简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBPUSD Slides to Flash Crash Lows - US Market Open

Abstract:GBPUSD Slides to Flash Crash Lows - US Market Open

MARKET DEVELOPMENT – GBPUSD Slides to Flash Crash Lows

市场发展 - 英镑兑美元下滑至闪电崩盘低位

DailyFX 2019 FX Trading Forecasts

DailyFX 2019外汇交易预测

GBP: The Pound is once again on the backfoot as the currency challenges its 2019 lows. UK data continues to deteriorate with the latest BRC sales report showing sales at UK retailers rose at the slowest pace on record. In turn, this provides yet another reminder that growth in the UK economy is likely to have contracted in Q2. Consequently, amid the backdrop of rising no-deal Brexit risks and with UK data continuing to disappoint, commentary from BoE rate setters will be eyed closely. Reminder, BoEs Tenreyro (Wednesday) and Vlieghe (Friday) are due to speak this week. 2019 lows reside at 1.2435, support at 1.2435-40 being tested as EURGBP oscillates around the 0.9000 handle. Speculators are also very bearish on the Pound.

英镑:由于货币挑战其英镑,英镑再次走在后脚2019年的低点。英国最新的BRC销售报告显示,英国零售商的销售增长速度创历史新高,英国数据继续恶化。反过来,这再次提醒人们英国经济增长可能在第二季度出现萎缩。因此,在英国脱欧风险上升以及英国数据持续令人失望的背景下,英国央行利率制定者的评论将受到密切关注。提醒,BoEs Tenreyro(周三)和Vlieghe(周五)将于本周发言。 2019年低点位于1.2435,支撑位于1.2435-40,因为EURGBP在0.9000手柄附近震荡。投机者对英镑也非常看空。

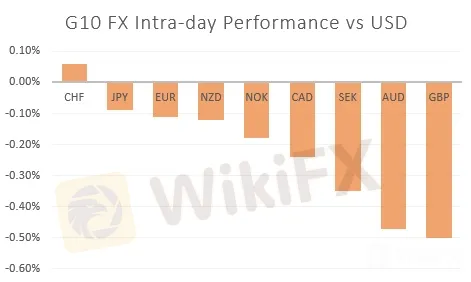

USD: The greenback has remained bid throughout the European session with eyes focusing on the testimony from Fed Chair Powell. The pricing out of a 50bps cut at the end of the month has continued to underpin the DXY, which in turn has seen EURUSD test 1.1200 on the downside. Fed members Bullard and Bostic due to speak later, however, much of the focus will be placed on Powell tomorrow.

美元:美元在整个欧洲时段仍在竞价,目光集中在证词上来自美联储主席鲍威尔。本月底降息50个基点的定价继续支撑DXY,后者反过来看欧元兑美元下行测试1.1200。美联储成员Bullard和Bostic将在稍后发言,但明天将把重点放在鲍威尔身上。

Source: DailyFX, Thomson Reuters

来源:DailyFX,汤森路透

IG Client Sentiment

IG客户情绪

How to use IG Client Sentiment to Improve Your Trading

如何使用IG客户端情绪来改善交易

WHATS DRIVING MARKETS TODAY

今天开车的市场

“USD Price Outlook: More Gains Possible Ahead of Fed Meeting” by Martin Essex, MSTA , Analyst and Editor

“USD价格展望:美联储会议前可能获得更多收益”bMartin Essex,MSTA,分析师和编辑

“GBP Most Bearish Currency, CAD Longs Surge - COT Report” by Justin McQueen, Market Analyst

市场分析师Justin McQueen撰写的“最多看跌货币,加元多头激增 - COT报告”

“Canadian Dollar Price Analysis: USD/CAD Sellers Await BOC and FED Powell” byMahmoud Alkudsi , Market Analyst

“加元汇率分析:美元/加元卖家等待BOC和FED Powell”作者:市场分析师Mamoud Alkudsi

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

“利用外汇有效交易IG的全球市场主题”作者:Tyler Yell,CMT,外汇交易指导员

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Economic Calendar Events for This Week (August 5-9, 2024)

This week's economic events include: Japan's Monetary Policy Minutes and U.S. Services PMI on Monday, impacting JPY and USD. Tuesday's RBA Interest Rate Decision affects AUD, with German Factory Orders influencing EUR. Wednesday sees German Industrial Production and U.S. Crude Inventories impacting EUR and USD. Thursday: RBA Governor speaks, with U.S. Jobless Claims. Friday: China's CPI and Canada's Unemployment Rate affect CNY and CAD.

Anticipating the Nonfarm Payroll Report

As we approach the Nonfarm Payroll (NFP) report on August 2, 2024, market participants are keenly observing the data for insights into the U.S. labor market. The report is expected to show an increase of 194,000 to 206,000 jobs for July, indicating modest growth. This suggests potential softening in the labor market. A weaker-than-expected report could prompt the Fed to consider rate cuts, influencing the USD. Major currency pairs and gold prices will likely see volatility around the NFP release

High Volatility Economic Events for This Week (GMT+8)

This week, key economic events expected to generate high volatility include China's Q2 GDP and retail sales data, impacting CNY. The US will release Core Retail Sales and Philadelphia Fed Manufacturing Index, affecting USD. The UK's CPI data will influence GBP, and the ECB Interest Rate Decision and Press Conference will impact EUR. These events will drive significant market movements due to their influence on monetary policy and economic outlooks.

Global Market Insights: Key Events and Economic Analysis Part 2

This week's global market analysis covers significant movements and events. Fed Chairman Powell's cautious stance on interest rates impacts the USD. TSMC benefits from Samsung's strike. Geopolitical tensions rise with Putin's diplomacy. PBOC plans bond sales to stabilize CNY. Key economic events include Core CPI, PPI, and Michigan Consumer Sentiment for the USA, and GDP data for the UK. These factors influence currency movements and market sentiment globally.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Exposed by SC: The Latest Investment Scams Targeting Malaysian Investors

Currency Calculator