简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NOK Eyes Crude Oil Prices, Norges Bank and FOMC Rate Decisions

Abstract:The Norwegian Krone will likely experience higher-than-usual volatility alongside crude oil prices ahead of rate decisions by the Norges Bank and Fed.

NORDIC FX, NOK, SEK WEEKLY OUTLOOK

NORDIC FX,NOK,SEK每周展望

Crude oil prices eyeing FOMC rate decision

原油价格盯住FOMC利率决定

NOK focusing on Norges Bank, global growth

NOK专注于Norges Bank,全球增长

SEK eyes key econ data as financial risks grow

SEK眼睛的关键随着财务风险的增长,经济数据增长

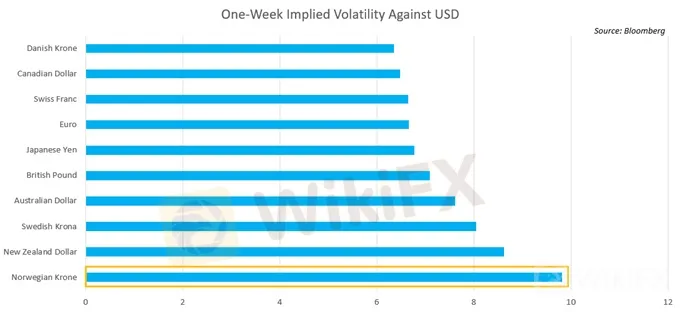

NORWEGIAN KRONE EXPECTED TO BE MOST VOLATILE G10 CURRENCY

NORWEGIAN KRONE预计将成为最具竞争力的G10货币

FOMC RATE DECISION: CRUDE OIL, S&P 500 OUTLOOK

FOMC汇率决定:原油,标准普尔500指数展望

The Norwegian Krone will be closely eyeing how crude oil prices react to the FOMC rate decision. Overnight index swaps are pricing in a 17 percent probability of a cut, though this jumps to a staggering 85 percent expectation for the July meeting. Market participants will be eagerly waiting for commentary from Fed Chairman Jerome Powell and will be keenly tuning in to pick up on any subtle hints on his outlook for policy.

挪威克朗将密切关注原油价格对FOMC利率决定的反应。隔夜指数互换的定价概率降低了17%,尽管这一数字跃升至7月份会议的惊人的85%预期。市场参与者将急切地等待美联储主席杰罗姆·鲍威尔的评论,并将敏锐地调整,以了解他对政策前景的任何微妙暗示。

US data has been broadly underperforming relative to economists‘ expectations with the most recent US CPI publications falling in line with this trend. The Fed’s neutrality may be offset by the underwhelming data, especially after Powell said that the temporary lull in inflation was “transitory”. Meaning, if price growth shows adequate momentum, the possibility of a hike could increase.

相对于经济学家的预期,美国数据普遍表现不佳,最近的美国CPI出版物与这一趋势一致。美联储的中立可能会被令人沮丧的数据所抵消,特别是在鲍威尔表示通货膨胀的暂时平息是“暂时的”之后。这意味着,如果价格增长显示出足够的势头,加息的可能性就会增加。

Commentary from officials will be key, especially since the Fed is largely expected to hold rates. A more dovish outlook could help lift equities on the prospect of cheaper credit at the expense of the US Dollar. A pessimistic outlook could also trigger the Greenbacks attraction as an anti-risk asset and send investors flocking to US Treasuries if the outlook for growth is significantly more sour than before.

官员的评论将是关键,特别是因为美联储在很大程度上预计会维持利率。更为温和的前景可能有助于提振股市,以牺牲美元为代价来实现更低廉的信贷前景。悲观的前景也可能引发美元作为反风险资产的吸引力,并让投资者涌向美国国债如果增长前景比以前更加糟糕。

As outlined in my weekly forecast, crude oil is very sensitive to changes in global sentiment. It frequently moves in tandem with the S&P 500 and may end up mirroring the index‘s reaction to the Fed’s commentary. However, it is important to remember: correlation does not equal causation.

正如我的每周预测所述,原油对全球情绪的变化非常敏感。它经常与标准普尔500指数同步上涨,最终可能反映出该指数对美联储评论的反应。然而,重要的是要记住:相关性不等于因果关系。

NORGES BANK RATE DECISION

NORGES银行利率决定

Given the central banks hawkish disposition at previous meetings, the Norges Bank will likely raise rates this week, though their outlook for future hikes may be more cautious now than before. As a petroleum-based economy with a strong reliance on European demand, waning growth out of the EU along with overall global deceleration is expected to make an appearance in official commentary and as a reason for a possible delay.

鉴于央行强硬的性格在之前的会议上,挪威银行可能会在本周加息,尽管他们对未来加息的前景可能比以前更加谨慎。作为一个强烈依赖欧洲需求的石油经济体,欧盟的增长减弱以及全球总体减速预计会在官方评论中出现,并可能导致延迟。

Apart from the rate decision, the Norwegian Krone will be eyeing external event risks as a catalyst for price movement. Rising geopolitical concerns out of Iran may buoy crude oil prices on the basis of supply shock fears and could end up carrying NOK with it. However, the long-term outlook for both suggests prevailing risk aversion will push these cycle-sensitive assets lower while the anti-risk US Dollar will emerge triumphant.

除了利率决定外,挪威克朗将把外部事件风险视为价格变动的催化剂。伊朗出现的地缘政治担忧上升可能会在供应冲击担忧的基础上提振原油价格,并最终可能带来挪威克朗。然而,两者的长期前景表明,普遍存在的风险厌恶情绪将推动这些对周期敏感的资产走低,同时抗风险美元将会获得胜利。

CRUDE OIL PRICES NOKSEK, OBX INDEX – Daily Chart

原油价格NOKSEK,OBX INDEX - 每日图表

SWEDEN: IS A FINANCIAL CRISIS LYING DORMANT?

瑞典:是一场危险的金融危机吗?

The Swedish Krona will also be eyeing similar external event risk – e.g. trade wars and the FOMC – though local economic data may capture SEKs attention as well. A slew of publications will be released on June 19, with expectations that manufacturing confidence will show weakness along with sentiment surveys. Local housing data may also garner more attention in light of rising concerns about systemic financial risks.

瑞典克朗也会关注类似的外部事件风险 - 例如贸易战和FOMC - 尽管当地经济数据也可能引起SEK的关注。 6月19日将发布大量出版物,预计制造业信心将随情绪调查显示疲软。当地住房数据由于对系统性金融风险的担忧日益增加,ay也引起了更多关注。

Local unemployment data will also be a key indicator to monitor along with a speech by Riksbank Deputy Governor Martin Floden. The central bank has grown increasingly frustrated that inflation as it continues to remain below target while rates continue to swim in negative territory against the backdrop of a slowing global economy. A bigger concern now is if a crisis comes, how will the central bank counter the downturn?

本地失业数据也将成为监控的关键指标瑞典央行副行长马丁·弗洛登致辞。在全球经济放缓的背景下,央行继续保持低于目标,而利率继续下滑至负值区域,央行对通胀的担忧日益沮丧。现在更大的担忧是,如果出现危机,中央银行将如何应对经济衰退?

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Prices, NOK, Brace for Norges Bank, FOMC Rate Decisions

The Norwegian Krone and crude oil prices will be in for turbulent week ahead of an avalanche of central bank rate decisions against the backdrop of political volatility in the middle east.

SEK, NOK Brace for Turbulence Ahead of FOMC and Sweden GDP

The Swedish Krona and Norwegian Krone will likely experience unusually high volatility with Swedish GDP, the FOMC rate decision and other high-event risk in the week ahead.

US Dollar Rises on Retail Sales, Gold and JPY Gain on Safe-Haven Flows - US Market Open

US Dollar Rises on Retail Sales, Gold and JPY Gain on Safe-Haven Flows - US Market Open

GBP Braces Ahead of Unemployment Data - NOK May Fall on Local CPI

Sterling will be casting a worried eye ahead of UK unemployment data after a dismal cascade of reports and NOK may fall on CPI amid falling crude oil prices.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

Currency Calculator