Score

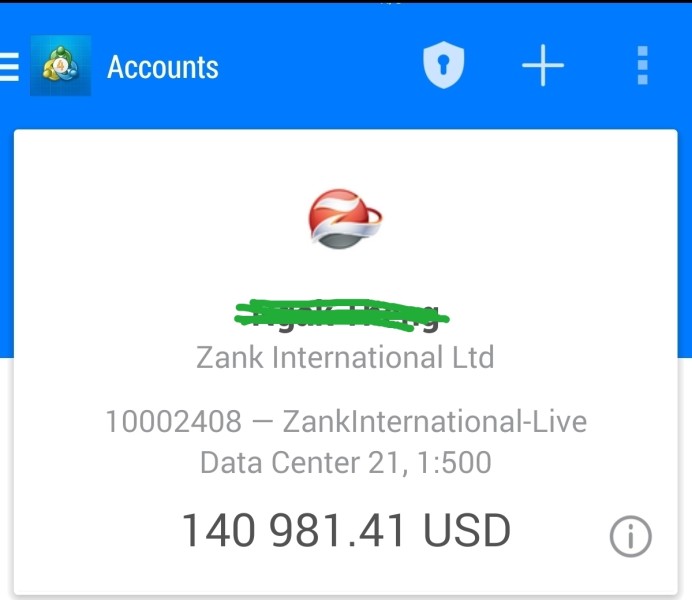

ZANK

Australia|2-5 years|

Australia|2-5 years| http://zankmt4.com/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Entity:ZANK CAPITAL LTD

License No. 246943

- The number of the complaints received by WikiFX have reached 9 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

Australia

AustraliaAccount Information

Users who viewed ZANK also viewed..

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

zankmt4.com

Server Location

Hong Kong

Website Domain Name

zankmt4.com

Server IP

103.72.145.120

Genealogy

VIP is not activated.

VIP is not activated.ORIGIN ECN

baixin

HONGKONGTC

Relevant Enterprises

Company Summary

| ZANK | Basic Information |

| Company Name | ZANK |

| Headquarters | China |

| Regulations | Exceeded |

| Account Types | VIP, Pro, Classic |

| Minimum Deposit | Vip –$100,000Pro –$50,000Classic –$10,000 |

| Minimum Spread | VIP –0.5Pro –0.8Classic –1.4 |

| Trading Platforms | Meta Trader 4 platform |

| Customer Support | E-mail: support@zkmt4.com |

Overview of ZANK

ZANK is a broker situated in China which is an online trading platform offering a variety of financial instruments to traders. With VIP, pro and classic account types, traders can access currency trading through the Meta Trader 4 platform. The company can be contacted at support@zkmt4.com for any inquiries or assistance.

Is ZANK Legit?

ZANK is beyond the scope of its business. it is exceeds the business scope regulated by Australia ASIC(license number: 246943)Investment Advisory License Non-Forex License. Please be aware of the risk. It is advisable for traders to thoroughly research and consider the regulatory status of a broker before engaging in trading activities to ensure a safer and more secure trading experience.

Pros and Cons

ZANK offers multiple chocies for clients who want to enter the international markets. Additionally, the utilization of the popular Meta Trader 4 platform enhances accessibility and familiarity for traders. However, the lack of regulatory oversight raises concerns about transparency and investor protection. Moreover, the limited customer support options, primarily through email, may hinder efficient resolution of queries or issues.

| Pros | Cons |

|

|

|

|

|

|

|

Account Types

Classic: Tailored for the seasoned trader, the Classic account also boasts a maximum leverage of 1:500, consistent with its counterparts. Designed for high rollers, the account demands a minimum deposit of $10,000. The minimum spread starts at 1.4 pips. The position size remains as flexible as the others, with a 0.01 minimum, ensuring detailed control over trade sizes and risk exposure.

Pro: The Pro account is a step up for serious traders, offering a substantial maximum leverage of 1:500, identical to the VIP. However, it requires a more significant commitment in terms of capital, with a $50,000 minimum deposit. The trading cost is reasonably managed with a minimum spread of 0.8 pips, and it shares the VIP account's minimum position size of 0.01, striking a balance between potential and accessibility.

VIP: This account provides traders with impressive financial leverage, peaking at a maximum of 1:500. Those interested need to start with a substantial investment, with a mandatory minimum deposit of $100,000. It offers an advantageously low minimum spread of just 0 pips signaling cost-effective trade execution. Plus, the account allows for executing trades with a minimum position size of 0.01, accommodating precision and risk management.

| Account Type | Classic | Pro | VIP |

| Maximum Leverage | 1:500 | 1:500 | 1:500 |

| Minimum Deposit | $10,000 | $50,000 | $100,000 |

| Minimum Spread | 1.4 pips | 0.8 pips | 0 pips |

| Minimum Position | 0.01 | 0.01 | 0.01 |

Leverage

ZANK allows its clients to trade with a maximum leverage of 1:500. A leverage of 1:500 means that a trader can control a position size 500 times larger than the initial capital they have in their account. It is worth noting that while higher leverage can lead to greater potential returns, it also increases the risk associated with trading, as losses can accumulate quickly.

Trading Platforms

ZANK offers its clients access to the MT4 trading platform, which iswidely used in the forex and CFD markets. By providing the MT4 platform, ZANK enables its clients to trade various tradable instruments, including currencies, stocks, indices, and commodities, through a user-friendly interface. MT4 offers advanced charting tools, technical analysis indicators, and automated trading capabilities, making it a preferred choice for many traders, particularly those involved in the forex market.

Customer Support

ZANK provides customer support primarily through email at support@zkmt4.com.

Conclusion

In conclusion, Ranger Capital presents traders with a variety of trading instruments and account types, along with the widely used Meta Trader 4 platform, facilitating flexible and accessible trading opportunities. However, the absence of regulatory oversight poses potential risk may hinder efficient resolution of inquiries. Additionally, the lack of educational resources and unclear company policies may present challenges for traders seeking comprehensive guidance.

FAQs

Q: Where is ZANK registered?

A: ZANK is registered in China.

Q: What regulations does ZANK adhere to?

A: ZANK exceeds the business scope regulated by Australia ASIC(license number: 246943)Investment Advisory License Non-Forex License.

Q: What are the minimum deposit requirements for each account type?

A: The minimum deposit is 10,000 for the most basic account, the classic account.

Q: What is the maximum leverage offered by ZANK?

A: The maximum leverage for all account types is 1:500.

Q: What are the spreads for each account type?

A: VIP account: Minimum spread of 0.5, Pro account: Minimum spread of 0.8, Classic account: Minimum spread of 1.4.

Risk Warning

Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 2-5 years

- Regulated in Australia

- Investment Advisory License

- Suspicious Scope of Business

- Suspicious Overrun

- High potential risk

View More

Comment 9

Content you want to comment

Please enter...

Comment 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

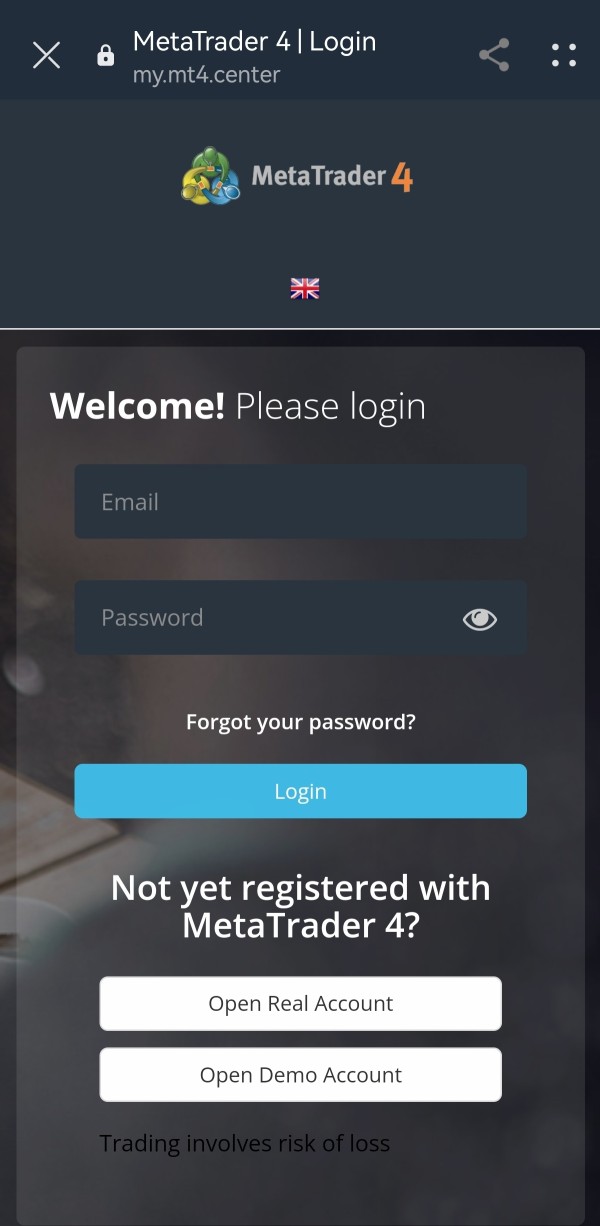

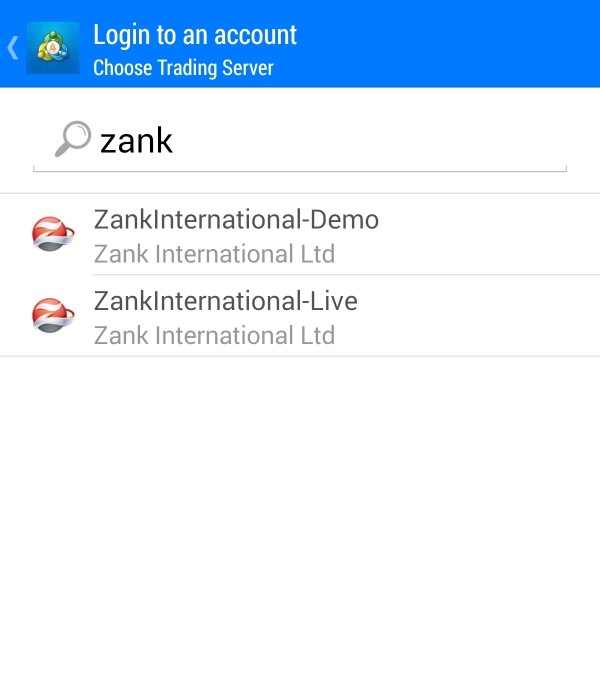

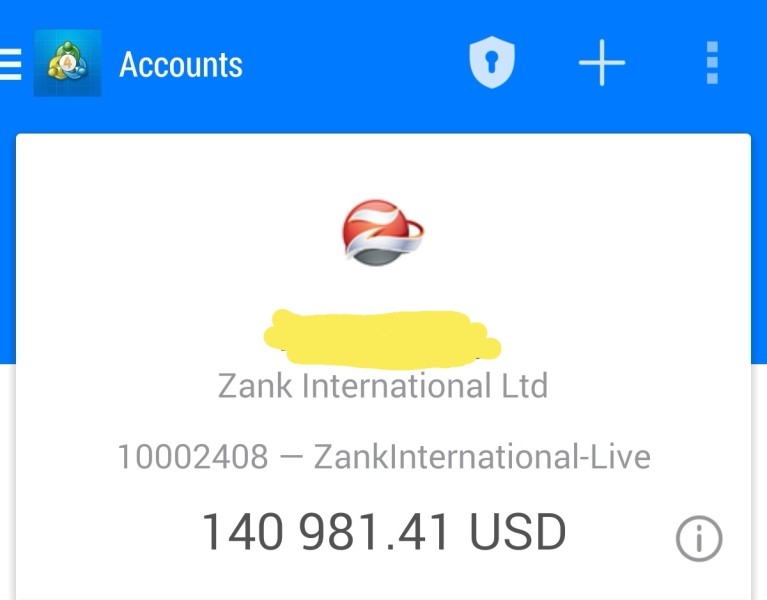

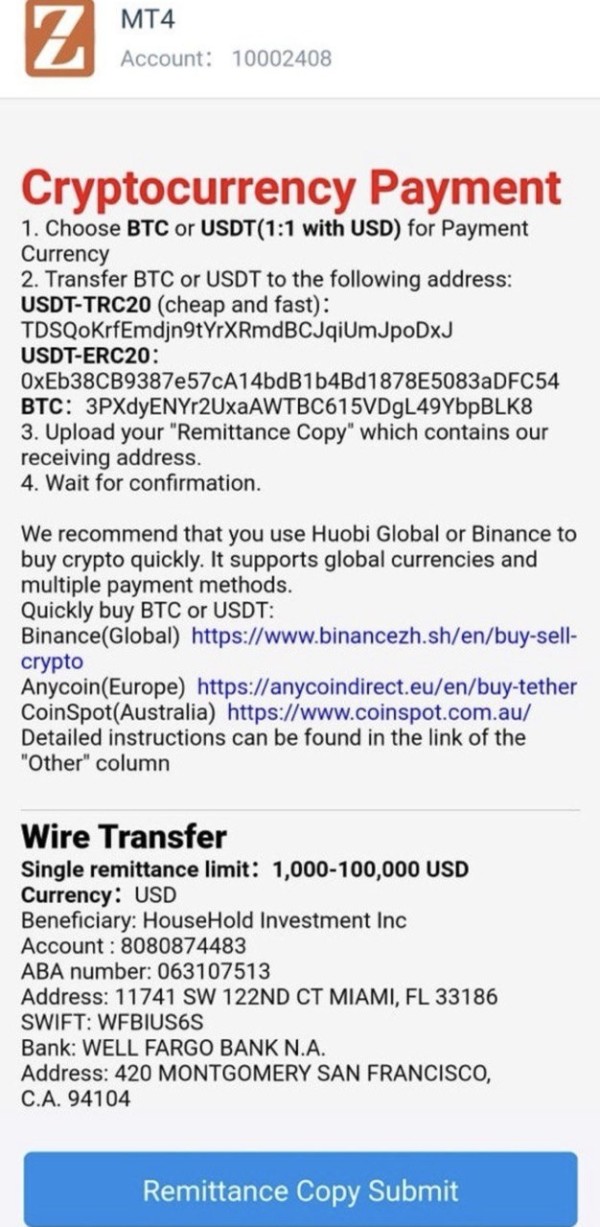

FX3769412812

Cambodia

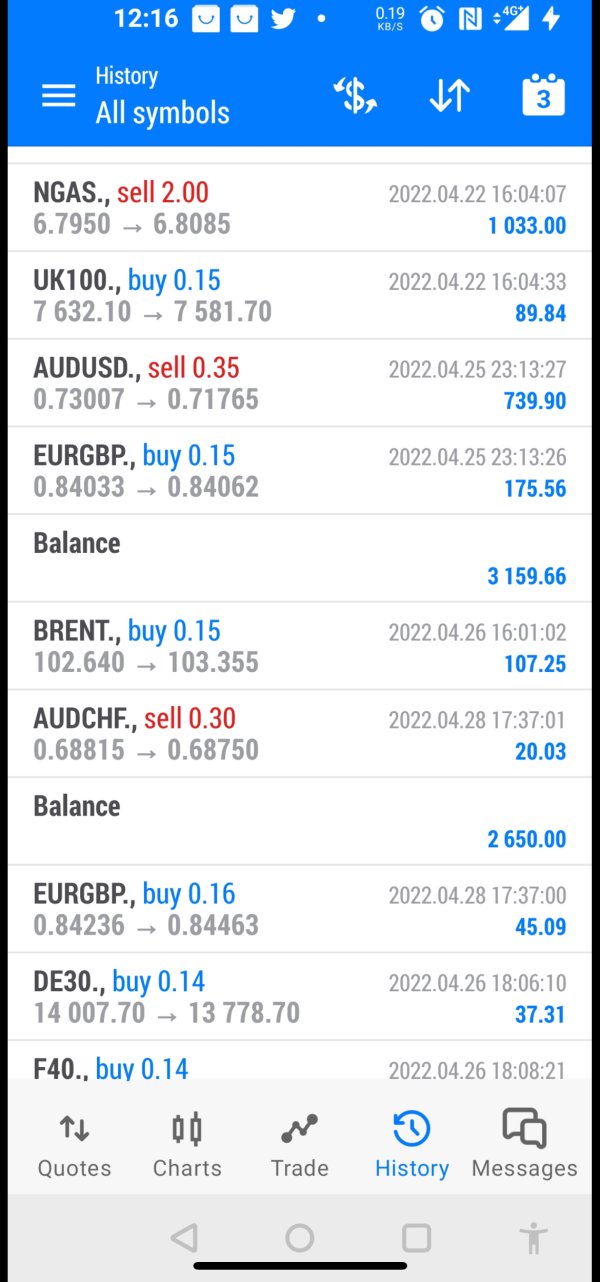

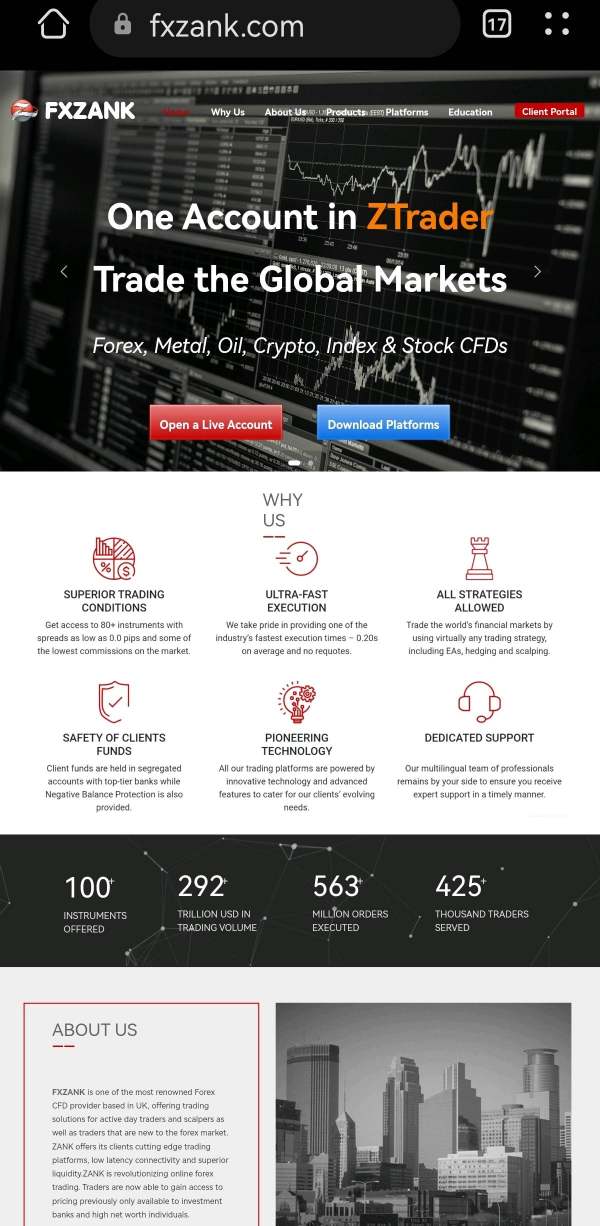

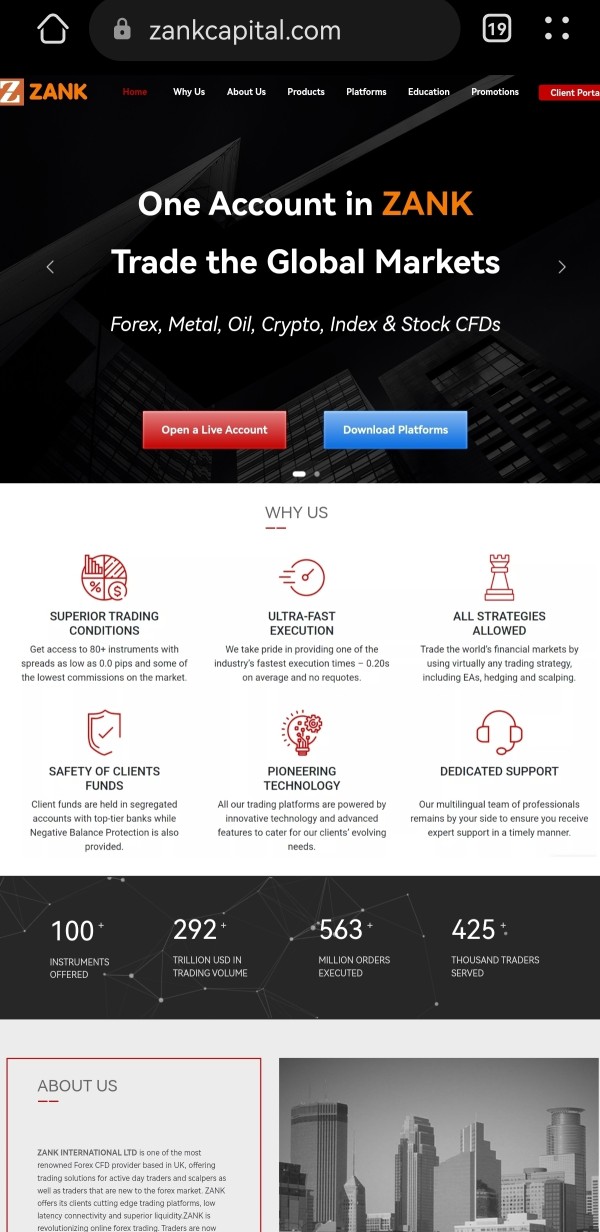

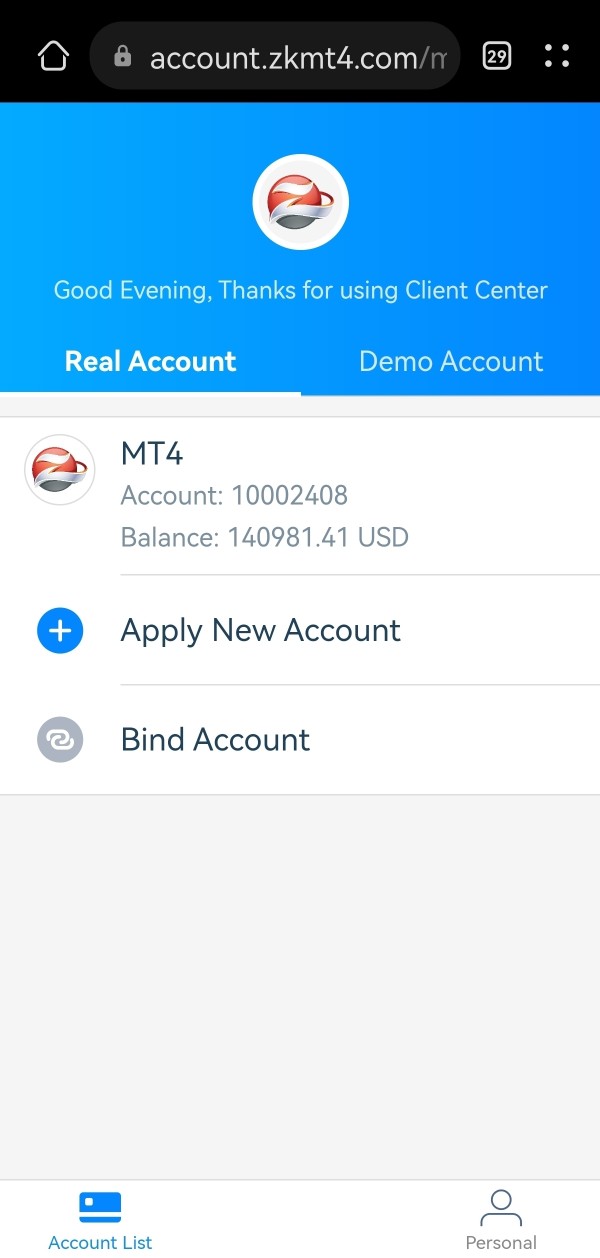

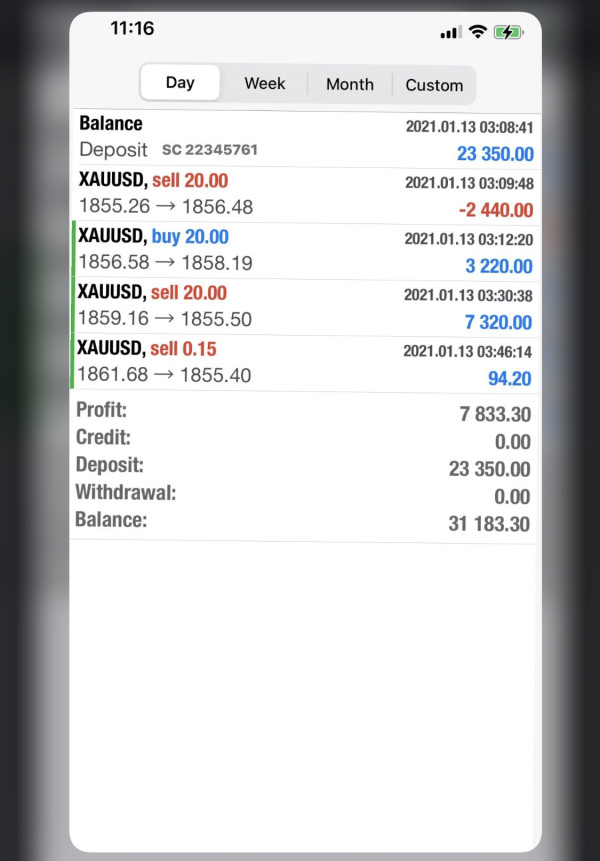

Zank's customer login website has been suspended (https://account.zkmt4.com/login). Now they are re-using https://my.mt4.center for new clients to scam them. The pictures below are of their new website from the website. Everyone be careuful please! !

Exposure

2022-08-11

FX1220961271

United States

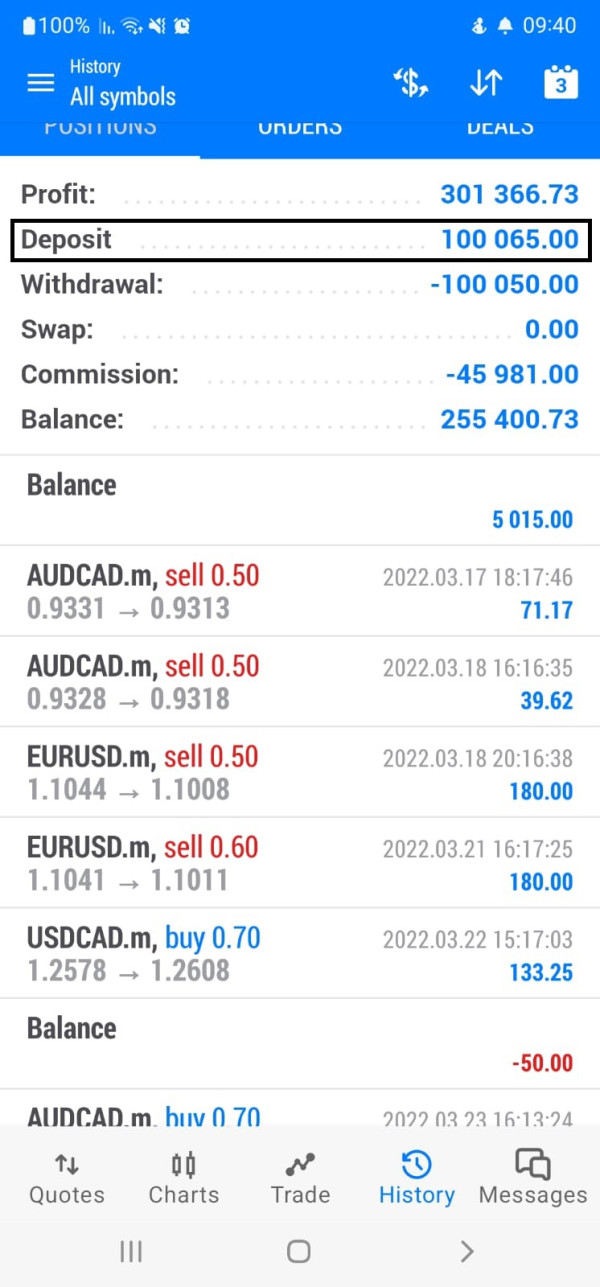

Zank Capital has taken $43,000 of my investment through false promises and as a result of unauthorized transactions. I have reported them to the Fraud Department and The Financial Conduct Authority, fintrack/ org hopeful there is a chance for retribution and more importantly that my investment be returned as it was the case with other investors.

Exposure

2022-06-14

FX3769412812

Cambodia

ZANK (Zank International Ltd) Fraud platform always change its name. Do not be deceived.

Exposure

2022-06-10

FX57947855

United States

My MT5 account at Zank has been taken for the past two weeks, which I found last week. By initiating and closing positions over the period of an hour, the thief converted the whole $107,000 capital in my account into commission and profit on the platform. After that, I attempted to contact customer service, but they refused to compensate me for my loss on the grounds that it could not be handled. It took a lawsuit filed by Assetsclaimback Legal department to get a quick recovery. Do not interact with Zank gang of con artists.

Exposure

2022-06-07

FX1537238665

United States

This strange girl reach out on WeChat and introduced me to this investment she has been doing which have made her a lot of profits . she sweet talked me to invest and upgrade my investment to VIP, when the withdrawal date comes , they ask me to pay tax

Exposure

2022-05-26

FX3012923282

United States

They did not allow the to withdraw my money, and required the me to trade 2000 lots before the withdrawal could be arranged I registered account in Zank two months ago. They started to prevent me from withdrawing funds when I got profits in the last month. i was able to withdraw with the action of AssetsClaimBack advisory All of It's horrible that they won't let me withdraw my funds after I've done good trade with them. Zank plan intended to take away my profits.

Exposure

2022-05-26

FX8896649272

Canada

don't even bother trying to set up an account with Zank Capital, they take time to respond and usually with a very short & unhelpful answer imagine their reaction when they noticed the funds retrieved by fintrack/ org initially in my account had gone missing from their fraudulent platform When i was ready to start trading the manager at Zank Capital helped me set up but they wouldn't help with the withdrawal process. I'd advice you save your time and just use a more reliable investment platforms

Exposure

2022-05-25

FX2978723126

Australia

the girl she just make the mistake to join in your WeChat and try to say about her and ask about you after one or two weeks she try to show her profit money from MT4 because her uncle can take her when it get the profits and try to make you join it put money in to trade and get profits every day but she want you to get more money and transfer her money to your and ask you to get VIP account it will get more profits needs $200,000 after I try to withdraw $20000 but she ask me to wait because this two weeks have profits so need funds and I just try to withdraw only $1700 it done after that she have me transfer to my account until $500.000 to upgraded to exclusive VIP and the day after we trading and get a lot of profit only two weeks my account over 1 million and she tell me her uncle said can withdraw all funds . After withdraw the VIP service ask me for the audit fee 5.6% to deposit and convert to AUD time to arrive but nothing I try to contact them. they said because of the big amount need to wait after that they sent me the resolve problem and need 1% more after that everything done just waiting for the money arrives. on the day that they informed me, my account can’t sign in and MT4 account has been frozen and the girl that I know over 5 months have broke my contact. Pleases pay attention to this scams platform ZANK Capital

Exposure

2022-05-25