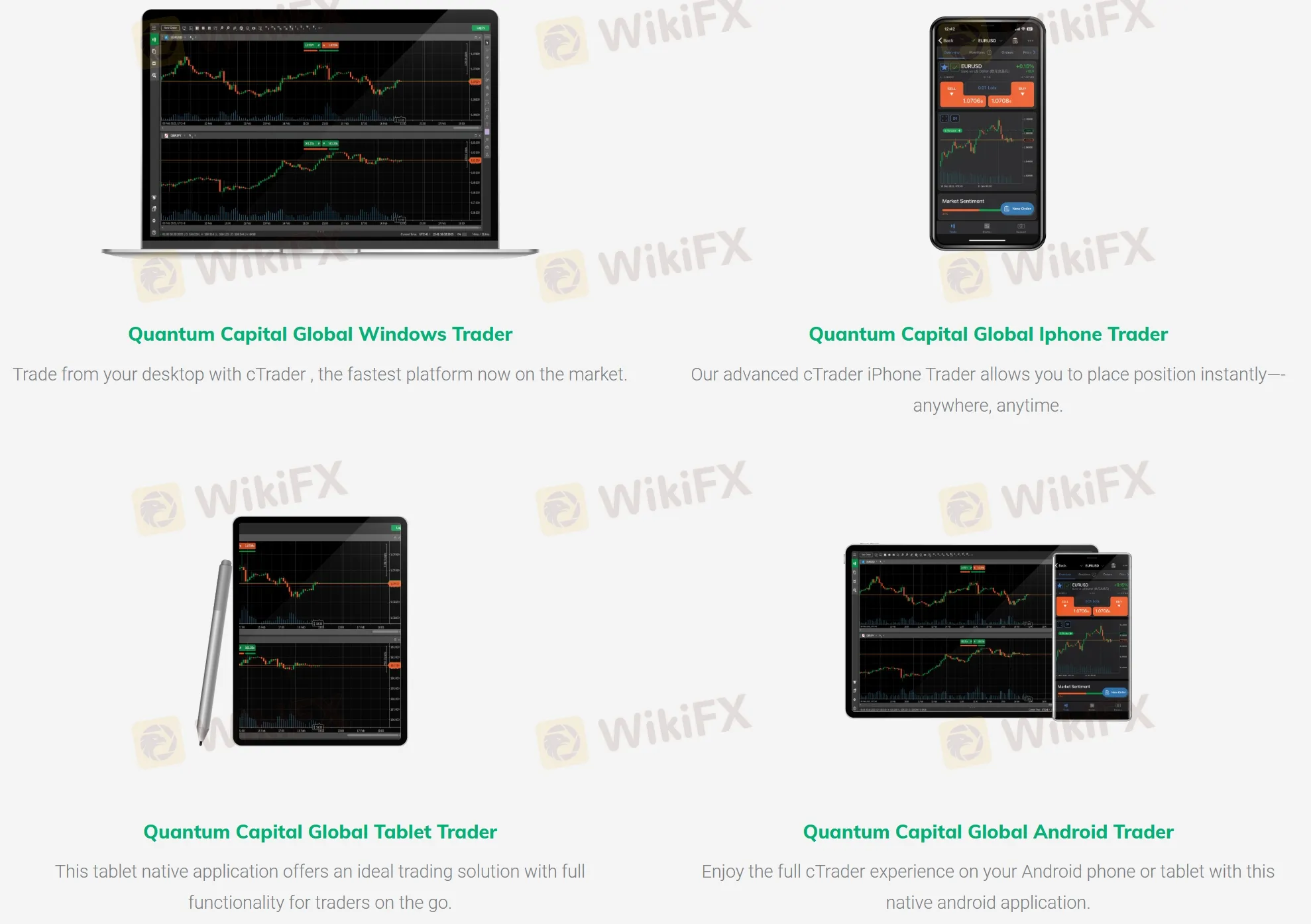

QCG's trading platforms, cTrader and Match-Trader, have impressed me with their advanced features and user-friendly interfaces. This, coupled with their wide variety of assets and high leverage of 1:500, gives me fantastic opportunities to diversify and expand my trading strategies. However, I'm concerned about their lack of regulatory oversight which leaves me unsure about the safety of my funds.

Neutral

2023-12-06

FX1501701504

Tunisia

I had a mixed experience with QCG. While their trading platforms and asset selection are decent, the lack of regulation is a significant concern. It's unsettling to trade with an unregulated broker, as it raises questions about the safety of funds and the transparency of operations. I also found their educational resources to be limited, which made it challenging to enhance my trading skills. Additionally, their customer support, although available via email, lacks other channels like live chat or phone support, which could have been more convenient. If they address these issues and prioritize regulation and customer support, it would significantly improve the overall user experience.

Neutral

2023-06-25

Mohd Ali bin Abdullah

Malaysia

IQCG cTrader 's functionality is solid, and the user experience is smooth, the range of charts, indicators, and tools quite comprehensive. 💯

Positive

2024-06-26

FX1501697579

Russia

I've been trading with QCG for a few months now, and I must say I'm impressed with their trading platforms and the range of assets they offer. The cTrader platform is powerful and user-friendly, making it easy to analyze the markets and execute trades. I particularly enjoy trading forex pairs and cryptocurrencies, and QCG provides competitive spreads and quick order execution. The copy trading feature is also a great addition, as it allows me to follow the trades of experienced traders and learn from their strategies. Overall, QCG has provided me with a satisfying trading experience.

Positive

2023-06-25